by Calculated Risk on 3/28/2012 08:38:00 AM

Wednesday, March 28, 2012

MBA: Refinance Applications Drop for Sixth Consecutive Week

From the MBA: Refinance Applications Drop for Sixth Consecutive Week

Mortgage applications decreased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending March 23, 2012. ...Now that the automated systems are available, we will probably see an increase in HARP refinance activity going forward.

The Refinance Index decreased 4.6 percent from the previous week. The Refinance Index has decreased for six consecutive weeks, falling to its lowest level since December, and is 24.2 percent lower than its 2012 peak observed in February. The decline in the Refinance Index this week was driven largely by a 12.0 percent drop in government refinance activity, while conventional refinance applications fell by less, decreasing 3.4 percent from the previous week. The seasonally adjusted Purchase Index increased 3.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.23 percent, the highest rate since November 2011, from 4.19 percent

Tuesday, March 27, 2012

Update: Greek Election in late April or May

by Calculated Risk on 3/27/2012 11:12:00 PM

From the WSJ: Greece's Fringe Parties Surge Amid Bailout Ire

The election, not yet scheduled but expected in April or May, is shaping up as a public revolt against Greece's political establishment, which has backed the austerity policies that are the price of financial life support from Europe and the International Monetary Fund. Mainstream politicians are increasingly painted as leading Greece into a debt trap, then impoverishing it in trying to escape.This sounds like a "just vote no" election.

As a result, Greece's major parties, which have promised Europe they will enact yet another round of deep public-spending cuts by summer, are struggling for support.

Half the electorate plans to vote for radical opposition groups, ranging from Soviet-style Communists to anti-immigrant neo-Nazis ...

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in January

• Real House Prices and Price-to-Rent Ratio decline to late '90s Levels

• All current house price graphs

Housing: Toll Brothers "Orders up significantly", "Best Spring season in five years"

by Calculated Risk on 3/27/2012 07:06:00 PM

From CNBC: 'Best Spring in Five Years' for Housing: Toll CEO

It's been the "best spring in five years," [Toll Brothers CEO Douglas Yearley told CNBC]. In 2012 "our orders are up significantly and continue to be up significantly. I'm optimistic right now."This still hasn't shown up in the Census Bureau new home sales reports - but it will. Lennar reported sales up 33% year-over-year, Hovanian reported sales up 30% - however KB Home reported a decline in sales, though, as Tom Lawler noted today "KB Home’s surprise YOY drop in net orders for the quarter ended February 29th was company specific, and may have been related to its “preferred mortgage lender” issue."

...

"25 percent of our communities have seen a price increase since Jan 1. That’s encouraging. There are places where we don’t have pricing power (but) we’re not dropping prices. We haven’t dropped prices in over a year."

...

Phoenix is hot for housing, having gone from 14 to 16 months of supply down to four or five months. "In the last month, Phoenix is back in a big way," Yearley said.

...

"We're bumping along the bottom in certain locations but we're clearly off the bottom in other locations," Yearley said.

Also the major homebuilders have probably gained share, so the increase will not be as sharp as some builders are reporting - but I expect to see a further increase in sales in the Census Bureau monthly report.

Bernanke Interview on ABC at 6:30 PM

by Calculated Risk on 3/27/2012 06:29:00 PM

From the transcript:

CHAIRMAN BERNANKE: Well, we are in a recovery. The economy's been growing-- for almost three years. And we've had some good news lately. We've-- seen the unemployment rate come down. We've seen more jobs be created. And-- consumer and household-- and business sentiment have all improved, so that's all positive, but--

DIANE SAWYER: Strong?

CHAIRMAN BERNANKE: --we do have a long way to go. I-- I would say that we-- you know, it's-- it's far too early to declare victory. We have-- still 8.3% unemployment, that's-- that's too high. We've got a lot of people been un-- out of work for more than six months.

...

DIANE SAWYER: Another quantitative easing on the table, always possible?

CHAIRMAN BERNANKE: Well, we don't take any options off the table. We don't know what's gonna happen in the future and we have to be prepared to respond to however the economy evolves. But again we have 17 people around the table. We look at the economy-- comprehensively and-- and review it-- at every meeting and we try to assess, you know, how much progress we're making and what else we can do that will help us achieve both the growth we want, the reduction in unemployment we want, but also maintain the price stability, the low inflation which is the other part of our mandate.

