by Calculated Risk on 2/26/2012 09:18:00 AM

Sunday, February 26, 2012

Unofficial Problem Bank list increases to 960 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 24, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement actions for January 2012 this Friday. Moreover, after playing footsie with community bankers last week as part of an effort to stem proposed Congressional action to broaden the examination appeal process, the FDIC got back to closing a couple this week. The release of these actions and closings contributed to many changes in the Unofficial Problem Bank List. In all, this week there were four removals and eight additions, which leave the list at 960 institutions with assets of $389.7 billion. A year ago, the list held also held 960 institutions but assets were higher at $413.8 billion.

With this being the last Friday of the month, it is time to review changes for the month. After experiencing declines in the number of institutions each month since July 2011, the list count increased by four institutions during February 2012. While the increase in assets of $649 million during the month was small, it was the first increase in total assets since October 2011. Other interesting factoids include the absence of any unassisted mergers during the month, which has not happened since November 2010; and the monthly additions of 16 are the highest since 18 institutions were added in October 2011.

Removals this week include two rehabilitations -- Ridgestone Bank, Brookfield, WI ($423 million) and Fireside Bank, Pleasanton, CA ($278 million Ticker: KMPR); and two failures -- Home Savings of America, Little Falls, MN ($440 million) and Central Bank of Georgia, Ellaville, GA ($276 million).

Among the eight additions are Britton & Koontz Bank, N.A., Natchez, MS ($371 million Ticker: BKBK); Crown Bank, Edina, MN ($258 million); Rabun County Bank, Clayton, GA ($248 million); and Farmers & Merchants Bank, Statesboro, GA ($231 million). After 76 failures, inclusive of the one tonight, many might think there are not any banks left in Georgia to turn bad.

Other changes to the list include the FDIC issuing Prompt Corrective Action orders against 1st Commerce Bank, North Las Vegas, NV ($32 million); First Carolina State Bank, Rocky Mount, NC ($90 million); Pisgah Community Bank, Asheville, NC ($30 million); Sunrise Bank, Valdosta, GA ($86 million); and Sunrise Bank of Albuquerque, Albuquerque, NM ($61 million). All five banks are controlled by Capitol Bancorp, Ltd., which has divested or merged 45 institutions that were under its control during the crisis. Capitol has pending sale agreements for two of the banks just issued PCA orders. Should any bank controlled by Capitol fail, the other 18 banks controlled by Capitol could be liable for the resolution cost should the FDIC decide to apply cross guaranty. The FDIC did not apply cross guaranty to Capitol back in November 2009, when Commerce Bank of Southwest Florida failed, which cost the FDIC insurance fund approximately $31 million.

Next week, the FDIC will likely release its quarterly financial performance report for the fourth quarter of 2010, which will include an update on the Official Problem Bank List figures.

Click on graph for larger image.

Click on graph for larger image.This graph shows the cumulative bank failures for each year starting in 2008. There have been 425 bank failures since the beginning of 2008, and so far, closings this year are running at about half the rate of 2010.

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Saturday, February 25, 2012

Buffett's Views on Housing

by Calculated Risk on 2/25/2012 06:44:00 PM

In Feb 2010, Warren Buffett wrote:

[W]ithin a year or so residential housing problems should largely be behind us, the exceptions being only high-value houses and those in certain localities where overbuilding was particularly egregious.Of course I disagreed with his timing.

Then in Feb 2011, Buffett wrote:

A housing recovery will probably begin within a year or so. In any event, it is certain to occur at some point.As I noted last year, the key word was "begin" and sure enough - based on housing starts and new home sales - it appears a modest recovery has begun.

Today Buffett wrote:

Last year, I told you that “a housing recovery will probably begin within a year or so.” I was dead wrong.Really? And I was going to give him a little credit this time. Oh well.

More from Buffett:

Housing will come back – you can be sure of that. Over time, the number of housing units necessarily matches the number of households (after allowing for a normal level of vacancies). For a period of years prior to 2008, however, America added more housing units than households. Inevitably, we ended up with far too many units and the bubble popped with a violence that shook the entire economy. That created still another problem for housing: Early in a recession, household formations slow, and in 2009 the decrease was dramatic.Buffett makes several key points:

That devastating supply/demand equation is now reversed: Every day we are creating more households than housing units. People may postpone hitching up during uncertain times, but eventually hormones take over. And while “doubling-up” may be the initial reaction of some during a recession, living with in-laws can quickly lose its allure.

