by Calculated Risk on 5/25/2012 02:35:00 PM

Friday, May 25, 2012

More Pain in Spain

From the NY Times: Spanish Lender Seeks 19 Billion Euros; Ratings Cut on 5 Banks

Standard & Poor’s slashed its ratings on the creditworthiness of five Spanish banks on Friday, just as one of them — Bankia, the nation’s largest real estate lender — requested an additional 19 billion euros in rescue funds from the country, far beyond initial government estimates.From the Financial Times: Spain to inject up to €19bn into Bankia

Madrid’s biggest bank nationalisation will take the total amount of state aid pumped into Bankia to €23.5bn, and will give the government as much as 90 per cent control of Spain’s second largest bank by domestic deposits. ...The Spanish 10 year bond yield is up to 6.31%.

Artur Mas, president of Catalonia, [said] the region was running out of options to refinance its debts, and wanted assistance from Madrid.

Zillow's forecast for Case-Shiller House Price index in March, Zillow index shows prices increased in April

by Calculated Risk on 5/25/2012 11:45:00 AM

Note: The Case-Shiller report is for March (really an average of prices in January, February and March). This data is released with a significant lag, see: House Prices and Lagged Data

Zillow Forecast: Zillow Forecast: March Case-Shiller Composite-20 Expected to Show 2.6% Decline from One Year Ago

On Tuesday, May 29th, the Case-Shiller Composite Home Price Indices for March will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will decline by 2.6 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will decline by 2.7 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from February to March will be 0.3 percent for both the 20 and 10-City Composite Home Price Index (SA).Zillow's forecasts for Case-Shiller have been pretty close, and I expect Case-Shiller will report NSA house prices at a new post-bubble low in March.

...

This will be the second month in a row where both of the Case-Shiller composite indices show monthly appreciation on a seasonally adjusted basis. However prices are still down from year ago levels. Most likely, there will be some see-sawing in home prices along the bottom before we start to see a more sustained recovery.

One of the keys this year will be to watch the year-over-year change in the various house price indexes. The composite 10 and 20 indexes declined 3.6% and 3.5% respectively in February, after declining 4.1% and 3.9% in January. Zillow is forecasting a smaller year-over-year decline in March, and for the seasonally adjusted indexes to increase for the 2nd consecutive month.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | March 2011 | 150.91 | 153.99 | 137.64 | 140.47 |

| Case-Shiller (last month) | February 2012 | 146.90 | 149.36 | 134.20 | 136.71 |

| Zillow March Forecast | YoY | -2.7% | -2.7% | -2.6% | -2.6% |

| MoM | -0.1% | 0.3% | -0.1% | 0.3% | |

| Zillow Forecasts1 | 146.8 | 149.8 | 134.1 | 136.9 | |

| Current Post Bubble Low | 146.90 | 149.25 | 134.20 | 136.50 | |

| Date of Post Bubble Low | February 2012 | January 2012 | February 2012 | January 2012 | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Also from Zillow: Home Values Continue to Climb in April (released a month ahead of Case-Shiller)

Zillow’s April Real Estate Market Report, released today, shows that home values increased 0.7 percent to $147,300 from March to April. Compared to April 2011, home values are still down by 1.8 percent. This strong monthly appreciation follows March’s encouraging data point, which also had home values appreciating at a healthy clip.

Consumer Sentiment increases in May to 79.3

by Calculated Risk on 5/25/2012 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for May increased to 79.3, up from the preliminary reading 77.8, and up from the April reading of 76.4.

This was above the consensus forecast of 77.8 and the highest level since October 2007 - before the recession started. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and the sluggish economy - but falling gasoline prices probably helped in May.

Tim Duy: "Is QE3 Just Around the Corner?"

by Calculated Risk on 5/25/2012 08:45:00 AM

From Tim Duy at Economist's View Fed Watch: Is QE3 Just Around the Corner?

