by Calculated Risk on 4/22/2013 05:58:00 PM

Monday, April 22, 2013

Lawler on Housing: Table of Cash Buyers in March, Updated Table of Short Sales and Foreclosures for Selected Cities

Economist Tom Lawler sent me the following table of cash buyers for selected cities in March 2013 compared to March 2012. This suggests significant investor buying in certain areas (like Florida):

| All-Cash Share of Home Sales | ||

|---|---|---|

| Mar-13 | Mar-12 | |

| Las Vegas | 57.5% | 54.5% |

| Orlando | 55.2% | 52.9% |

| Metro Detroit | 45.5% | N/A |

| Memphis | 41.2% | 41.0% |

| Toledo | 38.9% | 40.3% |

| Phoenix | 41.5% | 49.8% |

| Sacramento | 36.4% | 32.0% |

| So. Cal (DQ) | 34.1% | 32.4% |

| Wichita | 27.9% | 30.2% |

| Knoxville | 27.4% | 28.4% |

| Des Moines | 19.1% | 21.7% |

| Bay Area Cal (DQ) | 31.1% | 29.4% |

| Mid-Atlantic | 20.6% | 20.8% |

| Florida SF | 48.4% | 47.1% |

| Florida C/TH | 75.2% | 77.8% |

| Miami-FL-PB MSA SF | 45.5% | 46.4% |

| Miami-FL-PB MSA C/TH | 79.6% | 82.1% |

| Tucson | 35.0% | 38.3% |

| Omaha | 22.1% | 15.7% |

| Pensacola | 35.9% | 32.1% |

| Akron | 34.1% | 38.7% |

Lawler also sent me the updated table below of short sales and foreclosures for several selected cities in March. Note the declines in total distressed sales and foreclosure sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 13-Mar | 12-Mar | 13-Mar | 12-Mar | 13-Mar | 12-Mar | |

| Las Vegas | 33.3% | 26.6% | 11.2% | 40.7% | 44.5% | 67.3% |

| Reno | 32.0% | 34.0% | 9.0% | 32.0% | 41.0% | 66.0% |

| Phoenix | 15.1% | 25.7% | 11.6% | 21.1% | 26.8% | 46.8% |

| Sacramento | 27.0% | 29.0% | 10.5% | 30.7% | 37.5% | 59.7% |

| Minneapolis | 9.3% | 12.4% | 28.6% | 36.5% | 37.9% | 48.9% |

| Mid-Atlantic (MRIS) | 11.4% | 13.2% | 10.7% | 14.7% | 22.1% | 27.9% |

| Orlando | 21.7% | 33.1% | 21.3% | 26.0% | 43.1% | 59.2% |

| California (DQ)* | 21.5% | 24.5% | 15.2% | 32.8% | 36.7% | 57.3% |

| Bay Area CA (DQ)* | 10.7% | 25.5% | 19.0% | 23.8% | 29.7% | 49.3% |

| So. California (DQ)* | 21.5% | 24.6% | 13.9% | 31.5% | 35.4% | 56.1% |

| Florida SF | 15.9% | 21.8% | 16.4% | 19.4% | 32.3% | 41.1% |

| Florida C/TH | 11.4% | 18.1% | 14.1% | 16.0% | 25.5% | 34.2% |

| Miami MSA SF | 20.6% | 24.1% | 11.9% | 18.7% | 32.5% | 42.7% |

| Miami MSA C/TH | 13.7% | 20.2% | 14.5% | 16.7% | 28.2% | 36.9% |

| Northeast Florida | 40.0% | 43.2% | ||||

| Chicago | 43.0% | 46.0% | ||||

| Hampton Roads | 28.4% | 33.5% | ||||

| Charlotte | 12.3% | 15.8% | ||||

| Sarasota | 30.0% | 32.0% | ||||

| Metro Detroit | 35.4% | 46.6% | ||||

| Houston | 12.3% | 19.6% | ||||

| Memphis* | 26.8% | 32.7% | ||||

| *share of existing home sales, based on property records | ||||||

DOT: Vehicle Miles Driven decreased 1.4% in February

by Calculated Risk on 4/22/2013 03:09:00 PM

First, Brad Plumer at the WaPo has an excellent article: Why aren’t younger Americans driving anymore?

