by Calculated Risk on 11/23/2011 12:01:00 AM

Wednesday, November 23, 2011

Mortgage Servicer Settlement Update

Still no hint of timing ...

From Ruth Simon and Nick Timiraos at the WSJ: Foreclosure Talks Push Ahead Absent California

Bank representatives and government officials are working on a broad settlement of most state and federal foreclosure-practices investigations that could move forward without the participation of California ... Negotiators are continuing to make a push to persuade California to join a settlement valued at $25 billion among federal officials, state attorneys general and the nation's five largest mortgage servicers ... The dollar value would include the value of principal write-downs, interest-rate reductions and other benefits to homeowners as well as cash penalties.There are about 4 million seriously delinquent loans - about 1.8 million 90+ days delinquent, but not in foreclosure, and another 2.2 million in the foreclosure process - and this number has only been declining slowly. If and when this agreement is reached, there will probably be a significant increase in both completed foreclosures and in modifications - both reducing the number of seriously delinquent loans.

Tuesday, November 22, 2011

FDIC-insured institutions’ 1-4 Family Real Estate Owned (REO) decreased in Q3

by Calculated Risk on 11/22/2011 08:29:00 PM

The FDIC released the Quarterly Banking Profile today for Q3. The report showed that 1-4 family Real Estate Owned (REO) by FDIC insured institutions declined to $11.9 billion in Q3, from $12.1 billion in Q2 - and from a record $14.76 billion in Q3 2010.

As economist Tom Lawler has pointed out before, the FDIC does not collect data on the number of properties held by FDIC-insured institutions, instead they aggregate the carrying value of 1-4 family residential REO on FDIC-insured institutions’ balance sheets.

Using an average of $150,000 per unit would suggest the number of 1-4 family REOs declined from 80,597 in Q2 to 79,335 in Q3.

Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The left scale is the dollars reported in the FDIC Quarterly Banking Profile, and the right scale is an estimate of REOs using an average of $150,000 per unit. Using this estimate for the average per REO gives 79.3 thousand REO at the end of Q3.

Note: FDIC insured institutions have other REO and this is just the 1-4 family residential REO (other REO includes Construction & Development, Multi-family, Commercial, Farm Land).

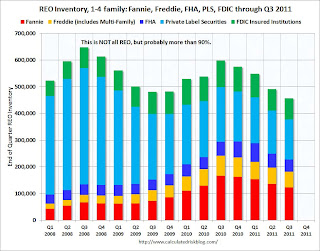

Of course this is just a small portion of the total 1-4 family REO. Here is a graph showing REO inventory for Fannie, Freddie, FHA1, Private Label Securities (PLS), and FDIC insured institutions. (economist Tom Lawler has provided some of this data).

The Fannie, Freddie, FHA, PLS, FDIC REO decreased to about 460,000 in Q3 from just under 500,000 in Q2.

The Fannie, Freddie, FHA, PLS, FDIC REO decreased to about 460,000 in Q3 from just under 500,000 in Q2.

1 Note: FHA inventory is for August.

As Tom Lawler has noted: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the 1-4 family REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is just around 510,000 in Q3.

Important: REO inventories have declined over the last year. This is a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process. There are many more foreclosures coming - see my post earlier this month Housing: REO and Mortgage Delinquencies.

Fed outlines new bank supervisory stress test

by Calculated Risk on 11/22/2011 04:40:00 PM

From the WSJ: Fed Outlines Plans for New Bank Stress Tests

The Federal Reserve on Tuesday outlined plans for annual tests of the financial strength of the largest U.S. banks and said some of the results would be made public.Here is the press release from the Federal Reserve.

Banks must submit their plans to the Fed by Jan. 9 for the "stress tests," which apply to 19 firms that participated in similar tests earlier this year and 12 more with at least $50 billion in assets that have not participated in similar tests before ... When the stress tests are complete, the Fed said it will publicly disclose its estimates of bank revenue and losses and estimates of bank capital ratios for the 19 largest firms.

The stress test scenario is outlined here. The stress tests assume the unemployment rate will rise to 13% in 2013, that the Dow Jones (update: Dow Jones Total Stock Market Index) will decline by more than 50% from the current level. The scenario assumes that house prices will fall another 20%+.

Click on graph for larger image.

Click on graph for larger image.This graphs shows the stress test scenarios for the Dow Jones and a house price index.

