by Calculated Risk on 3/29/2012 09:20:00 PM

Thursday, March 29, 2012

Los Angeles Mayor to "lay off a large number of employees"

Just a reminder that the state and local layoffs haven't ended ...

From the LA Daily News: L.A. Mayor Antonio Villaraigosa calls for layoffs of city workers

"We're going to lay off a large number of employees. I'm not going to say how many," [Mayor Antonio Villaraigosa] said ... today.According to the BLS, state and local governments have reduced payrolls by about 650 thousand over the last four years. The pace of layoffs has slowed recently, but there are still more to come.

...

City Administrative Officer Miguel Santana said this week the city's budget deficit for the next fiscal year is close to $220 million.

...

The mayor said he will push to raise the retirement age for city workers to 67, vowing to put it before voters if not approved by the City Council.

Q4 GDP and GDI

by Calculated Risk on 3/29/2012 07:19:00 PM

Early this morning the BEA released the third estimate of Q4 GDP. The BEA reported that Real gross domestic product "increased at an annual rate of 3.0 percent in the fourth quarter of 2011", the same as the previous estimate.

Also in the release, the BEA reported the real gross domestic income (GDI) increased at a 4.4% annualized rate in Q4.

There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). A research paper in 2010 suggested that GDI is often more accurate than GDP. For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity. An excerpt:

The U.S. produces two conceptually identical official measures of its economic output, currently called Gross Domestic Product (GDP) and Gross Domestic Income (GDI). These two measures have shown markedly different business cycle fluctuations over the past twenty five years, with GDI showing a more-pronounced cycle than GDP. These differences have become particularly glaring over the latest cyclical downturn, which appears considerably worse along several dimensions when looking at GDI. ...During the worst period of the recession, GDI fell more than GDP as Nalewaik noted. In subsequent revisions, GDP was revised down showing the economy contracted more than originally reported - and closer to the original GDI reports.

In discussing the information content of these two sets of estimates, the confusion often starts with the nomenclature. GDP can mean either the true output variable of interest, or an estimate of that output variable based on the expenditure approach. Since these are two very different things, using “GDP” for both is confusing. Furthermore, since GDI has a different name than GDP, it may not be initially clear that GDI measures the same concept as GDP, using the equally valid income approach.

The opposite has happened over the last two quarters - GDI is showing stronger growth than GDP - and this suggests that 2nd half 2011 GDP might be revised up with the next annual revision that will be released on July 27th (Revised Estimates will be provided for years 2009 through 2011).

David Wessell wrote about this at the WSJ Real Time Economics this morning GDI: An Alternate Measure Showing Stronger U.S. Growth

With its third revision of fourth-quarter GDP, issued Thursday, the agency also released its GDI estimates. Here’s what they show:Of course this is all history and the focus will be on Q1.

GDP Q4 up 3.0% GDI Q4 up 4.4%

GDP Q3 up 1.8% GDI Q3 up 2.6%

FULL YEAR 2011 GDP: up 1.7% FULL YEAR 2011 GDI: up 2.1%

As our colleague Jon Hilsenrath notes: “The clues in these numbers are especially important now because of the Okun’s Law conundrum: The economy doesn’t seem to be growing fast enough to account for the recent sharp declines in the unemployment rate. It might be the case that GDP numbers are understating growth.” (Read more about the disconnect between growth and labor-market improvement.)

Reacting to the latest numbers (on Twitter), economist Justin Wolfers of the University of Pennsylvania said: “GDI growth was fast enough to explain rapid jobs growth. Historically, GDP revises toward GDI.”

Note: Personal income and outlays for February will be released tomorrow.

Bernanke: "The Federal Reserve and the Financial Crisis" Part 4

by Calculated Risk on 3/29/2012 04:12:00 PM

This is part 4 of 4 of a lecture series on the Federal Reserve.

From the WSJ: Fed Chief Bernanke Defends Bond Buys

In the period after World War II, "many central banks began to view financial stability as kind of a junior partner to monetary policy—it was not as important," Mr. Bernanke said. "It's now clear that maintaining financial stability is just as important a responsibility as monetary and economic stability, and indeed this is very much a return to where the Fed came from in the beginning."My comment: One of the key reason for the financial crisis was the lack of proper oversight during the bubble. Usually I'm pretty optimistic, but as time passes, and memories fade, the oversight will probably be ignored again.

Here is a link to the lecture series including links to videos.

