by Calculated Risk on 3/21/2012 08:01:00 AM

Wednesday, March 21, 2012

MBA: Mortgage Refinance activity slows as rates rise, "Sand States" now "HARP states"

From the MBA: Interest Rates Highest Since December, Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 9.3 percent from the previous week. The seasonally adjusted Purchase Index decreased 1.0 percent from one week earlier.The purchase index was only off slightly - and this doesn't include the high percentage of cash buyers.

...

The refinance share of mortgage activity decreased to 73.4 percent of total applications, the lowest since July 2011, from 75.1 percent the previous week.

...

"With the rate increase last week, refinances are obviously slowing, and the refinance share at 73% is down to its lowest level since last July. With rate/term refinances falling as we go forward, HARP will be a bigger percentage of refinances but will be more concentrated in certain states," said Jay Brinkmann, MBA's Senior Vice President of Research and Education. Brinkmann continued, "Some of the largest institutions are reporting that the HARP share of their refinances remained at about 30% last week, but HARP volume is not equal across the country. The states that I started referring to years ago as the sand states that had the worst delinquencies we now should start calling the HARP states for mortgage refinances. We saw big state-level differences in refinance applications for February over January: Florida was up 49%, Arizona was up 61%, and Nevada was up 71%. Refinances in the rest of the country were generally flat or even down. For example, Texas had no change, Colorado was down 3%, Connecticut was up only 2%, and Virginia was up 1%. HARP clearly is a driving force in those states that saw the most defaults and the biggest drops in home equity."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.19 percent from 4.06 percent,with points increasing to 0.47 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Tuesday, March 20, 2012

Greece: Parliament Approves Bailout

by Calculated Risk on 3/20/2012 09:23:00 PM

No surprise ... from the WSJ: Greek Parliament Approves Second Bailout

Greece's Parliament approved a new international bailout deal ... setting the stage for a round of harsh measures that the country's international creditors have set as a precondition for the funds.Next up is an election in late April or early May.

The approval came in the early hours of Wednesday, with 213 lawmakers supporting the loan deal, and with 79 deputies voting against it. Eight didn't cast a vote.

Earlier:

• Housing Starts decline slightly in February

• Starts and Completions: Multi-family and Single Family

Bernanke: "The Federal Reserve and the Financial Crisis" Part 1

by Calculated Risk on 3/20/2012 05:55:00 PM

Update: Here are the slides. Link to lecture series (next is on Thursday)

This is part 1 of 4 of a lecture series on the Federal Reserve. The first lecture (about 1 hour) discusses monetary policy history, the tools and goals of the reserve - and he spent some time on the gold standard.

There should be slides available soon at the Federal Reserve. Joe Weisenthal at Business Insider has some of the slides (and Bernanke's comments on the gold standard).

LPS: 91,086 completed foreclosures in January 2012

by Calculated Risk on 3/20/2012 04:18:00 PM

There has been some discussion on when activity would increase for completed foreclosures. Last month, LPS reported that foreclosure sales increased 29% month-over-month in January.

LPS Applied Analytis was kind enough to provide me their estimates of foreclosure sales, by month, since January 2008.

Note: The sequence is 1) a loan goes delinquent, 2) if it doesn't cure, after several months, the foreclosure process begins (this is called the "foreclosure inventory"), 3) then the foreclosure is completed "foreclosure sale" and becomes REO (lender Real Estate Owned), and then 4) the REO is sold. Sometimes during this process, the loan will cure or a short sale approved, and not all loans in the foreclosure inventory reach "foreclosure sales".

Click on graph for larger image.

Click on graph for larger image.

This graph shows the number of foreclosure sales per month since January 2008 according to LPS Applied Analytics.

There was a significant decline in foreclosure sales in late 2010 due to the foreclosure process issues.

There is plenty of month-to-month variability, but it appears foreclosure sales have picked up again (sales were up 29% compared to December 2011, and up 15% compared to January 2011).

