by Calculated Risk on 11/21/2012 04:52:00 PM

Wednesday, November 21, 2012

DOT: Vehicle Miles Driven decreased 1.5% in September

I first started tracking monthly vehicle miles to see the impact of the recession on driving. Since then we've seen the impact of demographics and changing preferences ... very interesting.

The Department of Transportation (DOT) reported today:

Travel on all roads and streets changed by -1.5% (-3.6 billion vehicle miles) for September 2012 as compared with September 2011. ◦Travel for the month is estimated to be 237.1 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by 0.6% (14.2 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 58 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in September compared to September 2011. In September 2012, gasoline averaged of $3.91 per gallon according to the EIA. Last year, prices in September averaged $3.67 per gallon, so - just looking at gasoline prices - it is no surprise that miles driven decreased year-over-year in September.

Gasoline prices were up in September compared to September 2011. In September 2012, gasoline averaged of $3.91 per gallon according to the EIA. Last year, prices in September averaged $3.67 per gallon, so - just looking at gasoline prices - it is no surprise that miles driven decreased year-over-year in September.Just looking at gasoline prices suggest miles driven will be down again in October - especially with the very high prices in California. Nationally gasoline prices averaged $3.81 in October, up sharply from $3.51 a year ago.

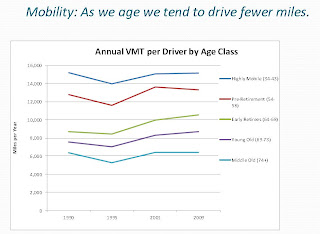

However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.Also miles driven has been falling for lower age groups over the last few years, and the next survey will probably show that decline. Here is an article on younger drivers: Young People Are Driving Less—And Not Just Because They're Broke (ht KarmaPolice)

An April study by the U.S. Public Interest Research Group found that between 2001 and 2009 the average annual vehicle miles traveled by Americans ages 16 to 34 fell by close to a quarter, from 10,300 to 7,900 per capita (four times greater than the drop among all adults), and from 12,800 to 10,700 among those with jobs.With all these factors, it may be years before we see a new peak in miles driven.

...

The PIRG researchers concluded that this change couldn’t simply be pegged to the economy, but indicates a value shift.

Business Insider Interview

by Calculated Risk on 11/21/2012 02:07:00 PM

I spoke with Joe Weisenthal at Business Insider yesterday. He wrote a way too nice article and included some of our conversation: The Genius Who Invented Economics Blogging Reveals How He Got Everything Right And What's Coming Next

Genius? Hardly. I just paid attention and put 2 plus 2 together.

And I didn't get "everything right", but I did get most of the US macro trends correct over the last 8 years. I started blogging in January 2005, and most of my early posts were about housing, as an example: Housing: Speculation is the Key

And I definitely didn't invent economics blogging. Barry Ritholtz and others were ahead of me.

In the interview, I mentioned the "doomer" mentality. Many people now think of the '90s as a great decade for the economy - and it was. But there were doomsday predictions every year. As an example, in 1994 Larry Kudlow was arguing the Clinton tax increases would lead to a severe recession or even Depression. Wrong. By the end of the '90s, there were many people concerned about the stock bubble and I shared that concern, but there were doomers every year (mostly wrong).

In the Business Insider interview, I said: "I’m not a roaring bull, but looking forward, this is the best shape we’ve been in since ’97". Obviously the economy is still sluggish, and the unemployment rate is very high at 7.9%, but I was looking forward. I mentioned the downside risks from Europe and US policymakers (the fiscal slope), but I think the next few years could see a pickup in growth.

In the article I highlighted two of the reasons I expect a pickup in growth that I've mentioned before on the blog; a further increase in residential investment, and the end of the drag from state and local government cutbacks.

I also mentioned an excellent piece on autos from David Rosenberg back in early 2009. His piece made me think about auto sales - and I came to a different conclusion than Rosenberg, see: Vehicle Sales. I started expecting auto sales to bottom, and that led me to be more optimistic for the 2nd half of 2009.

I enjoyed talking with Joe - although he was way too nice - and, yes, that is a picture of me.

AIA: Architecture Billings Index increases in October, Highest in Two Years

by Calculated Risk on 11/21/2012 11:49:00 AM

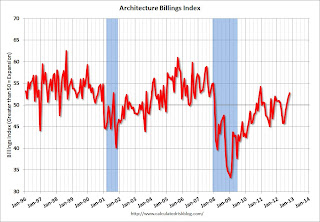

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Positive for Third Straight Month

Billings at architecture firms accelerated to their strongest pace of growth since December 2010. As a leading economic indicator of construction activity, the Architecture Billings Index (ABI) reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 52.8, up from the mark of 51.6 in September. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.4, compared to a mark of 57.3 the previous month.

