by Calculated Risk on 2/24/2014 09:13:00 PM

Monday, February 24, 2014

Tuesday: Case-Shiller and FHFA House Prices, Richmond Fed

An excellent article from Jared Bernstein: Lessons From the Recovery Act. A few excerpts:

A deeper understanding of the economic damage should have prevented the precipitous pivot away from stimulus toward deficit reduction.One of my key complaints was that policy pivoted to austerity way too soon. I never understood why infrastructure spending was only on "shovel ready" programs. Since recoveries from financial crisis recessions are always sluggish, the investments in infrastructure could have been significantly higher and over a longer period.

[I]in those days I learned the power of the single worst analogy I know: “just as families have to tighten their belts in tough times, so does the government.” It’s not just that this is wrong; it’s that it’s backward. When families are tightening, government (including the Federal Reserve) must loosen, and vice versa. But the phrase, uttered by no less than the president himself at times, makes so much folksy sense that it too infected the policy and precipitated the pivot.Absolutely correct. Every time I hear this - including from President Obama - I cringe. And more:

About one-third of the stimulus package went to tax cuts. There’s an excellent political rationale for that apportionment, but particularly given the diagnosis noted above, tax cuts’ bang-for-buck in terms of jobs is less than optimal. First, for the cuts to stimulate the economy, recipients have to spend the extra money, not save it. In a deleveraging cycle, that’s a heavier lift. Second, when they do spend the money, they need to spend it on domestic goods. So there’s a lot of potential leakage.I've argued before that even though the stimulus package was an obvious success, some parts of the package (like certain tax cuts) were not very effective. The debate now should be on how well each part of the package performed.

It’s also the case that one-quarter of the tax cuts went to relief from the alternative minimum tax that would have happened anyway, so that part wasn’t even stimulus (which by definition means new spending or tax cuts).

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December. The consensus is for a 13.3% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 13.5% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

• Also at 9:00 AM, the FHFA House Price Index for December 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

• Also at 9:00 AM, the Chemical Activity Barometer (CAB) for January from the American Chemistry Council. This appears to be a leading economic indicator.

• At 10:00 AM, the Conference Board's consumer confidence index for February. The consensus is for the index to decrease to 80.0 from 80.7.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for February

Weekly Update: Housing Tracker Existing Home Inventory up 5.7% year-over-year on Feb 24th

by Calculated Risk on 2/24/2014 07:13:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for January). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 5.7% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

DOT: Vehicle Miles Driven increased 1.1% year-over-year in December

by Calculated Risk on 2/24/2014 01:29:00 PM

The Department of Transportation (DOT) reported:

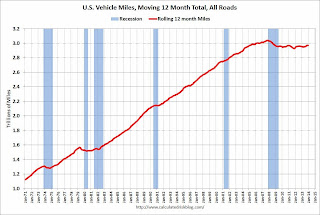

Travel on all roads and streets changed by 1.1% (2.7 billion vehicle miles) for December 2013 as compared with December 2012.The following graph shows the rolling 12 month total vehicle miles driven.

...

Cumulative Travel for 2013 changed by 0.6% (18.1 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways but has started to increase a little recently.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 73 months - 6+ years - and still counting. Currently miles driven (rolling 12 months) are about 2.2% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In December 2013, gasoline averaged of $3.36 per gallon according to the EIA. that was down slightly from 2012 when prices in December averaged $3.38 per gallon.

In December 2013, gasoline averaged of $3.36 per gallon according to the EIA. that was down slightly from 2012 when prices in December averaged $3.38 per gallon.As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 6 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven - but it appears miles driven might be gradually increasing again.

Dallas Fed Manufacturing: General Business Index Flat, Production Increases, Employment Increases

by Calculated Risk on 2/24/2014 10:38:00 AM

From the Dallas Fed: Texas Manufacturing Picks Up Again but Less Optimism in Outlook

Texas factory activity increased for the tenth month in a row in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 7.1 to 10.8, indicating output grew at a slightly stronger pace than in January.A mixed report, but the employment indexes were positive.

Other measures of current manufacturing activity also reflected a pick up. The capacity utilization index edged up to 9.1, with a quarter of manufacturers noting an increase. The shipments index rose again in February, coming in at 13.3. The new orders index continued to indicate demand growth and was 9.5, down from 14.4 in January but above the levels seen toward the end of last year.

...

The general business activity index fell to zero after eight positive readings in a row. The company outlook index also declined, from 15.9 to 3.4, hitting its lowest reading since last spring.

Labor market indicators reflected continued employment growth and longer workweeks. The February employment index edged up for a third consecutive month, rising to 9.9. Eighteen percent of firms reported net hiring compared with 8 percent reporting net layoffs. The hours worked index shot up from 3.4 to 12, reaching its highest level in more than two and a half years.