This scenario shows the Dow Jones Total Stock Market Index falling to 5,668 in Q4 2012 (from 11,771.86 at the end of Q3), and house prices declining until early 2014 - and off almost 47% from the peak in 2006.

ATA Trucking Index increased 0.5% in October

by Calculated Risk on 11/22/2011 03:27:00 PM

From ATA: ATA Truck Tonnage Index Rose 0.5% in October

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 0.5% in October after rising a revised 1.5% in September 2011. September’s increase was slightly less than the 1.6% gain ATA reported on October 25, 2011. The latest gain put the SA index at 116.3 (2000=100) in October, up from the September level of 115.8.

Compared with October 2010, SA tonnage was up 5.7%. In September, the tonnage index was 5.8% above a year earlier. Further, October’s tonnage reading was just 4.4% below the index’s all-time high in January 2005.

“Tonnage readings continue to show that economy is growing and not sliding back into recession,” ATA Chief Economist Bob Costello said. “Over the last two months, tonnage is up nearly 2% and is just shy of the recent high in January of this year.”

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.This index has started increasing again after stalling earlier this year - however this is still fairly sluggish growth.

FOMC Minutes: Discussion of providing "likely future path of the target federal funds rate"

by Calculated Risk on 11/22/2011 01:57:00 PM

From the Fed: Minutes of the Federal Open Market Committee, November 1-2, 2011. Excerpts:

Regarding their overall outlook for economic activity, participants generally agreed that, even with the positive news received over the intermeeting period, the most probable outcome was a moderate pace of economic growth over the medium run with only a gradual decline in the unemployment rate. While some factors were seen as likely to support growth going forward--such as pent-up demand, improvements in household and business balance sheets, and accommodative monetary policy--participants observed that the pace of economic recovery would likely continue to be held down for some time by persistent headwinds. In particular, they pointed to very low levels of consumer and business confidence, further efforts by households to deleverage, cutbacks at all levels of government, elevated financial market volatility, still-tight credit conditions for some households and small businesses, and the ongoing weakness in the labor and housing markets. While recent incoming data suggested reduced odds that the economy would slide back into recession, participants still saw significant downside risks to the outlook for economic growth. Risks included potential spillovers to U.S. financial markets and institutions, and so to the broader U.S. economy, if the European debt and banking crisis were to worsen significantly. In addition, participants noted the risk of a larger-than-expected fiscal tightening and the possibility that structural problems in the housing market had attenuated the transmission of monetary policy actions to the real economy. It was also noted that the extended period of highly accommodative monetary policy could eventually lead to a buildup of financial imbalances. A few participants, however, mentioned the possibility that economic growth could be more rapid than currently expected, particularly if gains in output and employment led to a virtuous cycle of improvements in household balance sheets, increased confidence, and easier credit conditions.And there was discussion about communication:

The staff gave a presentation on alternative monetary policy strategies, and meeting participants discussed those alternatives as well as potential approaches for enhancing the clarity of their public communications. No decision was made at this meeting to change the Committee's policy strategy or communications. It was noted that many central banks around the world pursue an explicit inflation objective, maintain flexibility to stabilize economic activity, and seek to communicate their forecasts and policy plans as clearly as possible. Many participants pointed to the merits of specifying an explicit longer-run inflation goal, but it was noted that such a step could be misperceived as placing greater weight on price stability than on maximum employment; consequently, some suggested that a numerical inflation goal would need to be set forth within a context that clearly underscored the Committee's commitment to fostering both parts of its dual mandate. More broadly, a majority of participants agreed that it could be beneficial to formulate and publish a statement that would elucidate the Committee's policy approach, and participants generally expressed interest in providing additional information to the public about the likely future path of the target federal funds rate. The Chairman asked the subcommittee on communications to give consideration to a possible statement of the Committee's longer-run goals and policy strategy, and he also encouraged the subcommittee to explore potential approaches for incorporating information about participants' assessments of appropriate monetary policy into the Summary of Economic Projections.There were concerns about targeting nominal GDP:

The Committee also considered policy strategies that would involve the use of an intermediate target such as nominal gross domestic product (GDP) or the price level. The staff presented model simulations that suggested that nominal GDP targeting could, in principle, be helpful in promoting a stronger economic recovery in a context of longer-run price stability. Other simulations suggested that the single-minded pursuit of a price-level target would not be very effective in fostering maximum sustainable employment; it was noted, however, that price-level targeting where the central bank maintained flexibility to stabilize economic activity over the short term could generate economic outcomes that would be more consistent with the dual mandate. More broadly, a number of participants expressed concern that switching to a new policy framework could heighten uncertainty about future monetary policy, risk unmooring longer-term inflation expectations, or fail to address risks to financial stability.

