by Calculated Risk on 6/28/2012 05:00:00 PM

Thursday, June 28, 2012

Europe: Growth Pact Update

There is a little news from the European summit meeting:

Herman Van Rompuy, President of the European Council did tweet:

With the #GrowthCompact we will boost the financing of the economy by mobilising around EUR 120 bn for immediate growth measures.This is the plan that was discussed last week.

Rompuy also wrote:

A EUR 10 bn increase of the EIB capital will increase the bank's overall lending capacity by EUR 60 bn. This money must flow across Europe.Earlier Angela Merkel cancelled a planned press conference.

The Financial Times is live blogging the European summit: EU summit: Live blog

Van Rompuy says no agreement yet on growth pact because they haven’t finished discussing all the chapters yet. He would not confirm it was being blocked by either Mario Monti or David Cameron; it was simply unfinished. He said two countries were most concerned to see agreement on both long and short term together – he didn’t name them, but Germany and Italy are the most likely suspects. Both inclined to say no agreement until it is all agreed.Meanwhile Bloomberg is reporting there is agreement: EU Leaders Agree 120 Billion-Euro Pact to Promote Growth, Jobs

excerpt with permission

A QE Timeline

by Calculated Risk on 6/28/2012 02:04:00 PM

By request, here is an updated timeline of QE (and Twist operations):

• November 25, 2008: Press Release: $100 Billion GSE direct obligations, $500 billion in MBS

• December 16, 2008 FOMC Statement: Evaluating benefits of purchasing longer-term Treasury Securities

• January 28, 2009: FOMC Statement: FOMC Stands Ready to expand program.

• March 18, 2009: FOMC Statement: Expand MBS program to $1.25 trillion, buy up to $300 billion of longer-term Treasury securities

• March 31, 2010: QE1 purchases were completed at the end of Q1 2010.

• August 27, 2010: Fed Chairman Ben Bernanke hints at QE2: Analysis: Bernanke paves the way for QE2

• November 3, 2010: FOMC Statement: $600 Billion QE2 announced.

• June 30, 2011: QE2 purchases were completed at the end of Q2 2011.

• September 21, 2011: "Operation Twist" announced. "The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less."

• June 20, 2012: "Operation Twist" extended. "The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities."

• June 20, 2012: "Operation Twist" extended. "The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities."

This graph show the S&P 500 and the Fed actions.

Click on graph for larger image.

Kansas City Fed: Growth in Regional Manufacturing Activity Slowed in June

by Calculated Risk on 6/28/2012 11:03:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Eased Further Activity Slowed

Growth in Tenth District manufacturing activity slowed in June, and expectations eased as producers grew more uncertain.. ...The regional manufacturing surveys were mostly weaker in June, especially the Philly Fed index.

The month-over-month composite index was 3 in June, down from 9 in May and equal to 3 in April ... The production index eased from 17 to 12, and the new orders index fell back into negative territory after rising slightly last month. Order backlogs continued to ease. The employment index moved lower but remained positive, while the new orders for exports index decreased.

Price indexes moderated for the second straight month, including an actual decline in monthly selling prices. The month-over-month finished goods price index dropped from 0 to -4, its lowest level since mid-2010, and the raw materials price index also decreased.

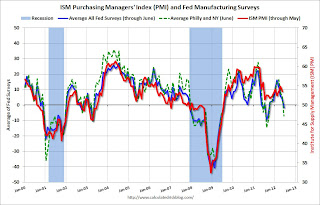

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

The ISM index for June will be released Monday, July 2nd, and these surveys suggest some decrease from the 53.5 reading in May.

Weekly Initial Unemployment Claims mostly unchanged

by Calculated Risk on 6/28/2012 08:30:00 AM

The DOL reports:

In the week ending June 23, the advance figure for seasonally adjusted initial claims was 386,000, a decrease of 6,000 from the previous week's revised figure of 392,000. The 4-week moving average was 386,750, a decrease of 750 from the previous week's revised average of 387,500.The previous week was revised up from 387,000 to 392,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined slightly to 386,750.

This is just off the high for the year.

And here is a long term graph of weekly claims:

This was near the consensus forecast of 385,000 and suggests some renewed weakness in the labor market.

This was near the consensus forecast of 385,000 and suggests some renewed weakness in the labor market.Wednesday, June 27, 2012

Tomorrow: Unemployment Claims, Q1 GDP (third estimate)

by Calculated Risk on 6/27/2012 10:30:00 PM

The focus tomorrow will be on the start of the two day European summit in Brussels, and also on the SCOTUS ruling on the health care law. The ruling on the Affordable Care Act is expected a little after 10 AM ET. (the SCOTUSblog is a good resource).

On Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 385 thousand from 387 thousand last week.

• Also at 8:30 AM, the third estimate of Q1 GDP will be released. The consensus is that real GDP increased 1.9% annualized in Q1; no change from the 2nd estimate.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for June will be released this is the last of the regional Fed surveys for June, and three out of four have been below expectations. The consensus is for a decrease to 4 from 9 in May (above zero is expansion).

Number of Cities with Increasing House Prices

by Calculated Risk on 6/27/2012 08:03:00 PM

The following graph shows the number of cities with increasing house prices on a year-over-year and month-over-month basis.

This graph is based on the Case-Shiller Composite 20 cities using seasonally adjusted data starting in January 2001.

Most cities were seeing month-over-month increases every month through 2005. In 2006, some cities started seeing year-over-year declines (red). There were still a few cities with increasing prices in early 2007. The increases in 2009 and 2010 were related to the housing tax credit (all of those gains and more are gone).

Recently prices have started increasing in more and more cities. Note: Case-Shiller data is through April.

Click on graph for larger image in graph gallery.

In April 2012, 17 cities saw month-over-month price increases (SA), and 10 cities saw year-over-year price increases.

I expect that the number of cities with a year-over-year price increase will continue to climb, and in a few months the Case-Shiller Composite 20 index will turn positive on a year-over-year basis.

Lawler on Lennar: Net Home Orders Jump, Pricing Improves in “Most” Markets

by Calculated Risk on 6/27/2012 04:29:00 PM

From economist Tom Lawler:

Lennar Corporation, the 3rd largest US home builder in 2011, reported that net home orders in the quarter ended May 31, 2012 totaled 4,481, up 39.9% from the comparable quarter of last year. The company’s sales cancellation rate, expressed as a % of gross orders, was 16% last quarter, down from 17% a year ago. Home deliveries last quarter totaled 3,222, up 20.1% from the comparable quarter last year. Lennar’s order backlog at the end of May was 3,970, up 60.7% from last May.CR Note: It helps to watch the builders. In early May, Tom Lawler sent me a chart on homebuilder sales, and Tom argued we'd see upward revisions to new home sales:

As with most other builders, Lennar reported that “pricing trends” were positive in “most” markets last quarter. Here are some comments by CEO Stuart Miller in the press release.

"Evidence from the field suggests that the 'for sale' housing market has, in fact, bottomed and that we have commenced a slow and steady recovery process. And while the housing downturn was broad-based and national, the recovery process continues to be very localized. Although highly conservative mortgage lending practices and challenging appraisals remain a constant headwind, we are experiencing net positive price and volume trends in most of our markets."

Mr. Miller continued, "As the overall housing market has continued to improve over the last several quarters, our well located communities and product execution has allowed us to outperform the market. During the quarter, deliveries increased 20%, new orders increased 40%, backlog increased 61% and our operating margin increased over 100% to 9.2%, our highest margin percentage since Q2 2006. This operating leverage was driven by our ability to increase sales per community, raise prices and lower incentives, and control our overhead costs."

Lennar’s results easily beat “consensus.”

"[R]ight now I estimate that revisions will lift Census’s estimates of new SF home sales last quarter from an average seasonally adjusted annual rate of 337,000 to a SAAR of 350,000."Sure enough, the Commerce Department has revised up Q1 new home sales to an average of just over 350,000.

Tom adds another key point today:

While the new home sales report exceeded “consensus,” recent numbers might even have been stronger if builders on average had higher inventories for sale. After being burned several times with some “false” signs of recovery, most builders have been pretty conservative in both “spec” building and community-count growth.

Merle Hazard: "Fiscal Cliff"

by Calculated Risk on 6/27/2012 01:40:00 PM

A new song from Merle Hazard called the "Fiscal Cliff"

This was debuted on PBS Making Sen$e this morning, see: A Q-and-A, Plus a Ditty and Contest as U.S. Races Toward the 'Fiscal Cliff'

They are having a contest for a new song. From Merle:

Though I'm a country singer, I also love surf-style music. The only thing wrong with the genre is that these songs are always -- of course -- about surfing, as well as teenage romance and drag races. There should be more on macro-economic topics and political economy. So I'd like to do another one like 'Fiscal Cliff,' but I'm out of ideas. I'm hoping NewsHour audience might help. I have in mind a song contest. Submit a topic, a key phrase, or a whole lyric. Whatever you like.

