by Calculated Risk on 3/28/2013 02:40:00 PM

Thursday, March 28, 2013

A comment on Jobs, Household Formation and New Residential Construction

Just a few thoughts based on some recent conversations: The key driver for new residential construction, both single family and rental properties, is household formation. And household formation is mostly driven by jobs. So jobs are the key driver for new residential construction.

But wait ... there are about 3 million fewer payroll jobs now than at the start of the recession. So why do we need any new housing units?

Two frequently mentioned reasons are more foreign buying (so jobs are not a driver), and that housing is not transportable, so some areas will need more housing. However many areas are seeing a pickup in construction (not just areas with better job growth). There probably is more foreign buying, especially in the gateway cities like New York, Miami (for South American buyers), and in California for Asian buyers, but that doesn't explain all of the apparent disconnect between total jobs and households.

I think the real reason for the changing ratio between total jobs and households is demographics.

In the decade from 1994 through 2003 (data started in 1994), the BLS reported the number of people "55 and over" and "not in the labor force" increased by 4.3 million. But in the last 9+ years, from January 2004 until February 2013, the BLS reports the number of people over 55 and not in the labor force increased by 8.1 million. So more older people are leaving the labor force.

And older people tend to live in smaller households (see from the Census Bureau: America’s Families and Living Arrangements: 2012), and this has pushed down the overall household size - even with some people doubling up. The overall mean household size in America is 2.55, but that falls to 2.29 for householders in the 55 to 59 age group, and 2.07 in the 60 to 64 age group, 1.91 in the 65 to 74 age group, and to 1.60 for those 75 and older.

This increase in the number of retired Americans with smaller household sizes means the relationship between jobs and households has changed over time. Models of the relationship of number of households to jobs have to be modified to include changing demographics - and this is one reason why the US needs more housing.

Kansas City Fed: Regional Manufacturing contracted slightly in March

by Calculated Risk on 3/28/2013 11:00:00 AM

This is the last of the regional manufacturing surveys for March, and the Kansas City region was the only area showing contraction. From the Kansas City Fed: Tenth District Manufacturing Survey Fell at a Slower Rate

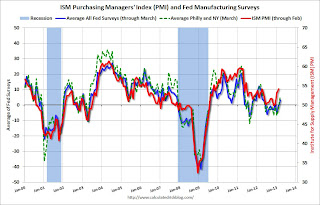

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity fell at a slower rate, but producers were considerably more optimistic about future months.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“Factory activity rebounded somewhat in March, although overall levels still remain sluggish. Contacts continued to cite uncertainty about healthcare costs and the overall economy as reasons for lower growth,” said Wilkerson. “However, the outlook for future activity was notably more positive than in previous months.”

The month-over-month composite index was -5 in March, up from -10 in February ... The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The production index increased from -11 to -1, and the shipments and new order indexes recorded levels of 0, the highest value in seven months. In contrast, the employment index posted its lowest level since July 2009, and the new orders for exports index also fell.

Most future factory indexes improved considerably in March. The future composite index jumped from 4 to 14, and the future production, shipments, new orders, and order backlog indexes also increased. The future employment index rose from 2 to 12, its highest level in six months.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

The average of the five regional surveys was at the highest level since April 2012.

The ISM index for March will be released Monday, April 1st, and these surveys suggest a positive reading.

Weekly Initial Unemployment Claims increase to 357,000

by Calculated Risk on 3/28/2013 08:42:00 AM

The DOL reports:

In the week ending March 23, the advance figure for seasonally adjusted initial claims was 357,000, an increase of 16,000 from the previous week's revised figure of 341,000. The 4-week moving average was 343,000, an increase of 2,250 from the previous week's revised average of 340,750.This report included the annual revision.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 343,000 - still near the post-recession low.

Weekly claims were above the 340,000 consensus forecast. Note: This might be the beginning of unemployment claims being impacted by the "sequestration" budget cuts.

