by Calculated Risk on 2/22/2013 01:00:00 PM

Friday, February 22, 2013

Housing: What if inventory keeps falling?

Just thinking out loud ... one of my ten economic questions for 2013 was: Will Housing inventory bottom in 2013?. My guess was active inventory would bottom in 2013, "probably in January". At the least, I expected that the rate of year-over-year decline would "slow sharply".

This could still be correct. The NAR reported yesterday that listed inventory fell to 1.74 million units in January, the lowest level since December 1999. This was down 25.3 percent from January 2012.

Note: Inventory will increase seasonally over the next few months (this happens every year), and this is why I'm tracking the weekly inventory data.

Click on graph for larger image.

Click on graph for larger image.

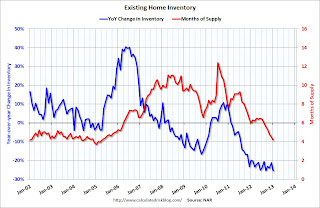

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Look at that year-over-year decline (blue line). Inventory has been falling sharply on a year-over-year basis for some time. With the low level of inventory, both in absolute numbers and as a month-of-supply, and the recent price increases in some areas, it would some likely more inventory would come on the market.

But what if this is incorrect? Just imagine if inventory falls another 25% by January 2014. That would be the lowest level of inventory in decades. At the current sales rate, the months-of-supply would fall to 3.2 months. I just don't see that happening. So, it seems likely that at least the rate of inventory decline will slow.

My view has been that if prices increase enough, then some of the potential sellers will come off the fence, and some underwater homeowners would be able to sell. Zillow just reported that 2 Million Homeowners Freed From Negative Equity in 2012; 1 Million More to Come in 2013

Almost 2 million American homeowners were freed from negative equity in 2012, and the overall percentage of all homeowners with a mortgage in negative equity fell to 27.5 percent at the end of the fourth quarter, according to Zillow’s fourth quarter Negative Equity Report.So some of these people can sell now.

The falling negative equity rate is good news for struggling homeowners and is largely attributable to a 5.9 percent bump in home values nationwide last year to a median Zillow Home Value Index of $157,400 (when home values rise, negative equity falls). At the end of 2011, 31.1 percent of homeowners with a mortgage were underwater, or more than 15.7 million people.

I need to think about this, but if inventory keeps falling sharply, we might see stronger house price gains in 2013 than originally expected - and maybe more new homes on the market (although some builders are lot constrained this year). This will be an interesting issue all year.