The Frontier Group has the most comprehensive look yet of why younger Americans are driving less. Public transportation use is up 40 percent per capita in this age group since 2001. Bicycling is up 24 percent overall in that time period. And this is true even for young Americans who are financially well off. Here are five big hypotheses:Although Plumer focused on younger drivers, he missed a major reason for the decline in miles driven - the aging of the population (over 55 drivers drive fewer miles)!

–The cost of driving has gone up. ...

–The recession. This is a big one. If fewer people have jobs, fewer people will commute. ...

–It’s harder to get a license. ...

–More younger people are living in transit-oriented areas. ...

Ecological concerns play a small role too, judging from survey data: “Some young people purposely reduce their driving in an effort to curb their environmental impact.”

–Technology is making it easier to go car-free.

Note: the graphs Plumer uses from Doug Short and are per capita (population adjusted).

The Department of Transportation (DOT) reported:

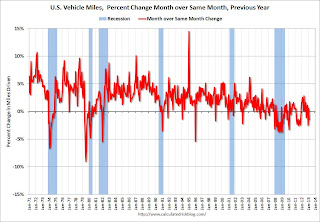

Travel on all roads and streets changed by -1.4% (-3.1 billion vehicle miles) for February 2013 as compared with February 2012. Travel for the month is estimated to be 214.6 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 63 months - over 5 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in February compared to February 2012. In February 2013, gasoline averaged of $3.74 per gallon according to the EIA. In 2012, prices in February averaged $3.64 per gallon. However prices declined in March, and miles driven will probably increase even more than the usual season increase.

Gasoline prices were up in February compared to February 2012. In February 2013, gasoline averaged of $3.74 per gallon according to the EIA. In 2012, prices in February averaged $3.64 per gallon. However prices declined in March, and miles driven will probably increase even more than the usual season increase.However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

Existing Home Sales: Conventional Sales up Sharply

by Calculated Risk on 4/22/2013 12:55:00 PM

Here are a few excerpts from a Reuters article: Existing Home Sales Fall as Prices Rise Most Since 2005

U.S. home resales edged downward in March, a pause in the housing market recovery that has helped boost the economy.First, this isn't a "pause in the housing market recovery". The housing recovery is based on residential investment, and only the commission on existing home sales is included in residential investment (the main contributors are new home sales and home improvement). A decline in the headline number for existing home sales due to fewer distressed sales, is a positive, not a negative!

...

Nationwide, the median price for a home resale rose to $184,300 in March, up 11.8 percent from a year earlier, the biggest increase since November 2005. The limited supply of available properties is pushing up home values.

Second, the median price is a poor measure of overall market prices since this reflects changes in the mix in addition to changes in prices (the repeat sales indexes are a better measure of price changes). Note: Lawler used the median over the weekend to show that investors are buying at a higher price point - an appropriate use of the median price.

The NAR reported total sales were up 10.3% from March 2012, but conventional sales are probably up over 20% from March 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes - foreclosures and short sales - accounted for 21 percent of March sales, down from 25 percent in February and 29 percent in March 2012.Although this survey isn't perfect, if total sales were up 10.3% from March 2012, and distressed sales declined from 29% of total sales to 21%, this suggests conventional sales were up sharply year-over-year - a good sign. However some of this increase is investor buying, although the NAR is reporting investors are buying about the same percentage as a year ago:

Individual investors, who account for most cash sales, purchased 19 percent of homes in March, down from 22 percent in February; they were 21 percent in March 2012.Other data suggests investor buying has increased, see Housing: Some thoughts on Investor Buying, Inventory and recent Price Increases and from the WaPo: Wall Street betting billions on single-family homes in distressed markets

Of course inventory is the key number in the NAR report. The NAR reported inventory increased to 1.93 million units in March, up from 1.90 million in February. Some of this increase was seasonal, and this is still a very low level of inventory. And inventory is still down sharply year-over-year; down 16.8% from March 2012. But this is the smallest year-over-year decline since 2011.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

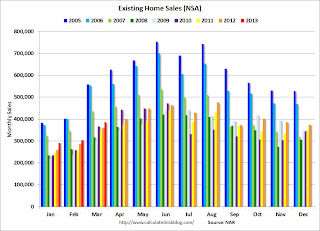

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in March (red column) are above the sales for for 2008 through 2012, but below the bubble years of 2005 and 2006.

