by Calculated Risk on 10/31/2011 10:27:00 PM

Monday, October 31, 2011

Gasoline Price Update

The graph below shows gasoline prices have been slowly moving down since peaking in early May.

Unfortunately, according to Bloomberg, Brent Crude is up to $109.12 per barrel, and WTI is up to $92.83.

According to the EIA, WTI is up from $79 per barrel at the end of September, and Brent is up from $105. It appears the gap between WTI and Brent is closing.

Note: This graph show oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Europe: Greece to Hold Referendum on Debt Deal in December or January

by Calculated Risk on 10/31/2011 06:14:00 PM

This was announced earlier today, but this story has the timing. From the NY Times: Greece to Hold Referendum on New Debt Deal

Prime Minister George Papandreou announced Monday night that his Socialist government would hold a rare national referendum on a new debt agreement for Greece ... Mr. Papandreou said that the decision on whether to adopt the deal, which includes fresh financial assistance for the country but also imposes unpopular austerity measures, belonged to the Greek people. “Let us allow the people to have the last word, let them decide on the country’s fate,” he said ... Government sources said that the confidence vote was expected by the end of the week, with the referendum much later, in December or even January.So there will be a vote of confidence by the end of this week, and then a general referendum later.

The Greek 2 year yield is down to 77.7%. The Greek 1 year yield is down to 158%.

The Portuguese 2 year yield is up to 18.3% and the Irish 2 year yield is up to 8.8%.

The Spanish 10 year yield is at 5.54% and the Italian 10 year yield is up to 6.1%.

The Belgian 10 year yield is at 4.4% and the French 10 year yield is down to 3.1%.

Fannie Mae and Freddie Mac Serious Delinquency Rates mixed in September

by Calculated Risk on 10/31/2011 04:14:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 4.00% in September. This is down from 4.03% in August, and down from 4.56% in September of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.51% in September, up from 3.49% in August. This is down from 3.80% in September 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent.

Tracking this on a monthly basis this is kind of like watching paint dry, but the serious delinquency rates are generally falling - but only falling slowly. The key is the normal serious delinquency rate is under 1%, and at this pace of decline, the delinquency rate will not be back to "normal" for a number of years.

Restaurant Performance Index increased in September

by Calculated Risk on 10/31/2011 12:45:00 PM

From the National Restaurant Association: Restaurant Performance Index Rose Above 100 in September, as Sales and Traffic Levels Improved

Buoyed by stronger same-store sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) topped the 100 mark in September for the first time in three months. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.1 in September, up 0.7 percent from August and its highest level since June. In addition, September represented the first time in three months that the RPI stood above 100, the level above which signifies expansion in the index of key industry indicators.

“The September increase in the Restaurant Performance Index was fueled by improvements in the same-store sales and customer traffic indicators,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Among the forward-looking indicators, restaurant operators are more optimistic about sales growth in the months ahead, while their outlook for the overall economy remains cloudy.”

...

Restaurant operators reported stronger same-store sales in September. ... Restaurant operators also bounced back from a sluggish August performance to report net positive customer traffic levels in September.

Click on graph for larger image.

Click on graph for larger image.The index increased to 100.1 in September (abpve 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

Last month I wrote: "August was an especially weak economic month following the debt ceiling debate, and it will be interesting to see if these indicators show some rebound in September and October." This is a small rebound, but this suggests the recent dip might have been partially due to the default threat.

Dallas Fed Manufacturing Survey shows sluggish expansion

by Calculated Risk on 10/31/2011 10:30:00 AM

This is the last of the regional Fed surveys for October. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were mixed and still weak in October, but improved from August and September.

Dallas Fed: Texas Manufacturing Activity Expands

Texas factory activity increased in October, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained positive but edged down from 5.9 to 4.1, suggesting growth slowed slightly.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Other measures of current manufacturing conditions also indicated growth in October, and the pace of new orders increased. The shipments index fell from 9.4 to 2.7, suggesting shipment volumes continued to increase but at a slower pace. The capacity utilization index moved back into positive territory after being negative for two months. The new orders index suggested a pickup in demand, moving from 3.6 to 8.3. ...

