by Calculated Risk on 2/19/2013 01:40:00 PM

Tuesday, February 19, 2013

Update: Real Estate Agent Boom and Bust

Way back in 2005, I posted a graph of "the Real Estate Agent Boom". I updated the graph last year The Real Estate Agent Bust .

Below is another update to the long term graph of the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

Click on graph for larger image.

Click on graph for larger image.

The number of salesperson's licenses is off 31% from the peak, and is still declining. The number of salesperson's licenses has fallen to June 2004 levels.

However brokers' licenses are only off 8% and have only fallen to late 2006 levels.

Someday the number of licenses will start to increase again (probably a sign that people think they can money as an agent again), but for now the number is still declining.

Builder Confidence declines slightly in February to 46

by Calculated Risk on 2/19/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) decreased 1 point in February to 46. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Virtually Unchanged in February

Builder confidence in the market for newly built, single-family homes was virtually unchanged in February with a one-point decline to 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

...

“Having risen strongly in 2012, the HMI hit a slight pause in the beginning of this year as builders adjusted their expectations to reflect the pace at which consumers are moving forward on new-home purchases,” observed NAHB Chief Economist David Crowe. “The index remains near its highest level since May of 2006, and we expect home building to continue on a modest rising trajectory this year.”

...

Holding above the critical mid-point of 50 for a third consecutive month, the HMI component gauging current sales conditions fell by a single point to 51 in February. Meanwhile, the component gauging sales expectations in the next six months rose by one point, to 50, and the component gauging traffic of prospective buyers slipped four points, to 32.

Three-month moving averages for each region’s HMI score were mixed in February, with the Northeast up three points to 39 and the West up four points to 55 and the Midwest and South each down two points, to 48 and 47, respectively.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the December data for starts (January housing starts will be released tomorrow). This was below the consensus estimate of a reading of 48.

Residential Remodeling Index declines 6% in December

by Calculated Risk on 2/19/2013 09:12:00 AM

From BuildFax:

Residential remodels authorized by building permits in the United States in December were at a seasonally-adjusted annual rate of 2,725,000. This is 6 percent below the revised November rate of 2,895,000 and is 6 percent below the December 2011 estimate of 2,901,000.

Seasonally-adjusted annual rates of remodeling across the country in December 2012 are estimated as follows: Northeast, 636,000 (up 39% from November and up 37% from December 2011); South, 1,088,000 (down 13% from November and down 1% from December 2011); Midwest, 596,000 (down 8% from November and down 17% from December 2011); West, 777,000 (down 16% from November and down 8% from December 2011).

"Repairs from super-storm Sandy attributed to the influx of Northeastern residential remodeling in December," said Joe Emison, Chief Technology Officer at BuildFax. "The last time the Northeast broke 600,000 estimated residential remodels was five years ago. Unfortunately, the rest of the country saw both month-over-month and year-over-year declines in residential remodeling activity."

The BuildFax Remodeling Index (BFRI) is based on construction permits for residential remodeling projects filed with local building departments across the country. The index estimates the number of properties permitted.

Click on graph for larger image.

Click on graph for larger image.This graph shows the Remodeling Index since January 2008 on a seasonally adjusted basis.

This index has generally been trending up, but was down in December even with all the repairs in the Northeast. Note: Permits are not adjusted by value, so this doesn't indicate the value of remodeling activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Monday, February 18, 2013

Tuesday: Homebuilder Confidence Survey

by Calculated Risk on 2/18/2013 09:15:00 PM

A couple of interesting stories ...

First, the prices for West Texas Intermediate (WTI) and Brent crude oil have diverged in recent years due to pipeline capacity issues. Jim Hamilton discusses the plans to build more pipelines: Planned crude oil pipelines. A pretty impressive amount of capaticy will be built over the next couple of years (See Hamilton's post).

And on California from the WaPo: Will higher taxes on the rich derail California’s economic comeback?

The tax increases approved in November are a big reason the state isn’t staring down another huge budget shortfall or the prospect of issuing IOUs to fill it. They include bumping the sales tax up slightly and raising the top income tax rate to 13.3 percent, which is four percentage points higher than the District of Columbia’s and more than double the rate in Virginia or Maryland.Tuesday economic releases:

Yet many economists and some young executives in the state say they don’t worry about that high rate chilling growth. Other factors loom much larger for California’s business and economic health, they say, including whether the state can maintain deep pools of highly skilled talent and, in complicated but important ways, the renewed upward march of home prices in the Bay Area and beyond.

“I don’t think we should be surprised that the state is growing, nor that California is growing faster than the national economy,” said Christopher Thornberg, an economist and the founding partner of Beacon Economics.

...

