by Calculated Risk on 2/18/2013 12:23:00 PM

Monday, February 18, 2013

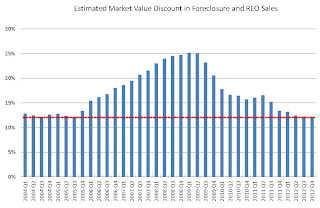

FNC: "Foreclosure price discounts drop to pre-crisis levels"

Some interesting data from FNC: Foreclosure price discounts drop to pre-crisis levels

Though home foreclosures continue to be a challenge in many hard-hit markets, a report released this week by mortgage technology company FNC indicates the ongoing housing recovery should continue for the long haul.

According to FNC’s Foreclosure Market Report, foreclosure prices have bottomed out in recent months and the foreclosure market has stabilized while underlying home values are rising. Foreclosure prices are at a 10-year low (when the sizes of foreclosed homes are factored in).

This trend of a rising underlying market accompanied by stabilizing foreclosure prices is the first encouraging development in the housing recession, according to FNC Senior Research Economist, Dr. Yanling Mayer.

“The fact that we are seeing a combination of rising home prices and a bottoming out of foreclosure prices is a very good sign the housing recovery is taking hold,” Mayer said. “This is the very first time in the long housing recession that the two are happening at the same time.”

Click on graph for larger image.

Click on graph for larger image.More from FNC:

FNC’s report shows that foreclosure price discounts, which compare a foreclosed home’s estimated market value to its final sales price, have dropped to pre-mortgage crisis levels at about 12.2% in Q4 2012. At the height of the mortgage crisis in 2008 and 2009, foreclosed homes were typically sold at more than 25% below their estimated market value. Additionally, the report indicates that the typical size of foreclosed homes is also approaching pre-crisis levels.Another sign that the housing market is recovering (although the percent of distressed sales - foreclosures and short sales - is still very high).

“If you look at the period of short-lived recovery under the first-time homebuyer tax credits, the foreclosure market was still in the midst of rapid deterioration with the influx of delinquent mortgages,” Mayer said. “This time, we are witnessing an entirely different development in the foreclosure market.”