by Calculated Risk on 3/15/2012 05:24:00 PM

Thursday, March 15, 2012

DataQuick: Bay Area California Home Sales increased in February

From DataQuick: Bay Area February Home Sales at Five-year High

A total of 5,702 new and resale houses and condos sold in the nine-county Bay Area in February. That was up 4.1 percent from 5,479 in January, and up 14.2 percent from 4,991 in February 2011. The year-over-year sales increase was the eighth in a row, according to San Diego-based DataQuick.Still over 50% of the market is "distressed". Here is an update to Tom Lawler's table of selected high distressed sales markets including the Bay Area. With the exception of Reno, the distressed share of sales is down from February 2011, the share of short sales has increased and the share of foreclosure sales are down:

...

Last month distressed property sales – the combination of foreclosure resales and “short sales” – made up about half of the Bay Area’s resale market.

Foreclosure resales ... accounted for 27.4 percent of resales in February. That was up from a revised 27.2 percent in January, and down from 32.6 percent a year ago.

Short sales ... made up an estimated 23.1 percent of Bay Area resales last month. That was down slightly from an estimated 23.5 percent in January – the high point for this cycle – and up from 20.1 percent a year earlier.

...

Last month absentee buyers – mostly investors – purchased a record 26.0 percent of all Bay Area homes sold, up from a revised 25.2 percent in January and 23.4 percent a year ago.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Feb | 11-Feb | 12-Feb | 11-Feb | 12-Feb | 11-Feb | |

| Las Vegas | 29.3% | 26.6% | 42.0% | 51.6% | 71.3% | 78.2% |

| Reno | 28.0% | 30.0% | 42.0% | 36.0% | 70.0% | 66.0% |

| Phoenix | 28.1% | 21.1% | 23.3% | 49.6% | 51.4% | 70.7% |

| Sacramento | 31.9% | 22.1% | 33.9% | 49.2% | 65.8% | 71.3% |

| Minneapolis | 15.0% | 13.6% | 42.3% | 47.9% | 57.3% | 61.5% |

| Mid-Atlantic (MRIS) | 16.4% | 14.5% | 17.5% | 27.2% | 33.9% | 41.7% |

| Orlando | 33.3% | 23.7% | 28.9% | 49.9% | 62.2% | 73.6% |

| Southern California | 20.5% | 19.7% | 32.5% | 37.0% | 53.0% | 56.7% |

| Bay Area, California | 23.1% | 20.1% | 27.4% | 32.6% | 50.5% | 52.7% |

The NAR will report February existing home sales next week on Wednesday March 21st.

CoreLogic: 69,000 completed foreclosures in January 2012

by Calculated Risk on 3/15/2012 01:33:00 PM

From CoreLogic: CoreLogic® Reports More Than 860,000 Completed Foreclosures Nationally in the Last Twelve Months

CoreLogic ... today released its National Foreclosure Report for January, which provides monthly data on completed foreclosures, foreclosure inventory and 90+ delinquency rates. There were 69,000 completed foreclosures in January 2012, compared to 80,000 in January 2011, and 65,000 in December 2011. The number of completed foreclosures for the previous twelve months was 860,128. From the start of the financial crisis in September 2008, there have been approximately 3.3 million completed foreclosures.This is a new monthly report and will help track the number of completed foreclosures.

...

Approximately 1.4 million homes, or 3.3 percent of all homes with a mortgage, were in the foreclosure inventory as of January 2012 compared to 1.5 million, or 3.6 percent, in January 2011 and 1.4 million, or 3.4 percent, in December 2011. Nationally, the number of loans in the foreclosure inventory decreased by 145,000, or 9.5 percent in January 2012 compared to January 2011. The foreclosure inventory is the stock of homes in the foreclosure process.

Note: The sequence is 1) a loan goes delinquent, 2) if it doesn't cure, after several months, the foreclosure process begins (this is called the "foreclosure inventory"), 3) then the foreclosure is completed and becomes REO (lender Real Estate Owned), and then 4) the REO is sold. Sometimes, during this process, the loan will cure or a short sale approved, so not all loans in the foreclosure inventory are future "completed foreclosures".

So when CoreLogic reports "completed foreclosures", they are discussing the number of homes moving from the foreclosure process to REO.

Philly Fed and Empire State Manufacturing Surveys indicate slightly stronger expansion in March

by Calculated Risk on 3/15/2012 10:00:00 AM

From the Philly Fed: March 2012 Business Outlook Survey

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, edged slightly higher, from a reading of 10.2 in February to 12.5, its highest reading since April of last year ... The new orders index decreased 8 points, to 3.3, while the shipments index declined 12 points, to 3.5.From the NY Fed: Empire State Manufacturing Survey

...

Firms' responses suggest a slight pickup in levels of employment this month. The current employment index, which has been positive for seven consecutive months, increased 6 points ... and the current workweek index decreased 7 points.

The general business conditions index was little changed in March and, at 20.2, indicated a continued moderate pace of growth in business activity for New York State manufacturers.

...

The new orders index inched down three points to 6.8, indicating a modest growth in orders. The shipments index fell five points to 18.2, revealing a continued increase in shipments, though at a slower pace than in February.

...

The number of employees index rose two points to 13.6, and the average workweek index climbed 11 points to 18.5.

...

Indexes for the six-month outlook were generally somewhat lower than they were last month, but held at levels that conveyed a high degree of optimism.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

The average of the Empire State and Philly Fed surveys increased slightly again in March, and is at the highest level since April 2011.

Both surveys indicated expansion in March, at a slightly faster pace than in February, and both were slightly above the consensus forecast.

Weekly Initial Unemployment Claims decline to 351,000

by Calculated Risk on 3/15/2012 08:38:00 AM

The DOL reports:

In the week ending March 10, the advance figure for seasonally adjusted initial claims was 351,000, a decrease of 14,000 from the previous week's revised figure of 365,000. The 4-week moving average was 355,750, unchanged from the previous week's revised average of 355,750.The previous week was revised up to 365,000 from 362,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 355,750.

The 4-week moving average is near the lowest level since early 2008.

And here is a long term graph of weekly claims:

Wednesday, March 14, 2012

LA area Port Traffic declines in February

by Calculated Risk on 3/14/2012 08:30:00 PM

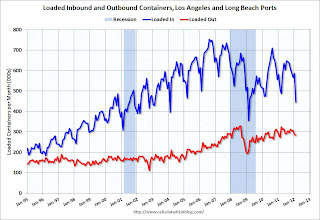

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for February. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is down 0.9% from January, and outbound traffic is up 0.3%.

On a rolling 12 month basis, outbound traffic is moving up slowly, and inbound traffic is declining slightly.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of February, loaded outbound traffic was up 4.6% compared to February 2011, and loaded inbound traffic was down 12.5% compared to February 2011. (typo corrected, reversed inbound and outbound).

For the month of February, loaded outbound traffic was up 4.6% compared to February 2011, and loaded inbound traffic was down 12.5% compared to February 2011. (typo corrected, reversed inbound and outbound).

Note: Every year imports decline in February mostly because of the Chinese New Year.