by Calculated Risk on 12/31/2013 09:38:00 PM

Tuesday, December 31, 2013

Market Update: Happy New Year!

Click on graph for larger image.

By request - following the huge market rally in 2013 - here are a couple of stock market graphs. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The market was up 29.6% in 2013 plus dividends.

The second graph (click on graph for larger image) is from Doug Short and shows the S&P 500 since the 2007 high ...

Happy 2014 to all.

Fannie Mae: Mortgage Serious Delinquency rate declined in November, Lowest since December 2008

by Calculated Risk on 12/31/2013 04:13:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in November to 2.44% from 2.48% in October. The serious delinquency rate is down from 3.30% in November 2012, and this is the lowest level since December 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate declined in November to 2.43% from 2.48% in October. Freddie's rate is down from 3.25% in November 2012, and is at the lowest level since March 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.86 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in less than 2 years. Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Restaurant Performance Index increases in November

by Calculated Risk on 12/31/2013 03:03:00 PM

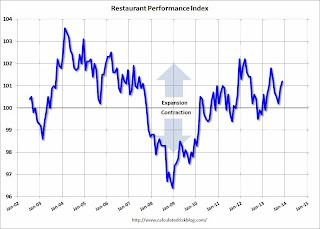

From the National Restaurant Association: Restaurant Performance Index Hit a Five-Month High in November

Driven by improving same-store sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) hit a five-month high in November. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.2 in November, up 0.3 percent from October and the strongest level since June. In addition, the RPI stood above 100 for the ninth consecutive month, which signifies expansion in the index of key industry indicators.

“Recent growth in the RPI was fueled in large part by improving same-store sales and customer traffic levels,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the National Restaurant Association. “In addition, restaurant operators are somewhat more confident that sales levels will improve, and a majority plan to make a capital expenditure in the next six months.”

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 101.2 in November – up 0.3 percent from a level of 100.9 in October and the highest level in six months. ...

Fifty-seven percent of restaurant operators reported a same-store sales gain between November 2012 and November 2013, up from 54 percent in October and the highest level in six months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 101.2 in November, up from 100.9 in October. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and this is fairly positive.

Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

by Calculated Risk on 12/31/2013 12:58:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2014. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2013.

5) Monetary Policy: It appears the Fed's current plan is to reduce their monthly asset purchases by about $10 billion at each FOMC meeting in 2014. That would put the monthly purchases at close to zero in December 2014. Will the Fed complete QE3 in 2014? Or will the Fed continue to buy assets in 2015?

Although the Fed is not on auto-pilot - the FOMC is still data dependent - I think it is very likely that QE3 will be completed by the end of 2014. There are 8 meetings during the year, and I expect the FOMC to reduce the pace of asset purchases at about $10 billion per meeting. In January, the Fed will purchase $75 billion in assets and I expect that to be reduced to $65 billion in February (following the meeting on January 28th and 29th). And a similar reduction at each meeting all year.

It appears they will only slow the taper if inflation declines sharply - or if the economy stalls (I think both are unlikely).

It also seems unlikely they will accelerate the pace of the taper significantly.

So even though the Fed is data-dependent, I currently expect the Fed to reduce their asset purchases by $10 billion per month (or so) at each meeting this year and conclude QE3 at the end of the 2014.

Here are the ten questions for 2014 and a few predictions:

• Question #1 for 2014: How much will the economy grow in 2014?

• Question #2 for 2014: How many payroll jobs will be added in 2014?

• Question #3 for 2014: What will the unemployment rate be in December 2014?

• Question #4 for 2014: Will too much inflation be a concern in 2014?

• Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Case-Shiller: Press Release and Graphs

by Calculated Risk on 12/31/2013 09:59:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Stage Advance According to the S&P/Case-Shiller Home Price Indices

Data through October 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed that the 10-City and 20-City Composites posted year-over-year gains of 13.6%. This is their highest gain since February 2006 and marks the seventeenth consecutive month that both Composites increased on an annual basis.

In October 2013, the two Composites showed a small gain of 0.2% for the month. Eighteen cities posted lower monthly rates in October than in September. After 19 months of gains, San Francisco showed a slightly negative return. Phoenix held onto its streak and posted its 25th consecutive increase.

“Home prices increased again in October,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Both Composites’ annual returns have been in double-digit territory since March 2013 and increasing; now up 13.6% in the year ending in October. However, monthly numbers show we are living on borrowed time and the boom is fading.

“The year-over-year figures increased slightly from last month. Thirteen cities and both Composites posted double-digit annual returns. Cities at the top of the range (Las Vegas, San Diego and San Francisco) saw smaller annual increases. On the other hand, cities that have been relatively underperforming (Cleveland, New York and Washington) saw their annual gains grow. Miami showed the most improvement. Chicago recorded its highest annual rate (+10.9%) since December 1988. Charlotte and Dallas posted annual increases of 8.8% and 9.7%, their highest since the inception of their indices in 1987 and 2000.

