by Calculated Risk on 3/06/2012 12:22:00 PM

Tuesday, March 06, 2012

Greek Update: Collective action clause

From the Financial Times: Greece threatens default on PSI holdouts

The Greek public debt management agency said in a statement that Athens “does not contemplate the availability of funds to make payments to private sector creditors that decline to participate in PSI”.And the details from Financial Times Alphaville: Now witness the firepower of this fully armed and operational collective action clause, etc

The threat is aimed in particular at the 14 per cent of investors who own Greek bonds issued under international law.

excerpt with permission

The Republic’s representative noted that Greece’s economic programme does not contemplate the availability of funds to make payments to private sector creditors that decline to participate in PSI. Finally, the Republic’s representative noted that if PSI is not successfully completed, the official sector will not finance Greece’s economic programme and Greece will need to restructure its debt (including guaranteed bonds governed by Greek law) on different terms that will not include co-financing, the delivery of EFSF notes, GDP-linked securities or the submission to English law.The deadline is Thursday, March 8th.

LPS: Foreclosure Starts and Sales increase Sharply in January

by Calculated Risk on 3/06/2012 08:50:00 AM

LPS released their Mortgage Monitor report for January today.

According to LPS, 7.97% of mortgages were delinquent in January, down from 8.15% in December, and down from 8.90% in January 2011.

LPS reports that 4.15% of mortgages were in the foreclosure process, up from 4.11% in December, and down slightly from 4.16% in January 2011.

This gives a total of 12.13% delinquent or in foreclosure. It breaks down as:

• 2.23 million loans less than 90 days delinquent.

• 1.77 million loans 90+ days delinquent.

• 2.08 million loans in foreclosure process.

For a total of 6.08 million loans delinquent or in foreclosure in January.

This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 7.97% from the peak in January 2010 of 10.97%, but the decline has halted. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.15%, down from the record high in October 2011 of 4.29%. There are still a large number of loans in this category (about 2.08 million).

Foreclosure starts and sales were up sharply in January. This is just one month, but it is possible that the lenders are finally working through the backlog of loans (and this was before the mortgage servicer settlement).

Monday, March 05, 2012

Housing: Year over Year change in Asking Prices

by Calculated Risk on 3/05/2012 09:04:00 PM

Earlier today I noted that existing home inventory, according to HousingTracker, is down 20.5% year-over-year in early March.

I mentioned that HousingTracker / DeptofNumbers also report asking prices for 54 markets, including the median, the 25th percentile, and the 75th percentile. Note: NDD at the Bonddad blog has been watching asking prices since last year.

According to housingtracker, median asking prices are up 3.9% year-over-year in early March. We can't read too much into this increase because these are just asking prices, and median prices can be distorted by the mix. As an example, the median asking price might have increased just because there are fewer low priced foreclosures listed for sale.

But with those caveats, here is a graph of asking prices compared to the year-over-year change in the Case-Shiller composite 20 index.

Click on graph for larger image.

Click on graph for larger image.

The Case-Shiller index is in red. The brief period in 2010 with a year-over-year increase in the repeat sales index was related to the housing tax credit (notice that asking prices showed a small year-over-year declines before Case-Shiller increased since Case-Shiller is for closed transactions).

Also note that the 25th percentile took the biggest hit (that was probably the flood of low end foreclosures on the market).

Now asking prices have turned positive. We have to be careful about the mix (fewer foreclosures on the market), but it appears sellers are a little more optimistic.

Lawler: Maryland and Foreclosures: Living for Free in the Free State?

by Calculated Risk on 3/05/2012 03:32:00 PM

From economist Tom Lawler:

Yesterday the Washington Post carried two stories on foreclosures that are definitely worth reading. One is entitled “We don’t believe in living for free: Md. couple fight foreclosure on million-dollar home for years without ever making a payment”. It basically chronicles how a Maryland couple (who were real-estate speculators) were (amazingly) able to buy a million dollar plus home with no money down in 2006 (getting a million dollar first mortgage from a now defunct Mississippi lender and a second mortgage from another lender) for their primary residence, and who have not made a mortgage payment in five years. They’ve been able to do this by “using every tactic in the book” to hold off foreclosure. It is a good but disturbing article, and can be read at A million-dollar mortgage goes unpaid for years while couple fights foreclosure. You will probably be amazed that the couple, one of whom was convicted of bankruptcy fraud (related to real estate transactions) in 2000, agreed to be interviewed for the article.

CR Note: These people bought the house with no money down and never made a single mortgage payment. It would NOT be a tragedy if they lost "their" house. Prior to the Depression, people usually put 50% down and financed their homes for 5 years with a balloon payment. During the Depression they couldn't refinance even if they could make their payment. Losing their homes WAS a tragedy. There is no comparison to this couple in Maryland.

Lawler: The second is entitled “The foreclosure crisis: Two strategies,” which discusses how various legislative and other actions have dramatically lengthened Maryland’s foreclosure timelines, which “some economists and housing experts contend” has worked to “stifle” a recovery in the “Free State.“ It also does a comparison of the housing busts in Prince George’s County, Maryland and Prince Williams County, Virginia, that is similar to my “A Tale of Two Counties” piece last year. See: Maryland vs. Virginia: Two different approaches to foreclosure

CR Note: From the 2nd article:

“The real issue is the length of time of the process. If you just keep pushing back foreclosures that would happen anyway, it just delays the inevitable,” said Thomas A. Lawler, whose firm, Lawler Economic & Housing Consulting, provides market data, analysis and forecasts. “I am not saying therefore everyone should have a fast process that is not fair, but a fair process should not leave a house in foreclosure for multiple years.”

Existing Home Inventory declines 21% year-over-year in early March

by Calculated Risk on 3/05/2012 12:55:00 PM

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for monthly inventory (54 metro areas), is off 20.5% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

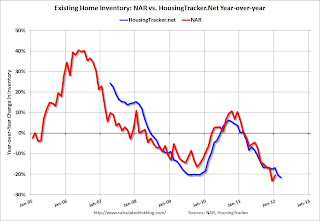

This graph shows the NAR estimate of existing home inventory through January (left axis) and the HousingTracker data for the 54 metro areas through early March.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory, the NAR and HousingTracker inventory numbers have tracked pretty well.

Seasonally housing inventory usually bottoms in December and January and then starts to increase again through mid to late summer. So inventory should increase over the next 6 months.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early March listings - for the 54 metro areas - declined 20.5% from the same period last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

HousingTracker reported that the early March listings - for the 54 metro areas - declined 20.5% from the same period last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

This is just inventory listed for sale, sometimes referred to as "visible inventory". There is also a large "shadow inventory" that is currently not on the market, but is expected to be listed in the next few years. But this year-over-year decline is significant.

Note: HousingTracker also reports asking prices. They report the median, 25th percentile, and 75th percentile prices for each metro area. Of course these are just "asking" prices, and the median can be distorted by the mix - but asking prices are up 3.9% year-over-year (something to watch).