Wednesday, March 27, 2013

Thursday: Initial Weekly Unemployment Claims, GDP, Chicago PMI

by Calculated Risk on 3/27/2013 09:39:00 PM

The banks open in Cyprus tomorrow with strict capital controls, from Reuters: G4S Readies Guards as Cypriot Banks Prepare to Open

The Central Bank said banks would open their doors at midday (6 a.m. EST) on Thursday after nearly two weeks when Cypriots could only get cash through limited ATM withdrawals.I doubt the controls will last only four days. The more important question is what happens to the economy and employment in Cyprus. The unemployment rate is already 14.7% in Cyprus and could double over the next couple of years.

A central bank official said Cypriots would be allowed to withdraw no more than 300 euros ($380) a day.

Yiangos Demetriou, head of internal audit at the Central Bank, said ... that the controls would allow unlimited use of credit cards within Cyprus, but set a limit of 5,000 euros per month abroad. He said the measures would last four days but could be reviewed.

Note: SIFMA recommends 2:00 PM market close on Thursday in observance of the Good Friday Holiday.

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 340 thousand from 336 thousand last week. The "sequester" budget cuts might start impacting weekly claims soon.

• Also at 8:30 AM, the BEA will release their third estimate of Q4 GDP. The consensus is that real GDP increased 0.6% annualized in Q4, revised up from 0.1% in the second estimate.

• At 9:45 AM, the Chicago Purchasing Managers Index for March. The consensus is for a decrease to 56.1, down from 56.8 in February.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for March will be released. This is the last of the regional surveys, and the consensus is for a reading of minus 3, up from minus 10 in February (below zero is contraction).

Analysts increase 2013 house price forecasts

by Calculated Risk on 3/27/2013 05:07:00 PM

I've been watching inventory closely, and in February I wrote: "if inventory keeps falling sharply, we might see stronger house price gains in 2013 than originally expected ...". Since then I've pointed out several analysts who have increased their house price forecasts for 2013.

Nick Timiraos at the WSJ lists more analysts today: Home Prices Seen Making Stronger Gains in 2013

Ivy Zelman, chief executive of research firm Zelman & Associates, said Wednesday she was now expecting prices to rise by 7% this year, up from earlier estimates of 6%, 5%, and 3%. ... She’s also calling for a 5% gain next year because she says the supply shortages and growing demand that fueled last year’s turnaround show no signs of easing.The key is inventory. In recent weeks, we've seen some increase in inventory (more than the usual seasonal increase), but inventory levels are still very low. Right now, unless inventory increases significantly over the next few months, it looks like prices will increase at about the same rate as in 2012.

John Burns, who runs a real-estate consulting firm in Irvine, Calif., is calling for a 9% gain in home prices this year, up from a 5% forecast late last year.

Among those who have revised up their forecasts in the last month are analysts at Morgan Stanley, Bank of America, Capital Economics and J.P. Morgan, which have taken their forecasts to 6-8%, from earlier predictions of 3-6%.

Although there are reasons for the low inventory - homeowners with negative equity can't sell, strong investor buying at the low end, homeowners not wanting to "sell at the bottom" to list a few - eventually higher prices will lead to more inventory coming on the market and smaller price increases.

Lawler: Single Family REO inventories down 23.4% in 2012

by Calculated Risk on 3/27/2013 02:31:00 PM

From economist Tom Lawler:

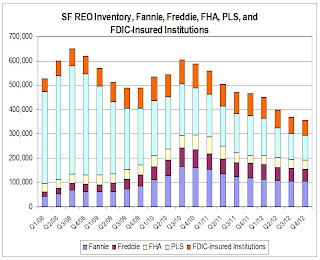

While Fannie Mae still hasn’t released its 2012 10-K, FHFA released its quarterly “Foreclosure Prevention Report” for Q4/2012, which includes data on foreclosure prevention activity, foreclosures, short sales/DILs, loan modifications, credit performance, and Real Estate Owned (REO) activity at Fannie Mae and Freddie Mac. ...

Here is a chart showing the SF REO Inventory of Fannie, Freddie, FHA, Private-Label Securities, and FDIC-Insured Institutions. For the latter, I assume that the average carrying value is 50% higher than that of the average for Fannie and Freddie.

Click on graph for larger image.

Click on graph for larger image.

SF REO inventories for these combined sectors were down 23.4% in 2012.

CR Note: Total REO is about half the level in 2008. In 2008 most of the REO was Private-Label Securities. The peak in 2010 was related to more foreclosure activity at Fannie, Freddie and the FHA.