[T]oday's comments from New York Federal Reserve President William Dudley [are interesting]. From the Wall Street Journal:CR Note: The Fed's program to extend the average maturity of its holdings (aka "Operation Twist") ends in June, and the Fed might consider QE3 some time after that program ends. But as Tim Duy notes - based on Dudley's comments and unless Europe implodes after the Greek election - it is too soon to be looking for QE3 right now.

Expectations for U.S. economic growth, while “pretty disappointing” at around 2.4%, is sufficient to keep the central bank from easing monetary policy, Federal Reserve Bank of New York President William Dudley said.Dudley is considered part of the inner circle; if he doesn't think the Fed needs to do something more, the baseline scenario should be that QE3 is not on the table.

“My view is that, if we continue to see improvement in the economy, in terms of using up the slack in available resources, then I think it’s hard to argue that we absolutely must do something more in terms of the monetary policy front,” Dudley said in an interview with CNBC, aired Thursday.

At least for the moment. Simply put, I think market participants are getting ahead of the Fed. My suspicion is that the Fed will need to see a weaker data flow in the months ahead to justify getting back into the game. ...

...

Overall, it seems unlikely that the data flow as a whole will turn fast enough to prompt the Fed into easing next month. Only the next employment report stands out as a potential deal breaker. In general, though, I would think you need at a minimum the Q2 GDP report to justify additional easing - which pushes us out to the July/August meeting at least.

So if we take the US data off the table, then we are looking for financial disruption, which is obviously a possibility given the current unpleasantness in Europe. Indeed, we should not be surprised if the Fed needs to further improve dollar liquidity abroad (an action that is sure to be taken as a sign that QE3 is imminent; expect Fed speakers to deny a policy shift is afoot). And note that the next FOMC meeting is just 2 days after the June 17 Greek vote - and that could be the vote heard round the financial world that prompts the Fed to act.

...

[F]inancial conditions will need to deteriorate dramatically to prompt action in June. So if you are looking for the Fed to ease in just four weeks, you are looking for financial markets to turn very, very ugly. Lehman ugly. And I wish that I could say that it won't happen, but European policymakers are hell-bent to push their economies to the wall while worshipping at the alter of moral hazard.

Thursday, May 24, 2012

European Gloom and Look Ahead: Consumer sentiment

by Calculated Risk on 5/24/2012 10:28:00 PM

First a little European gloom ... Note: US markets will be closed on Monday in observance of the Memorial Day, but the European markets will be open.

From the NY Times: European Economic Outlook Dims Amid Leaders’ Impasse

A Markit Economics index that tracks the European services and manufacturing sectors fell in May to 45.9 from 46.7, worse than economists surveyed by Reuters and Bloomberg had expected. An index reading below 50 suggests the economy is contracting. ...And from the NY Times: British Recession Is Worse Than Thought, Data Says

Perhaps even more worryingly, German data released Thursday showed signs of a slowdown in an economy that until now had been a bright spot for the Continent. A Markit index based on surveys of purchasing managers of German manufacturing companies fell to 45.0 in May from 46.2 in April.

A separate report from the Ifo Institute, based on surveys of German companies, showed “greater pessimism about their business outlook,” and noted that the “recent surge in uncertainty in the euro zone is impacting the German economy.”

The Office for National Statistics revised the decline in gross domestic product in the first three months of this year to 0.3 percent, from the 0.2 percent it estimated last month, because of a deeper slump in the construction industry. Construction output dropped 4.8 percent from a year earlier, the agency said, not 3 percent, as it had estimated earlier.

The revised figures were “bad news for U.K. policy makers as it shows the economy faring even more badly than initially thought,” said Scott Corfe, senior economist at the Center for Economics and Business Research in London. “Indeed, the latest data show the U.K. economy performing worse than the euro zone economy, which saw zero growth at the start of the year — meaning the U.K.’s woes cannot even be fully attributable to the debt crisis embroiling the Continent.”

• Friday at 9:55 AM ET the final May Reuter's/University of Michigan's Consumer sentiment index will be released. The consensus is for no change from the preliminary reading of 77.8. The recent decline in gasoline prices might boost sentiment, although that might be offset by weaker job growth and European concerns. From MarketWatch: Gasoline prices add to the holiday cheer

The average price for a gallon of regular gas has fallen each day since May 16 and stood at $3.676 on Thursday, according to AAA data. That is down 17 cents from a month ago.

Record Low Mortgage Rates and Refinance Activity

by Calculated Risk on 5/24/2012 08:37:00 PM

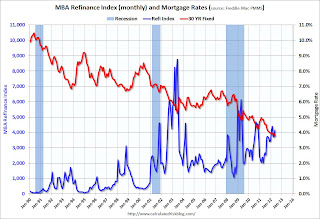

Below is a graph comparing mortgage rates from the Freddie Mac Primary Mortgage Market Survey® (PMMS®) and the refinance index from the Mortgage Bankers Association (MBA).

Freddie Mac reported earlier today that 30 year mortgage rates had fallen to a record 3.78% in the PMMS®.

And the MBA reported yesterday that refinance activity has been increasing again.

Earlier from Freddie Mac: Historic Lows for Fixed Mortgage Rates Hold Steady

30-year fixed-rate mortgage (FRM) averaged 3.78 percent with an average 0.8 point for the week ending May 24, 2012, down from last week when it averaged 3.79 percent. Last year at this time, the 30-year FRM averaged 4.60 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently at the record low for the last 40 years.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates are getting close! The 30 year conforming mortgage rates were at 4.23% in October 2010, so a 50 bps drop would be 3.73% - just below the current rate.

There has also been an increase in refinance activity from borrowers with negative equity and loans owned or guaranteed by Fannie or Freddie. As the MBA noted, the HARP share of refinance applications was 28 percent last week.

Lawler: Post-Census Study of Census 2010

by Calculated Risk on 5/24/2012 04:39:00 PM

From economist Tom Lawler:

Post-Census Study of Census 2010: Population, Household Count Extremely Close; Vacant Housing Unit Count Too Low

Census yesterday released some of the results from its “Census Coverage Measurement” (CCM) program for Census 2010, which is a post-enumeration exercise to assess the “accuracy” of the decennial Census numbers. While there’s a lot of “stuff” in the two CCM memoranda released yesterday, here are a couple of “highlights.”

1. The CCM (similar to the 2000 A.C.E. Revision II and the 1990 P.E.S) for the US household population (excluding remote Alaska areas) suggests that the 2010 Census had a de minimus net “over-count” of just 36,000, or 0.01%. Studies mentioned above suggested that Census 2000 had a net over-count of 0.49%, and Census 1990 had a net under-count of 1.61%. While net over/under-counts for specific race/ethnic groups or age groups were in many cases “significantly different from zero,” on balance Census 2010 seems to have been the “best” ever. (see http://2010.census.gov/news/pdf/g-01.pdf)

2. The CCM designed to provide estimates of housing unit net coverage suggest that Census 2010 under-counted the number of US housing units by 0.60%, similar to Census 2000’s estimated 0.61% under-count. The 2010 estimated under-count for occupied units was an insignificant 0.03%, below Census 2000’s 0.33%, while the estimated under-count for vacant units was 4.80%, higher than Census 2000’s 3.37%.

