by Calculated Risk on 2/05/2013 11:55:00 AM

Tuesday, February 05, 2013

Trulia: Asking House Prices increased in January

Press Release: Asking Prices Up 5.9 Percent Nationally Year-Over-Year, Rents Rose 4.1 Percent

Indicating the strength of the home price recovery, asking prices rose 0.3 percent quarter-over-quarter (Q-o-Q) in January without seasonal adjustment—despite the fact that prices typically fall during the wintertime. Seasonally adjusted, prices rose 2.2 percent Q-o-Q. Moreover, prices rose 0.9 percent month-over-month (M-o-M), the highest monthly gain since the price recovery began. Year-over-year (Y-o-Y), prices rose 5.9 percent; excluding foreclosures, prices rose 6.5 percent.More from Jed Kolko, Trulia Chief Economist: Asking Home Prices Set New Records While Rents Ease as Supply Expands

With more newly-constructed multi-unit buildings coming to completion, rent gains fell behind asking price increases at the national level for the first time since the price recovery began last spring. In January, rents rose 4.1 percent Y-o-Y nationally, slowing down from 4.7 percent in July 2012. Regionally, rent gains cooled the most in San Francisco, where rents rose 2.4 percent versus 11.5 percent in July 2012.

“Rent gains are slowing down because of more supply, not less demand,” explains Jed Kolko, Trulia’s Chief Economist. “Many of the multi-unit buildings that have been under construction over the past two years are now coming onto the market. Renters in San Francisco, Seattle, and Denver are starting to get a touch of relief, even though rising prices might put homeownership out of their reach.”

These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

ISM Non-Manufacturing Index indicates expansion in January

by Calculated Risk on 2/05/2013 10:00:00 AM

The January ISM Non-manufacturing index was at 55.2%, down from 55.7% in December. The employment index increased in January to 57.5%, up from 55.3% in December. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: January 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in January for the 37th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 55.2 percent in January, 0.5 percentage point lower than the seasonally adjusted 55.7 percent registered in December. This indicates continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 56.4 percent, which is 4.4 percentage points lower than the seasonally adjusted 60.8 percent reported in December, reflecting growth for the 42nd consecutive month. The New Orders Index decreased by 3.9 percentage points to 54.4 percent, and the Employment Index increased 2.2 percentage points to 57.5 percent, indicating growth in employment for the sixth consecutive month. The Prices Index increased 1.9 percentage points to 58 percent, indicating prices increased at a faster rate in January when compared to December. According to the NMI™, eight non-manufacturing industries reported growth in January. Respondents' comments are mixed about the economy and business conditions; however, the majority of respondents are optimistic about the overall direction."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly above the consensus forecast of 55.0% and indicates slightly slower expansion in January than in December.

CoreLogic: House Prices up 8.3% Year-over-year in December

by Calculated Risk on 2/05/2013 08:59:00 AM

Notes: This CoreLogic House Price Index report is for December. The recent Case-Shiller index release was for November. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Home Price Index Rises for the 10th Consecutive Month in December; Biggest Year-Over-Year Increase Since May 2006

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 8.3 percent in December 2012 compared to December 2011. This change represents the biggest increase since May 2006 and the 10th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 0.4 percent in December 2012 compared to November 2012. The HPI analysis shows that all but four states are experiencing year-over-year price gains.

Excluding distressed sales, home prices increased on a year-over-year basis by 7.5 percent in December 2012 compared to December 2011. On a month-over-month basis, excluding distressed sales, home prices increased 0.9 percent in December 2012 compared to November 2012. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that January 2013 home prices, including distressed sales, are expected to rise by 7.9 percent on a year-over-year basis from January 2012 and fall by 1 percent on a month-over-month basis from December 2012, reflecting a seasonal winter slowdown.

...

“December marked 10 consecutive months of year-over-year home price improvements, and the strongest growth since the height of the last housing boom more than six years ago,” said Mark Fleming, chief economist for CoreLogic. “We expect price growth to continue in January as our Pending HPI shows strong year-over-year appreciation.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.4% in December, and is up 8.3% over the last year.

The index is off 26.9% from the peak - and is up 9.4% from the post-bubble low set in February 2012 (the index is NSA, so some of the increase is seasonal).

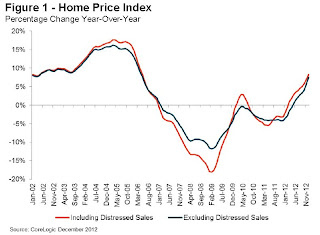

The second graph is from CoreLogic. The year-over-year comparison has been positive for ten consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for ten consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in December - instead the index increased, and, considering seasonal factors, this month-to-month increase was very strong.

Monday, February 04, 2013

Tuesday: ISM Service Index

by Calculated Risk on 2/04/2013 08:20:00 PM

A different view from Stephen Foley at the Financial Times: House price rebound cruising for a fall

The new flippers of US housing are not the individual speculators of the boom years ... These investors, who have poured into the US housing market since its nadir, are hedge funds and private equity vehicles, and recently (belatedly) individual entrepreneurs. They may be planning to hold the property for a while and harvest rental income in the interim, but decent returns are predicated on a sale, and usually a quick one.Maybe. But these investors initially bought for the cash-flow, and they would only sell now if they could make a solid profit - and that means a higher price. This isn't logic for a "fall" in house prices, rather this is an argument for less future appreciation.

