by Calculated Risk on 10/19/2011 09:35:00 PM

Wednesday, October 19, 2011

Europe Update: Prepare to be underwhelmed

A few articles ahead of the meeting this weekend ...

From the Financial Times: Eurozone leaders meet in Frankfurt

France’s president Nicolas Sarkozy flew to Frankfurt on Wednesday night for an emergency meeting with leading players in the eurozone crisis including German chancellor Angela Merkel, as Franco-German differences bedevilled attempts to agree a comprehensive package of measures.From the NY Times: Leaders in Europe Take Time From a Farewell to Negotiate a Bailout Deal

excerpt with permission

Angela Merkel, the chancellor of Germany, tried to play down expectations, saying that it would not be possible “to erase the mistakes of the past in just one stroke.” A European summit meeting Sunday ... will be just “one point” in “a long journey.”From the WSJ: Doubts Grow on Euro Fund

European officials are discussing a scenario in which governments issuing bonds would borrow from the bailout fund to guarantee a portion of the bond issues—a move that would increase debts for already troubled economies.And from the Financial Times: EU bank recap could be only €80bn. The IMF was calling for a €200bn plan, and some estimates were for €275bn. Maybe they should do another stress test and announce all the banks passed - that has worked well before - Not!

Pressure is rising ahead of a weekend summit of European leaders billed as critical to stemming the region's deepening debt crisis.

Earlier:

• Housing Starts increased in September

• Rate of increase slows for Key Measures of Inflation in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

LA Port Traffic in September: Exports increase year-over-year, Imports Down

by Calculated Risk on 10/19/2011 06:13:00 PM

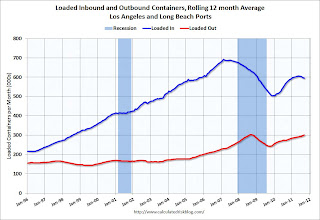

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for August. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a rolling 12 month basis, inbound traffic is down 0.3% from August, and outbound traffic is up 0.9%.

Inbound traffic is "rolling over" and this might suggest that retailers are cautious about the coming holiday season. However, the National Retail Federation says that imports will be pick up in October:

[T]he [import] statistics were skewed because of high-than-normal numbers in 2010 when fears of shortages in shipping capacity caused many retailers to bring holiday merchandise into the country earlier than usual.The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

...

“After a summer of trying to compare apples to oranges, retail cargo is back to normal [in October],” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “October is the historic peak of the shipping cycle each year, and retailers are bringing merchandise into the country on their usual schedule and at normal levels again instead of being forced to move cargo early."

For the month of September, loaded inbound traffic was down 4% compared to September 2010, and loaded outbound traffic was up 12% compared to September 2010.

For the month of September, loaded inbound traffic was down 4% compared to September 2010, and loaded outbound traffic was up 12% compared to September 2010. Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but are still below the peak in 2008.

Imports have been soft - this is the 4th month in a row with a year-over-year decline in imports. However, if the NRF is correct, imports will pick up in October to the highest level this year.

Merle Hazard: "Diamond Jim"

by Calculated Risk on 10/19/2011 04:03:00 PM

Earlier:

• Housing Starts increased in September

• Rate of increase slows for Key Measures of Inflation in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

A new song from blog favorite Merle Hazard about banking regulation. A creative joint venture of Merle Hazard & Marcy Shaffer (see Marcy's site for lyrics). Song by Merle Hazard, Marcy Shaffer and Curtis Threadneedle.

And from Paul Solman at the PBS NewsHour site, including a link to his 12 1/2 minute interview with former IMF chief economist Simon Johnson, discussing the song.

Fed's Beige Book: Pace of economic growth "modest" or "slight""

by Calculated Risk on 10/19/2011 02:00:00 PM

Reports from the twelve Federal Reserve Districts indicate that overall economic activity continued to expand in September, although many Districts described the pace of growth as "modest" or "slight" and contacts generally noted weaker or less certain outlooks for business conditions. The reports suggest that consumer spending was up slightly in most Districts, with auto sales and tourism leading the way in several of them. Business spending increased somewhat, particularly for construction and mining equipment and auto dealer inventories, but many Districts noted restraint in hiring and capital spending plans.And on real estate:

...

Consumer spending was up slightly in September. The majority of Districts reported increases in auto sales, with the largest improvements in San Francisco and New York.

...

Respondents indicated that labor market conditions were little changed, on balance, in September. ... Most Districts reported that wage pressures remained subdued.

All twelve Districts reported that real estate and construction activity was little changed on balance from the prior report. Residential construction remained at low levels, particularly for single-family homes. That said, Philadelphia, Cleveland, and Minneapolis noted small increases in single-family construction, and construction of multifamily dwellings continued to increase at a moderate pace in Boston, Philadelphia, Cleveland, Kansas City, Dallas, and San Francisco. Home sales remained weak overall, and home prices were reported to be either flat or declining across all of the Districts. In contrast, rental demand continued to rise in a number of Districts.This was based on data gathered on or before October 7th. More sluggish growth ...

Commercial real estate conditions remained weak overall, although commercial construction increased at a slow pace in most Districts.

Earlier:

• Housing Starts increased in September

• Rate of increase slows for Key Measures of Inflation in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

Rate of increase slows for Key Measures of Inflation in September

by Calculated Risk on 10/19/2011 01:06:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in September on a seasonally adjusted basis ... The index for all items less food and energy increased 0.1 percent in September, its smallest increase since March.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in September. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.5% annualized rate) during the month.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for September here.

Over the last 12 months, the median CPI rose 2.1%, the trimmed-mean CPI rose 2.5%, the CPI rose 3.9%, and the CPI less food and energy rose 2.0%

On a year-over-year basis, these measures of inflation are increasing, and are around the Fed's target.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.On a monthly basis, the median Consumer Price Index increased 2.3% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 2.5% annualized in July, and core CPI increased 0.7% annualized.

These key price measures increased at a lower rate than in August.

Earlier:

• Housing Starts increased in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase