by Calculated Risk on 3/05/2014 03:41:00 PM

Wednesday, March 05, 2014

Employment Preview for February: Another Weak Report

Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus is for an increase of 150,000 non-farm payroll jobs in February, and for the unemployment rate to be unchanged at 6.6%.

Note: This was an unusually harsh winter, and the weather apparently impacted hiring in December, January and in February too. The Fed's beige book today mentioned weather 119 times (including all the District reports). In the January beige book, weather was only mentioned 21 times. In the March 2013 beige book, weather was mentioned 18 times. So weather could be a significant factor in the February report.

Here is a summary of recent data:

• The ADP employment report showed an increase of 139,000 private sector payroll jobs in February. This was below expectations of 158,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index was unchanged in February at 52.3%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 7,000 in February. The ADP report indicated a 1,000 increase for manufacturing jobs in February.

The ISM non-manufacturing employment index decreased in February to 47.5% from 56.4% in January. A historical correlation between the ISM non-manufacturing index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing were unchanged in February.

Taken together, these surveys suggest around 6,000 fewer jobs in February - far below the consensus forecast.

• Initial weekly unemployment claims averaged close to 338,000 in February. This was up from an average of 333,000 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 334,000; this was up slightly from 329,000 during the reference week in January.

This suggests mostly layoffs in line with the consensus forecast.

• The final February Reuters / University of Michigan consumer sentiment index increased to 81.6 from the January reading of 81.2. This is frequently coincident with changes in the labor market, but there are other factors too.

• The small business index from Intuit showed no change in small business employment in February.

• Conclusion: Usually the data is mixed, but the data this month was fairly weak across the board. The ADP report was lower in February compared to the initial January report (January was revised down in the report today), the Intuit small business index showed no hiring, and the ISM surveys suggest essentially no change in payrolls in February

There is always some randomness to the employment report - and the timing and survey methods are different than for some other reports - but my guess is the BLS report will be under the consensus forecast of 150,000 nonfarm payrolls jobs added in February.

Fed's Beige Book: Economic activity increased at "modest to moderate" pace in Most Districts

by Calculated Risk on 3/05/2014 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Atlanta and based on information collected before February 24, 2014."

Reports from most of the twelve Federal Reserve Districts indicated that economic conditions continued to expand from January to early February. Eight Districts reported improved levels of activity, but in most cases the increases were characterized as modest to moderate. New York and Philadelphia experienced a slight decline in activity, which was mostly attributed to the unusually severe weather experienced in those regions. Growth slowed in Chicago, and Kansas City reported that conditions remained stable during the reporting period. The outlook among most Districts remained optimistic.And on real estate:

Reports on residential housing markets were somewhat mixed. Many Districts continued to report improving conditions but noted that growth had slowed. Most of the Districts indicating otherwise attributed the slowing pace of improvement to unusually severe winter weather conditions. Home sales increased in Richmond, Atlanta, Chicago, St. Louis, and Dallas, while sales were down in Philadelphia, Cleveland, Minneapolis, and Kansas City. Boston and New York reported that the trend in sales for their Districts was mixed. New home construction increased in Richmond, Atlanta, Chicago, St. Louis, and Minneapolis, and remained flat in Kansas City, and was down slightly from the previous period in Philadelphia. Most Districts reported low levels of home inventories and indicated that home prices continued to appreciate. The outlook for sales and residential construction was positive in Boston, Philadelphia, Cleveland, Atlanta, and San Francisco.Some pretty positive comments on commercial real estate. This is a downgrade to the previous beige book, but might be weather related.

Strong multifamily construction was cited in New York, Cleveland, Richmond, Atlanta, and Dallas, while Boston indicated that its pipeline of multifamily construction was declining. Dallas experienced rent growth above its historical average, while New York reported mixed trends in rent growth. Cleveland noted that it expects healthy growth in rents this year.

Many Districts, including New York, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, and San Francisco, indicated that commercial real estate activity had increased and that conditions continued to improve since the previous report. Philadelphia noted that there was very little activity to report in construction or leasing due to severe winter weather. The outlook for nonresidential construction was fairly optimistic in Boston, Philadelphia, Cleveland, Atlanta, Minneapolis, Kansas City, Dallas, and San Francisco.

emphasis added

Lawler on Hovnanian: Net Home Orders Far Short of Expectations; Sales Incentives Coming

by Calculated Risk on 3/05/2014 11:02:00 AM

From housing economist Tom Lawler:

Hovnanian Enterprises, the nation’s sixth largest home builder in 2012, reported that net home orders (including unconsolidated joint ventures) in the quarter ended January 31, 2014 totaled 1,202, down 10.6% from the comparable quarter of 2013. The company’s sales cancellation rate, expressed as a % of gross orders, was 18% last quarter, up from 17% a year ago. Home deliveries last quarter totaled 1,138, down 4.2% from the comparable quarter of 2013, at an average sales price of $351,279, up 6.1% from a year ago. The company’s order backlog at the end of January was 2,438, up 6.0% from last January, at an average order price of $368,243, up 4.3% from a year ago.