That makes them flippers – and it means that the recent run of strong housing market data may be more chimeric than real.

excerpt with permission

Also - the author argues "individual entrepreneurs" were late to the party and that is incorrect. Many individuals and small groups were ahead of the hedge funds and private equity groups. I've noted my discussions with some of these groups over the last few years, and they are very happy with their properties (I called one group after reading this article, and I was told they have no intention of selling any properties).

Tuesday economic releases:

• At 10:00 AM ET, the ISM non-Manufacturing Index for January. The consensus is for a decrease to 55.0 from 55.7 in December. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Trulia Price Rent Monitors for January will be released. This is the index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

Fed: Some domestic banks "eased lending standards", Demand for some Loans "strengthened"

by Calculated Risk on 2/04/2013 02:00:00 PM

From the Federal Reserve: The January 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the January survey, generally modest fractions of domestic banks reported having eased their standards across major loan categories over the past three months on net. Domestic respondents indicated that demand for business loans, prime residential mortgages, and auto loans had strengthened, on balance, while demand for other types of loans was about unchanged. U.S. branches and agencies of foreign banks, which mainly lend to businesses, reported little change in their lending standards, while demand for their loans was reportedly stronger on net.

...

Within consumer lending, a moderate fraction of domestic banks reported an easing of standards on auto loans, on net, while standards on other types of consumer loans were about unchanged. On balance, banks indicated having eased selected terms on consumer loans over the survey period. A moderate fraction of respondents continued to experience stronger demand for auto loans, on net, while demand for credit card loans was reportedly unchanged.

...

The January survey also included three sets of special questions: The first set asked banks about lending to and competition from banks headquartered in Europe; the second set asked banks about changes in their lending policies on CRE loans over the past year; and the third set asked banks about their outlook for asset quality in major loan categories during 2013. In response to the first set, only a small fraction of domestic banks indicated that lending standards to European banks and their affiliates had been tightened, on net, while foreign respondents' standards were reportedly little changed for such institutions. In response to the second set, respondents indicated that they had eased selected CRE loan terms over the past 12 months on net, with the rest of the surveyed terms having been about unchanged. Finally, respondents' answers for the outlook for asset quality revealed that moderate to large fractions of banks expect improvements in credit quality in most major loan categories on balance.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

These two graphs shows the change in lending standards and demand for CRE (commercial real estate) loans.

Increasing demand and some easing in standards suggests some increase in CRE activity going forward.

In general this survey indicates lending standards are still tight, but some banks are loosening a little - and there is also increasing demand for certain loans.

Housing: Inventory down 22% year-over-year in early February

by Calculated Risk on 2/04/2013 12:39:00 PM

Inventory declines every year in December and January as potential sellers take their homes off the market for the holidays - and then starts increasing again in February. That is why it helps to look at the year-over-year change in inventory.

According to the deptofnumbers.com for (54 metro areas), overall inventory is down 22.2% year-over-year in early February and up slightly from January (on a monthly basis).

This graph shows the NAR estimate of existing home inventory through December (left axis) and the HousingTracker data for the 54 metro areas through early February.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory in 2011, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms during the holidays and then starts increasing in February - and peaks in mid-summer. So inventory will probably increase for the next 6+ months.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early February listings, for the 54 metro areas, declined 22.2% from the same period last year.

HousingTracker reported that the early February listings, for the 54 metro areas, declined 22.2% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already very low.

One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm also tracking inventory weekly this year.

If inventory does bottom, we probably will not know for sure until late in the year. Ben at Housing Tracker (Department of Numbers) has provided me weekly inventory data for the last several years and this is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak.

So far in 2013, even with the slight decline last week (probably noise), inventory is already up 3.0%. The next few months will be very interesting for inventory!

Irwin: No Bond Bubble

by Calculated Risk on 2/04/2013 11:11:00 AM

I was going to write about this since I'm asked about a "bond bubble" all the time - but Neil Irwin at the WaPo beat me too it: No, there probably isn’t a bond bubble

One peculiar legacy of the financial crisis is that, among the financial commentariat, there is a tendency to see a bubble whenever the market for a particular asset rises.Yes - people see bubbles everywhere!

[N]o bubble fears are as widespread as the conviction that the markets for government bonds—in the United States in particular, but also in many other nations. It almost passes as a mark of seriousness to argue that Treasuries are the next big bubble to pop, the biggest in a long series that also included the stock market bubble of the late 1990s and the housing and mortgage securities bubble of the 2000s.This reminds me of discussions we had back in 2005 about "what is a bubble"? Back then we were discussing the housing bubble (See: Housing: Speculation is the Key). Here is what I wrote about housing in April 2005:

That kind of talk particular heats up whenever bond prices start to fall a bit, as they have in the last few weeks. (The phrase “bond bubble” appeared in major world publications included in the Nexis database 28 times in January—up from two in January 2012). And it is true that bonds have been in a remarkable 30 year rally, their prices climbing as interest rates have fallen almost constantly since the early 1980s.