As with other post-Census studies, the CCM for 2010 shows “Census 2010” numbers that don’t quite jive with the previously-released Census 2010 number for total, occupied, and vacant units, which I think is because they reported Census 2010 results adjusted for “reinstated units.” (don’t ask!). However, as best as I can tell here is a table showing “official” Census housing units counts and “post-Census-study” estimates of housing units counts for Census 2010 and Census 2000.

| "Official" Census Housing Unit Counts (000's) | |||

|---|---|---|---|

| 2010 | 2000 | Change | |

| Total | 131,705 | 115,905 | 15,800 |

| Occupied | 116,716 | 105,480 | 11,236 |

| Vacant | 14,988 | 10,425 | 4,563 |

| Gross Vacancy Rate | 11.38% | 8.99% | 2.39% |

| "Adjusted" Census Housing Unit Counts (000's) | |||

| 2010 | 2000 | Change | |

| Total | 132,466 | 116,586 | 15,880 |

| Occupied | 116,735 | 105,809 | 10,926 |

| Vacant | 15,732 | 10,778 | 4,954 |

| Gross Vacancy Rate | 11.88% | 9.24% | 2.63% |

Based on the CCM results, Census 2010 understated the gross vacancy rate by about 0.5 percentage points. The CCM’s gross vacancy rate was higher than the Census 2010 GVR in all states save Alaska.

The CCM results also suggest that the US homeownership rate on April 1, 2010 was 65.2%, just a tad above the “official” estimate of 65.1%.

There’s a lot more in the report, available at http://2010.census.gov/news/pdf/g-05.pdf.

There are a couple of things worth noting. First, the higher estimate for 2010 housing units, combined with the 2000 HUCS results, suggest that the US housing stock from 4/1/2000 to 4/1/2010 increased by 15.880 million units. Other Census estimates (from surveys) suggest that housing completions plus manufactured housing put in place from April 2000 to March 2010 totaled about 16.734 million. That implies that the net loss in the housing stock to demolition, net conversions, and “other stuff” over that 10-year period by just 854,000, or 85,400 a year – an incredibly low number. I hope someone at Census plans to look at that.

Second, of course, the CCM suggests that official Census 2010 results understated gross vacancy rates, which suggests that estimates of the “excess” supply of housing on April 1, 2010 based on decennial Census results are “too low” – though, of course, adjusted estimates are still way below estimates using the obviously biased CPS/HVS data.

| Adjusted Decennial Census Measures | |||

|---|---|---|---|

| 1990 | 2000 | 2010 | |

| Gross Vacancy Rate | 10.50% | 9.20% | 11.90% |

| Homeownership Rate | 64.20% | 66.10% | 65.20% |

| CPS/HVS Measures (first half average) | |||

| 1990 | 2000 | 2010 | |

| Gross Vacancy Rate | 11.40% | 11.70% | 14.50% |

| Homeownership Rate | 63.90% | 67.20% | 67.00% |

CR Note: The calculated number of demolitions per year seems very low. As Lawler notes, I hope someone at the Census Bureau is looking into this. Also - this review suggests that estimates of excess vacant housing units as of April 1, 2010 were low.

Misc: Kansas City Fed manufacturing index "Rebounds", "Flash PMI" shows slower expansion, Mortgage Rates at record low

by Calculated Risk on 5/24/2012 12:32:00 PM

• From the Kansas City Fed: Growth in Tenth District Manufacturing Eased Further but Activity Remained Expansionary

Growth in Tenth District manufacturing activity rebounded in May, and producers were more optimistic than in previous months. The majority of producers reported stable or increasing capital spending plans in the next six to twelve months, with very few anticipating a decrease. Most price indexes moderated, although more producers than in April plan to raise selling prices in future months.The regional manufacturing surveys have been mixed in May. The NY (Empire State) and Kansas City Fed surveys showed faster expansion, but the Richmond Fed showed slower expansion. And the Philly Fed survey showed contraction.

The month-over-month composite index was 9 in May, up from 3 in April and equal to 9 in March ... In contrast, the employment index eased slightly from 12 to 8.

• Also for manufacturing, the new Markit Flash PMI showed slower expansion. From Markit: PMI falls to three-month low, signalling slower rate of manufacturing expansion

The May Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) indicated a solid improvement in U.S. manufacturing sector business conditions, according to the preliminary ‘flash’ reading which is based on around 85% of usual monthly replies. However, with the seasonally adjusted PMI falling from 56.0 in April to 53.9, the headline PMI nonetheless signalled the weakest expansion in three months.This is the first release of the Flash PMI, and it has no track record of predicting the ISM number (the May report will be released June 1st).