Hovnanian’s net orders in California plunged by 43.4% compared to a year ago. Hovnanian’s average net order price in California last quarter was $653,366, up 46.8% from a year ago and up 83.2% from two years ago. Net orders in the Southwest were down 10.0% YOY.

Here is an excerpt from the company’s press release.

"While our first quarter is always the slowest seasonal period for net contracts, the strong recovery trajectory from the spring selling season of 2013 has softened on a year-over-year basis. Net contracts in the months of December, January and February have not met our expectations. In addition to the lull in sales momentum, both sales and deliveries were impacted by poor weather conditions and deliveries were further impacted by shortages in labor and certain materials in some markets that have extended cycle times," stated Ara K. Hovnanian, Chairman of the Board, President and Chief Executive Officer.The company reported that it owned or controlled 34,763 lots at the end of January, up 17.0% from last January.

"We are encouraged by the fact that we have a higher contract backlog, gross margin and community count than we did at the same point in time last year. Furthermore, we have taken steps to spur additional sales in the spring selling season, including the launch of Big Deal Days, a national sales campaign during the month of March. Our first quarter has always been the slowest seasonal period and we expect to report stronger results as the year progresses. We believe this is a temporary pause in the industry's recovery, and based on the level of housing starts across the country, we continue to believe the homebuilding industry is still in the early stages of recovery," concluded Mr. Hovnanian.

emphasis added

ISM Non-Manufacturing Index decreases to 51.6 in February

by Calculated Risk on 3/05/2014 10:05:00 AM

The February ISM Non-manufacturing index was at 51.6%, down from 54.0% in January. The employment index decreased sharply in February to 47.5%, down from 56.4% in January. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2014 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 49th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 51.6 percent in February, 2.4 percentage points lower than January's reading of 54 percent. The Non-Manufacturing Business Activity Index decreased to 54.6 percent, which is 1.7 percentage points lower than the reading of 56.3 percent reported in January, reflecting growth for the 55th consecutive month and at a slower rate. The New Orders Index registered 51.3 percent, 0.4 percentage point higher than the reading of 50.9 percent registered in January. The Employment Index decreased 8.9 percentage points to 47.5 percent from the January reading of 56.4 percent and indicates contraction in employment for the first time after 25 consecutive months of growth. The Prices Index decreased 3.4 percentage points from the January reading of 57.1 percent to 53.7 percent, indicating prices increased at a slower rate in February when compared to January. According to the NMI®, ten non-manufacturing industries reported growth in February. The majority of respondents' comments indicate a slowing in the rate of growth month over month of business activity. Some of the respondents attribute this to weather conditions. Overall respondents' comments reflect cautiousness regarding business conditions and the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was well below the consensus forecast of 53.6% and indicates slower expansion in February than in January.

ADP: Private Employment increased 139,000 in February

by Calculated Risk on 3/05/2014 08:23:00 AM

Private sector employment increased by 139,000 jobs from January to February according to the February ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 158,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "February was another soft month for the job market. Employment was weak across a number of industries. Bad winter weather, especially in mid-month, weighed on payrolls. Job growth is expected to improve with warmer temperatures.”

Note: ADP hasn't been very useful in directly predicting the BLS report on a monthly basis, but it might provide a hint. The BLS report for February will be released on Friday.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/05/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 9.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 28, 2014. ...

The Refinance Index increased 10 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. ...

The seasonally adjusted Purchase Index was 6 percent higher than its level two weeks earlier, but was still 19 percent lower than the same week one year ago. Despite the increase observed this week, the Refinance Index is still 3 percent lower than it was two weeks ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.47 percent from 4.53 percent, with points decreasing to 0.28 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) decreased to 4.37 percent from 4.47 percent, with points increasing to 0.20 from 0.13 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 69% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 17% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Note: Jumbo rates are still below conforming rates.

Tuesday, March 04, 2014

Wednesday: ISM Service Index, ADP Employment, Fed's Beige Book

by Calculated Risk on 3/04/2014 08:19:00 PM

Note on the previous post: I've contacted the FHA and will post the quarterly FHA REO data soon.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 158,000 payroll jobs added in January, down from 175,000 in January.