This will be very useful data to track the expected increase in foreclosure activity.

Philly Fed State Coincident Indexes increased in January

by Calculated Risk on 3/20/2012 12:14:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2012. In the past month, the indexes increased in 48 states, decreased in one (Alaska), and remained unchanged in one (Wisconsin) for a one-month diffusion index of 94. Over the past three months, the indexes increased in 48 states, decreased in one, and remained unchanged in one for a three-month diffusion index of 94.

Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In January, 49 states had increasing activity, up from 47 in December. This is the highest level since January 2007.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. Now only Alaska is red, and Wisconsin unchanged. The recovery may be sluggish, but it is widespread geographically.

Earlier:

• Housing Starts decline slightly in February

• Starts and Completions: Multi-family and Single Family

Starts and Completions: Multi-family and Single Family

by Calculated Risk on 3/20/2012 10:37:00 AM

For a couple of years I've been posting a graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

This month (second graph) I've added a graph for single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer.

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing since mid-2010. And completions (red line) are now following starts up.

It is important to emphasize that even with a strong increase in multi-family construction, it is 1) from a very low level, and 2) multi-family is a small part of residential investment (RI).

The blue line is for single family starts and the red line is for single family completions.

The blue line is for single family starts and the red line is for single family completions.

In February, the rolling 12 month total for starts is above completions for the first time since May 2006. This usually only happens at a bottom, although the recovery for single family starts will probably remain sluggish.

Housing Starts decline slightly in February

by Calculated Risk on 3/20/2012 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 698,000. This is 1.1 percent (±15.9%)* below the revised January estimate of 706,000 (revised up from 699,000), but is 34.7 percent(±16.7%) above the February 2011 rate of 518,000.

Single-family housing starts in February were at a rate of 457,000; this is 9.9 percent (±11.4%)* below the revised January figure of 507,000. The February rate for units in buildings with five units or more was 233,000.

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 717,000. This is 5.1 percent (±1.2%) above the revised January rate of 682,000 and is 34.3 percent (±3.1%) above the February 2011 estimate of 534,000.

Single-family authorizations in February were at a rate of 472,000; this is 4.9 percent (±1.2%) above the revised January figure of 450,000. Authorizations of units in buildings with five units or more were at a rate of 219,000 in February.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 698 thousand (SAAR) in February, down 1.1% from the revised January rate of 706 thousand (SAAR). Note that January was revised up from 699 thousand.

Single-family starts declined 9.9% to 457 thousand in February. Permits moved higher, so single family starts will probably increase in March.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after sideways for about two years and a half years. Total starts are up 34.7% from a year ago.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after sideways for about two years and a half years. Total starts are up 34.7% from a year ago.This was slightly below expectations of 700 thousand starts in February.

Monday, March 19, 2012

Market Update: Still a Lost Decade

by Calculated Risk on 3/19/2012 07:01:00 PM

Click on graph for larger image.

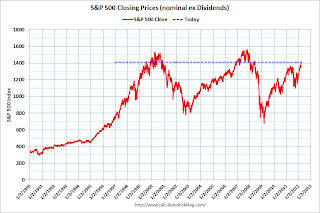

The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in July 1999; almost 13 years ago.

The second graph (click on graph for larger image) from Doug Short shows the sharp increase over the last few months.