“The key economic question facing housing is the Fed’s future course to scale back quantitative easing and how this will affect mortgage rates. Other housing data paint a mixed picture suggesting that we may be close to the peak gains in prices. However, other economic data point to somewhat faster growth in the new year. Most forecasts for home prices point to single digit growth in 2014.”

In October 2013, ten cities posted positive monthly returns. Las Vegas showed the largest gain with an increase of 1.2%, followed by Miami with a 1.1% monthly gain. Atlanta, Boston, Chicago, Cleveland, Dallas, Denver, San Francisco, Seattle and Washington were the nine cities that declined month-over-month; two of them, Denver and Dallas, are slightly off their peak set last month. New York remained flat. Only Charlotte and Miami accelerated on a monthly basis.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 21.5% from the peak, and up 1.0% in October (SA). The Composite 10 is up 19.0% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 20.7% from the peak, and up 1.0% (SA) in October. The Composite 20 is up 19.7% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 13.6% compared to October 2012.

The Composite 20 SA is up 13.6% compared to October 2012. This was the seventeenth consecutive month with a year-over-year gain.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in October seasonally adjusted. Prices in Las Vegas are off 46.6% from the peak, and prices in Denver and Dallas are at new highs.

This was slightly below the consensus forecast for a 13.7% YoY increase. I'll have more on prices later.

Case-Shiller: Comp 20 House Prices increased 13.6% year-over-year in October

by Calculated Risk on 12/31/2013 09:24:00 AM

Note: I'm having difficulties with the S&P website. I'll some graphs soon ...

From Reuters: US home prices notch big annual gain: S&P/Case-Shiller

The S&P/Case Shiller composite index of 20 metropolitan areas gained 0.2 percent in October on a non-seasonally adjusted basis ... On a seasonally-adjusted basis, prices were up 1 percent.This was close to the consensus forecast of a 13.7% year-over-year increase.

Compared to a year earlier, prices were up 13.6 percent ...

the more subdued monthly gains "show we are living on borrowed time and the boom is fading," David Blitzer, chairman of the index committee at S&P Dow Jones Indices, said in a statement.

Monday, December 30, 2013

Tuesday: Case-Shiller House Prices, Chicago PMI

by Calculated Risk on 12/30/2013 08:50:00 PM

I've posted some thoughts (and a few predictions) on half of my ten questions for 2014. There will be more to come (I've also received some thoughtful disagreements - I don't have a crystal ball, I just try to outline my current views):

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October. The consensus is for a 13.7% year-over-year increase in the Composite 20 index (NSA) for October.

• At 9:45 AM, the Chicago Purchasing Managers Index for December. The consensus is for a decrease to 61.3, down from 63.0 in November.

• At 10:00 AM, the Conference Board's consumer confidence index for December. The consensus is for the index to increase to 76.8 from 70.4.

Question #6 for 2014: How much will Residential Investment increase?

by Calculated Risk on 12/30/2013 05:46:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2014. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2013.

6) Residential Investment: Residential investment (RI) picked was up solidly in 2012 and 2013. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. Even with the recent increases, RI is still at a historical low level. How much will RI increase in 2014?

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2013.

Click on graph for larger image.

Click on graph for larger image.

Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the recovery was sluggish so far. Residential investment finally turned positive during 2011 and made a solid positive contribution to GDP in both 2012 and 2013.

But even with recent increases, RI as a percent of GDP is still very low - and still below the lows of previous recessions - and it seems likely that residential investment as a percent of GDP will increase further in 2014.

The second graph shows total and single family housing starts through November 2013.

The second graph shows total and single family housing starts through November 2013.

Housing starts are on pace to increase about 20% in 2013. And even after the sharp increase over the last two years, the approximately 938 thousand housing starts in 2013 will still be the 6th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the five lowest years were 2008 through 2012).

Here is a table showing housing starts over the last few years. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will return to close to the 1.5 million per year average from 1959 through 2000. That means starts will come close to increasing 60% over the next few years from the 2013 level.

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 2012 | 780.6 | 28.2% | 535.3 | 24.3% |

| 20131 | 938.0 | 20% | 625.0 | 17% |

| 12013 estimated | ||||

The third graph shows New Home Sales since 1963 through November 2013. The dashed line is the current sales rate.

The third graph shows New Home Sales since 1963 through November 2013. The dashed line is the current sales rate.Just like for RI as a percent of GDP, and housing starts, new home sales were up in 2013, but are still near the low historically.