“With three straight monthly gains – and the past two being quite strong – it’s beginning to look like demand for design services has turned the corner,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “With 2012 winding down on an upnote, and with the national elections finally behind us, there is a general sense of optimism. However, this is balanced by a tremendous amount of anxiety and uncertainty in the marketplace, which likely means that we’ll have a few more bumps before we enter a full-blown expansion.”

• Regional averages: South (52.8), Northeast (52.6), West (51.8), Midwest (50.8)

• Sector index breakdown: multi-family residential (59.6), mixed practice (52.4), institutional (51.4), commercial / industrial (48.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in October, up from 51.6 in September. Anything above 50 indicates expansion in demand for architects' services.

This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). New project inquiries are also increasing. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests some increase in CRE investment next year (it will be some time before investment in offices and malls increases significantly).

Final November Consumer Sentiment at 82.7, MarkIt Flash PMI shows Improvement in Manufacturing

by Calculated Risk on 11/21/2012 09:58:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for November declined to 82.7 from the preliminary reading of 84.9, and was up from the October reading of 82.6.

This was below the consensus forecast of 84.0. Overall, consumer sentiment has been improving; the recent decline in sentiment might be related to the stock market decline (the consumer sentiment index is impacted by employment, gasoline prices, the stock market and more).

From MarkIt: Manufacturing growth strengthens to five-month high in November

The Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™)1 signalled the strongest improvement in U.S. manufacturing business conditions for five months in November. The preliminary ‘flash’ PMI reading, which is based on around 85% of usual monthly replies, rose to 52.4 from 51.0 in October to indicate a moderate manufacturing expansion overall.

Weekly Initial Unemployment Claims decline to 410,000

by Calculated Risk on 11/21/2012 08:30:00 AM

The DOL reports:

In the week ending November 17, the advance figure for seasonally adjusted initial claims was 410,000, a decrease of 41,000 from the previous week's revised figure of 451,000. The 4-week moving average was 396,250, an increase of 9,500 from the previous week's revised average of 386,750.The previous week was revised up from 439,000.

[New York] +43,956 Increase in initial claims due to Hurricane Sandy. These separations were primarily in the construction, food service, and transportation industries.

[New Jersey] +31,094 Increase in initial claims due to Hurricane Sandy. These separation were primarily in the accommodation and food services, manufacturing, transportation and warehousing, administrative service, healthcare and social assistance,construction, retail, professional, trade, educational service, and public administration industries.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 396,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year until the recent spike due to Hurricane Sandy. Weekly claims should continue to decline over the next few weeks.

MBA: Purchase Mortgage Applications increase, Refinance Applications decrease

by Calculated Risk on 11/21/2012 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.54 percent from 3.52 percent, with points decreasing to 0.40 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years, however the purchase index has increased 7 of the last 9 weeks and is now near the high for the year - but this index still isn't showing an increase like other housing reports.

Zillow: House Prices increased 4.7% Year-over-year in October

by Calculated Risk on 11/21/2012 12:22:00 AM

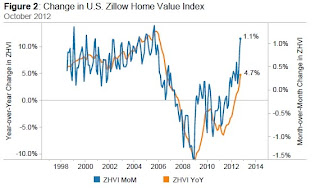

From Zillow: October Marks 12th Consecutive Month of National Home Value Increases

Zillow’s October Real Estate Market Reports, released today, show that national home values rose 1.1% from September to October to $155,400. This is the largest monthly increase since August 2005 when home values rose 1.2% month-over-month. October 2012 marks the 12th consecutive month of home value appreciation, further evidence of a durable housing market recovery. On a year-over-year basis, home values were up by 4.7% in October 2012 – a rate of annual appreciation we haven’t seen since September of 2006 ...

In October, 276 (75%) of the 366 markets showed monthly home value appreciation, and 228 (62%) of the 366 markets saw annual home value appreciation. Among the top 30 metros, 29 experienced monthly home value appreciation and 26 saw annual increases.

Click on graph for larger image.

Click on graph for larger image. The graph from Zillow shows both the year-over-year and month-over-month change for the Zillow HPI.

This is a very strong month-over-month increase, and the largest year-over-year increase since 2006.

Tuesday, November 20, 2012

Wednesday: Unemployment claims, Consumer sentiment

by Calculated Risk on 11/20/2012 09:04:00 PM

There is an EU summit meeting on Thursday, so there might be some news over the holiday.

From Reuters: Euro zone mulls Greek debt buy-back up to 40 billion euros

Euro zone finance ministers are considering allowing Athens to buy back up to 40 billion euros of its own bonds at a discount as one of a number of measures to cut Greek debt to 120 percent of GDP within the next eight years.Wednesday:

...

