by Calculated Risk on 12/27/2012 06:46:00 PM

Thursday, December 27, 2012

Sales Ratio: Existing to New Homes

Earlier I posted a graph that shows the "distressing gap" between new and existing home sales. I've argued that this gap has been mostly caused by distressed sales (foreclosures and short sales) and that eventually the gap would close.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

Click on graph for larger image.

Click on graph for larger image.

In general the ratio has been trending down, although it increased over the last few months with the recent pickup in existing home sales. I expect this ratio to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 377,000 SAAR in November

• New Home Sales graphs

Philly Fed: State Coincident Indexes increased in 45 States in November

by Calculated Risk on 12/27/2012 03:28:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2012. In the past month, the indexes increased in 45 states and decreased in five states, for a one-month diffusion index of 80. Over the past three months, the indexes increased in 45 states, decreased in three, and remained stable in two, for a three-month diffusion index of 84. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index rose 0.2 percent in November and 0.6 percent over the past three months.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In November, 45 states had increasing activity, down slightly from 46 in October (including minor increases). This is the second consecutive year with a weak spot during the summer, and improvement towards the end of the year.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. The map was all green earlier this year, than started to turn red, and is mostly green again.

"Fiscal Cliff": There is no Drop Dead Date and more thoughts

by Calculated Risk on 12/27/2012 01:50:00 PM

Two months ago I pointed out that there was no drop dead date for the "fiscal cliff" (more a slope than a cliff).

A few things to remember:

• There is no drop dead date. Online sites and TV channels with "fiscal cliff" countdown timers are an embarrassment and are just trying to scare viewers.

• The "fiscal cliff" is about too much austerity too quickly (cutting the deficit too quickly). The "cliff" is a combination of expiring tax cuts (income taxes, payroll taxes, and more will increase), and forced spending cuts (mostly for defense). This has NOTHING to do with other long term fiscal issues, primarily related to medicare.

• All along I've assumed an agreement would be reached in January. That timing is based on a two assumptions: 1) the tax cuts for high income earners would be allowed to expire, and 2) some politicians will not vote for any package that included a tax rate increase. After January 1st the politicians can vote for a tax cut for most Americans. That is obviously dumb, and makes extra work for many involved with payrolls and taxes, but that is politics. It is possible an agreement could be reached in the next few days - but I still think January is more likely. If it slips to February, I'll be concerned.

• We need the details of the fiscal agreement before we can estimate the drag on the US economy from all the austerity.

New Home Sales and Distressing Gap

by Calculated Risk on 12/27/2012 11:49:00 AM

New home sales have averaged 363,000 on an annual rate basis through November. That means sales are on pace to increase 18%+ from last year. Most sectors would be pretty happy with an 18% increase in sales.

But even with the significant increase this year, 2012 will be the 3rd lowest year for New Home sales since the Census Bureau started tracking new home sales in 1963. This year will be above 2010 and 2011, but below the 375,000 sales in 2009. I expect new home sales to double from here within the next several years as distressed sales continue to decline.

I started posting the following graph four years ago when the "distressing gap" first appeared.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through October. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Click on graph for larger image.

Click on graph for larger image.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 377,000 SAAR in November

• New Home Sales graphs

New Home Sales at 377,000 SAAR in November

by Calculated Risk on 12/27/2012 10:00:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 377 thousand. This was up from a revised 361 thousand SAAR in October (revised down from 368 thousand). Sales for August and September were revised up slightly.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in November 2012 were at a seasonally adjusted annual rate of 377,000 ... This is 4.4 percent above the revised October rate of 361,000 and is 15.3 percent above the November 2011 estimate of 327,000.

Click on graph for larger image in graph gallery.

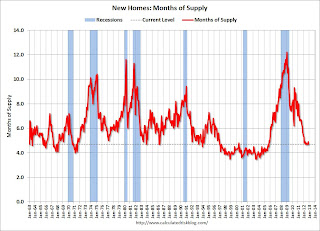

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply decreased in November to 4.7 months. October was revised up to 4.9 months (from 4.8 months).

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of November was 149,000. This represents a supply of 4.7 months at the current sales rate.On inventory, according to the Census Bureau:

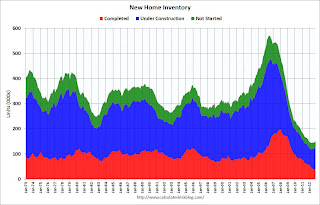

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was just above the record low in November. The combined total of completed and under construction is also just above the record low since "under construction" is starting to increase.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In November 2012 (red column), 27 thousand new homes were sold (NSA). Last year only 23 thousand homes were sold in November. This was the fourth weakest November since this data has been tracked (above 2011, 2009 and 1966). The high for November was 86 thousand in 2005.