“The evidence is, from past tax increases, that it makes very little difference,” said Jerry Nickelsburg, a senior economist at the UCLA Anderson Forecast, who predicts only a slight scrape to state growth from the new rate increases. Since 1967, he added, tax hikes and cuts in the state have had a “second-order effect” on growth.

The bigger threat, other economists say, might be another run-up of housing prices, especially where the innovators live.

Housing prices are a much bigger factor in most people’s budgets than state tax rates, said Jed Kolko, chief economist for the online real estate site Trulia. If home prices rise quickly, he said, they constrain growth more than taxes do: “The skilled workforce that California presents as an advantage,” Kolko said, “is also threatened by higher housing prices.”

• At 10:00 AM ET, the February NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in January. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

Lawler: Early Look At January Existing Home Sales

by Calculated Risk on 2/18/2013 06:17:00 PM

From economist Tom Lawler:

While several MLS that I follow have been unusually late in releasing their monthly reports, based on the reports that I have seen I estimate that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.10 million in January, up about 3.2% from December’s seasonally-adjusted pace, and up 10.2% from last January’s seasonally-adjusted pace. January, of course, is seasonally by far the weakest month of the year for closed home sales, with the January “seasonal” factor (for total existing home sales) typically averaging about 67.5% (depending on the year’s calendar). The seasonal factor for a “neutral” month is, of course, 100%.

On the inventory front, my “best guess” is that the NAR’s existing home inventory estimate for January will be unchanged from December’s estimate.

CR Note: The NAR will report January existing home sales on Thursday, February 21st. The consensus is the NAR will report sales of 4.90 million on a seasonally adjusted annual rate (SAAR) basis.

Based on Lawler's estimates, the NAR will report inventory at around 1.82 million units for January (same as December), and months-of-supply around 4.3 months (down from 4.4 months in December). This would be the lowest months-of-supply since May 2005.

Existing Home Inventory up 2.3% year-to-date in mid-February

by Calculated Risk on 2/18/2013 04:21:00 PM

One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'll be tracking inventory weekly for the next few months.

If inventory does bottom, we probably will not know for sure until late in the year. In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through mid-February - it appears inventory is increasing at a sluggish rate.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak.

So far in 2013, inventory is up 2.2%. If inventory doesn't increase soon, then the bottom for inventory might not be until 2014.

FNC: "Foreclosure price discounts drop to pre-crisis levels"

by Calculated Risk on 2/18/2013 12:23:00 PM

Some interesting data from FNC: Foreclosure price discounts drop to pre-crisis levels

Though home foreclosures continue to be a challenge in many hard-hit markets, a report released this week by mortgage technology company FNC indicates the ongoing housing recovery should continue for the long haul.

According to FNC’s Foreclosure Market Report, foreclosure prices have bottomed out in recent months and the foreclosure market has stabilized while underlying home values are rising. Foreclosure prices are at a 10-year low (when the sizes of foreclosed homes are factored in).

This trend of a rising underlying market accompanied by stabilizing foreclosure prices is the first encouraging development in the housing recession, according to FNC Senior Research Economist, Dr. Yanling Mayer.

“The fact that we are seeing a combination of rising home prices and a bottoming out of foreclosure prices is a very good sign the housing recovery is taking hold,” Mayer said. “This is the very first time in the long housing recession that the two are happening at the same time.”

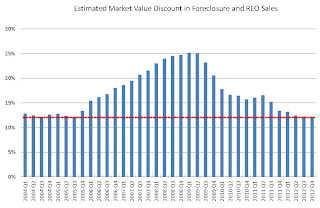

Click on graph for larger image.

Click on graph for larger image.More from FNC:

FNC’s report shows that foreclosure price discounts, which compare a foreclosed home’s estimated market value to its final sales price, have dropped to pre-mortgage crisis levels at about 12.2% in Q4 2012. At the height of the mortgage crisis in 2008 and 2009, foreclosed homes were typically sold at more than 25% below their estimated market value. Additionally, the report indicates that the typical size of foreclosed homes is also approaching pre-crisis levels.Another sign that the housing market is recovering (although the percent of distressed sales - foreclosures and short sales - is still very high).

“If you look at the period of short-lived recovery under the first-time homebuyer tax credits, the foreclosure market was still in the midst of rapid deterioration with the influx of delinquent mortgages,” Mayer said. “This time, we are witnessing an entirely different development in the foreclosure market.”

LA area Port Traffic in January

by Calculated Risk on 2/18/2013 09:42:00 AM

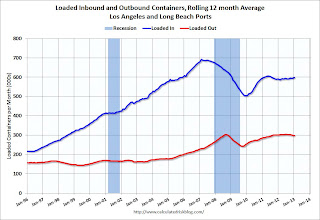

I've been following port traffic for some time. Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for January. LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up slightly in January, and outbound traffic down slightly, compared to the rolling 12 months ending in December.