Housing: Inventory and Negative Equity

by Calculated Risk on 6/27/2012 11:57:00 AM

In the Pending Home Sales report this morning, the NAR analysts noted:

Low inventory results partly from underwater homeowners who are unwilling to list their homes, which would require a lengthy short sale process, or additional cash to complete the transaction. NAR estimates 85 percent of homeowners have positive equity, with 15 percent in an underwater situation.Zillow chief economist Stan Humphries has been discussing this: The Connection Between Negative Equity, Inventory Shortage and Increasing Home Values: Why the Bottom Won’t Be as Boring as We Expected

What markets like Miami and Phoenix may now be showing us is that negative equity has another very powerful effect on the supply side beyond increasing the flow of foreclosed homes onto the market: all the households that we predicted would be trapped in their homes and unable to buy new ones are similarly unable to sell their current homes, severely decreasing the overall supply of homes on the market.CR comment: Negative equity is probably contributing to the lower levels of inventory, but I think there are other factors too.

...

And negative equity may well be so constraining the supply side of the housing market that it’s creating acute inventory shortages that are bidding up prices.

...

What does all of this imply for the housing bottom? Our emerging hypothesis is that, instead of a long, flat bottom with price appreciation constrained by weak demand and elevated foreclosures, we might end up in an environment in which constrained supply (due to negative equity), together with robust demand from investors and first-time home buyers (not weighed down by negative equity), combine to create cycles of home value spikes followed by cooling periods. These cooling periods are created once local home values have risen enough to free some homeowners from negative equity at which point some of these resurfacing homeowners attempt to sell their homes, thus creating additional supply which tempers price appreciation.

One key is the substantial increase in investor owned single family homes. These are not "flippers", but cash flow investors - and these investors will not sell just because prices have risen a few percent (I've talked with some of these investors, and they many are making 8% to 12% cash-on-cash after expenses - and they have no intention of selling in the near term). Economist Tom Lawler discussed this back in February, and concluded that a significant "share of the decline in the share of homes for sale reflects the acquisition of SF (and condo) properties by investors as multi-year rental properties".

Another key driver of lower inventory is price expectations. As I noted: "When the expectation is that prices will fall further, marginal sellers will try to sell their homes immediately. And marginal buyers will decide to wait for a lower price. This leads to more inventory on the market. But when the expectation is that prices are stabilizing (the current situation), sellers will wait until it is convenient to sell."

So there are several factors pushing down inventory - and it looks like inventory was flat or declined in June too. The recent NAR report was for May; below are some numbers for June, and it is possible inventory has already peaked for the year.

According to the deptofnumbers.com for (54 metro areas), inventory is off 22.0% compared to June 2011. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

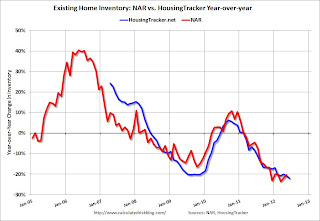

This graph shows the NAR estimate of existing home inventory through May (left axis) and the HousingTracker data for the 54 metro areas through June.

Click on graph for larger image.

Click on graph for larger image.Since the NAR released their revisions for sales and inventory, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then starts to increase again through the summer. So inventory still might increase a little over the next couple of months, but the forecasts for a "surge" in inventory this summer were clearly incorrect. It is even possible that inventory has already peaked for the year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the June listings, for the 54 metro areas, declined 22.0% from the same month last year. So far in 2012, there has only been a small seasonal increase in inventory.

HousingTracker reported that the June listings, for the 54 metro areas, declined 22.0% from the same month last year. So far in 2012, there has only been a small seasonal increase in inventory.Whatever the reasons - negative equity, investor owned properties, "price expectations", or other reasons - this decline in active inventory remains a significant story.

NAR: Pending home sales index increased 5.9% in May

by Calculated Risk on 6/27/2012 10:04:00 AM

From the NAR: Pending Home Sales Up in May, Continue Pattern of Strong Annual Gains

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 5.9 percent to 101.1 in May from 95.5 in April and is 13.3 percent above May 2011 when it was 89.2. The data reflect contracts but not closings.This was above the consensus of a 1.2% increase for this index.

The index also reached 101.1 in March, which is the highest level since April 2010 when buyers were rushing to beat the deadline for the home buyer tax credit.

The PHSI in the Northeast increased 4.8 percent to 82.9 in May and is 19.8 percent above May 2011. In the Midwest the index rose 6.3 percent to 98.9 in May and is 22.1 percent higher than a year ago. Pending home sales in the South increased 1.1 percent to an index of 106.9 in May and are 11.9 percent above May 2011. In the West the index jumped 14.5 percent in May to 108.7 and is 4.8 percent stronger than a year ago.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in June and July.