...

DIANE SAWYER: I-- I want to just make sure I cover housing. And we're seeing these mixed signals on housing, housing prices still low, but we are seeing some-- up-tick in new house sales and also existing house sales. Have we hit bottom on housing?

CHAIRMAN BERNANKE: Well, housing remains-- a big concern for us. Normally in a recovery you would see housing growing much more quickly, construction-- housing related industries. So far housing is-- kinda still pretty flat. We have seen a few signs-- of-- of progress-- a few extra permits for construction. We see more construction in multi-family-- housing. More people are moving into apartment buildings for example. So there's a bit of-- a bit of a green shoot there if you-- if you will. But-- you know, we're not really yet in a full-fledged housing recovery. And you know, that will be part of-- the full recovery of the economy.

ATA Trucking index Increased 0.5% in February

by Calculated Risk on 3/27/2012 02:58:00 PM

From ATA: ATA Truck Tonnage Increased 0.5% in February

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index rose 0.5% in February after falling 4.6% in January. (January’s decrease was more than the preliminary 4% drop we reported on February 28th.) The latest gain put the SA index at 119.3 (2000=100), up from January’s level of 118.7. Compared with February 2011, the SA index was up 5.5%, better than January’s 3.1% increase.

...

“Fleets told us that February was decent and that played out in the numbers,” ATA Chief Economist Bob Costello said. Costello noted that February’s month-to-month increase was sixth in the last seven months.

“I’m still expecting continued truck tonnage growth going forward. Rising manufacturing activity and temperate consumer spending should be helped a little from an improving housing market,” he said.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and up 5.5% year-over-year. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in January

• Real House Prices and Price-to-Rent Ratio decline to late '90s Levels

• All current house price graphs

Real House Prices and Price-to-Rent Ratio decline to late '90s Levels

by Calculated Risk on 3/27/2012 12:15:00 PM

Another Update: Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1998 and early 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through January) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to January 2003 levels, and the CoreLogic index is back to February 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to February 2000, and the CoreLogic index back to August 1999.

In real terms, all appreciation in the '00s - and more - is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to October 1998 levels, the Composite 20 index is back to February 2000 levels, and the CoreLogic index is back to August 1999.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels, and will all probably be back to late '90s levels within the next few months.

Earlier:

• Case Shiller: House Prices fall to new post-bubble lows in January

Misc: Lennar reports 33% increase in orders, Richmond Fed survey shows slower Expansion, Consumer confidence declines

by Calculated Risk on 3/27/2012 10:27:00 AM

• From Lennar:

"New sales orders in the first quarter were encouraging. We have seen the market stabilize, driven by a combination of low home prices and low interest rates, making the decision to purchase a new home more attractive, compared to the heated rental market. We recorded our strongest first quarter sales since 2008, with new orders increasing 33% year-over-year. We have been able to increase sales prices and have started to reduce sales incentives in some of our communities. We have also seen a noticeable improvement in our sales pace per community, which should lead to a significant increase in the operating leverage of our homebuilding segment in the second half of the year." [said Stuart Miller, Chief Executive Officer of Lennar Corporation]• From the Richmond Fed: Manufacturing Growth Moderates In March; Expectations Remain Positive

In March, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — declined thirteen points to 7 from February's reading of 20. Among the index's components, shipments lost twenty-three points to 2, new orders dropped ten points to finish at 11, and the jobs index moved down seven points to end at 6.This suggests slower growth in March.

• From MarketWatch: March consumer-confidence gauge declines to 70.2

A gauge of U.S. consumer confidence declined in March due to lower employment expectations, while views on the present situation rose to the highest level since 2008, the Conference Board reported Tuesday. The consumer-confidence gauge fell to 70.2 in March from a February reading of 71.6.

Case Shiller: House Prices fall to new post-bubble lows in January

by Calculated Risk on 3/27/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January (a 3 month average of November, December and January).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P:

2012 Home Prices Off to a Rocky Start According to the S&P/Case-Shiller Home Price Indice

Data through January 2012, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices ... showed annual declines of 3.9% and 3.8% for the 10- and 20-City Composites, respectively. Both composites saw price declines of 0.8% in the month of January. Sixteen of 19 MSAs also saw home prices decrease over the month; only Miami, Phoenix and Washington DC home prices went up versus December 2011. (Due to delays in data reporting, the January 2012 index values for Charlotte are not included in this month’s release).

