by Calculated Risk on 2/07/2013 05:43:00 PM

Thursday, February 07, 2013

Lawler on Housing: More Data on Cash Buyers

From economist Tom Lawler:

DataQuick reported yesterday that both the number and the share of California home sales purchased with cash (meaning no mortgage was recorded at the time of sale) hit record levels in 2012. According to DataQuick, 145,797 California condos and homes were bought without mortgage financing last year, representing a record high 32.4% of all home sales, up from 30.4% in 2011 and more than double the average “all-cash” share since 1991. Based on mailing addresses vs. property addresses, DataQuick said that “investors and vacation-home buyers” represented “roughly” 55% of all California homes purchased with cash last year. Dataquick also reported that in 2012 there were “more than” 11,700 buyers who bought more than one home for cash, and that these “multi-home, all-cash” buyers combined purchased “about” 41,450 homes, representing “about” 9.3% of total sales.

Various MLS data on sales by financing indicate that the “all-cash” share of home purchases increased significantly in a wide range of markets starting in the latter part of decade, and remained high last year. Here are a few areas where either (1) local MLS produce annual stats which include data on financing type; or (2) where I went back to monthly reports.

| All-Cash Share of MLS Home Purchases (Yearly Totals) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Phoenix | Orlando | Tucson | Miami MSA: SF | Miami MSA: C/TH | Sacramento | Des Moines | Omaha | |

| 2002 | 14.1% | 10.0% | ||||||

| 2003 | 10.8% | 9.4% | 13.5% | |||||

| 2004 | 13.5% | 10.5% | 14.9% | |||||

| 2005 | 12.1% | 9.3% | 14.8% | |||||

| 2006 | 9.2% | 6.6% | 12.8% | |||||

| 2007 | 11.6% | 9.0% | 12.6% | 4.4% | ||||

| 2008 | 12.6% | 20.3% | 18.8% | 15.4% | 12.1% | |||

| 2009 | 37.2% | 41.4% | 23.9% | 25.1% | 11.8% | |||

| 2010 | 41.8% | 51.5% | 28.3% | 26.7% | 20.1% | 16.7% | ||

| 2011 | 46.9% | 52.9% | 34.6% | 43.8% | 80.8% | 30.1% | 21.9% | 20.2% |

| 2012 | 46.0% | 53.1% | 34.4% | 45.0% | 79.8% | 34.0% | 21.5% | 17.6% |

| All-Cash Share of MLS Home Purchases | |||

|---|---|---|---|

| Dec-12 | Dec-11 | Dec-07 | |

| DC Metro | 19.9% | 20.3% | 6.2% |

| Baltimore Metro | 23.4% | 22.5% | 9.0% |

| Florida SF | 47.2% | ||

| Florida C/TH | 73.5% | ||

| Toledo | 44.4% | 45.3% | |

| Akron | 33.0% | 39.4% | 28.1% |

| Peoria | 20.7% | 19.9% | 8.6% |

| Las Vegas | 55.2% | 50.8% | |

| Memphis | 39.8% | 30.8% | 22.6% |

The surge in the all-cash share of home purchases in many areas reflects an increase in the investor share of total purchases, though there also appears to have been an increase in the all-cash share of owner-occupied purchases.

In the early-to-mid part of last decade the investor share of home purchases increased significantly in several areas, especially areas that experienced a sharp increase in home prices. However, back then, the bulk of investors buying homes used mortgage financing, often with as much leverage as allowable and often with loan features that many today would view as “risky.” In the early/mid part of last decade few investors bought homes because rental yields looked attractive, but instead the purchases were driven by expectations of price appreciation. When prices started to soften investor buying eased, many investors listed homes for sale at price levels above the new, lower “market-clearing” levels, home listings soared, mortgage defaults surged, and, well, ...

CR Note: This was from Tom Lawler.

Fed: Consumer Credit increased $14.6 Billion in December

by Calculated Risk on 2/07/2013 03:08:00 PM

I rarely mention consumer credit, but the amount of credit outstanding has been steadily increasing as is normal in a recovery. This is OK if the borrowers can repay the debt, unfortunately much of the recent increase has been related to student loans - and student loan defaults are increasing.

From the Fed:

Consumer credit increased at a seasonally adjusted annual rate of 6-1/2 percent during the fourth quarter. Revolving credit was little changed, while nonrevolving credit increased at an annual rate of 9-1/2 percent. In December, consumer credit increased at an annual rate of 6-1/4 percent.Consumer credit increased $14.6 billion in December, with nonrevolving credit increasing $18.2 billion (this includes auto, student and other loans).

Also, talking about credit, from Fed Governor Jeremy Stein: Overheating in Credit Markets: Origins, Measurement, and Policy Responses

The question I'd like to address today is this: What factors lead to overheating episodes in credit markets? In other words, why do we periodically observe credit booms, times during which lending standards appear to become lax and which tend to be followed by low returns on credit instruments relative to other asset classes? We have seen how such episodes can sometimes have adverse effects on the financial system and the broader economy, and the hope would be that a better understanding of the causes can be helpful both in identifying emerging problems on a timely basis and in thinking about appropriate policy responses.This is an important topic.

