by Calculated Risk on 6/06/2013 09:40:00 PM

Thursday, June 06, 2013

Friday: Jobs, Jobs, Jobs

First, LPS released their Mortgage Monitor report for April today. According to LPS, 6.21% of mortgages were delinquent in April, down from 6.59% in March

LPS reports that 3.17% of mortgages were in the foreclosure process, down from 4.20% in April 2012.

This gives a total of 9.38% delinquent or in foreclosure. It breaks down as:

• 1,717,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,394,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,588,000 loans in foreclosure process.

For a total of 4,699,000 loans delinquent or in foreclosure in April. This is down from 5,617,000 in April 2012.

The first graph from LPS shows percent of mortgage delinquent and in-foreclosure by month.

The percent of delinquent loans is still high (normal is in the 4% to 5% range), but the percent of delinquent loans is falling quickly.

The second graph shows the percent of loans in foreclosure in judicial and non-judicial foreclosure states.

[T]he disparity in foreclosure timelines between judicial and non-judicial states -- continues to grow. Still, as LPS Applied Analytics Senior Vice President Herb Blecher explained, the steady return to a relative degree of normality in the foreclosure sale rate has helped to bring down foreclosure inventories at the national level.There is much more in the mortgage monitor.

“The foreclosure sale rate in judicial states rose nearly 17 percent from March to April,” Blecher said. “This is the highest that rate has been since the moratoria and process reviews in the fall of 2010 led to a near-complete halt in the process in both judicial and non-judicial states. Non-judicial rates were relatively quick to bounce back, but judicial states experienced a much slower, though steady, increase. This has helped drive an overall decline in foreclosure inventory at the national level, which is now at 3.2 percent -- its lowest point in four years.

“The situation is far from resolved,” Blecher stressed. “Foreclosure inventories in judicial states are still more than three times the size of those in non-judicial states, and national inventories are still more than seven times pre-crisis levels. Additionally, recently announced moratoria will need to be monitored to determine the impact on timelines, as well as the rate of the improvement trend.”

Friday economic releases:

• At 8:30 AM, the BLS will release the Employment Report for May. The consensus is for an increase of 167,000 non-farm payroll jobs in May; the economy added 165,000 non-farm payroll jobs in April. The consensus is for the unemployment rate to be unchanged at 7.5% in May.

• At 3:00 PM, Consumer Credit for April from the Federal Reserve. The consensus is for credit to increase $14.0 billion in April.

Bank Failure #15 in 2013: 1st Commerce Bank, North Las Vegas, Nevada

by Calculated Risk on 6/06/2013 07:20:00 PM

From the FDIC: Plaza Bank, Irvine, California, Assumes All of the Deposits of 1st Commerce Bank, North Las Vegas, Nevada

As of March 31, 2013, 1st Commerce Bank had approximately $20.2 million in total assets and $19.6 million in total deposits. ... The FDIC estimates that cost to the Deposit Insurance Fund will be $9.4 million. ... 1st Commerce Bank is the 15th FDIC-insured institution to fail in the nation this year, and the first in Nevada.Surferdude has been discussing this bank in his weekly unofficial problem bank posts. Three weeks ago he wrote:

[I]n Nevada, the Nevada Department of Business and Industry's Financial Institutions Division was prevented from closing 1st Commerce Bank, North Las Vegas ($24 million) through another legal action by Capitol Bancorp.And last week he noted:

There is nothing new to report on the status of Capitol Bancorp's banking subsidiaries, particularly 1st Commerce Bank, North Las Vegas ($24 million), which is subject to a sealed hearing on the ability of the Nevada Department of Business and Industry's Financial Institutions Division to terminate its banking charter.This is the second mid-week Capitol Bancorp related closing in the last month - both closings were delayed by legal filings.