Chicago Fed: "Economic growth slowed in January"

by Calculated Risk on 2/24/2014 08:51:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth slowed in January

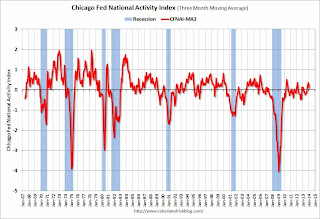

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.39 in January from –0.03 in December.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to +0.10 in January from +0.26 in December, marking its fifth consecutive reading above zero. January’s CFNAI-MA3 suggests that growth in national economic activity was above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in January (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, February 23, 2014

Sunday Night Futures

by Calculated Risk on 2/23/2014 08:25:00 PM

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for January. This is a composite index of other data.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for February. The general business activity index was at 3.8 in January.

Weekend:

• Schedule for Week of Feb 23rd

• Housing Weakness: Temporary or Enduring?

From MarketWatch: Asia Markets live blog: Stocks rolling higher

Both Japan’s Nikkei Average and Australia’s S&P/ASX 200 spent a little time in negative territory during the opening minutes, but both are higher now, up 0.5% and 0.3%, respectively.From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 4 and DOW futures are up 37(fair value).

Oil prices are up with WTI futures at $102.58 per barrel and Brent at $110.19 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.40 per gallon (up sharply over the last two weeks, but down significantly from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Housing Weakness: Temporary or Enduring?

by Calculated Risk on 2/23/2014 12:29:00 PM

The recent data for housing has been weak, with new home sales and housing starts mostly moving sideways over the last year (with plenty of ups and downs, and I expect downward revisions to Q4 new home sales). Existing home sales have declined 14% from a peak of 5.38 million in July 2013 on a seasonally adjusted annual rate basis (SAAR), to just 4.62 million SAAR in January.

There are several reasons for the recent weakness:

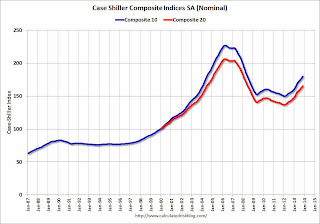

1) Higher prices. Case-Shiller reported prices were up 13.7% year-over-year in November. Other indexes had smaller increases, but all showed significant price increases in 2013.

2) Higher mortgage rates. 30 year fixed mortgage rates increased last summer from around 3.5% in May 2013 to 4.4% in July 2013. Since then, mortgage rates have mostly moved sideways, but some of the weakness since last summer is probably related to higher mortgage rates.

3) Fewer distressed sales. Although the decline in foreclosures, short sales, and mortgage delinquencies is good news, this has meant fewer overall existing home sales (this isn't a surprise - I've been predicting a decline in overall existing home sales for exactly this reason). Even though overall sales have been declining, equity sales (aka conventional transactions), are actually up year-over-year. Note: Of course fewer distressed sales should be a positive for new home sales, so this doesn't explain some of the recent weakness for new home sales.

4) Less investor buying. This is related to fewer distressed sales. If we use cash buyers as an indicator of the level of investor buying, then the decline in cash buyers in areas like Las Vegas, Phoenix, and Sacramento suggests investors are pulling back.

5) Limited inventory. The sharp decline in inventory over the last few years was a key story for housing (I beat that horse into the ground). There are several reasons inventory has been low: a) Most of the recent investor buying has been "buy-to-rent" and these investors aren't selling, Note: Economist Tom Lawler discussed this two year ago, and he concluded that a significant "share of the decline in the share of homes for sale reflects the acquisition of SF (and condo) properties by investors as multi-year rental properties", b) Is it difficult for people who are underwater (negative equity) to sell, c) Seller psychology: When the expectation is that prices will fall further, marginal sellers will try to sell their homes immediately. And marginal buyers will decide to wait for a lower price. This leads to more inventory on the market. But when the expectation is that prices are stabilizing (the current situation), sellers will wait until it is convenient to sell. d) Low inventory can keep some potential sellers from listing their homes because they can't find a move-up home to buy.

6) Supply chain constraints for New Homes. I noted at the beginning of 2013 "I've heard some builders might be land constrained in 2013 (not enough finished lots in the pipeline)." That was correct - some builders had limited entitled land and there were other constraints too (material shortages, skilled labor in certain areas) - and this limited the number of new home sales last year (sales were only up 16.3% in 2013).

7) And some of the recent weakness in December and January (and February) might have been weather related.

Here are a few graphs to show the recent weakness:

Click on graph for larger image.

Click on graph for larger image.

Total housing starts in January were at a seasonally adjusted annual rate of 880,000 - only 2% above January 2013, and single-family housing starts in January were at a rate of 573,000 - down 6% from January 2013.