At our current annual pace of 600,000 housing starts – considerably less than the number of new households being formed – buyers and renters are sopping up what’s left of the old oversupply. (This process will run its course at different rates around the country; the supply-demand situation varies widely by locale.) While this healing takes place, however, our housing-related companies sputter, employing only 43,315 people compared to 58,769 in 2006. This hugely important sector of the economy, which includes not only construction but everything that feeds off of it, remains in a depression of its own. I believe this is the major reason a recovery in employment has so severely lagged the steady and substantial comeback we have seen in almost all other sectors of our economy.

1) Housing completions have been at record lows.

2) There are currently more households being formed than new housing units completed, and this is decreasing the excess supply.

3) The excess supply will be "sopped up" at different rates across the country.

4) Housing is a key reason for the sluggish economy (not the only reason).

Earlier:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Schedule for Week of February 26th

by Calculated Risk on 2/25/2012 01:15:00 PM

Earlier:

• Summary for Week ending February 24th

The key reports this week are the January Personal Income and Outlays report, and the ISM Manufacturing survey - both will be released on Thursday. Other key reports include the Case-Shiller house price index on Tuesday, vehicle sales on Thursday, and the second estimate of Q4 GDP on Wednesday.

On Wednesday and Thursday, Fed Chairman Ben Bernanke provides the Fed's Semiannual Monetary Policy Report to the House and Senate respectively.

NOTES: The February employment report will be released the following week on Friday March 9th. Also both Fannie Mae and Freddie Mac are expected to report results this week.

10:00 AM ET: Pending Home Sales Index for January. The consensus is for a 1.5% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for February. The consensus is for 15.0 for the general business activity index, down slightly from from 15.3 in January.

11:00 AM: New York Fed to release Q4 2011 Report on Household Debt and Credit

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes (the Composite 20 was started in January 2000).

The consensus is for a 0.7% decrease in prices (NSA) in December. I expect these indexes to be at new post-bubble lows, both seasonally adjusted (SA) and not seasonally adjusted (NSA). The CoreLogic index declined 1.4% decrease in December (NSA).

10:00 AM: Conference Board's consumer confidence index for February. The consensus is for an increase to 64.0 from 61.1 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February. The consensus is for an increase to 13 for this survey from 12 in January (above zero is expansion). This is the last of the regional Fed manufacturing surveys for February, and the other surveys have indicated stronger expansion in February.

10:00 AM: Testimony, Fed Governor Elizabeth A. Duke, "The Housing Market", Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Q4 GDP (advance release). This is the second estimate from the BEA. The consensus is that real GDP increased 2.8% annualized in Q4 (same as advance estimate).

8:30 AM: Q4 GDP (advance release). This is the second estimate from the BEA. The consensus is that real GDP increased 2.8% annualized in Q4 (same as advance estimate).This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column is the advance estimate for Q4 GDP.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for an increase to 61.0, up from 60.2 in January.

10:00 AM: Testimony, Fed Chairman Ben S. Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 355,000 from 351,000 last week.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 0.5% increase in personal income in January, and a 0.4% increase in personal spending, and for the Core PCE price index to increase 0.2%.

10:00 AM: Construction Spending for January. The consensus is for a 1.0% increase in construction spending.

10:00 AM ET: ISM Manufacturing Index for February.

10:00 AM ET: ISM Manufacturing Index for February. Here is a long term graph of the ISM manufacturing index. The consensus is for a slight increase to 54.6 from 54.1 in January.

All day: Light vehicle sales for February. Light vehicle sales are expected to decline slightly to 14.0 million from 14.13 million in January (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate. TrueCar is forecasting:

The February 2012 forecast translates into a Seasonally Adjusted Annualized Rate (SAAR) of 14.3 million new car sales, up from 13.3 million in February 2011 and up from 14.2 million in January 201210:00 AM: Testimony, Fed Chairman Ben S. Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate (repeat of previous day testimony).

No Releases Scheduled.

Summary for Week ending February 24th

by Calculated Risk on 2/25/2012 08:18:00 AM

There were few economic releases last week, but once again most of the data suggested some increase in economic activity. Of course the better than normal weather helped again, especially for housing.