The bottom line is this was a solid report. Conventional sales have increased sharply, although some of this is investor buying. And inventory is low, but the year-over-year decline in inventory is decreasing.

Earlier:

• Existing Home Sales in March: 4.92 million SAAR, 4.7 months of supply

Existing Home Sales in March: 4.92 million SAAR, 4.7 months of supply

by Calculated Risk on 4/22/2013 10:00:00 AM

The NAR reports: March Existing-Home Sales Slip Due to Limited Inventory, Prices Maintain Uptrend

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 0.6 percent to a seasonally adjusted annual rate of 4.92 million in March from a downwardly revised 4.95 million in February, but remain 10.3 percent higher than the 4.46 million-unit pace in March 2012.

Total housing inventory at the end of March increased 1.6 percent to 1.93 million existing homes available for sale, which represents a 4.7-month supply at the current sales pace, up from 4.6 months in February. Listed inventory remains 16.8 percent below a year ago when there was a 6.2-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2013 (4.92 million SAAR) were 0.6% lower than last month, and were 10.3% above the March 2012 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.93 million in March up from 1.90 million in February. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer (so some of this increase was seasonal).

According to the NAR, inventory increased to 1.93 million in March up from 1.90 million in February. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer (so some of this increase was seasonal).The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 16.8% year-over-year in March compared to March 2012. This is the 25th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).

Inventory decreased 16.8% year-over-year in March compared to March 2012. This is the 25th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).Months of supply increased to 4.7 months in March.

This was below expectations of sales of 5.03 million, but close to Tom Lawler's forecast. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. This was a solid report. I'll have more later ...

Chicago Fed: "Economic Activity Slower in March"

by Calculated Risk on 4/22/2013 08:37:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Slower in March

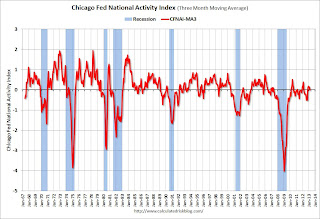

Led by declines in production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.23 in March from +0.76 in February. Three of the four broad categories of indicators that make up the index decreased from February, and only one of the four categories made a positive contribution to the index in March.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.01 in March from +0.12 in February. March’s CFNAI-MA3 suggests that growth in national economic activity was very near its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity slowed in March, and growth was near the historical trend (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, April 21, 2013

Monday: Existing Home Sales

by Calculated Risk on 4/21/2013 08:17:00 PM

A major revision to GDP is coming this summer, from Robin Harding at the Financial Times: Data shift to lift US economy 3%

The US economy will officially become 3 per cent bigger in July as part of a shake-up that will see government statistics take into account 21st century components such as film royalties and spending on research and development.This is a technical change on what is included in GDP, as an example R&D has been considered an expense and will now be included as an investment and capitalized. Another change will be that underfunded pension plans will be included as a liability. According to the article, the BEA doesn't expect any "large changes in trends or cycles".

Monday economic releases:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for sales of 5.03 million on seasonally adjusted annual rate (SAAR) basis. Sales in February were at a 4.98 million SAAR. Economist Tom Lawler is estimating the NAR will report a March sales rate of 4.89 million.

Weekend:

• Summary for Week Ending April 19th

• Schedule for Week of April 21st

The Japanese market opened up sharply with the Nikkei up 1.7%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up slightly and Dow futures are up 16 (fair value).

Oil prices are down over the last week with WTI futures at $88.01 per barrel and Brent at $99.44 per barrel.

According to Gasbuddy.com, gasoline prices are down about 24 cents over the last 7 weeks to $3.50 per gallon. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.32 per gallon. That is about 18 cents below the current level according to Gasbuddy.com, so I expect gasoline prices to fall further.

Housing: Some thoughts on Investor Buying, Inventory and recent Price Increases

by Calculated Risk on 4/21/2013 01:26:00 PM

One of the key themes I've mentioned over the last year is the increase in conventional sales and the corresponding decline in distressed sales (Foreclosures and short sales). I've argued this increase in conventional sales is a sign of a healing market.

Tom Lawler has sent me some rough data that suggests much of the increase in conventional sales in California has been due to investor buying (mostly large institutional investors buying single family homes to rent). As an example, reports are Blackstone has purchased 20,000 homes nationally and Colony Capital has purchased 7,000 homes. And there a number of other large players. There groups have continued to buy even as the number of foreclosures has declined.

Note: some of the smaller investor groups I've mentioned on this blog have stopped buying (they started buying at the low end in late 2008). They say the numbers no longer make sense.

Historically single family rentals were a mom-and-pop venture, and these large institutional buyers are a significant change in the market. These buyers are one of the reason the current active inventory is so low (other reasons include "underwater" homeowners who can't sell, potential sellers unable to find a new home to buy, and a change in seller psychology "not wanting to sell at the bottom").

This investor buying is making it very difficult for first time buyers to find a home, and this is probably keeping some potential buyers as renters - and maybe pushing up some buyers to higher price points just to buy.

In the short run (the next few years), I don't think these institutional buyers will have a negative impact on the market. It seems unlikely they will be large sellers, and they will probably maintain the homes that they purchase. However this could impact the housing market in the future, especially the move-up market, since the move-up market usually needs previous first-time buyers to sell their first homes. Obviously institutional sellers will not be move-up buyers.

The impacts of this investor buying are something to consider. Below is some comments and data from Tom Lawler. He makes a couple of key points: 1) owner occupied buying is actually down a little in California, and 2) it appears the investors are moving up to higher price points.

The following is from economist Tom Lawler:

Dataquick [released estimates for all-cash and absentee buyer shares] for the Southern California area and the Bay Area, which are shown on the [below], along with the foreclosure and short sales shares for each area, as well as the median sales price for all-cash transactions and absentee buyer transactions.

There are a few interesting things to note: first, while the foreclosure share of resales was down sharply from last March to this March, and last month’s short-sales share was down from a year ago, both areas saw an increase in both the all-cash share of sales and in the “absentee” buyer share of sales. This confirms anecdotal reports that “investors,” rather than curtailing purchases because of declines in “distressed” properties for sale, have increasingly been purchasing non-foreclosure properties, and possibly even non-distressed properties. Second, the median sales price for homes sold to “all-cash” buyers and to “absentee” buyers – and, of course, there is a lot of overlap in these two – increased by a lot more than the overall median sales price in both areas, also shown on the next page.

| Dataquick Estimates, California Home Sales | ||||

|---|---|---|---|---|

| All-Cash Share | Absentee Buyer Share | |||

| 13-Mar | 12-Mar | 13-Mar | 12-Mar | |

| SoCal | 34.1% | 32.4% | 30.6% | 28.2% |

| Bay Area | 31.1% | 29.4% | 27.3% | 24.2% |

| Median Sales Price, All-Cash Share | Median Sales Price, Absentee Buyer Share | |||

| 13-Mar | 12-Mar | 13-Mar | 12-Mar | |

| SoCal | $280,750 | $215,000 | $274,000 | $212,000 |

| Bay Area | $325,000 | $250,000 | $324,000 | $250,000 |

| Foreclosure Share | Short Sales Share | |||

| 13-Mar | 12-Mar | 13-Mar | 12-Mar | |

| SoCal | 13.9% | 31.5% | 21.5% | 24.6% |

| Bay Area | 10.7% | 25.5% | 19.0% | 23.8% |

| Median Prices1 | SoCal | Bay Area | ||||

|---|---|---|---|---|---|---|

| 13-Mar | 12-Mar | % Chg | 13-Mar | 12-Mar | % Chg | |

| All Transactions | $345,500 | $280,000 | 23.4% | $436,000 | $358,000 | 21.8% |

| All-Cash | $280,750 | $215,000 | 30.6% | $325,000 | $250,000 | 30.0% |

| Absentee Buyer | $274,000 | $212,000 | 29.2% | $324,000 | $250,000 | 29.6% |

This confirms anecdotal reports that “investors” in California have been “moving up” the price points at which they purchase homes.