Lawler on FHA: Number of Seriously Delinquent SF Loans Down Slightly in February, Way Up from Year Ago

by Calculated Risk on 3/19/2012 03:53:00 PM

Some interesting data from economist Tom Lawler (the FHA remains a significant problem):

Updated data from the FHA’s early warning system shows that the number of FHA-insured SF loans serviced by entities with a combined FHA SF servicing portfolio of almost 7.4 million loans totaled 722,030 at the end of February, down from 732,775 in January. While this report doesn’t always exactly match other FHA reports, it tracks the “official” numbers pretty closely. Here, e.g., are the reported number of seriously delinquent FHA-insured SF loans from the EWS and from the FHA’s monthly Outlook Report.

| Seriously Delinquent FHA-Insured SF Loans | ||

|---|---|---|

| EWS | Outlook | |

| Oct-11 | 657,552 | 661,554 |

| Nov-11 | 690,271 | 689,346 |

| Dec-11 | 713,793 | 711,082 |

| Jan-12 | 732,775 | 733,844 |

| Feb-12 | 722,030 | |

Assuming the EWS numbers are reasonable estimates for February’s SDQ total, here is some historical data. In the table on the next page, the FHA insurance in force is number of loans, and is from the Monthly Report to the FHA Commissioner. These numbers differ from those in the FHA Outlook Report, for reasons unclear to me. The data on the number of SDQ loans in the Commissioner report and the Outlook report are the same save for March 2011, and I believe the Commissioner report has an incorrect number, so I used the March 2011 number from the Outlook report (aarrgh!).

| FHA SF Insured Portfolio | Seriously Delinquent | SDQ Rate | |

|---|---|---|---|

| 10/31/2010 | 6,658,560 | 532,938 | 8.00% |

| 11/30/2010 | 6,724,304 | 588,947 | 8.76% |

| 12/31/2010 | 6,813,888 | 598,140 | 8.78% |

| 1/31/2011 | 6,889,701 | 612,443 | 8.89% |

| 2/28/2011 | 6,933,260 | 619,712 | 8.94% |

| 3/31/2011 | 6,984,580 | 580,480 | 8.31% |

| 4/30/2011 | 7,036,153 | 575,950 | 8.19% |

| 5/31/2011 | 7,079,820 | 578,933 | 8.18% |

| 6/30/2011 | 7,152,140 | 584,822 | 8.18% |

| 7/31/2011 | 7,203,809 | 598,921 | 8.31% |

| 8/31/2011 | 7,260,598 | 611,822 | 8.43% |

| 9/30/2011 | 7,288,440 | 635,096 | 8.71% |

| 10/31/2011 | 7,342,712 | 661,554 | 9.01% |

| 11/30/2011 | 7,378,126 | 689,346 | 9.34% |

| 12/31/2011 | 7,415,002 | 711,082 | 9.59% |

| 1/31/2012 | 7,464,533 | 733,844 | 9.83% |

| 2/29/2012 | 7,499,802 | 722,030 | 9.63% |

CR Note: Fannie and Freddie serious delinquencies are down year-over-year, but the FHA delinquencies are up from 8.94% in Feb 2011 to 9.63%.

Desktop Underwriter® Refi Plus and Wells Fargo

by Calculated Risk on 3/19/2012 01:08:00 PM

Over the weekend I noted that Fannie Mae has updated Desktop Underwriter® (DU) so that lenders can now use the automated system. There are several advantages to the automated system, one was that borrowers would now be able to apply for a "HARP 2.0" refinance with lenders other than the lender for their original mortgage.

This morning I read the Wells Fargo "Amended DU Refi PlusTM Policy and Effective Dates".

First, Wells Fargo has decided to limit HARP 2.0 to loans that Wells services. If Wells is not the current servicer, then Wells will limit LTV to 105% - the same as HARP 1.0 guidelines. Well Fargo wrote:

"After further assessment of the new parameters for DU Refi Plus transactions, and the current market environment, Wells Fargo has reconsidered our policy regarding loans not currently serviced by Wells Fargo. As a result we will not offer unlimited LTV/CLTV options for Loans not currently serviced by Wells Fargo."This is a significant change from just a few weeks ago.

On timing of DU Refi Plus:

"Loans with the expanded parameters defined above may not be submitted for Prior Approval underwriting until April 23, 2012, when loans can be delivered to Wells Fargo."So any increase in refinance activity associated with the automated DU system, will start in late April for Wells Fargo.