New home sales will still be competing with distressed sales (short sales and foreclosures) in some judicial foreclosure states in 2014. However, unlike last year when I reported that some builders were land constrained (not enough finished lots in the pipeline), land should be less of an issue this year. Even with the foreclosures, I expect another solid year of growth for new home sales.

Here are some recent forecasts for housing in 2014. I expect growth for new home sales and housing starts in the 20% range in 2014 compared to 2013. That would still make 2014 the tenth weakest year on record for housing starts (behind 2008 through 2012 and few other recession lows). So I expect further growth in 2015 too.

Here are the ten questions for 2014 and a few predictions:

• Question #1 for 2014: How much will the economy grow in 2014?

• Question #2 for 2014: How many payroll jobs will be added in 2014?

• Question #3 for 2014: What will the unemployment rate be in December 2014?

• Question #4 for 2014: Will too much inflation be a concern in 2014?

• Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Question #7 for 2014: What will happen with house prices in 2014?

by Calculated Risk on 12/30/2013 11:45:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2014. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2013.

7) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 12% or so in 2013. What will happen with house prices in 2014?

Calling the bottom for house prices in 2012 was correct, but I underestimated how quickly prices would increase in 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change in the Case-Shiller Composite 10 and Composite 20 indexes.

The Composite 10 SA was up 13.2% YoY in September, and the Composite 20 SA was also up 13.2% year-over-year. Other house price indexes have indicated lower gains (see table below).

Note: the year-over-year gain in 2010 was related to the homebuyer tax credit. However, in 2010, prices were still too high based on fundamentals. However, when prices started increasing in 2012, prices were more in line with fundamentals based on price-to-income, price-to-rent and real house prices.

Although I use Case-Shiller, I do think the index overstates national prices due to the inclusion of foreclosures and the weighting of certain coastal areas. The following table shows the year-over-year change for several house prices indexes. Clearly prices were up in 2013, but there was a pretty significant difference between the various measures of prices:

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Sep-13 | 13.2% |

| Case-Shiller National | Q3 | 11.2% |

| CoreLogic | Oct-13 | 12.5% |

| Zillow | Oct-13 | 5.2% |

| LPS | Oct-13 | 8.8% |

| FNC | Oct-13 | 6.5% |

| FHFA Purchase Only | Oct-13 | 8.8% |

Some of the key factors in 2012 and 2013 were limited inventory, fewer foreclosures, investor buying in certain areas, and a change in psychology as buyers and sellers started believing house prices had bottomed.

In some areas, like Phoenix, there appeared to be a bounce off the bottom - but that bounce appears to be slowing. CoreLogic economist Sam Khater wrote today: Low-End Home Price Correction Over, Portends a Substantial Slowdown in Prices

Analyzing low-end versus high-end price trends reveals two stylized facts. First, low-end price changes and levels lead high-end prices and levels by six months to a year. The low-end price trough in March 2011 was clearly foreshadowing that the market was set to recover. Second, low-end prices are much more volatile than high end prices, which sometimes makes turning points easier to catch.In 2014, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. This suggests more house price increases in 2014, but probably at a slow pace.

While there are some caveats, clearly lower-end home prices are decelerating, especially in the former boom/bust markets of the Southwest. More importantly, the magnitude of the declines presages lower growth for prices overall.

As Khater noted, some of the "bounce back" in certain areas is probably over, also suggesting slower price increases going forward. And investor buying appears to have slowed. A positive for the market will probably be a little looser mortgage credit.

All of these factors suggest further prices increases in 2014, but at a slower rate than in 2013. There tends to be some momentum for house prices, and I expect we will see prices up mid-to-high single digits (percentage) in 2014 as measured by Case-Shiller.

Here are the ten questions for 2014 and a few predictions:

• Question #1 for 2014: How much will the economy grow in 2014?

• Question #2 for 2014: How many payroll jobs will be added in 2014?

• Question #3 for 2014: What will the unemployment rate be in December 2014?

• Question #4 for 2014: Will too much inflation be a concern in 2014?

• Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Pending Home Sales Index increased 0.2% in November

by Calculated Risk on 12/30/2013 10:00:00 AM

From the NAR: Pending Home Sales Edge Up in November

The Pending Home Sales Index, a forward-looking indicator based on contract signings, inched up 0.2 percent to 101.7 in November from a downwardly revised 101.5 in October, but is 1.6 percent below November 2012 when it was 103.3. The data reflect contracts but not closingsContract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

...

The PHSI in the Northeast declined 2.7 percent to 82.6 in November, but is 1.9 percent above a year ago. In the Midwest the index fell 3.1 percent to 100.6 in November, but is 0.4 percent higher than November 2012. Pending home sales in the South rose 2.3 percent to an index of 116.1 in November, and are 0.1 percent above a year ago. The index in the West increased 1.8 percent in November to 95.0, but is 8.7 percent below November 2012, in part from inventory constraints.

emphasis added