Under a proposal discussed by ministers, Greece would offer private-sector bondholders around 30 cents for every euro of Greek debt they hold ... The ministers, who failed to reach agreement last week, have also discussed granting Greece a 10-year moratorium on paying interest on about 130 billion euros of loans from the euro zone's emergency fund ...There is also the possibility of reducing the interest rate on loans made by euro zone countries directly to Greece in 2010, from 1.5 percent to just 0.25 percent ...

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 415 thousand from 439 thousand. Note: Claims increased sharply last week due to Hurricane Sandy.

• At 9:00 AM, The Markit US PMI Manufacturing Index Flash will be released. This is a new release and might provide hints about the ISM PMI for November. The consensus is for a decline to 51.0 in November, from 51.5 in October.

• At 9:55 AM, the finale Reuters/University of Michigan's Consumer sentiment index for November will be released). The consensus is for a decline to 84.0 from the preliminary reading of 84.9. Goldman Sachs is forecasting a decline in confidence to 81.0, and Merrill Lynch is forecasting a decline to 83.

• At 10:00 AM, the Conference Board Leading Indicators for October. The consensus is for a 0.2% decrease in this index.

• During the day: The AIA's Architecture Billings Index for October will be released (a leading indicator for commercial real estate).

Earlier on Housing Starts:

• Housing Starts increased to 894 thousand SAAR in October

• Starts and Completions: Multi-family and Single Family

• Quarterly Housing Starts by Intent compared to New Home Sales

• All Housing Investment and Construction Graphs

WaPo: Price-to-rent ratio for Certain Cities

by Calculated Risk on 11/20/2012 05:46:00 PM

Neil Irwin at the WaPo looks at the price-to-rent ratio for several cities using Case-Shiller prices and Owner's equivalent rent (OER) from the BLS. This is the same approach I use with the national data very month.

From Neil Irwin at the WaPo: Why Atlanta, New York, and Chicago are poised to drive a housing recovery

A good way to look at which housing markets are potentially overvalued and which are undervalued—and where the market seems to be begging for new home construction and where there is still a surplus of unneeded houses—is to look at the relationship between rents and home prices. Over long periods of time, the price to rent a given house should rise at about the same rate as the price to buy one.Irwin only looked at Case-Shiller cities with monthly OER data. However the BLS has semi-annual OER data for several more Case-Shiller cities.

But over shorter periods of time, the two can diverge. And when they do, it is usually a sign that something curious is up in that market. For example, from 2000 to 2005, prices in the Miami metro area rose by 136 percentage points more than did rents, a sure sign that it was one of the nation’s most bubbly housing markets.

...

The best news out of this analysis, though, may be this: Most of the largest U.S. cities have housing markets that have been in pretty good balance over the last year, with prices rising at about the same rate as rents. That’s true of the Washington metro area ( where prices are up 4.3 percent, rents up 2.4 percent), and also of San Francisco, Los Angeles, Boston, Dallas, Seattle, and Cleveland.

And that may be the best sign for the housing market of all. After all these years of bubbles and busts, ups and downs, there finally is a measure of stability.

Click on graph for larger image.

Click on graph for larger image.This graph shows the price-to-rent ratio of Case-Shiller and OER for Denver, Portland and San Diego (cities Irwin didn't include).

The BLS only provides first and second half OER data for these cities, so I averaged six months of the Case-Shiller indexes to calculate the price-to-rent ratio. I set the ratio to 1.0 for the period 1997 through 2000.

It appears San Diego is back to normal, and prices in Denver and Portland might be a little high by this measure.

Quarterly Housing Starts by Intent compared to New Home Sales

by Calculated Risk on 11/20/2012 02:58:00 PM

In addition to housing starts for October, the Census Bureau released Housing Starts by Intent for Q3. Note: Most text is a repeat from last quarter with updated graphs.

First, we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released this morning showed there were 104,000 single family starts, built for sale, in Q3 2012, and that was above the 96,000 new homes sold for the same quarter, so inventory increased a little (Using Not Seasonally Adjusted data for both starts and sales).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 33% compared to Q3 2011. This is still very low, and only back to 2008 levels.

Owner built starts were unchanged from Q3 2011. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly and is up about 33% year-over-year.

The second graph shows quarterly single family starts, built for sale and new home sales (NSA).

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are starting a few more homes than they are selling, and the inventory of under construction and completed new home sales increased slightly to 122,000 in Q3 (this is still near record lows).

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control, and also suggests that the year-over-year increase in housing starts is directly related to an increase in demand and not renewed speculative building.