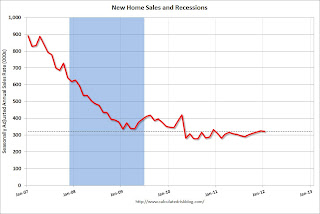

The key economic release last week was new home sales. Although the Census Bureau report showed a small decline in sales from December, this was because December was revised up from a 307 thousand sales rate (Seasonally Adjusted Annual Rate) to 324 thousand. After averaging a 300 thousand sales rate for the 18 months following the expiration of the tax credit, new home sales have averaged a sales rate over 320 thousand for the last 3 months. Not much of an increase from a historical perspective, but it appears new home sales have bottomed. Of course it is just 3 months of better sales, and the critical selling months are coming up.

For existing home sales, the key number is inventory - and the NAR reported inventory declined 20.6% year-over-year in January. The sharp decline in inventory has lead to a scramble to explain the decline. Both Tom Lawler and I posted some thoughts on the decline (something we've been tracking all year, so we weren't surprised), see: Comments on Existing Home Inventory and Lawler: Declining Inventory of Existing Homes for Sale: Don’t Forget Conversion to Rentals

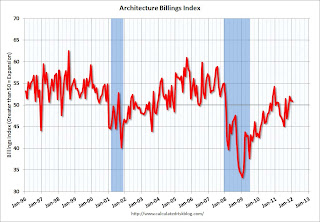

Other positive data included another drop in the four week average of initial weekly unemployment claims, an increase in consumer sentiment, and another positive reading for the Architecture Billings Index, and for manufacturing, an increase in Kansas City (10th District) manufacturing survey showing faster expansion in February.

Overall this was another solid week. Here is a summary in graphs:

• New Home Sales in January at 321,000 Annual Rate

Click on graph for larger image.

Click on graph for larger image.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 321 thousand. This was down from a revised 324 thousand in December (revised up from 307 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate. This was below the revised December rate of 324,000 and is 3.5 percent above the January 2011 estimate of 310,000.

On inventory, according to the Census Bureau:

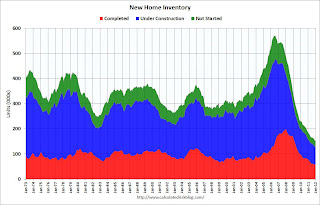

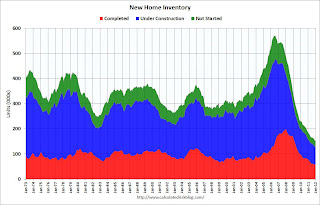

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 57,000 units in January. The combined total of completed and under construction is at the lowest level since this series started.

This was above the consensus forecast of 315 thousand, and sales for October, November and December were revised up. With the record low levels of inventory, any pickup in sales should translate into more construction.

• Existing Home Sales in January: 4.57 million SAAR, 6.1 months of supply

The NAR reported: Existing-Home Sales Rise Again in January, Inventory Down

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in January 2012 (4.57 million SAAR) were 4.3% higher than last month, and were 0.7% above the January 2011 rate.

But the key number in the report was inventory.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 2.31 million in January from 2.32 million in December. This is the lowest level of inventory since March 2005.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply.

Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.Inventory decreased 20.6% year-over-year in January from January 2011. This is the eleventh consecutive month with a YoY decrease in inventory.

Months of supply decreased to 6.1 months in January, down from 6.4 months in December.

• AIA: Architecture Billings Index indicated expansion in January

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Remains Positive for Third Straight Month

This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in January (slight expansion). Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in January (slight expansion). Anything above 50 indicates expansion in demand for architects' services.Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing later in 2012.

• Weekly Initial Unemployment Claims unchanged at 351,000

The DOL reports:

The DOL reports:In the week ending February 18, the advance figure for seasonally adjusted initial claims was 351,000, unchanged from the previous week's revised figure of 351,000. The 4-week moving average was 359,000, a decrease of 7,000 from the previous week's revised average of 366,000.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 359,000.

The 4-week moving average is at the lowest level since early 2008.

Note: Nomura analysts argue some of the recent improvement is related to seasonal distortions, see Financial Times Alphaville: US jobs and seasonality: the DeLorean edition.

• Other Economic Stories ...