Although starts have been up and down over the last year, starts have mostly moved sideways. Of course starts were up 18.7% in 2013 compared to 2012, so there was little "weakness" on an annual basis.

New home sales followed the same pattern has housing starts: up solidly in 2013 compared to 2012, but with sales mostly moving sideways all year (with ups and downs).

New home sales followed the same pattern has housing starts: up solidly in 2013 compared to 2012, but with sales mostly moving sideways all year (with ups and downs).

New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 414 thousand up only 4.5% from December 2012.

New home sales for January 2014 will be released this coming Wednesday, and I expect sales to be down year-over-year, and to see some downward revisions for Q4 sales.

Existing home sales in January were at a 4.62 million SAAR, and were 5.1% below the January 2013 rate.

Existing home sales in January were at a 4.62 million SAAR, and were 5.1% below the January 2013 rate.

So what should we make of this "weakness"?

First, the decline in existing home sales is not bad news. See: Home Sales Reports: What Matters. Fewer distressed sales - and more equity sales (conventional sales) - is a positive.

Second, we need to put the recent "weakness" for starts and new home sales in perspective. New home sales were up 16.3% in 2013 - a solid year of growth - and 2013 was still the sixth weakest year since 1963 when the Census Bureau started tracking new home sales. For housing starts, even after increasing 28.2% in 2012 and 18.7% in 2013, the 927 thousand housing starts in 2013 were the sixth lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2008 through 2012). Also, this was the fifth lowest year for single family starts since 1959 (only 2009 through 2012 were lower).

These low levels of housing starts and new home sales, combined with a growing population and new household formation, suggests new home sales and housing starts should increase over the next few years.

Also higher prices should lead to more inventory (the NAR reported inventory was up 7.6% year-over-year in January). More inventory should mean slower price increases (maybe even flat of declining prices in certain markets), and also more non-distressed sales. For new homes, the builders are reporting more selling communities in 2014, and it appears some of the land constraints have diminished. As Lawler recently wrote:

First, fueled by low mortgage rates, low new and existing home inventories, and some “pent-up” demand, builders as a group experienced a significant increase in net home orders starting in the latter part of 2012 and continuing into the spring of 2013. While many builders responded by increasing significantly land acquisitions and development spending in 2012 and 2013, many builders were unable to meet demand, partly reflecting longer-than-normal development timelines related to “supply-chain” issues. Many responded by increasing prices substantially, in some areas at a pace seldom seen. When mortgage rates subsequently rose sharply, the combination of higher mortgage rates and substantially higher new home prices resulted in a significant slowdown in net home orders. While mortgage rates eased somewhat in the latter part of last year, orders did not rebound much (or for some builders at all), mainly reflecting potential buyers balking at the higher home prices.The bottom line is the housing weakness should be temporary. There should be more inventory this year, price increases should slow, and sales volumes increase.

That slowdown did not dampen most builders’ optimism for the 2014 spring selling season, and most builders have the land/lots to increase substantially their community counts this year, and plan to do so. One reason for their optimism is that the previous hikes in prices have at many builders pushed margins up well above “normal” levels, meaning they can drive higher revenues with higher volumes without price increases, and in fact can be “quite profitable” by holding prices even if construction costs rise. As such, a reasonable assumption for new home prices from the end of 2013 to the end of 2014 would be “flattish.”

Saturday, February 22, 2014

Schedule for Week of Feb 23rd

by Calculated Risk on 2/22/2014 12:51:00 PM

The key reports this week are the second estimate of Q4 GDP on Friday, January New Home sales on Wednesday, and December Case-Shiller house prices on Tuesday.

For manufacturing, the February Dallas, Richmond and Kansas City Fed surveys will be released.

Note: The FDIC is expected to release the Q4 FDIC Quarterly Banking Profile during the week.

Also Fed Chair Janet Yellen will provide the Semiannual Monetary Policy Report to the Congress on Thursday.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for February.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through November 2012 (the Composite 20 was started in January 2000).

The consensus is for a 13.3% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 13.5% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

9:00 AM: FHFA House Price Index for December 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

9:00 AM: Chemical Activity Barometer (CAB) for January from the American Chemistry Council. This appears to be a leading economic indicator.

10:00 AM: Conference Board's consumer confidence index for February. The consensus is for the index to decrease to 80.0 from 80.7.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the December sales rate.

The consensus is for a decrease in sales to 405 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 414 thousand in December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 336 thousand.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

10:00 AM: Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

11:00 AM: the Kansas City Fed manufacturing survey for February. This is the last of the regional Fed surveys for February.