New home sales have averaged 363 thousand SAAR through November 2012, up sharply from the 307 thousand sales in 2011. Also sales are finally at the lows for previous recessions too.

New home sales have averaged 363 thousand SAAR through November 2012, up sharply from the 307 thousand sales in 2011. Also sales are finally at the lows for previous recessions too.This was slightly above expectations of 375,000. I'll have more soon ...

Weekly Initial Unemployment Claims decline to 350,000, 4-Week average at low for 2012

by Calculated Risk on 12/27/2012 08:30:00 AM

The DOL reports:

In the week ending December 22, the advance figure for seasonally adjusted initial claims was 350,000, a decrease of 12,000 from the previous week's revised figure of 362,000. The 4-week moving average was 356,750, a decrease of 11,250 from the previous week's revised average of 368,000.The previous week was revised up slightly from 361,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 356,750.

The 4-week average is now at the low for the year. The previous low for the 4-week average was 363,000.

The recent spike in the 4-week average was due to Hurricane Sandy.

Weekly claims were lower than the 365,000 consensus forecast.

And here is a long term graph of weekly claims:

Note: There are large seasonal factors in December and January, and that can make for large swings for weekly claims. Still - it is nice finishing year at the lowest level for the 4-week average.

Wednesday, December 26, 2012

Thursday: New Home Sales, Initial Unemployment Claims

by Calculated Risk on 12/26/2012 09:02:00 PM

First, a reminder that rents can't outpace incomes for long ... from Conor Dougherty at the WSJ: Tenants Feel Pinch of Rising Rents

The rising cost of renting is putting pressure on tenants at a time when many are still grappling with slow or falling income growth. In the third quarter, renters spent 24.12% of their disposable income on financial obligations—things such as rent, debts and auto leases. That was the highest level since early 2010, according to the Federal Reserve.And on house prices from Nick Timiraos at the WSJ: Home Prices Hit a Milestone

Home prices are on track to notch their first yearly gain since 2006, the strongest performance since the housing bust and a development that could accelerate the real-estate rebound even as the broader economy stutters.Thursday economic releases:

...

"The tide has changed," said Ivy Zelman, chief executive of research firm Zelman & Associates. "People feel it's OK to go back into residential real estate—it's no longer taboo—and that change in sentiment could have a very powerful effect."

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 361 thousand last week. If correct, this would put the 4-week average near the low for the year.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is for an increase in sales to 375 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 368 thousand in October.

• Also at 10:00 AM, the Conference Board's consumer confidence index for December will be released. The consensus is for an decrease to 70.0 from 73.7 last month.

Earlier on house prices:

• Case-Shiller: House Prices increased 4.3% year-over-year in October

• Comment on House Prices, Real House Prices, and Price-to-Rent Ratio

• All Current House Price Graphs

Another question for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Lawler: An “Update” to the “Excess” Supply of Housing

by Calculated Risk on 12/26/2012 04:42:00 PM

CR: Housing economist Tom Lawler sent me the following long piece that suggests a large number of the excess vacant housing supply has been absorbed.

Housing economist Tom Lawler writes: An “Update” to the “Excess” Supply of Housing; How Much Has the Number of Vacant Homes Fallen Since April 1, 2010 (through December 1, 2012?)

It is over 2 1/2 years since the Decennial Census 2010’s “snapshot” of the US population and housing market on April 1, 2010. While private housing analysts are still awaiting the result of research by Census analysts on the reasons for the sharply different results of Census 2010 compared to other Census surveys (e.g., the ACS and the HVS), I thought it might be useful to review some numbers since the Census was taken.

On the housing production from, Census estimates suggest that from April 2010 to November 2012, housing completions plus manufactured housing units totaled about 1.817 million (an annualized pace of about 681 thousand).

There are no data on the net loss to the housing stock over this period. Prior to the release of Census 2010 results many folks thought that the net loss to the housing stock last decade was averaging around 200 – 250 thousand units a year, but the decennial Census results suggested a much smaller number. But for fun, let’s assume that the net loss in the housing stock since the decennial Census has been about 400,000, or an annualized rate of 150,000.

Such a number would imply that the housing stock at the end of November/beginning of December increased by about 1.417 million, or an annualized rate of about 531 thousand.