The second graph is for just Fannie, Freddie and the FHA REO.

REO at the "Fs" peaked in 2010, and is down about 35% since then.

REO at the "Fs" peaked in 2010, and is down about 35% since then.

Freddie Mac Mortgage Serious Delinquency rate declined in February, Lowest since mid-2009

by Calculated Risk on 3/27/2013 12:38:00 PM

Freddie Mac reported that the Single-Family Serious Delinquency rate declined in February to 3.15% from 3.20% in January. The serious delinquency rate is down from 3.57% a year ago (February 2012), and this is the lowest level since mid-2009.

The Freddie Mac serious delinquency rate peaked in February 2010 at 4.20%.

Fannie Mae hasn't reported for February yet.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%. At the recent pace of improvement, it will take several years until the rates are back to normal.

NOTE: When Fannie Mae eventually releases their annual report for 2012, I'll post a graph of Real Estate Owned (REO) by Fannie, Freddie and the FHA (This is real estate that the agencies acquired through foreclosure or deed-in-lieu and haven't sold yet). Both Freddie and the FHA reported that their REO declined in Q4, and the combined total will be at the lowest level since 2009. Also the FDIC reported that the dollar value of REO for FDIC insured institutions declined in Q4, and it appears the private label REO declined too.

Pending Home Sales index declines in February

by Calculated Risk on 3/27/2013 10:05:00 AM

From the NAR: Pending Home Sales Slip on Constrained Inventory

The Pending Home Sales Index, a forward-looking indicator based on contract signings, slipped 0.4 percent to 104.8 in February from a downwardly revised 105.2 in January, but is 8.4 percent higher than February 2012 when it was 96.6. Contract activity has been above year-ago levels for the past 22 months; the data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

...

The PHSI in the Northeast declined 2.5 percent to 82.8 in February but is 6.8 percent above February 2012. In the Midwest the index rose 0.4 percent to 103.6 in February and is 13.2 percent higher than a year ago. Pending home sales in the South slipped 0.3 percent to an index of 118.8 in February but are 12.1 percent above February 2012. In the West the index increased 0.1 percent in February to 101.4 but is 0.8 percent below a year ago.

"The volume of home sales appears to be leveling off with the constrained inventory conditions, and the leveling of the index means little change is likely in the pace of sales over the next couple months," [Lawrence Yun , NAR chief economist] said.

As I've noted several times, with limited inventory at the low end and fewer foreclosures, we might see flat or even declining existing home sales. The key is that the number of conventional sales is increasing while foreclosures and short sales decline - and that is a sign of an improving market, even if total sales decline.

MBA: Mortgage Applications increase in latest survey

by Calculated Risk on 3/27/2013 08:31:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 8 percent from the previous week. The seasonally adjusted Purchase Index increased 7 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.79 percent from 3.82 percent, with points increasing to 0.44 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) decreased to 3.90 percent from 3.95 percent, with points increasing to 0.42 from 0.36 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

Refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

Tuesday, March 26, 2013

Wednesday: Pending Home Sales

by Calculated Risk on 3/26/2013 09:32:00 PM

The WSJ has an estimate of the losses for uninsured depositors in Cyprus: Cyprus Sets Bank Revamp Amid Protests

We are in no position to give you the exact amount this moment," [Central banker Panicos Demetriades] told reporters, referring to the amount that will be taken from large deposits at Bank of Cyprus, but he added "it's about 40%."Wednesday economic releases:

Based on estimates from government officials, the losses would affect some 19,000 deposit-holders at the Bank of Cyprus who, combined, hold some €8.01 billion ($10.30 billion) in uninsured deposits. Uninsured savers at Cyprus Popular Bank, who hold a combined €3.2 billion, will lose most of that.

"Realistically, very little will be returned," Finance Minister Michalis Sarris said in the interview broadcast on state television. "The amount [returned], could be 20%. Certainly, for depositors above €100,000 it could be a very significant blow," he said.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Pending Home Sales Index for February. The consensus is for a 0.7% decrease in this index.

Earlier:

• Case-Shiller: Comp 20 House Prices increased 8.1% year-over-year in January

• Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

• New Home Sales at 411,000 SAAR in February

• A few comments on New Home Sales