8:30 AM: Q4 GDP (second estimate). This is the second estimate of Q4 GDP from the BEA. The consensus is that real GDP increased 2.5% annualized in Q4, revised down from the advance estimate of 3.2%.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a decrease to 57.8, down from 59.6 in January.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 81.2, unchanged from the preliminary reading of 81.2, and unchanged from the January reading.

10:00 AM ET: Pending Home Sales Index for January. The consensus is for a 2.7% increase in the index.

Unofficial Problem Bank list declines to 578 Institutions

by Calculated Risk on 2/22/2014 08:05:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 21, 2014.

Changes and comments from surferdude808:

Late Friday, the OCC released an update on its recent enforcement action activity that contributed to many removals from the Unofficial Problem Bank List. During the week, there were eight removals that lowered the list institution count to 578 with assets of $193.0 billion. A year ago, the list held 809 institutions with $302.8 billion of assets.

The OCC terminated actions against Home Federal Savings Bank, Rochester, MN ($562 million Ticker: HMNF); The Farmers National Bank of Buhl, Buhl, ID ($391 million); 1st National Bank of South Florida, Homestead, FL ($307 million); American National Bank, Oakland Park, FL ($235 million); Liberty Bank, National Association, Twinsburg, OH ($203 million); Cherokee Bank, National Association, Canton, GA ($168 million Ticker: CHKJ); First Capital Bank, Bennettsville, SC ($58 million Ticker: FCPB); and The First National Bank of Fleming, Fleming, CO ($23 million).

Next week, the FDIC should release an update on its latest enforcement action activities and a report on industry results for the fourth quarter and full year of 2013. Included should be updated figures on the Official Problem Bank List. At the last quarterly release in November 2013, the count on the unofficial list exceeded the official by 130. Since then, the unofficial list has declined by 67 institutions. We are anticipating for the difference to narrow with this release.

Friday, February 21, 2014

Weekend Reading: 2008 FOMC Transcripts

by Calculated Risk on 2/21/2014 08:43:00 PM

From some weekend reading, here are the 2008 FOMC transcripts.

Here is a gem from August 2008 from St Louis Fed President James Bullard:

My sense is that the level of systemic risk associated with financial turmoil has fallen dramatically. For this reason, I think the FOMC should begin to de-emphasize systemic risk worries. My reasoning is as follows. Systemic risk means that the sudden failure of a particular financial firm would so shock other ostensibly healthy firms in the industry that it would put them out of business at the same time. The simultaneous departure of many firms would badly damage the financial services industry, causing a substantial decline in economic activity for the entire economy. This story depends critically on the idea that the initial failure is sudden and unexpected by the healthy firms in the industry. But why should this be, once the crisis has been ongoing for some time? Are the firms asleep? Did they not realize that they may be doing business with a firm that may be about to default on its obligations? Are they not demanding risk premiums to compensate them for exactly this possibility? My sense is that, because the turmoil has been ongoing for some time, all of the major players have made adjustments as best they can to contain the fallout from the failure of another firm in the industry. They have done this not out of benevolence but out of their own instincts for self-preservation. As one of my contacts at a large bank described it, the discovery process is clearly over. I say that the level of systemic risk has dropped dramatically and possibly to zero.And then the economy collapsed. I guess the "discovery process" wasn't over!

emphasis added

From Annie Lowrey at the NY Times Economix: How the Fed Saw a Recession, Then Didn’t, Then Did. From January 2008:

JANET L. YELLEN: The severe and prolonged housing downturn and financial shock have put the economy at, if not beyond, the brink of recession.As I've noted over the years, Dr. Yellen is usually correct and Mr. Fisher is frequently funny - and usually wrong.

RICHARD FISHER: While there are tales of woe, none of the 30 C.E.O.’s to whom I talked, outside of housing, see the economy trending into negative territory. They see slower growth. Some of them see much slower growth. None of them at this juncture – the cover of Newsweek notwithstanding, a great contra-indicator, which by the way shows “the road to recession” on the issue that is about to come out – see us going into recession.

CHARLES EVANS: Our cumulative actions following this meeting should provide noticeable stimulus to the economy by midyear.… In the absence of further negative developments, growth should improve in the second half of this year.

ERIC ROSENGREN: We could soon be or may already be in a recession.

From Cardiff Garcia at the FT Alphaville: FOMC transcripts: Bernanke on Japanese vs American monetary policy (or QE vs credit easing)

More excerpts from the NY Times: Inside the Fed’s 2008 Proceedings

And more from Annie Lowrey at the NY Times Economix: In a Dark Year, a Lighter Side at the Fed

MR. MISHKIN: I am very skeptical of [household surveys] because they tend to react very much to current conditions. Also, if you ask people what TV shows they are watching, they will tell you that they are watching PBS and something classy, but you know they are watching “Desperate Housewives.”

MR. BERNANKE. What is wrong with “Desperate Housewives”?