Perceptions of general business conditions improved in October. The general business activity index jumped up from -14.4 to 2.3, its first positive reading in six months. The company outlook index also rose markedly, bouncing back to a reading of 7.2 after coming in near zero in September.

Labor market indicators reflected higher labor demand growth. The employment index came in at 15.1, up slightly from 13.4 in September.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

The ISM index for October will be released Tuesday, Nov 1st and this suggests another fairly weak reading in October. The consensus is for a slight increase to 52.0 from 51.6 in September.

Chicago PMI at 58.4, down from 60.4 in September

by Calculated Risk on 10/31/2011 09:45:00 AM

From the Chicago ISM Chicago Business Barometer™ Stabilized:

The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER stabilized in October. The Business Barometer marked a 25th month of expansion, yet the 3 month moving average for the barometer fell for the 7th consecutive month. Monthly changes in the individual Business Activity components were generally modest with all but one component converging towards their 3 month moving averages.The overall index decreased to 58.4 from 60.4 in September. This was close to consensus expectations of 58.0.

Note: any number above 50 shows expansion.

The employment index increased to 62.3 from 60.6. "EMPLOYMENT highest in 6-months"

The new orders index decreased to 61.3 from 65.3. "NEW ORDERS erased half of September's gain"

Weekend:

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th

• FOMC Meeting Preview

Mario Draghi takes over at ECB tomorrow, FT Cartoon

by Calculated Risk on 10/31/2011 08:51:00 AM

A cartoon from the FT Alphaville: E*C*B

[This] appears on page 8 of the FT’s UK print edition. It’s like one of them Renaissance allegory paintings ... Interpretations welcome.

I'm not sure about the meaning, but I liked the play on M*A*S*H.

Maybe this has something to do with Mario Draghi taking over at the ECB tomorrow. Although the ECB will obviously cut rates soon (they were caught going the wrong direction), it seems that Draghi's hands are mostly tied as far as QE.

Sunday, October 30, 2011

Sunday Night Futures: Japan Intervenes in foreign-exchange

by Calculated Risk on 10/30/2011 10:14:00 PM

From the WSJ: Japan Intervenes on Yen

[T]he Japanese government launched a new foreign-exchange intervention on Monday, Finance Minister Jun Azumi said ... The intervention came after the dollar fell to a post-World War II record low of ¥75.31 in early Asian trading.The Asian markets are mixed tonight. The Nikkei is up 0.75%, the Hang Seng is down slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is down about 5 points, and Dow futures are down about 40 points.

Oil: WTI futures are down slightly to $93.07 and Brent is down to $109.35 per barrel.

Weekend:

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th

• FOMC Meeting Preview

Recovery Measures

by Calculated Risk on 10/30/2011 05:33:00 PM

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that most major indicators are still way below the pre-recession peaks.

Click on graph for larger image.

Click on graph for larger image.

This graph is for real GDP through Q3 2011 and shows real GDP is finally back to the pre-recession peak. Gross Domestic Income (not shown) returned to the pre-recession peak in Q2 - GDI for Q3 will be released with the 2nd estimate of GDP. (For a discussion of GDI, see here).

At the worst point, real GDP was off 5.1% from the 2007 peak. Real GDI was off 5.7% at the trough.

And real GDP has performed better than other indicators ...

And real GDP has performed better than other indicators ...

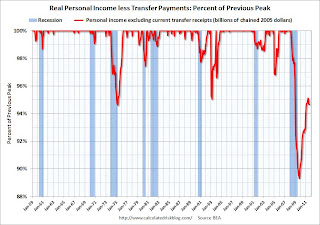

This graph shows real personal income less transfer payments as a percent of the previous peak through September.

This measure was off almost 11% at the trough!

Real personal income less transfer payments is still 5.3% below the previous peak and has declined over the last three months.

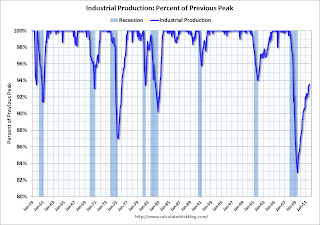

This graph is for industrial production through September.

This graph is for industrial production through September.

Industrial production had been one of the stronger performing sectors because of inventory restocking and some growth in exports.

However industrial production is still 6.5% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 4.8% below the pre-recession peak.