NAHB: Builder Confidence in the 55+ Housing Market dips in Q4, Up year-over-year

by Calculated Risk on 2/07/2013 10:39:00 AM

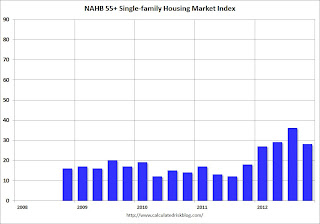

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so all readings are very low.

From the NAHB: Builder Confidence in the 55+ Housing Market Ends Year on a Positive Note

Builder confidence in the 55+ housing market for single-family homes showed continued improvement in the fourth quarter of 2012 compared to the same period a year ago, according to the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today. The index increased 10 points to a level of 28, the fifth consecutive quarter of year over year improvements.

...

Although all components of the 55+ single-family HMI remain below 50, they have improved significantly from a year ago: present sales climbed 10 points to 27, expected sales for the next six months increased 12 points to 38 and traffic of prospective buyers rose nine points to 24.

...

“Like the overall housing market, the 55+ segment of the market is undergoing a slow but steady recovery,” said NAHB Chief Economist David Crowe. “That said, there are serious obstacles to a continued and stronger recovery. While problems with tight credit conditions for buyers and obtaining accurate appraisals are still lingering, new problems like spot shortages and rising costs for labor, materials and lots are beginning to emerge.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q4 2012. All of the readings are very low for this index, and the index dipped in Q4 - but the general trend is up. Still, any reading below 50 "indicates that more builders view conditions as poor than good."

This is going to be a key demographic for household formation over the next couple of decades, but only if the baby boomers can sell their current homes!

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group.

The second graph shows the homeownership rate by age for 1990, 2000, and 2010. This shows that the homeownership rate usually increases until 70 years old or so.

The second graph shows the homeownership rate by age for 1990, 2000, and 2010. This shows that the homeownership rate usually increases until 70 years old or so.So demographics should be favorable for the 55+ market.

Weekly Initial Unemployment Claims at 366,000

by Calculated Risk on 2/07/2013 08:38:00 AM

The DOL reports:

In the week ending February 2, the advance figure for seasonally adjusted initial claims was 366,000, a decrease of 5,000 from the previous week's revised figure of 371,000. The 4-week moving average was 350,500, a decrease of 2,250 from the previous week's revised average of 352,750.The previous week was revised up from 368,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 350,500.

Weekly claims were above the 360,000 consensus forecast, however the 4-week average is at the lowest level since early 2008.

Wednesday, February 06, 2013

Thursday: Weekly Unemployment Claims, Consumer Credit

by Calculated Risk on 2/06/2013 07:45:00 PM

The light week for economic data continues ...

I guess we have to start paying attention to the "sequester" negotiations. From the WSJ: Sequester Triggers Delay in Deployment

The Pentagon’s decision to delay the deployment of a carrier to the Middle East could give opponents of the sequester some added ammunition in their battle to undo the across-the-board Pentagon spending cuts.My prediction at the beginning of the year was:

Sen. Kelly Ayotte (R., N.H.), a member of the Armed Services Committee, called the decision to delay the carrier deployment “deeply disturbing.”

“I hope what has happened here with these very stark examples of how [the sequester] is going to undermine our national security will move people to resolve this,” Ms. Ayotte said. “There are ways forward.”

...

Cuts totaling $85 billion are scheduled to start March 1 and run through Sept. 30; after that, about $110 billion in annual spending cuts would kick in.

Although the negotiations on the "sequester" will be tough, I suspect something will be worked out (remember the goal is to limit the amount of austerity in 2013).The only thing that seems certain is that negotiations will go down to the wire. The sequester cuts would be an additional drag on the economy on top of the "fiscal cliff" agreement.

Thursday economic releases:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 360 thousand from 368 thousand last week. The 4-week average could fall to the lowest level since early 2008.

• At 3:00 PM, Consumer Credit for December from the Federal Reserve. The consensus is for credit to increase $14.5 billion in December.

California Housing Report: Record Cash Buying in 2012

by Calculated Risk on 2/06/2013 03:52:00 PM

From DataQuick: Record Number of California Homes Bought with Cash

The number of California homes purchased with cash reached an all-time high last year ... A total of 145,797 condos and houses were bought without mortgage financing in 2012, a record. That was up from 125,812 in 2011, the previous high. In 2007, as the housing market deflated, cash sales totaled 39,731, according to San Diego-based DataQuick.Cash buying at the low end is mostly investors, but there are a large number of cash buyers for higher priced homes.

"It's clear that a lot of today's housing market recovery is being fueled by people putting their own money into homes. Some cash buying is part of a normal housing market, but we're at twice that normal rate. There are always some rich people, also buyers from abroad, but in a normal market the biggest single category would be retirees and empty-nesters who are down-sizing. Today, a lot of buyers are chasing what they view as the deal of a lifetime," said John Walsh, DataQuick president.