“Despite some positive economic signs, home prices continued to drop. The 10- and 20- City Composites and eight cities – Atlanta, Chicago, Cleveland, Las Vegas, New York, Portland, Seattle and Tampa – made new lows,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Detroit and Phoenix, two cities that have suffered massive price declines, plus Denver, saw increasing prices versus January 2011. The 10-City Composite was down 3.9% and the 20-City was down 3.8% compared to January 2011.

Click on graph for larger image.

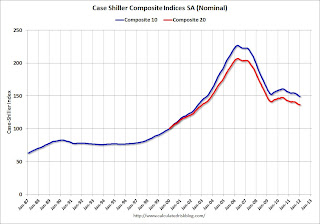

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.2% from the peak, and down 0.1% in January (SA). The Composite 10 is at a new post bubble low (both Seasonally adjusted and Not Seasonally Adjusted).

The Composite 20 index is off 33.9% from the peak, and unchanged in January (SA) from December. The Composite 20 is also at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.8% compared to January 2011.

The Composite 20 SA is down 3.8% compared to January 2011. This was a slightly smaller year-over-year decline for both indexes than in December.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in January seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.8% from the peak, and prices in Dallas only off 8.6% from the peak. There was no data for Charlotte in January.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in January seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.8% from the peak, and prices in Dallas only off 8.6% from the peak. There was no data for Charlotte in January.Both the SA and NSA are at new post-bubble lows - and the NSA indexes will continue to decline for the next couple of months (this report was for the three months ending in January). I'll have more on prices later.

Monday, March 26, 2012

House Prices and Lagged Data

by Calculated Risk on 3/26/2012 10:33:00 PM

All data is lagged, but some data is lagged more than others.

In times of economic stress, I tend to watch the high frequency data closely: initial weekly unemployment claims, monthly manufacturing surveys, and consumer sentiment. The “high frequency” data is lagged, but the lag is usually just a week or two.

Most of the time I focus on the monthly employment report, GDP, housing starts, new home sales and retail sales. The lag for most of this data is several weeks. As an example, the BLS reference period contains the 12th of the month, so the report is lagged a few weeks by the time it is released. The housing starts and new home sales data released last week were for February, so the lag is also a few weeks after the end of the month. The advance estimate of quarterly GDP is released several weeks after the end of the quarter.

But sometimes the lag can be much longer. Tomorrow morning the January Case-Shiller house price index will be released. This is actually a three month average for house sales recorded in November, December and January. (Update: April 24: S&P obtains the data when recorded, but uses closing dates, not recording dates for the price index).

But remember that the purchase agreement for a house that closed in November was probably signed in September or early October. So some portion of the Case-Shiller index will be for contract prices 6 or even 7 months ago!

Other house price indexes do a little better. CoreLogic uses a weighted 3 month average with the most recent month weighted the most – and they will release their February index next week, almost a month ahead of Case-Shiller. The LPS house price index is for just one month (not an average) and uses only closings (not recordings like other indexes that can add an additional lag).

But the key point is that the Case-Shiller index will not catch the inflection point for house prices until well after the event happens. Just something to remember ...

Dallas Fed: Texas Manufacturing Expansion Continues in March

by Calculated Risk on 3/26/2012 06:40:00 PM

This was released earlier today.

From the Dallas Fed: Texas Manufacturing Expansion Continues

Texas factory activity continued to increase in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, held steady at 11.1, suggesting growth continued at about the same pace as last month.The Dallas Fed asked some special questions on hiring plans too. The survey indicated that more firms expect to hire over the next six months as opposed to the previous special survey in January 2011. The reason given for hiring is "Expected growth of sales or revenue is high". More demand.

...

Perceptions of broader economic conditions remained positive in March. The general business activity index was positive for the third month in a row, although it fell from 17.8 to 10.8. Twenty-three percent of firms noted improvement in the level of business activity, while 12 percent noted a worsening. The company outlook index posted a sixth consecutive positive reading, but it also retreated slightly, falling to 9.5 from 15.8 last month.

Labor market indicators reflected higher labor demand. Strong employment growth continued in March, although the index edged down from 25.2 to 21.7. Twenty-nine percent of firms reported hiring new workers, while 7 percent reported layoffs. The hours worked index continued to suggest average workweeks lengthened.