Now what about the number of households (or occupied housing units)? Sadly, here there are no good, reliable data to count on. For 2012, there are two sources of “estimates” on US “households,” both based on supplement surveys of the Current Population Survey. One source is the Housing Vacancy Survey, which assumes that (1) the Census’ Population Division estimates of the US housing stock are correct; and (2) the HVS’ estimates of the % of the housing stock are correct. Census 2010 results (and to a lesser extent ACS results) strongly indicated, of course, that the latter assumption is not correct: the HVS appears to overstate significantly the share of the housing stock that is vacant, with the overstatement growing over the past few decades.

With that caveat in mind, the HVS estimates are that the number of US households averaged 114.916 million in September 2012, compared to an average of 112.633 million in March-April of 2010. The official Census 2010 household estimate for April 2010 was 116.716 million. Assuming that the HVS estimates for the last 3 months of 2012 show similar YOY growth as the previous few months, and “grossing up” the totals to be consistent with Census 2010 totals, the HVS estimates might suggest household growth from April 1, 2010 to December 1, 2012 of about 2.62 million, or an annualized rate of about 983 thousand. This is a “low” estimate.

Another source of an “estimate” of US households in 2012 is the Annual Social and Economic Supplement to the Current Population Survey. This annual survey, taken over February, March, and April with an “expanded” sample size relative to the “normal” monthly CPS and HVS surveys, purportedly produces “estimates” of the number of US households in March of each year that are consistent with (1) civilian non-institutionalized population estimates, and (2) survey results. The CPS/ASEC, in essence, is “controlled” to population estimates, as opposed to the CPS/HVS, which is “controlled” to housing stock estimates.

In the latest CPS/ASEC for March, 2012, the estimate of the number of US households was 121.084 million, which is a staggering 4.368 million higher than the official Census 2010 estimate for April 1, 2010. The CPS/ASEC revised household estimate for March, 2011, based on Census 2010 population controls, was 119.927 million, up from the previous 118.682 million in the 2011 report based on Census 2000 population controls. Census did not provide updated March 2010 estimates based on Census 2010 population controls.

It should be noted, however, that the CPS/ASEC household “estimates” are not “controlled” to Census 2010 household estimates, but instead are “controlled” to population estimates, and the CPS/ASEC survey results appear to significantly overstate US households (they also aren’t consistent with decennial Census estimates of the household, as opposed to civilian non-institutionalized, population estimates). I “guesstimate” that a CPS/ASEC household estimate consistent with Census 2010 household population estimates and recently-released 2012 household population estimates by age group for March, 2012 would be about 119.6 million, and that an estimate for December 1, 2012 using updated household population estimates would be about 120.5 million, about 3.8 million higher than the Census 2010 estimate for April 1, 2010, and an annualized increase of about 1.425 million. This is a “high” to “very high” estimate.

Another alternative would be to look at updated estimates of the household population (available through December 1, 20121), and then make certain assumptions either about household size (very crude) or make certain assumptions about “headship” rates by age group. Below is a table with some data to start with.

A few things are worth noting: first, overall population growth is estimated to have grown at an annualized rate of about 0.74% since the decennial Census was taken, and the household population is estimated to have grown at an annualized rate of 0.76%. This growth rate is significantly lower than last decade’s average, partly reflecting lower immigration levels and partly reflecting lower birth rates.

The population of adults – which is more important in terms of household growth, is estimated to have grown at a more rapid annualized rate. E.g., the 25+ year household population is estimated to have grown at an annualized rate of about 1.09%.

| Annualized % Chg | ||||

| 4/1/2010 | 12/1/2012 | |||

| Resident Population | 308,747,508 | 314,918,615 | 0.74% | |

| Household Population | 300,758,251 | Average Household Size | 306,855,515 | 0.76% |

| Households | 116,716,292 | 2.577 | ||

| Household Population by Age Group | ||||

| 15-24 | 40,202,045 | 40,442,554 | 0.22% | |

| 25-34 | 40,005,898 | 41,371,961 | 1.27% | |

| 35-44 | 40,277,153 | 39,666,291 | -0.57% | |

| 45-54 | 44,288,729 | 43,274,284 | -0.87% | |

| 55-64 | 36,068,290 | 38,485,646 | 2.46% | |

| 65-74 | 21,429,316 | 24,256,989 | 4.76% | |

| 75+ | 17,380,962 | 18,231,315 | 1.81% | |

| 25+ Years | 199,450,348 | 205,286,486 | 1.09% | |

| Households by Age Group | Headship Rate* | |||

| 15-24 | 5,400,799 | 13.43% | ||

| 25-34 | 17,957,375 | 44.89% | ||

| 35-44 | 21,290,880 | 52.86% | ||

| 45-54 | 24,907,064 | 56.24% | ||

| 55-64 | 21,340,338 | 59.17% | ||

| 65-74 | 13,504,517 | 63.02% | ||

| 75+ | 12,315,319 | 70.86% | ||

| * Households divided by Household Population | ||||

[Note: the difference between the “resident” population and the “household” population is the number of people estimated to be living in “group quarters,” usually broken out between “institutionalized” (including correctional facilities for adults, juvenile facilities, and nursing/skilled nursing facilities) and “non-institutionalized” (including college/university student housing, military quarters, and other group housing).]

There are two “Q&D” ways one might “gueestimate” the number of households on December 1, 2012: one – very quick, extremely dirty – would be to assume that the average household size had remained the same. That approach, which doesn’t take into account shifts in the age distribution of the population, would lead to an estimate of 119.028 million, up 2.366 million from April 1, 2010.

A second approach would be to assume that the “headship” rates for different age groups on December 1, 2012 was about the same as on April 1, 2012. Using that “Q&D” approach, one would get an estimate of the number of households on December 1, 2012 of about 120.283 million, up 3.567 million from April 1, 2010.

So … let’s assume that a “very low” case for household growth from April 1, 2010 is around 2.4 million (annual rate of 900 thousand); a “high” case is 4.0 million (annual rate of 1.5 million), and a “base” case is around 3.2 million (annual rate of around 1.2 million). What might these numbers mean for the number of vacant homes as of December 1, 2012 compared to April 1, 2010? Here is a table showing (rounded) what the numbers might look like.

| Changes from April 1, 2010 to December 1, 2012 (millions of units) | |||

|---|---|---|---|

| Low | Base | High | |

| Household Increase | 2.4 | 3.1 | 3.8 |

| Housing Production* | 1.8 | 1.8 | 1.8 |

| Net Housing Units Lost | 0.4 | 0.4 | 0.4 |

| Housing Units | 1.4 | 1.4 | 1.4 |

| Vacant Housing Units | -1.0 | -1.7 | -2.4 |

| *Housing Completions plus Manufactured Housing Placements (with November estimate) | |||

Under a “very low end” estimate of household growth, the number of vacant units since April 1, 2010 would be down by about a million. Under a “very high end” estimate of household growth, the number of vacant housing units would be 2.4 million lower. And a “not too unrealistic” estimate of household growth would imply that the number of vacant housing units was down by about 1.7 million.

Now, does a 1.7 million decline in the number of vacant homes for sale since April 1, 2010 seem plausible? Well, if that were the case one would probably expect that the number of homes for sale, for rent, and held as REO would be down significantly. So, let’s take a look at some available numbers.

NAR estimates that the number of existing homes for sales declined from 3.09 million at the end of March 2010 to 2.03 million at the end of November 2012, a decline of about 1.06 million. Realtor.com’s listings numbers fell by a similar amount. Obviously not all homes listed for sale are vacant, but a significant % are vacant.

Census estimates that the number of completed new SF homes for sales declined from 92 thousand at the end of March 2010 to 40 thousand at the end of October 2012, a decline of 52 thousand.

The REO inventory of Fannie, Freddie, FHA, and private-label ABS, combined with an estimate of the REO inventory of FDIC-insured institutions (based on $ carrying amounts and estimates of the average carrying balance) declined from about 531 thousand from the end of March 2010 to about 367 thousand at the end of September 2012, a decline of about 164 thousand. Some, but probably less than 40%, of these REO properties were listed for sale.

There aren’t good, aggregate data on the number of homes for rent: HVS has estimates, but comparisons with decennial Census data indicate that HVS rental vacancy rates not only are overstated, but also that the overstatement has grown over time. Given that caveat, the HVS estimates show that the number of homes for rent declined from a first-half 2010 average (to come close to an April 1 estimate) of about 4.458 million to a third-quarter 2012 average of 3.809 million, a decline of about 649 thousand. The actual decline is probably larger.

Hmmmm…..gosh, a decline in the number of vacant homes of about 1.7 million since April 1, 2010 sure SEEMS plausible!

But wait: if the number of vacant homes since Census 2010 has been that large, then that would imply a sizable reduction in the “excess” supply of housing – enough so that, if true, one should have expected to see stability in, or even in many areas even increases in, home prices in 2012! Could that really be true? (CR note: see previous posts!)

Looking ahead to the next few years, the likely growth in population by age groups suggests that household formations should average about 1.3 million a year, with some upside if headship rates rebound in any meaningful fashion.

1 Actually, “estimates” are available through July 1, 2012, and data from August 1, 2012 through December 1, 2012, are short-term “projections.”

CR Note: This was from housing economist Tom Lawler.

Comment on House Prices, Real House Prices, and Price-to-Rent Ratio

by Calculated Risk on 12/26/2012 12:23:00 PM

There is a seasonal pattern for house prices, and I've been predicting that the Case-Shiller indexes would turn negative month-to-month in October on a Not Seasonally Adjusted (NSA) basis.

That is the normal seasonal pattern. Also, as I've noted, I expect smaller month-to-month declines this winter than for the same months last year. Sure enough, Case-Shiller reported that the Composite 20 index declined 0.1% in October from September (barely negative). In October 2011, the index declined 1.3% on a month-to-month basis.

Over the winter, the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. I think the house price indexes have already bottomed, and will be up about 6% or so year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years (both through October). The CoreLogic index turned negative month-to-month in the September report (CoreLogic is a 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA turned negative month-to-month in the October report (also a three month average, but not weighted).

Case-Shiller reported the fifth consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in October suggests that house prices probably bottomed earlier this year (the YoY change lags the turning point for prices).

The following table shows the year-over-year increase for each month this year.

| Case-Shiller Composite 20 Index | |

|---|---|

| Month | YoY Change |

| Jan-12 | -3.9% |

| Feb-12 | -3.5% |

| Mar-12 | -2.6% |

| Apr-12 | -1.7% |

| May-12 | -0.5% |

| Jun-12 | 0.6% |

| Jul-12 | 1.1% |

| Aug-12 | 1.9% |

| Sep-12 | 2.9% |

| Oct-12 | 4.3% |

| Nov-12 | |

| Dec-12 | |

| Jan-13 | |

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through October) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through October) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to September 2003 levels, and the CoreLogic index (NSA) is back to January 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to July 2000, and the CoreLogic index back to January 2001.

In real terms, most of the appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to August 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to 1999 or early 2000 levels.

Case-Shiller: House Prices increased 4.3% year-over-year in October

by Calculated Risk on 12/26/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October (a 3 month average of August, September and October).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Sustained Recovery in Home Prices According to the S&P/Case-Shiller Home Price Indices

Data through October 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices, ... showed home prices rose 4.3% in the 12 months ending in October in the 20-City Composite, out-distancing analysts’ forecasts. Anticipated seasonal weakness appeared as twelve of the 20 cities and both Composites posted monthly declines in home prices in October.

The 10- and 20-City Composites recorded respective annual returns of +3.4% and +4.3% in October 2012 – larger than the +2.1% and +3.0% annual rates posted for September 2012. In nineteen of the 20 cities, annual returns in October were higher than September. Chicago and New York were the only two cities with negative annual returns in October. Phoenix home prices rose for the 13th month in a row. San Diego was second best with nine consecutive monthly gains.

...

“Annual rates of change in home prices are a better indicator of the performance of the housing market than the month-over-month changes because home prices tend to be lower in fall and winter than in spring and summer. Both the 10- and 20-City Composites and 19 of 20 cities recorded higher annual returns in October 2012 than in September. The impact of the seasons can also be seen in the seasonally adjusted data where only three cities declined month-to-month. The 10-City Composite annual rate of +3.4% in October was lower than the 20-City Composite annual figure of +4.3% because the two weaker cities – Chicago and New York – have higher weights in the 10-City Composite." [says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices.]

“Looking over this report, and considering other data on housing starts and sales, it is clear that the housing recovery is gathering strength. Higher year-over-year price gains plus strong performances in the southwest and California, regions that suffered during the housing bust, confirm that housing is now contributing to theeconomy.'

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.0% from the peak, and up 0.6% in October (SA). The Composite 10 is up 4.8% from the post bubble low set in March (SA).

The Composite 20 index is off 30.3% from the peak, and up 0.7% (SA) in October. The Composite 20 is up 5.4% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 3.4% compared to October 2011.

The Composite 20 SA is up 4.3% compared to October 2011. This was the fifth consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 17 of the 20 Case-Shiller cities in October seasonally adjusted (also 12 of 20 cities increased NSA). Prices in Las Vegas are off 58.0% from the peak, and prices in Dallas only off 4.6% from the peak. Note that the red column (cumulative decline through October 2012) is above previous declines for all cities.

Prices increased (SA) in 17 of the 20 Case-Shiller cities in October seasonally adjusted (also 12 of 20 cities increased NSA). Prices in Las Vegas are off 58.0% from the peak, and prices in Dallas only off 4.6% from the peak. Note that the red column (cumulative decline through October 2012) is above previous declines for all cities.This was slightly above the consensus forecast for a 4.1% YoY increase. I'll have more on prices later.