• From Freddie Mac: Historic Lows for Fixed Mortgage Rates Hold Steady

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the record lows for average fixed mortgage rates holding steady for the week. The 30-year fixed-rate mortgage ticked slightly down to 3.78 percent and 15-year fixed-rate mortgages remained unchanged from last week at 3.04 percent.

30-year fixed-rate mortgage (FRM) averaged 3.78 percent with an average 0.8 point for the week ending May 24, 2012, down from last week when it averaged 3.79 percent. Last year at this time, the 30-year FRM averaged 4.60 percent.

FDIC-insured institutions’ 1-4 Family Real Estate Owned (REO) decreased in Q1

by Calculated Risk on 5/24/2012 10:45:00 AM

The FDIC released the Quarterly Banking Profile today for Q1 2012.

Here is the press released from the FDIC: FDIC - Insured Institutions Earned $35.3 Billion in the First Quarter of 2012

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported an aggregate profit of $35.3 billion in the first quarter of 2012, a $6.6 billion improvement from the $28.8 billion in net income the industry reported in the first quarter of 2011. This is the 11th consecutive quarter that earnings have registered a year-over-year increase. However, loan balances declined by $56.3 billion (0.8 percent) after three consecutive quarterly increases.On 1-4 family Real Estate Owned (REO), the report showed that REO by FDIC insured institutions declined to $11.08 billion in Q1, from $11.64 billion in Q4 2011. FDIC insured institutions REO peaked at $14.8 billion in Q3 2010.

FDIC Acting Chairman Martin J. Gruenberg said, "The condition of the industry continues to gradually improve. Insured institutions have made steady progress in shedding bad loans, bolstering net worth, and increasing profitability." He also noted, "The overall decline in loan balances is disappointing after we saw three quarters of growth last year. But we should be cautious in drawing conclusions from just one quarter."

...

The number of "problem" institutions fell for the fourth quarter in a row. The number of "problem" institutions declined from 813 to 772. This is the smallest number of "problem" banks since year-end 2009. Total assets of "problem" institutions declined from $319 billion to $292 billion. Sixteen insured institutions failed during the first quarter. This is the smallest number of failures in a quarter since the fourth quarter of 2008, when there were 12.

The Deposit Insurance Fund (DIF) balance continued to increase. The DIF balance — the net worth of the fund — rose to $15.3 billion at March 31 from $11.8 billion at the end of 2011. Assessment revenue and fewer bank failures continued to drive growth in the fund balance.

Unfortunately the FDIC does not collect data on the number of properties held by FDIC-insured institutions, instead they aggregate the carrying value of 1-4 family residential REO on FDIC-insured institutions’ balance sheets.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003.

Note: FDIC insured institutions have other REO and this is just the 1-4 family residential REO (other REO includes Construction & Development, Multi-family, Commercial, Farm Land).

Of course this is just a small portion of the total 1-4 family REO. The FHA, Fannie and Freddie have already reported that REO declined in Q1. I'll have more on REO soon.

Weekly Initial Unemployment Claims essentially unchanged at 370,000

by Calculated Risk on 5/24/2012 08:30:00 AM

The DOL reports:

In the week ending May 19, the advance figure for seasonally adjusted initial claims was 370,000, a decrease of 2,000 from the previous week's revised figure of 372,000. The 4-week moving average was 370,000, a decrease of 5,500 from the previous week's revised average of 375,500.The previous week was revised up from 370,000 to 372,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 370,000.

The 4-week average has declined for three consecutive weeks. The average has been between 363,000 and 384,000 all year.

And here is a long term graph of weekly claims:

This was close the consensus forecast of 371,000.