• From the Chicago Fed: Index shows economic growth in January again above average

• DOT: Vehicle Miles Driven increased 1.3% in December

• LPS: Number of delinquent mortgage loans declined in January, In foreclosure increases slightly

• Kansas City Fed: Tenth District Manufacturing Activity Increased Further in February

Friday, February 24, 2012

Oil Prices and the Economy

by Calculated Risk on 2/24/2012 10:18:00 PM

Once again we have to consider the impact of high oil prices on the US economy. Bloomberg reports brent crude futures are up to $125.47 per barrel, and WTI is up to $109.77.

From the WSJ: Gas Prices Annoy Consumers but Don't Dim Outlook Yet

Prices at the pump have risen in recent weeks as tensions with Iran have sparked fears of a supply disruption, driving up the cost of crude oil. Prices of crude hit a nearly 10-month high on Friday, rising $1.94 a barrel to close at $109.77 on the New York Mercantile Exchange, their highest level since early May. Nationally, the average price of a gallon of regular gasoline hit $3.647 on Friday, according to the auto club AAA, up nearly 27 cents from a month earlier and up 11.8 cents in the past week.When oil prices are increasing, I usually turn to Professor Hamilton's blog. In earlier research, Dr. Hamilton showed that prices had to rise above previous prices to be a significant drag on the economy. Last August he wrote: Economic consequences of recent oil price changes

...

"Consumers are not as concerned with the current level of gas prices as they were in past episodes," said Jonathan Basile, an economist with Credit Suisse.

In my 2003 study, I found the evidence favored a specification with a longer memory, looking at where oil prices had been not just over the last year but instead over the last 3 years. My reading of developments during 2011 has been that, because of the very high gasoline prices we saw in 2008, U.S. car-buying habits never went back to the earlier patterns, and we did not see the same shock to U.S. automakers as accompanied some of the other, more disruptive oil shocks. My view has been that, in the absence of those early manifestations, we might not expect to see the later multiplier effects that account for the average historical response summarized in the figure above. If one uses the 3-year price threshold that the data seem to favor, the inference would be that we'll do just fine in 2011:H2, because oil prices in 2011 never exceeded what we saw in 2008.So far gasoline prices aren't above the 2011 peak levels, although they are getting close. I'm not sure 2008 counts since that is more than 3 years ago.

Another post from Hamilton two days ago: Crude oil and gasoline prices. Just something to think about ...

Note: The graph below shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Bank Failure #11 in 2012: Home Savings of America, Little Falls, Minnesota

by Calculated Risk on 2/24/2012 06:13:00 PM

Where the Feds often will play

Where seldom is heard,

A bid for this turd,

And the skies are not cloudy all day

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of the Insured Deposits of Home Savings of America, Little Falls, Minnesota

As of December 31, 2011, Home Savings of America had $434.1 million in total assets and $432.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $38.8 million. Home Savings of America is the eleventh FDIC-insured institution to fail in the nation this year, and the second in Minnesota.We haven't seen a payout in some time ... I guess no one wanted this one.

Bank Failure #10 in 2012: Central Bank of Georgia, Ellaville, Georgia

by Calculated Risk on 2/24/2012 05:10:00 PM

Feds in Georgia discover

Deposits to dust

by Soylent Green is People

From the FDIC: Ameris Bank, Moultrie, Georgia, Assumes All of the Deposits of Central Bank of Georgia, Ellaville, Georgia

As of December 31, 2011, Central Bank of Georgia had approximately $278.9 million in total assets and $266.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $67.5 million. ... Central Bank of Georgia is the tenth FDIC-insured institution to fail in the nation this year, and the second in Georgia.Here is a "central bank" that failed ...

Lawler: Declining Inventory of Existing Homes for Sale: Don’t Forget Conversion to Rentals

by Calculated Risk on 2/24/2012 03:16:00 PM

CR Note: Yesterday I posted some thoughts on the sharp decline in listed inventory. Here are some additional comments from housing economist Tom Lawler:

While there has been a lot of discussion among analysts on the reasons behind the “stunning” plunge in existing SF homes listed for sale over the past several years, few have mentioned what appears to have been a substantial increase in the number of SF homes purchased by investors with the explicit intention to rent the homes out for several years. One reason, of course, is that there are not good, reliable, and timely statistics on the number of SF homes rented out, much less any data at all on the intended holding-period of folks renting out SF homes. There are, of course, lots of anecdotal stories about a surge in the number of investors (including LLCs, hedge funds, etc.) buying SF properties, especially REO properties, because of attractive rental yields; there are some data from local MLS on leasing activity showing a surge in the past several years; and there are certainly surveys pointing not just to an increase in investor buying of homes, but a rise in the cash share of investors purchases over the past several years. But there is a dearth of actual data.