Here are the slides for the lectures:

Lecture 1: Origins and Mission of the Federal Reserve

Lecture 2: The Federal Reserve after World War II

Lecture 3: The Federal Reserve’s Response to the Financial Crisis

Lecture 4: The Aftermath of the Crisis

CoreLogic: Almost 65,000 completed foreclosures in February 2012

by Calculated Risk on 3/29/2012 01:03:00 PM

From CoreLogic: CoreLogic® Reports Almost 65,000 Completed Foreclosures Nationally in February

CoreLogic ... today released its National Foreclosure Report for January, which provides monthly data on completed foreclosures, foreclosure inventory and 90+ delinquency rates. There were approximately 65,000 completed foreclosures in February 2012, compared to 66,000 in February 2011, and 71,000 in January 2012. The number of completed foreclosures for the 12 months ending in February was 862,000. From the start of the financial crisis in September 2008, there have been approximately 3.4 million completed foreclosures.This is a new monthly report and will help track the number of completed foreclosures, and to see if the lenders are starting to clear the foreclosure inventory backlog following the mortgage settlement.

Approximately 1.4 million homes, or 3.4 percent of all homes with a mortgage, were in the foreclosure inventory as of February 2012 compared to 1.5 million, or 3.6 percent, in February 2011 and 1.4 million, or 3.4 percent, in January 2012. Nationally, the number of borrowers in the foreclosure inventory decreased by 115,000, a decline of 7.6 percent, in February 2012 compared to February 2011.

"The pace of completed foreclosures is down slightly compared to January, running at an annualized pace of 670,000, but compares favorably to the pace of completed foreclosures in February a year ago. Even though the pace of completed foreclosures has slowed, the overall foreclosure inventory is decreasing because REO sales were up in February,” said Mark Fleming, chief economist for CoreLogic. “With the spring buying season upon us, the inventory may decline further as the pace of distressed-asset sales rises along with the rest of the housing market.”

Notes: The sequence is 1) a loan goes delinquent, 2) if it doesn't cure, after several months, the foreclosure process begins (this is called the "foreclosure inventory"), 3) then the foreclosure is completed and becomes REO (lender Real Estate Owned), and then 4) the REO is sold. Sometimes, during this process, the loan will cure or a short sale approved, so not all loans in the foreclosure inventory are future "completed foreclosures".

When CoreLogic reports "completed foreclosures", they are discussing the number of homes moving from the foreclosure process to REO.

Another vendor, LPS, reported 91,086 completed foreclosures in January (significantly above the revised 71,000 reported by CoreLogic). I've heard that the LPS February numbers will probably be higher than CoreLogic too (LPS will release next week).

Kansas City Fed: Growth in Manufacturing Activity Moderated Slightly in March

by Calculated Risk on 3/29/2012 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Moderated Slightly but Remained Solid Overall

Growth in Tenth District manufacturing activity moderated slightly but remained generally solid overall, with a continued positive outlook for future months. ... The month-over-month composite index was 9 in March, down from 13 in February but up from 7 in January ...The index for number of employees increased from 11 to 12, and the average workweek index increase to +2 from -3 in February.

The production index dropped from 20 to 13, and the order backlog index also fell after rising last month. In contrast, the shipments and new order indexes both increased from 8 to 17, and employment index also edged higher.

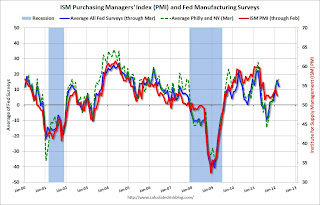

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

The ISM index for March will be released Monday April 2nd, and these surveys suggest some increase from the 52.4 reading in February.

Weekly Initial Unemployment Claims decline to 359,000

by Calculated Risk on 3/29/2012 08:30:00 AM

The DOL reports:

In the week ending March 24, the advance figure for seasonally adjusted initial claims was 359,000, a decrease of 5,000 from the previous week's revised figure of 364,000. The 4-week moving average was 365,000, a decrease of 3,500 from the previous week's revised average of 368,500.Note: "This week's release reflects the annual revision to the weekly unemployment claims seasonal adjustment factors. The seasonal adjustment factors used for the UI Weekly Claims data from 2007 forward, along with the resulting seasonally adjusted values for initial claims and continuing claims, have been revised."

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 365,000 (after annual revisions).

The 4-week moving average is at the lowest level since early 2008 (including revisions).

And here is a long term graph of weekly claims:

The ongoing decline in initial weekly claims is good news. After the revisions, this is the lowest level for claims since early 2008 and the trend is down.