State Unemployment Rates "little changed or slightly lower" in October

by Calculated Risk on 11/22/2011 10:52:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed or slightly lower in October. Thirty-six states and the District of Columbia recorded unemployment rate decreases, five states posted rate increases, and nine states had no rate change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state finally has some blue - indicating no state is currently at the maximum during the recession.

...

Nevada continued to record the highest unemployment rate among the states, 13.4 percent in October. California posted the next highest rate, 11.7 percent. North Dakota registered the lowest jobless rate, 3.5 percent, followed by Nebraska, 4.2

percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

From the BLS: "Forty-five states recorded unemployment rates that were not appreciably different from those of a year earlier."

The fact that 45 states have seen little or no improvement over the last year is a reminder that the unemployment crisis is ongoing.

Richmond Fed: Manufacturing activity stabilized in November

by Calculated Risk on 11/22/2011 10:06:00 AM

From the Richmond Fed: Manufacturing Activity Steadied in November; Expectations Were Upbeat

Manufacturing activity in the central Atlantic region stabilized in November following four months of contraction, according to the Richmond Fed's latest survey ... In November, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — increased six points to 0 from October's reading of −6. Among the index's components, shipments gained seven points to 1, while new orders edged up three points to finish at −2 and the jobs index steadied, moving up seven points to 0.This was slightly above consensus.

Labor market conditions changed little at District plants in November. Both the manufacturing employment and average workweek indexes registered a reading of 0, moving up seven points and one point, respectively. Wage growth doubled, picking up five points to finish at 10.

In our November survey, our contacts were more bullish about their business prospects for the next six months. The index of expected shipments increased eight points to 36, and expected orders jumped twelve points to finish at 37. ...

District manufacturers' hiring plans were more upbeat in November. The expected manufacturing employment index gained nine points to 22, while the average workweek indicator held constant at 3. In addition, the index of expected wages moved up nine points to 28.

Richmond and New York (Empire state) have been the two weakest regions, and both showed stabilization in November - but still not expansion.

Q3 real GDP growth revised down to 2.0% annualized rate

by Calculated Risk on 11/22/2011 08:52:00 AM

From the BEA: Gross Domestic Product, Second Quarter 2011 (second estimate

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.0 percent in the third quarter of 2011 (that is, from the second quarter to the third quarter) according to the "second" estimate released by the Bureau of Economic Analysis.This was revised down from 2.5% and below the consensus of 2.4%.

The downward revisions was mostly due to a large decline in the "change in real private inventories " - this subtracted 1.55 percentage points from the third-quarter change in real GDP (second estimate) as opposed to 1.08 percentage points in the advance estimate. Final domestic demand was mostly unchanged (the inventories will probably reverse in Q4). Still sluggish growth ...

WSJ: BofA warned by regulators

by Calculated Risk on 11/22/2011 12:35:00 AM

From the WSJ: BofA Warned to Get Stronger

Bank of America Corp.'s board has been told that the company could face a public enforcement action if regulators aren't satisfied with recent steps taken to strengthen the bank ... The nation's second-largest lender has been operating under a memorandum of understanding since May 2009 ... In recent months, regulators met with Bank of America's board and said they wanted to see more progress ... Otherwise the informal order could turn into a formal and public action ...This would be a huge addition to the "Unofficial" problem bank list (We only include banks operating under a formal action on the list). A formal action would mean greater restrictions - and would bring more negative publicity to the bank.

Earlier:

• Existing Home Sales in October: 4.97 million SAAR, 8.0 months of supply

• Existing Home Sales: More on Inventory and NSA Sales Graph

• Existing Home Sales graphs

Monday, November 21, 2011

Housekeeping: New CR iPad Layout

by Calculated Risk on 11/21/2011 08:46:00 PM

Just a quick note - for anyone accessing Calculatedriskblog via an iPad, I'm trying out some new software with a customized tablet layout. I'll be adding smart phone software soon ...

Earlier:

• Existing Home Sales in October: 4.97 million SAAR, 8.0 months of supply

• Existing Home Sales: More on Inventory and NSA Sales Graph

• Existing Home Sales graphs