Europe: Been down so long ...

by Calculated Risk on 6/06/2013 05:54:00 PM

From Jack Ewing at the NY Times: Down So Long It Looks Like Up to the Euro Zone

This is what passes for good economic news in Europe: Spain just added 265 jobs. ... Never mind that nearly five million people in Spain are out of work. The latest unemployment report from the government, issued on Tuesday, was held up by Mr. Rajoy as a sign that maybe, just maybe, the economy is getting better.Eventually the euro zone will start growing again. The will not be a sign of "success" of current policies - these are already a clear failure given the severe pain and suffering in the interim.

Nearly six years after the financial crisis in the United States spread across the Atlantic, plunging Europe into recession and, in some places, desperate depression, “good” is relative. ...

During a visit to Athens last week, the Dutch finance minister said he detected “the first signal of a turn in the economy.” Then, on Wednesday, news arrived from Brussels that the Greek economy was indeed getting better. It shrank by only — only — 5.3 percent in the first three months of the year. That was in fact an improvement: it had contracted 5.7 percent the previous quarter.

Employment Situation Preview: Expect Disappointment

by Calculated Risk on 6/06/2013 02:24:00 PM

On Friday, at 8:30 AM ET, the BLS will release the employment report for May. The consensus is for an increase of 167,000 non-farm payroll jobs in May, and for the unemployment rate to be unchanged at 7.5%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 135,000 private sector payroll jobs in May. This was below expectations of 171,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in May to 50.1% from 50.2% in April. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased by close to 20,000 in May. The ADP report indicated a 6,000 decrease in manufacturing jobs.

The ISM non-manufacturing (service) employment index decreased in May to 50.1% from 52.0% in April. A historical correlation between the ISM service employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 65,000 in May.

Taken together, these surveys suggest only around 45,000 jobs added in May - significantly below the consensus forecast.

• Initial weekly unemployment claims averaged about 348,000 in May. This was up from 343,000 in March, but still near the low for the year.

For the BLS reference week (includes the 12th of the month), initial claims were at 344,000; down from 355,000 in April.

• The final May Reuters / University of Michigan consumer sentiment index increased to 84.5 from the April reading of 76.4. This was the highest level since July 2007. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors.

• The small business index from Intuit showed 35,000 payroll jobs added, the same as for April. This index is improving a little.

• And on the unemployment rate from Gallup: U.S. Payroll to Population and Unemployment Worsen in May

Gallup's unadjusted unemployment rate for the U.S. workforce was 7.9% for the month of May, a half-point increase over April, and statistically unchanged from May 2012 (8.0%).Note: So far the Gallup numbers haven't been very useful in predicting the BLS unemployment rate.

Gallup's seasonally adjusted U.S. unemployment rate for May was 8.2%, up from 7.8% in April. Gallup calculates its seasonally adjusted employment rate by applying the adjustment factor the U.S. government used for the same month in the previous year.

• Conclusion: The employment related data was mostly disappointing again in May. The ADP and ISM manufacturing reports suggest a decrease in hiring. However weekly claims for the reference week were slightly lower in May than in April (although claims for the month were higher), and consumer sentiment increased sharply.

There is always some randomness to the employment report, but my guess is the BLS will report below the consensus of 171,000 jobs added in May. Based on the ISM reports (and more), we might see a very weak report on Friday.

Fed's Q1 Flow of Funds: Household Mortgage Debt down $1.3 Trillion from Peak, Record Household Net Worth

by Calculated Risk on 6/06/2013 12:26:00 PM

The Federal Reserve released the Q1 2013 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q1 compared to Q4 2012, and is at a new record. Net worth peaked at $67.4 trillion in Q3 2007, and then net worth fell to $51.4 trillion in Q1 2009 (a loss of $16 trillion). Household net worth was at $70.3 trillion in Q1 3013 (up $18.3 trillion from the trough).

The Fed estimated that the value of household real estate increased to $18.5 trillion in Q1 2013. The value of household real estate is still $4.2 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.

This is the Households and Nonprofit net worth as a percent of GDP. Although household net worth is at a record high, this is still below the peaks in 2000 (stock bubble) and 2006 (housing bubble).