Finally, while the sharp drop in the “distressed” share of sales over the last year indicates that there was strong YOY growth in “non-distressed” sales, the increase in the absentee buyer share of sales indicates that sales last months to folks planning to occupy the home they were purchasing were down from a year ago in both areas.

| New and Resale Home Sals, Socal and Bay Area | |||

|---|---|---|---|

| 13-Mar | 12-Mar | % Chg. | |

| Southern California | |||

| Total | 20,581 | 19,953 | 3.1% |

| Owner Occupant | 14,283 | 14,326 | -0.3% |

| Bay Area | |||

| Total | 7,263 | 7,723 | -6.0% |

| Owner Occupant | 5,280 | 5,854 | -9.8% |

These data strongly suggest the investor buying – a lot of which was all-cash and a lot of which has or will become rental units (witness the sharp drop in home listings in California, suggesting that few of the investor purchases were for quick flipping) – has been a major driver of the housing and home price recovery in California.

Shiller on Housing: "Could be an auspicious time to buy"

by Calculated Risk on 4/21/2013 10:07:00 AM

I think Professor Shiller has changed his view ... writing in the NY Times: Before Housing Bubbles, There Was Land Fever

"With rates now relatively low, this could be an auspicious time to buy a house with a fixed-rate mortgage. That could make good sense for people who aren’t out to bet on the housing or mortgage markets but are instead focused on settling into a home for the long term."It might be an "auspicious" time to buy ... if someone can find a home for sale (there is so little inventory in many areas).

Saturday, April 20, 2013

Schedule for Week of April 21st

by Calculated Risk on 4/20/2013 06:34:00 PM

Earlier:

• Summary for Week Ending April 19th

The key reports this week are the Q1 advance GDP report to be released on Friday, New home sales for March on Tuesday, and existing home sales for March on Monday.

There are also two more regional manufacturing surveys to be released this week.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for sales of 5.03 million on seasonally adjusted annual rate (SAAR) basis. Sales in February were at a 4.98 million SAAR. Economist Tom Lawler is estimating the NAR will report a March sales rate of 4.89 million.

A key will be inventory and months-of-supply.

9:00 AM: FHFA House Price Index for February 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase

9:00 AM: The Markit US PMI Manufacturing Index Flash for April. The consensus is for a decrease to 54.2 from 54.9 in March.

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the February sales rate.

The consensus is for an increase in sales to 419 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 411 thousand in February.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April. The consensus is for a reading of 3.0 for this survey, unchanged from March (Above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 2.8% decrease in durable goods orders.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 350 thousand from 352 thousand last week. The "sequester" budget cuts might be starting to impact weekly claims.

11:00 AM: Kansas City Fed regional Manufacturing Survey for April. The consensus is for a reading of minus 1, up from minus 5 in March (below zero is contraction).

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 3.1% annualized in Q1.

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 3.1% annualized in Q1.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the consensus forecast for Q1 GDP.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for April). The consensus is for a reading of 73.0, up from 72.3.

Summary for Week ending April 19th

by Calculated Risk on 4/20/2013 12:45:00 PM

According to the Fed's Beige book released last week, "economic activity expanded at a moderate pace" recently with housing leading the way. That is reflected in the data released.

Housing starts were at the highest level since June 2008. The monthly increase was a related to a surge in multi-family starts (there is significant month-to-month variability in multi-family starts), however single family starts were up 28.7% year-over-year, a strong increase too. And even with the recent increase in starts, housing starts - especially single family starts - are still low, and we will probably see continued growth over the next few years. Since residential investment is usually the best leading indicator for the economy, this suggests the economy will continue to grow over the next couple of years.

Of course manufacturing is seeing more sluggish growth (as reflected in the Empire State and Philly Fed manufacturing surveys for April). And initial weekly unemployment claims have increased recently - perhaps related to the sequestration budget cuts.

But overall the data suggests continued growth.

Here is a summary of last week in graphs:

• Housing Starts increased to 1.036 million SAAR in March

Click on graph for larger image.

Click on graph for larger image.

From the Census Bureau: Permits, Starts and Completions "Privately-owned housing starts in March were at a seasonally adjusted annual rate of 1,036,000. This is 7.0 percent above the revised February estimate of 968,000 and is 46.7 percent above the March 2012 rate of 706,000.

