by Calculated Risk on 3/14/2012 04:16:00 PM

Wednesday, March 14, 2012

Lawler: Updated “Distressed Sales” Shares Table, Select Areas

Economist Tom Lawler sent me the updated table below for several distressed areas. He added Orlando and Southern California today.

Lawler noted that the Reno data is NOT directly from the realtor association/MLS. Also "SoCal shares are not MLS based, but are Dataquick estimates based on property records".

CR Note: This could be very useful data over the next several months (and years) as we try to track the impact of the mortgage servicer settlement and to see if the markets are improving. Obviously fewer distressed sales would indicate a less unhealthy market (except it might be due to process delays right now).

For most of the areas (with the exception of Reno), the distressed share of sales is down from February 2011, the share of short sales has increased and the share of foreclosure sales are down - and down significantly in some areas.

Look at Orlando: Short sales have increased from 23.7% to 33.3%, and foreclosures have declined from almost half of sales (49.9%) to 28.9%.

Note: The table is a percentage of total sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Feb | 11-Feb | 12-Feb | 11-Feb | 12-Feb | 11-Feb | |

| Las Vegas | 29.3% | 26.6% | 42.0% | 51.6% | 71.3% | 78.2% |

| Reno | 28.0% | 30.0% | 42.0% | 36.0% | 70.0% | 66.0% |

| Phoenix | 28.1% | 21.1% | 23.3% | 49.6% | 51.4% | 70.7% |

| Sacramento | 31.9% | 22.1% | 33.9% | 49.2% | 65.8% | 71.3% |

| Minneapolis | 15.0% | 13.6% | 42.3% | 47.9% | 57.3% | 61.5% |

| Mid-Atlantic (MRIS) | 16.4% | 14.5% | 17.5% | 27.2% | 33.9% | 41.7% |

| Orlando | 33.3% | 23.7% | 28.9% | 49.9% | 62.2% | 73.6% |

| Southern California | 20.5% | 19.7% | 32.5% | 37.0% | 53.0% | 56.7% |

DataQuick: Socal Home Sales increased in February

by Calculated Risk on 3/14/2012 01:43:00 PM

Another key distressed market ... from DataQuick: Southland Home Sales Jump in February, Prices Still Down Yr/Yr

The Southland housing market posted the highest number of February home sales in five years as record levels of investor and cash buyers helped spur robust activity under $300,000. ...And on distressed sales:

A total of 15,573 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 7.2 percent from 14,523 in January, and up 8.4 percent from 14,369 in February 2011, according to San Diego-based DataQuick.

The increase in sales between January and February was larger than usual. On average, sales have risen 1.1 percent between those two months since 1988, when DataQuick’s statistics begin.

...

“February sales got a big boost from investors and others paying cash for relatively affordable homes, as well as from an extra day’s worth of sales thanks to the leap year. Without the latter, sales might have been up a bit, but not to a five-year high. It’s just one more reason for us to remind everyone that January and February usually aren’t good months to use for forecasting purposes. The big picture remains one where the bottom of the housing market continues to see much of the action, while move-up activity remains sluggish. Financing is still difficult for many and lots of potential move-up buyers and sellers are stuck because they owe more than their homes are worth,” said John Walsh, DataQuick president.

Foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 32.5 percent of the resale market last month, down from a revised 32.6 percent in January and down from 37.0 percent a year earlier. Foreclosure resales hit a high for the current cycle of 56.7 percent in February 2009 and a low of 31.6 percent last November.Distressed sales are very high at about 53% of the market, but the percentage is down from 56.7% a year ago.

Short sales ... made up an estimated 20.5 percent of Southland resales last month. That compares with 21.1 percent in January, which was a high point for the current real estate cycle, and 19.7 percent in February 2011.

...

Cash purchasers accounted for a record 32.8 percent of February home sales, up from 32.2 percent in January and up from 32.3 percent a year earlier.

The NAR will report February existing home sales next week on Wednesday March 21st.

Las Vegas House sales up 13% YoY in February, Inventory off sharply

by Calculated Risk on 3/14/2012 12:09:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities. Prices, as of the December report, were off 61.8% from the peak according to Case-Shiller, and off 8.9% over the last year.