• At 10:00 AM, the ISM non-Manufacturing Index for February. The consensus is for a reading of 53.6, down from 54.0 in January. Note: Above 50 indicates expansion, below 50 contraction.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Fannie, Freddie, FHA REO inventory increased in Q4

by Calculated Risk on 3/04/2014 02:01:00 PM

EDIT: Ooops. The FHA data is for a year ago.

In their Q4 SEC filing, Fannie reported their Real Estate Owned (REO) increased to 103,229 single family properties, up from 100,941 at the end of Q3.

Freddie reported their REO increased to 47,308 in Q4, up from 44,623 at the end of Q3.

The FHA reported their REO increased to 37,977 in Q4, up from 37,445 in Q3. (EDIT: wrong year)

The combined Real Estate Owned (REO) for Fannie, Freddie and the FHA increased to 188,514, up from 185,505 at the end of Q3 2013. The peak for the combined REO of the F's was 295,307 in Q4 2010.

This following graph shows the REO inventory for Fannie, Freddie and the FHA.

Click on graph for larger image.

Click on graph for larger image.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions (declined in Q4), VA and more. REO has been declining for those categories.

Although REO is down slightly from Q4 2012, REO has increased for two consecutive quarters - and is still at a high level.

EDIT: Incorrect FHA data.

CoreLogic: House Prices up 12% Year-over-year in January

by Calculated Risk on 3/04/2014 10:50:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Home Prices Nationwide Increased 12 Percent Year Over Year In January

Home prices, including distressed sales, increased by 12.0 percent in January 2014 compared to December 2013. January marks the 23nd consecutive month of year-over-year home price gains.

Excluding distressed sales, home prices increased by 9.8 percent year over year.

... Despite gains in December, home prices nationwide remain 17.3 percent below their peak, which was set in April 2006.

“Polar vortices and a string of snow storms did not manage to weaken house price appreciation in January. The last time January month-over-month and year-over-year price appreciation was this strong was at the height of the housing bubble in 2006.” [said Dr. Mark Fleming, chief economist for CoreLogic]

Click on graph for larger image.

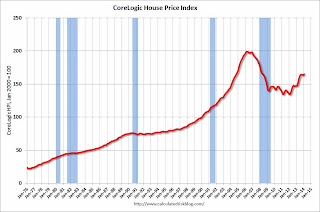

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.9% in January, and is up 12.0% over the last year. This index is not seasonally adjusted, so this was a strong month-to-month gain during the "weak" season.

The index is off 17.3% from the peak - and is up 22.9% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty three consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty three consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).I expect the year-over-year increases to slow - but it isn't showing up in the CoreLogic index yet.

Mortgage Monitor: Mortgage Loan originations declined to the lowest point since Nov. 2008

by Calculated Risk on 3/04/2014 09:21:00 AM

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for January today. According to LPS, 6.27% of mortgages were delinquent in January, down from 6.47% in December. BKFS reports that 2.35% of mortgages were in the foreclosure process, down from 3.41% in January 2013.

This gives a total of 8.62% delinquent or in foreclosure. It breaks down as:

• 1,851,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,289,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,175,000 loans in foreclosure process.

For a total of 4,315,000 loans delinquent or in foreclosure in January. This is down from 5,208,000 in January 2013.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

“In January, we saw origination volume continue to decline to its lowest point since 2008, with prepayment speeds pointing to further drops in refinance-related originations,” said Herb Blecher, senior vice president of Black Knight Financial Services’ Data & Analytics division. “Overall originations were down almost 60 percent year-over-year, with HARP volumes (according to the most recent FHFA report) down 70 percent over the same period. These declines are largely tied to the increased mortgage interest rate environment, which is having a significant impact on the number of borrowers with incentive to refinance. A high-level view of this refinancible population shows a decline of about 13 percent just over the last two months.There is much more in the mortgage monitor.

“Of course, in addition to higher interest rates, a good deal of this decline can be attributed to the fact that a majority of those who could refinance at historically low rates in recent years already have, and we see a similar dynamic in terms of HARP-eligible loans. The volume of HARP refinances over the past year has driven this population down to about 700,000 loans in January 2014, as compared to over 2.3 million at the same time last year. From a geographic perspective, outside of Florida and Nevada, we see the Midwestern states of Illinois, Michigan, Missouri and Ohio have among the highest percentage of HARP eligibility.”

emphasis added