Single-family housing starts in March were at a rate of 619,000; this is 4.8 percent below the revised February figure of 650,000. The March rate for units in buildings with five units or more was 392,000."

This was well above expectations of 930 thousand starts in March, mostly due to the sharp increase in multi-family starts - and the highest level since June 2008. Starts in March were up 46.7% from March 2012; single family starts were up 28.7% year-over-year. Starts in February were revised up sharply. This was a strong report.

• Fed: Industrial Production increased 0.4% in March

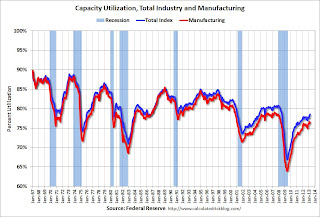

From the Fed: Industrial production and Capacity Utilization

From the Fed: Industrial production and Capacity Utilization

"Industrial production rose 0.4 percent in March after having increased 1.1 percent in February. ... The rate of capacity utilization for total industry moved up in March to 78.5 percent, a rate that is 1.2 percentage points above its level of a year earlier but 1.7 percentage points below its long-run (1972--2012) average."

This graph shows Capacity Utilization. This series is up 11.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.5% is still 1.7 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production increased in March to 99.5. This is 18.8% above the recession low, but still 1.3% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations.

• NMHC Apartment Survey: Market Conditions Tighten in April

From the National Multi Housing Council (NMHC): Apartment Markets Resume Growth According to NMHC Survey "Market Tightness Index rose to 54 from 45."

From the National Multi Housing Council (NMHC): Apartment Markets Resume Growth According to NMHC Survey "Market Tightness Index rose to 54 from 45."

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. This quarterly increase was small, but indicates tighter market conditions.

On supply: Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2013 and 2014, than in 2012, increasing the supply.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates might be nearing a bottom, although apartment markets are still tight, so rents will probably continue to increase.

• Key Measures show low inflation in March

This graph shows the year-over-year change for these four key measures of inflation: median CPI, trimmed-mean CPI, CPI less food and energy, and core PCE prices. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for January and increased 1.3% year-over-year.

This graph shows the year-over-year change for these four key measures of inflation: median CPI, trimmed-mean CPI, CPI less food and energy, and core PCE prices. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for January and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 1.1% annualized, trimmed-mean CPI was at 0.7% annualized, and core CPI increased 1.3% annualized. Also core PCE for February increased 0.7% annualized.

With this low level of inflation and the current high level of unemployment, I expect the Fed will continue the large scale asset purchases (QE) at the current level.

• New York and Philly Fed Manufacturing Surveys Show Slower Expansion in April

From the NY Fed: Empire State Manufacturing Survey "Manufacturing Survey indicates that conditions for New York manufacturers improved slightly. The general business conditions index fell six points but, at 3.1, remained positive for a third consecutive month." This suggests some expansion, but was below the consensus forecast of a reading of 7.5.

From the NY Fed: Empire State Manufacturing Survey "Manufacturing Survey indicates that conditions for New York manufacturers improved slightly. The general business conditions index fell six points but, at 3.1, remained positive for a third consecutive month." This suggests some expansion, but was below the consensus forecast of a reading of 7.5.

From the Philly Fed: April Manufacturing Survey "The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, was 1.3, just slightly lower than the reading of 2.0 in March."

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys decreased in April, but remained positive for the 2nd consecutive month after indicating contraction for 9 straight months. This suggests the ISM manufacturing index will show further expansion in April.

• Weekly Initial Unemployment Claims increase to 352,000

The DOL reports: "In the week ending April 13, the advance figure for seasonally adjusted initial claims was 352,000, an increase of 4,000 from the previous week's revised figure of 348,000. The 4-week moving average was 361,250, an increase of 2,750 from the previous week's revised average of 358,500."

The DOL reports: "In the week ending April 13, the advance figure for seasonally adjusted initial claims was 352,000, an increase of 4,000 from the previous week's revised figure of 348,000. The 4-week moving average was 361,250, an increase of 2,750 from the previous week's revised average of 358,500."

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 361,250 - the highest level since January.

Weekly claims were above the 347,000 consensus forecast.