In general, inbound traffic has been increasing slightly recently, and outbound traffic has been mostly moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March.

For the month of January, loaded outbound traffic was up slightly compared to January 2012, and loaded inbound traffic was up 4% compared to January 2012.

This suggest a slight increase in the trade deficit with Asia for January.

Sunday, February 17, 2013

Update: Recovery Measures

by Calculated Risk on 2/17/2013 02:26:00 PM

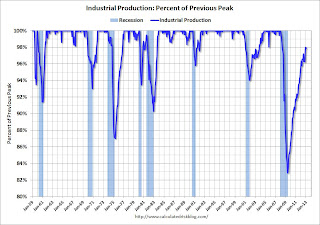

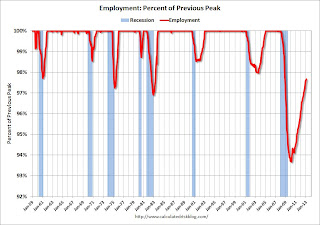

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that some major indicators are still significantly below the pre-recession peaks.

Click on graph for larger image.

Click on graph for larger image.

This graph is for real GDP through Q4 2012.

Real GDP returned to the pre-recession peak in Q4 2011, and hit new post-recession highs for four consecutive quarters until dipping slightly in Q4 2012 (Q4 GDP will probably be revised up).

At the worst point - in Q2 2009 - real GDP was off 4.7% from the 2007 peak.

Real GDP has performed better than other indicators ...

Real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak through the December report.

This measure was off 11.2% at the trough in October 2009.

Real personal income less transfer payments returned to the pre-recession peak in December, but that was due to a one time surge in income as some high income earners accelerated earnings to avoid higher taxes in 2013. Without that distortion, real personal income less transfer payments would probably still be 2.5% or so below the previous peak.

The third graph is for industrial production through January 2013.

The third graph is for industrial production through January 2013.

Industrial production was off over 17% at the trough in June 2009, and has been one of the stronger performing sectors during the recovery.

However industrial production is still 2.1% below the pre-recession peak. This indicator will probably return to the pre-recession peak in 2013.

The final graph is for employment and is through January 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment and is through January 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 2.3% below the pre-recession peak.

All of these indicators collapsed in 2008 and early 2009, and only real GDP is back to the pre-recession peak (personal income was due to a one time increase in income and will be back below the pre-recession peak in January). At the current pace of improvement, industrial production will be back to the pre-recession peak later this year, personal income less transfer payments late in 2013, and employment in late 2014.

Inland Empire: Starting to Recover

by Calculated Risk on 2/17/2013 10:28:00 AM

Southern California's "Inland Empire" was one of epicenters of the housing bust. Now the area is recovering ...

From Alejandro Lazo at the LA Times: Inland Empire housing is more affordable but still out of reach

Bill Sepe has gotten used to rejection.

The 28-year-old Rancho Cucamonga native has put in nearly 200 unsuccessful offers since August on Inland Empire homes, varying from typical suburban ranches to classic craftsman homes.

All this anguish comes in pursuit of a modest home in the exurb of San Bernardino County, the epicenter of the Southern California housing crash. Plummeting values here sparked a vicious wave of foreclosures.

...

The repeated rejections come despite Sepe's solid qualifications: a stable job as a cell tower technician and a pre-approved home loan. He watches as houses hit the market, then get scooped up within an hour. ...

The Inland Empire has gone from bust to boom with a vigor few could have predicted, mirroring Western regions such as Phoenix and Las Vegas. Surging demand has tightened inventory ... That's great for the real estate industry and helps the local economy. ...

In the Inland Empire's darkest hour, nearly one of five borrowers was behind on a home loan. Foreclosed properties made up more than two-thirds of sales. Work on half-built subdivisions stopped dead, with as construction jobs drying up and the unemployment rate soaring. Last year the city of San Bernardino declared bankruptcy.

...

But a turnaround is well underway, thanks in part to deep-pocketed investors snapping up bargains with cash. The housing supply is now so tight that it's common for home shoppers to put in 20 or 30 offers before securing a house, real estate agents say.

...

For real estate professionals, the turnaround is like a downpour after years of drought.

"There is optimism here for the first time in eight years," said Paul Herrera, government affairs director for the Inland Valleys Assn. of Realtors. "For the first time since 2005, we are thinking that next year will be better than this year."

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, but still very high 10.9% (down from 15.0% in 2010). And construction employment is still near the lows. But the area is recovering.