Sales in 2011 were at record levels, more than during the bubble, and it looks like 2012 will be an even stronger year - even with some new rules that slow the foreclosure process.

From the LVGAR: GLVAR reports increasing home sales, prices, decreasing inventory. First on a record sales pace:

According to GLVAR, the total number of local homes, condominiums and townhomes sold in February was 3,794. That’s up from 3,591 in January, and up from 3,371 total sales in February 2011.And on the decline in inventory:

Compared to one year ago, single-family home sales during February increased by 17.8 percent, while sales of condos and townhomes decreased by 5.0 percent.

By the end of February, GLVAR reported 6,543 single-family homes listed without any sort of offer. That’s down 18.2 percent from 8,001 such homes listed in January and down 45.6 percent from one year ago. For condos and townhomes, the 1,598 properties listed without offers in February represented an 8.5 percent decline from 1,746 such properties listed without offers in January and a decrease of 45.6 percent from one year ago.And on the percent distressed:

Meanwhile, 29.3 percent of all existing local homes sold during February were short sales ... Bank-owned homes accounted for 42 percent of all existing home sales in February, down from 45.5 percent in January.So 71.3% of the sales were distressed, and over half were purchased with cash.

One of the keys is the decline in inventory. Note that the GLVAR reports both total inventory, and inventory excluding "contingent" listings (usually short sales). Total single family inventory was down 15.4% from a year ago, and excluding contingent listings, inventory was down 45.6%!

MBA: Mortgage Purchase Applications increase

by Calculated Risk on 3/14/2012 09:07:00 AM

Purchase activity has picked up a little from the beginning of the year. Refinance activity fell, but HARP refinance activity is picking up ...

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 4.1 percent from the previous week to its lowest level since January 6, 2012. This is the fourth consecutive weekly decline in the Refinance Index.

The seasonally adjusted Purchase Index increased 4.4 percent from one week earlier to its highest level since January 13, 2012.

...

“Applications for home purchase increased again last week, coinciding with another strong job market report. Purchase applications are now almost 12 percent above the level one month ago, even after adjusting for typical seasonal patterns. However, this level of purchase activity, adjusted or unadjusted, was essentially unchanged when compared to the same time last year. Purchase activity remains subdued and within the narrow range we have seen since the expiration of the homebuyer tax credit in 2010,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Refinance application volume fell last week. Although rates were unchanged on average, they trended up through the course of the week, and this likely discouraged many potential refinance applicants. HARP volume continued to grow as a share of total refinance volume, reaching roughly 30 percent of refinance activity in the last two weeks. Typical HARP loans had loan-to-value ratios above 90 percent, indicating that lenders are reaching out to underwater borrowers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) remained unchanged at 4.06 percent ...

Tuesday, March 13, 2012

Ceridian-UCLA: Diesel Fuel index increased 0.7% in February

by Calculated Risk on 3/13/2012 10:37:00 PM

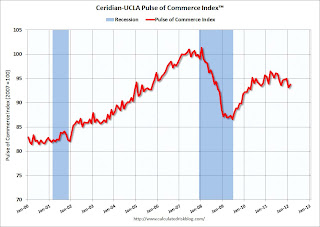

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Increased 0.7 Percent in February

The Ceridian-UCLA Pulse of Commerce Index® (PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, rose 0.7 percent in February but was not enough to offset the 1.7 percent decline in the previous month. The most recent three-month period from December to February is lower than the previous three months from September to November 2011 by 3.2 percent at an annualized rate.

...

“The continuing weakness of the PCI is signaling that, perhaps, the recovery in home building has not yet taken hold. The recent improvement in building permits and housing starts may get building going again and therefore, trucking as well, as it has been said that it takes 17 truckloads to build a home. If we get the saws and hammers going again, we will have a real recovery with much healthier job growth,” said Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and Director of the UCLA Anderson Forecast.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index has been weaker than the ATA trucking index and the reports for rail traffic. It is possible that the high cost of fuel is shifting some long haul traffic from trucks to rail (intermodal).