This shows that the recovery in all indicators has been very sluggish compared to recent recessions.

Yesterday:

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th

FOMC Meeting Preview

by Calculated Risk on 10/30/2011 01:55:00 PM

There will be a two day meeting of the Federal Open Market Committee (FOMC) this coming Tuesday and Wednesday. I expect no changes to the Fed Funds rate, or to the recently announced program to "extend the average maturity of its holdings of securities" (scheduled to end in June 2012), or to the program to "reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities".

The FOMC statement will be released at 12:30PM and Fed Chairman Ben Bernanke will hold a quarterly press briefing at 2:15 PM ET.

A couple of things to look for:

1) Fed Chairman Press Briefing. This is the third of the new press briefings. At the press briefing, Chairman Bernanke will discuss the new FOMC forecasts (these forecasts used to be released a few weeks after the FOMC meeting with the minutes). Growth forecasts have surely been revised down since June, the unemployment rate revised up, and inflation forecasts have been revised up.

Mr. Bernanke will probably also discuss some other policy options. I expect he will be asked about the possibility of a large scale MBS purchase program (as recently discussed by Fed Vice Chairman Janet Yellen, NY Fed President William Dudley, and Fed Governor Daniel Tarullo).

Here are the updated forecasts through June. The FOMC GDP forecasts for 2011 have been revised down all year, and will probably be revised down to the 1.5% to 2.0% range. The forecast for 2012 will probably be revised down again too.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 3.4 to 3.9 | 3.5 to 4.4 | 3.7 to 4.6 |

| April 2011 Projections | 3.1 to 3.3 | 3.5 to 4.2 | 3.5 to 4.3 |

| June 2011 Projections | 2.7 to 2.9 | 3.3 to 3.7 | 3.5 to 4.2 |

| November 2011 Projections | ??? | ??? | ??? |

The unemployment rate was revised down in April, but was revised back up in June. This will probably be revised up to around 9.0% to 9.2% in the November forecast. The forecasts for the unemployment rate in 2012 and 2013 will also be key. In June, the FOMC expected the unemployment rate to be in the 7.0% to 7.5% in Q4 2013 (still high), and this forecast will probably be revised up again.

Note: The first forecast for 2014 will be included too.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 8.8 to 9.0 | 7.6 to 8.1 | 6.8 to 7.2 |

| April 2011 Projections | 8.4 to 8.7 | 7.6 to 7.9 | 6.8 to 7.2 |

| June 2011 Projections | 8.6 to 8.9 | 7.8 to 8.2 | 7.0 to 7.5 |

| November 2011 Projections | ??? | ??? | ??? |

The forecasts for overall and core inflation have been revised up all year and will probably be revised up again in November (PCE inflation will probably be revised up close to 3% and core PCE inflation close to 2%).

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 1.3 to 1.7 | 1.0 to 1.9 | 1.2 to 2.0 |

| April 2011 Projections | 2.1 to 2.8 | 1.2 to 2.0 | 1.4 to 2.0 |

| June 2011 Projections | 2.3 to 2.5 | 1.5 to 2.0 | 1.5 to 2.0 |

| November 2011 Projections | ??? | ??? | ??? |

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 1.0 to 1.3 | 1.0 to 1.5 | 1.2 to 2.0 |

| April 2011 Projections | 1.3 to 1.6 | 1.3 to 1.8 | 1.4 to 2.0 |

| June 2011 Projections | 1.5 to 1.8 | 1.4 to 2.0 | 1.4 to 2.0 |

| November 2011 Projections | ??? | ??? | ??? |

2) Possible Statement Changes. The incoming data has been marginally better since the September meeting, so we might see some wording changes. I don't expect the key sentence "The Committee ... currently anticipates that economic conditions ... are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013" to be changed any time soon.

There will probably be some changes to the first paragraph to mention the recent improvement in economic data. I expect the phrase "Household spending has been increasing at only a modest pace" to be upgraded a little.

In the second paragraph, the sentence "there are significant downside risks to the economic outlook, including strains in global financial markets" might also be upgraded a little. There might be some other minor upgrades, but overall the statement will probably be pretty similar to the September statement.

I expect the focus will be on the press briefing and the FOMC forecasts.

Yesterday:

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th