Cash purchases accounted for a record 32.4 percent of California's overall home sales last year, up from 30.4 percent in 2011 and more than double the annual average of 15.6 percent since 1991, when DataQuick's cash statistics begin.

...

Last year more all-cash deals occurred above the $500,000 threshold, and fewer below $100,000. Cash-only purchases of $500,000 or more rose 35.0 percent compared with 2011. That compares with an 11.2 percent decline in the number of homes cash buyers purchased below $100,000.

Investors and vacation-home buyers bought roughly 55 percent of all homes purchased with cash last year. Multi-home buyers, meaning those purchasing two or more properties, accounted for about 28 percent of last year's cash sales, up from around 24 percent in 2011, according to an analysis of buyer names in the public record.

Last year more than 11,700 cash-paying, multi-home buyers collectively purchased about 41,450 homes.

emphasis added

DataQuick reports that a total of "447,573 homes were sold in California to all buyers". If we assume that last sentence is institutional investors - then institutional investors are buying close to 10% of all homes in California.

Redfin: "Homebuyer Demand Takes Off in January"

by Calculated Risk on 2/06/2013 12:38:00 PM

This fits with the MBA purchase index released this morning ...

From Redfin: Homebuyer Demand Takes Off in January with Home Offers up 70%, Tours up 58%

• Customers signing offers increased 70.4 percent in January, compared with an increase of 58.5 percent a year earlier.Note that demand always picks up in January and Redfin provides a comparison to the increase last year in their markets.

• Customers requesting home tours were up 57.9 percent in January, compared with an increase of 52.0 percent in 2012.

The increase in homebuyer demand seen in January paired with a nation-wide inventory shortage has created an extreme seller’s market as we head into the spring home-buying and selling season. Particularly in Redfin’s Southern California markets, bidding wars involving thirty or more offers have become increasingly common. With no signs that homebuyer demand will let up any time soon, all eyes are on the nation's homeowners, builders and banks to list their homes for sale, providing some relief from this chaotic market.

I expect more inventory to come on the market over the next few months (Several potential sellers have told me they plan to list their homes soon since the market has "improved").

MBA: Purchase Mortgage Applications Increase, Highest Since May 2010

by Calculated Risk on 2/06/2013 08:43:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier was at its highest level since the week ending May 7, 2010. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.73 percent from 3.67 percent, with points increasing to 0.43 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The contract interest rate for 30-year fixed mortgages has increased for seven of the last eight weeks.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has increased in all but one week this year, and is now at the highest level since May 7, 2010 - and that was a spike related to the housing tax credit. The 4-week average of the purchase index is also at the highest level since May 2010.

Tuesday, February 05, 2013

Update: Seasonal Pattern for House Prices

by Calculated Risk on 2/05/2013 08:23:00 PM

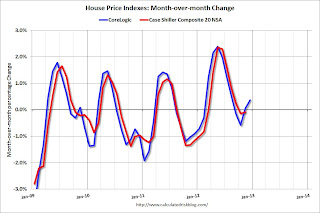

There is a clear seasonal pattern for house prices. Even in normal times house prices tend to be stronger in the spring and early summer, than in the fall and winter. Recently there has been a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter.

However, house prices - not seasonally adjusted (NSA) - have been pretty strong over the last few months - at the start of the normally weak months.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years (Case-Shiller through November, CoreLogic through December).

The CoreLogic index has been positive in both the November and December reports (CoreLogic is a 3 month weighted average, with the most recent month weighted the most).

Case-Shiller NSA turned negative month-to-month in the October report (also a three month average, but not weighted), but was only slightly negative in November. I expect more inventory to come on the market over the next few months than during the spring of 2011 and 2012, and that might slow the price increases - but it looks like the "off-season" for prices will be pretty strong.

CBO: Deficit to decline to 2.4% of GDP in Fiscal 2015

by Calculated Risk on 2/05/2013 03:36:00 PM

The Congressional Budget Office (CBO) released their new The Budget and Economic Outlook: Fiscal Years 2013 to 2023.

From the WSJ: CBO Sees Rising U.S. Debt, Economic Rebound in 2014

Economic growth and recent legislation have cut the federal budget deficit in half in the past four years ... the Congressional Budget Office said Tuesday in the annual update of its budget and economic forecast.The CBO projects the deficit will decline to 3.7% of GDP in fiscal 2014, and 2.4% of GDP in fiscal 2015.

The CBO said it expected economic growth to be sluggish in 2013, in part because of a sharp drop in government spending, but it sees a better economy in 2014 as the recovery takes hold.

The federal deficit for the fiscal year ending Sept. 30, 2013, is projected to fall to $845 billion, or 5.3% of gross domestic product, said the CBO, which produces nonpartisan reports on the budget and economy for Congress. That is down sharply from the past four years, which each had deficits exceeding $1 trillion. The 2012 deficit amounted to 7% of GDP.

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The CBO deficit estimates are even lower than my projections.

After 2015, the deficit will start to increase again according to the CBO, but as I've noted before, we really don't want to reduce the deficit much faster than this path over the next few years, because that will be too much of a drag on the economy.