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was relatively stable (or increasing gradually) for almost 50 years, and then we saw the stock market and housing bubbles. The ratio has been trending up and increased again in Q1 with both stock and real estate prices increasing.

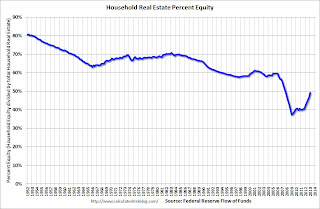

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2013, household percent equity (of household real estate) was at 49.2% - up from Q4, and the highest since Q4 2007. This was because of both an increase in house prices in Q1 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 49.2% equity - and millions have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $53.2 billion in Q1. Mortgage debt has now declined by $1.27 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q1 (as house prices increased), but not far above the lows of the last 30 years. However household mortgage debt, as a percent of GDP, is still historically high, suggesting still more deleveraging ahead for certain households.

Trulia: Asking House Prices increased in May

by Calculated Risk on 6/06/2013 09:46:00 AM

Press Release: Trulia Reports Asking Prices up 16.3 Percent Year-over-year in the Least Affordable Housing Markets

In May, asking prices continued to increase steadily across the country, rising in 98 of the largest 100 metros. Nationally, prices are up 9.5 percent year-over-year (Y-o-Y). Seasonally adjusted, prices increased 4.0 percent quarter-over-quarter and 1.1 percent month-over-month.On rents, this is similar to the quarterly Reis report on apartments. It appears that rent increases are slowing.

Eight out of the 10 least affordable markets, with seven in California, are all showing double digit asking price increases making home affordability even tougher for would-be buyers. Orange County, Oakland, and San Jose all had price increases of more than 20 percent, making these already expensive markets even less affordable. Prices are up 16.3 percent, on average, in these 10 least affordable housing markets.

Nationally, rents are up 2.3 percent Y-o-Y, rising slower than asking prices in 23 of the 25 largest rental markets. Out of the 10 least affordable rental markets, five show increases below the national average, with California markets moving especially slow – San Francisco rents up 0.2 percent, Los Angeles 1.8 percent and Oakland 1.3 percent. Among these least affordable rental markets, Miami and Boston had the largest rent increases.

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

Weekly Initial Unemployment Claims decline to 346,000

by Calculated Risk on 6/06/2013 08:37:00 AM

The DOL reports:

In the week ending June 1, the advance figure for seasonally adjusted initial claims was 346,000, a decrease of 11,000 from the previous week's revised figure of 357,000. The 4-week moving average was 352,500, an increase of 4,500 from the previous week's revised average of 348,000.The previous week was revised up from 354,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 352,500.

Claims close to the 345,000 consensus forecast.

Wednesday, June 05, 2013

Thursday: Weekly Unemployment Claims, Flow of Funds Report

by Calculated Risk on 6/05/2013 07:18:00 PM

A few interesting articles ...

From Joseph Cotterill at Alphaville on the IMF report about the mishandling of the situation in Greece: Ignored Many Flaws — the report

Click for the IMF’s “ex post evaluation” of its role in the Greek bailout. Its mea culpa.So they needed to write down debt sooner, and severe austerity made the situation much worse. Hoocoodanode?

And if you thought we were being harsh here, parts of the real thing are excoriating.

And from Tim Duy: Falling Inflation Expectations

...Yes, I know the Fed said they could move up or down. But I think the idea of "up" would only come after a "down." And clearly, if inflation expectations are any guide, market participants are getting the message that "down" is what is coming. And they are not getting that from just the hawkish policymakers. The doves too have been getting in on the action.And a funny (but still serious) piece from Noah Smith: What is "derp"? The answer is technical. It is always frustrating that so many pundits and policymakers don't change their views when confronted with contradictory data - Noah's post helps explain why.

Moreover, I have to imagine that the recent market action in Tokyo has made some policymakers a little bit nervous about the limits to quantitative easing. The Nikkei's rise and fall seems to indicate that at some point asset purchases do in fact become destabilizing.