It’s certainly true that bond prices could fall (and, conversely, longer-term interest rates rise). On balance, that is more likely to be for good reasons–because the economy is getting back on track–than for bad reasons, like inflation getting out of control.

But I’m not particularly worried that Treasury bonds are a bubble about to pop. Here’s why.

The first, and simplest reason to be skeptical of the bond bubble story is this: What defines a bubble is people buying an asset at ever-rising prices for speculative reasons, not based on the fundamental value of the asset, but because they are assuming somebody else will buy it at a higher price. I see no evidence of this behavior by buyers of Treasury bonds.

I have taken to calling the housing market a "bubble". But how do I define a bubble?With bonds, I don't see speculation, significant leveraged buying, "storage" or any of the other factors that defined a housing "bubble". I think Irwin is correct - there is no bond bubble, and when bond prices eventually fall (and interest rates rise) it will most likely "be for good reasons–because the economy is getting back on track".

A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation - the topic of this post. Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the "bubble" bursts.

Lawler: More Home Builder Results for Last Quarter

by Calculated Risk on 2/04/2013 09:09:00 AM

CR Note: the following comments and table are from economist Tom Lawler.

This table is for many of the public home builders as of Dec 2012.

This shows that combined net order are up 37% compared to Q4 2011. As Lawler notes, the combined backlog is up 57.1%!

From Tom Lawler:

The combined order backlog of these companies at the end of 2012 was 26,638, up 57.1% from the end of 2011.

While not all builders comment on pricing trends, those that do have reported increased prices, “pricing power,” and/or lower incentives/price concessions.

As one builder noted, “being able to sell homes at a price that is higher than what it costs to build them is ‘sweet’.”

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg |

| D.R. Horton | 5,259 | 3,794 | 38.6% | 5,182 | 4,118 | 25.8% | $236,067 | $214,740 | 9.9% |

| PulteGroup | 3,926 | 3,084 | 27.3% | 5,154 | 4,303 | 19.8% | $287,000 | $271,000 | 5.9% |

| NVR | 2,625 | 2,158 | 21.6% | 2,788 | 2,391 | 16.6% | $331,900 | $304,600 | 9.0% |

| The Ryland Group | 1,502 | 915 | 64.2% | 1,578 | 1,040 | 51.7% | $270,000 | $254,000 | 6.3% |

| Standard Pacific | 983 | 615 | 59.8% | 973 | 782 | 24.4% | $388,000 | $374,000 | 3.7% |

| Meritage Homes | 1,094 | 749 | 46.1% | 1,240 | 894 | 38.7% | $294,000 | $275,000 | 6.9% |

| MDC Holdings | 869 | 523 | 66.2% | 1,221 | 792 | 54.2% | $318,700 | $291,300 | 9.4% |

| M/I Homes | 673 | 505 | 33.3% | 887 | 667 | 33.0% | $273,000 | $257,000 | 6.2% |

| Total | 16,931 | 12,343 | 37.2% | 19,023 | 14,987 | 26.9% | $285,300 | $265,785 | 7.3% |

Sunday, February 03, 2013

Sunday Night Futures

by Calculated Risk on 2/03/2013 10:04:00 PM

Monday:

• At 10:00 AM ET, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is for a 2.2% increase in orders.

• At 2:00 PM, The January 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve. This might show some slight loosening in lending standards.

Weekend:

• Summary for Week Ending Feb 1st

• Schedule for Week of Feb 3rd

The Asian markets are green tonight with the Nikkei up 0.5%, and the Shanghai Composite index is up 0.4%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up slightly and DOW futures are up 10.

Oil prices have moved up recently WTI futures at $97.58 per barrel and Brent at $116.62 per barrel. Gasoline prices are up 20 cents over the last couple of weeks.

Below is a graph from Gasbuddy.com showing the recent increase in gasoline prices.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Restaurant Performance Index: "Softer Sales, Traffic" in December

by Calculated Risk on 2/03/2013 02:32:00 PM

From the National Restaurant Association: December RPI declines due to softer sales, traffic

Due in large part to softer same-store sales and customer traffic levels, the National Restaurant Association's Restaurant Performance Index (RPI) declined in December. The RPI stood at 99.7 in December, down 0.2 percent from November, marking the third consecutive month in which the RPI stood below 100, which signifies contraction in the index of key industry indicators.

“Although restaurant operators reported softer same-store sales and customer traffic levels in December, they are cautiously optimistic about sales growth in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “However, operators remain decidedly pessimistic about the overall economy, with only 17 percent saying they expect business conditions to improve in the next six months.”

...

The Current Situation Index stood at 99.1 in December - down 0.7 percent from November and the lowest level in nearly two years. Although restaurant operators reported net positive same-store sales for the 19th consecutive month, December's results were much softer than the November performance.

Click on graph for larger image.

Click on graph for larger image.The index declined to 99.7 in December, down from 99.9 in November (below 100 indicates contraction).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Earlier:

• Summary for Week Ending Feb 1st

• Schedule for Week of Feb 3rd