Wednesday, March 28, 2012

Update: Gasoline Prices

by Calculated Risk on 3/28/2012 08:14:00 PM

From the WSJ: Iran Oil Flow Slows, and Price Fears Rise

By the end of March, with three months until a European Union embargo on Iranian oil takes effect, Iran's exports are expected to fall by about 300,000 barrels a day from last month, to 1.9 million barrels daily, a nearly 14% drop ...From Jim Hamilton at Econbrowser: A rational reason for high oil prices

Mounting fears of Iranian disruptions have sent the price U.S. motorists pay at gasoline pumps closer to $4 a gallon.

From the WaPo: Gas prices in D.C. surpass $4 a gallon

Two months before the summer driving season officially starts, average gas prices in the Washington region have hit $4, the earliest they have ever reached that milestone ... According to AAA’s national survey of gas prices, a gallon of regular-grade fuel is now averaging $4.15 in the District. ... The national average is $3.91, compared to about $3.70 last month and just below $3.59 this time last year.Hey - I wish gasoline was back to only $4 per gallon in California!

Note: The graph shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

JPMorgan CEO on Housing

by Calculated Risk on 3/28/2012 05:05:00 PM

From Margo Beller at CNBC: Improving Housing Market Driving Economy: Jamie Dimon

"I believe we’re very close to the inflection point. People look at prices that are still coming down but all the other signs are flashing green," [CEO Jamie Dimon] said during a job fair in New York for hiring veterans.The comment on inventory declining in half is a bit of an exaggeration - actually listed inventory peaked at just over 4 million in July 2007, and is down about 40% - and inventory will increase seasonally over the next 6 months.

... "the shadow inventory everyone talks about is lower today than it was 12 months ago. It will be a lot lower 12 months from now," he said.

Distressed inventory "is actually coming down, not going up. Homes for sale are about half what they were four years ago. You could come up with a pretty bullish case. If the economy grows, housing gets better, quicker."

However I agree with Dimon on his key points. The first "bottom" for housing (new home sales, housing starts and residential investment) has already happened, and the second bottom (for prices) is close to an "inflection point".

See my posts from early February: The Housing Bottom is Here and Housing: The Two Bottoms

The long term impact of unemployment

by Calculated Risk on 3/28/2012 02:09:00 PM

This is a depressing, but important post from Binyamin Appelbaum at the NY Times Economix: The Enduring Consequences of Unemployment

Our economic malaise has spurred a wave of research about the impact of unemployment on individuals and the broader economy. The findings are disheartening. The consequences are both devastating and enduring.As Appelbaum notes, much of this research was related to earlier recessions and does not address the issue of duration of unemployment.

People who lose jobs, even if they eventually find new ones, suffer lasting damage to their earnings potential, their health and the prospects of their children. And the longer it takes to find a new job, the deeper the damage appears to be.

...

A 2009 study, to cite one recent example, found that workers who lost jobs during the recession of the early 1980s were making 20 percent less than their peers two decades later. The study focused on mass layoffs to limit the possibility that the results reflected the selective firings of inferior workers.

Losing a job also is literally bad for your health. A 2009 study found life expectancy was reduced for Pennsylvania workers who lost jobs during that same period. A worker laid off at age 40 could expect to die at least a year sooner than his peers.

And a particularly depressing paper, published in 2008, reported that children also suffer permanent damage when parents lose jobs.

Here is a repeat of a graph of duration of unemployment based on the most recent employment report:

Click on graph for larger image.

Click on graph for larger image.This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

One of the defining characteristics of the 2007 recession is the large number of workers unemployed for an extended period (the red line on the graph). The consequences of long term unemployment are probably worse than the studies Appelbaum mentioned.

Report: US, UK and France considering releasing Oil

by Calculated Risk on 3/28/2012 10:28:00 AM

The Financial Times is reporting: US, France and UK consider oil release

Asked by reporters ... whether France would join a US-UK move to release strategic stocks, [French energy minister] Eric Besson replied: “It is the US that has asked for it. France is favourable to the suggestion.”The article notes that the head of the IEA has recently said that a release is not warranted because there is no disruption in supply.

The minister added: “We are waiting now for the conclusions of the International Energy Agency”.

excerpt with permission

More from Reuters: France discussing strategic oil release with UK, US

France's Energy Minister Eric Besson told journalists after the weekly ministers' meeting that the United States had asked France to join it in a possible emergency inventory release.According to Bloomberg, Brent Crude futures are at $123.99 per barrel, and West Texas Intermediate (WTI) is at $105.37 per barrel.

Such a release could happen "in a matter of weeks", Le Monde daily said on Wednesday, citing presidential sources.