Data from the ACS does suggest that the share of occupied SF detached homes that were occupied by renters increased rather dramatically in the latter part of last decade, The below table is based on decennial Census data for 2000, and the 5-year, 3-year, and 1-year estimates from the ACS for 2006-10, 2008-10, and 2010.

While last year there was a drop in completed foreclosures, there was no corresponding drop in the sales of REO properties, many of which were to investors not planning to “flip” properties, but to rent them out. Short sales also increased last year, and anecdotal evidence suggests that a non-trivial share were to investors looking to rent the properties out. I’d guess that the 2011 data will suggest that the share of occupied SF detached homes occupied by renters will come in at around 16%.

Net, a not insignificant share of the decline in the share of homes for sale reflects the acquisition of SF (and condo) properties by investors as multi-year rental properties.

| Percent of Occupied Single Family Detached Homes Occupied by Renters | ||||

|---|---|---|---|---|

| 2000 | 2006-07 Avg. | 2008-09 Avg. | 2010 | |

| US | 13.2% | 12.8% | 14.3% | 15.1% |

| Maricopa County | 10.4% | 13.5% | 16.8% | 19.8% |

| Clark County | 12.5% | 18.2% | 22.0% | 24.4% |

| Sacramento County | 18.8% | 16.7% | 20.2% | 22.4% |

| Lee County | 10.6% | 12.3% | 14.6% | 17.3% |

New Home Sales: 2011 Still the Worst Year, "Distressing Gap" remains very wide

by Calculated Risk on 2/24/2012 12:09:00 PM

Even with the upward revisions to new home sales in October, November and December, 2011 was the worst year for new home sales since the Census Bureau started tracking sales in 1963. The three worst years were 2011, 2010, and 2009 with sales of 304, 323 and 375 thousand respectively.

Sales will probably increase in 2012, and sales will also probably be higher than the 323 thousand in 2010. But I expect this year will still be the third worst on record.

The following graph shows the recent minor increase off the bottom for new home sales:

Click on graph for larger image.

Click on graph for larger image.

Not much of an increase.

Last month I posted a few housing forecasts for 2012. The forecasts for new home sales ranged from 330 thousand to 365 thousand (excluding Moody's) - and that wouldn't be much of an increase from the current level.

The second graph shows existing home sales (left axis) and new home sales (right axis) through January. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

I expect this gap to eventually close once the number of distressed sales starts to decline.

I expect this gap to eventually close once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

On January New Home Sales:

• New Home Sales in January at 321,000 Annual Rate

• New Home Sales graphs

Earlier this week on Existing Home sales:

• Existing Home Sales in January: 4.57 million SAAR, 6.1 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

New Home Sales in January at 321,000 Annual Rate

by Calculated Risk on 2/24/2012 10:00:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 321 thousand. This was down from a revised 324 thousand in December (revised up from 307 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in January 2011 were at a seasonally adjusted annual rate of 321,000. This is below the revised December rate of 324,000 and is 3.5 percent above the January 2011 estimate of 310,000.

Click on graph for larger image.

Click on graph for larger image.

The second graph shows New Home Months of Supply.

Months of supply decreased to 5.6 in January. This is the lowest level since January 2006.

The all time record was 12.1 months of supply in January 2009.

This is now normal (less than 6 months supply is normal).

This is now normal (less than 6 months supply is normal).

The seasonally adjusted estimate of new houses for sale at the end of January was 151,000. This represents a supply of 5.6 months at the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 57,000 units in January. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In January 2012 (red column), 22 thousand new homes were sold (NSA). This was the second weakest January since this data has been tracked. The record low for January was 21 thousand set in 2011. The high for January was 92 thousand in 2005.

This was above the consensus forecast of 315 thousand, and sales for October, November and December were revised up.

This was above the consensus forecast of 315 thousand, and sales for October, November and December were revised up.It appears New Home sales have started to slowly increase. I'll have more later.