by Calculated Risk on 2/02/2012 03:55:00 PM

Thursday, February 02, 2012

January Employment Report Revisions and Issues

Tomorrow (Friday) the BLS will release the January Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 135,000 payroll jobs in January, and for the unemployment rate to remain unchanged at 8.5%.

Here are a few revisions and issues to look for tomorrow:

• Establishment Data: "With the release of January 2012 data on February 3, 2012, the Current Employment Statistics (CES) survey will introduce revisions to nonfarm payroll employment, hours, and earnings data to reflect the annual benchmark adjustment for March 2011 and updated seasonal adjustment factors. Not seasonally adjusted data beginning with April 2010 and seasonally adjusted data beginning with January 2007 are subject to revision."

The preliminary benchmark was for an increase of 192,000 total nonfarm payroll jobs, and 140,000 private sector jobs as of March 2011. The annual revision is benchmarked to state tax records, and usually the preliminary estimate is pretty close to the final benchmark estimate.

This will be the first upward revision since 2006.

• Household Survey: "Effective with the release of The Employment Situation for January 2012 scheduled for February 3, 2012, population controls that reflect the results of Census 2010 will be used in the monthly household survey estimation process. Historical data will not be revised to incorporate the new controls; consequently, household survey data for January 2012 will not be directly comparable with that for December 2011 or earlier periods. A table showing the effects of the new controls on the major labor force series will be included in the January 2012 release."

• Issue: Several analysts have noted that it appears the seasonal adjustment for "Transportation and warehousing" over-counted employment in December by about 42,000 and this should be unwound in January. So December payroll growth was probably overstated, and January will be understated.

• And on the unemployment rate from Gallup:

The U.S. government's January unemployment rate that it will report Friday morning will be based largely on mid-month conditions. At mid-month, Gallup reported that its unemployment rate had declined to 8.3%, based on data collected through the 15th of the month.The Gallup survey hasn't predicted the BLS "not seasonally adjusted" unemployment rate very well, but this suggests a possible unemployment rate surprise. January has the largest downward seasonal adjustment, and usually the seasonally adjusted rate is 0.5% to 0.7% lower than the NSA rate. If the headline unemployment rate is 8.5% (as analysts expect) then I'd expect the NSA rate to be in the 9.1% range - not 8.3% as the Gallup survey found.

The mid-month reading normally provides a pretty good estimate of the government's unadjusted unemployment rate for the month. However, the government is revising its methodology beginning with the January 2012 report. As a result, the government notes, "household survey data for January 2012 will not be directly comparable with that for December 2011 or earlier periods." In turn, this makes estimating the government's unemployment rate for January even more difficult than usual.

NMHC Apartment Survey: Market Conditions Tighten in Recent Survey

by Calculated Risk on 2/02/2012 01:25:00 PM

From the National Multi Housing Council (NMHC): Apartment Industry Continues Recovery, Survey Says

Market conditions continued to improve for the multifamily industry across all areas, according to the latest National Multi Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. For the seventh time in the last eight quarters, all four indexes reflecting Market Tightness, Sales Volume, Equity Financing and Debt Financing were at or above 50 – indicating growth from the previous quarter.

"In the face of an unprecedented virtual shutdown of development, the apartment market continues its strong recovery as developers play catch-up to the growing demand for rental housing," said NMHC Chief Economist Mark Obrinsky.

...

The Market Tightness Index rose to 60 from 52, marking the eighth straight quarter with the index at or above 50.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last eight quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q4 2011 to 5.2%, down from 5.6% in Q3 2011, and 9.0% at the end of 2009.

New multi-family construction remains a bright spot for the U.S. economy and this survey indicates demand for apartments is still strong.

A final note: This index helped me call the bottom for effective rents (and the top for vacancy rate) early in 2010.

CoreLogic: House Price Index declined 1.4% in December to new post-bubble low

by Calculated Risk on 2/02/2012 11:08:00 AM

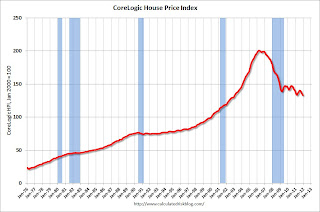

Notes: This CoreLogic House Price Index report is for December. The Case-Shiller index released last week was for November. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of September, October and November (November weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Prices fell by 4.7 percent nationally in 2011

The CoreLogic HPI shows that, including distressed sales, home prices in the U.S. decreased 4.7 percent in 2011 compared with December 2010. This year-end report shows that home prices continued the trend of year-end decreases—this is the fifth consecutive year with a decrease in the HPI. The HPI excluding distressed sales shows that home prices decreased by 0.9 percent in 2011, giving an indication of the impact of distressed sales on home prices in 2011.

The report also shows that national home prices including distressed sales decreased 1.4 percent on a month-over-month basis, the fifth consecutive monthly decline. However, the HPI excluding distressed sales posted its first month-over-month gain since July 2011, rising 0.2 percent.

“While overall prices declined by almost 5 percent in 2011, non-distressed prices showed only a small decrease. Until distressed sales in the market recede, we will see continued downward pressure on prices,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.4% in December, and is down 4.7% over the last year.

The index is off 33.7% from the peak - and is now at a new post-bubble low.

Some of this decline was seasonal (the CoreLogic index is NSA) and month-to-month price changes will probably remain negative through March 2012. Last year prices fell about 4% from December 2010 to March 2011, and there will probably be a similar decline this year.

Bernanke Testimony: "The Economic Outlook and the Federal Budget Situation"

by Calculated Risk on 2/02/2012 10:00:00 AM

Fed Chairman Ben Bernanke's testimony, "The Economic Outlook and the Federal Budget Situation", Before the Committee on the Budget, U.S. House of Representatives.

Here is the CSpan feed

Here is the CNBC video feed.

Prepared testimony: The Economic Outlook and the Federal Budget Situation

Weekly Initial Unemployment Claims decline to 367,000

by Calculated Risk on 2/02/2012 08:30:00 AM

The DOL reports:

In the week ending January 28, the advance figure for seasonally adjusted initial claims was 367,000, a decrease of 12,000 from the previous week's revised figure of 379,000. The 4-week moving average was 375,750, a decrease of 2,000 from the previous week's revised average of 377,750.The previous week was revised up to 379,000 from 377,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 375,750.

The 4-week moving average remains below 400,000.

And here is a long term graph of weekly claims:

Weekly claims have been bouncing around lately - January is a period with large seasonal adjustments and that can lead to some large swings. The 4-week average of weekly claims has been moving sideways this year after trending down over the last few months of 2011.