My view is that asset purchases would be most effective if coupled with fiscal stimulus. Working only through financial markets may be simply too restrictive to yield broad-based economic improvement. It is almost as if the Fed is trying to force a fire hose of policy through a garden hose. Keep turning up the volume, and eventually that hose bursts. And that might be what we are seeing in Japan.

Bottom Line: Inflation[sp] expectations are falling, and that by itself should complicate the Fed's expectation that they can start scaling back asset purchases at the end of the summer. But falling inflation expectations may complicate monetary policy more broadly by revealing the limits to quantitative easing. And Japan isn't helping.

Thursday economic releases:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for a decrease to 345 thousand from 354 thousand last week.

• At 10:00 AM, the Trulia Price Rent Monitors for May will be released. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 12:00 PM, the Federal Reserve will release the Q1 Flow of Funds Accounts of the United States.

Report: Personal Bankruptcy Filings decline 11% year-over-year in May

by Calculated Risk on 6/05/2013 04:35:00 PM

From the American Bankruptcy Institute: May Bankruptcy Filings Decrease 12 Percent from Previous Year, Business Filings Decrease 25 Percent

Total bankruptcy filings in the United States decreased 12 percent in May over last year, according to data provided by Epiq Systems, Inc. Bankruptcy filings totaled 96,430 in May 2013, down from the May 2012 total of 109,538. Consumer filings declined 11 percent to 92,413 from the May 2012 consumer filing total of 104,197. Total commercial filings in May 2013 decreased to 4,017, representing a 25 percent decline from the 5,341 business filings recorded in May 2012.Personal bankruptcy filings peaked in 2010 at 1.54 million (highest since the bankruptcy law change in 2005). Filings declined to 1.22 million last year, and will probably be just over 1 million this year - the lowest level since 2008. Note: Even in good economic years, there are around 800 thousand personal bankruptcy filings.

...

"Sustained low interest rates, tighter lending standards and decreased consumer spending are assisting consumers and companies to shore up their balance sheets,” said ABI Executive Director Samuel J. Gerdano. “As households and businesses remain committed to deleveraging, the number of filings will continue to decrease.”

This is another indicator of a little less financial stress.

Fed's Beige Book: Economic activity "increased at a modest to moderate pace"

by Calculated Risk on 6/05/2013 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Minneapolis and based on information collected on or before May 24, 2013."

Overall economic activity increased at a modest to moderate pace since the previous report across all Federal Reserve Districts except the Dallas District, which reported strong economic growth. The manufacturing sector expanded in most Districts since the previous Beige Book. Most Districts noted slight to moderate gains in consumer spending and a moderate increase in vehicle sales. Tourism showed signs of strength in several Districts. A wide variety of business services expanded, and transportation traffic increased for producer, consumer, and trade goods. Residential real estate and construction activity increased at a moderate to strong pace in all Districts. Commercial real estate and construction activity grew at a modest to moderate pace in most Districts. Overall bank lending increased since the previous report.And on real estate:

Residential real estate and construction activity increased at a moderate to strong pace in all Districts. Several Districts reported that higher demand and low inventory of homes available for sale are resulting in multiple offers on properties. Almost all Districts reported higher home sale prices. The Kansas City District reported concerns that appraisals were not keeping pace with price increases. Foreclosed properties available for sale have declined significantly in the San Francisco District. The rental market remains tight with noticeable increases in rental rates in the New York District. Residential construction increased across all of the reporting Districts. ...Residential real estate continues to be a strong sector for the economy. Overall this was a slight downgrade from the previous beige book (downgrade from "moderate" growth to "modest to moderate").

Commercial real estate and construction activity expanded at a modest to moderate pace in most Districts. The New York District reported that the Manhattan market is particularly robust. The Chicago District noted that an increase in demand for leasing was pushing up commercial rents, with strong demand from the health care sector. However, a market in the Boston District indicated no change in commercial rents or vacancy rates since the previous report.