by Calculated Risk on 10/18/2011 06:10:00 PM

Tuesday, October 18, 2011

Housing: A comment on Shadow Inventory

Several readers have sent me an article by Toluse Olorunnipa at McClatchy Newspapers: Millions of homes lurk on bank inventories, casting doubts of rebound

This article is decent if you understand the numbers (ignore the headline). Unfortunately some commentary about this article is wrong.

First, what is "shadow inventory"? There are different definitions for shadow inventory, but this is usually considered inventory that will be coming on the market soon, but is NOT currently listed for sale. Inventory that is listed for sale is "visible inventory".

An all encompassing definition of shadow inventory would probably include bank owned property (Real Estate Owned), properties in the foreclosure process, other properties with delinquent mortgages (both serious delinquencies of over 90+ days, and less serious), condos that were converted to apartments (and will be converted back), investor owned rental properties, and homeowners "waiting for a better market", and a few other categories - as long as the properties were not currently listed for sale. But many of these properties will not come on the market for several years, and that isn't exactly "soon".

A more conservative estimate would just be the number of 90+ day delinquencies, properties in-foreclosure and REOs not currently listed for sale. That is CoreLogic's approach - they compare the addresses of REO and delinquent properties with current listings and at the end of Q2 CoreLogic reported:

Of the 1.6 million properties currently in the shadow inventory, 770,000 units are seriously delinquent, 430,000 are in some stage of foreclosure and 390,000 are already in REO.Now compare those numbers to the McClatchy article:

Calculating the size of the shadow market has proved difficult, and estimates range from 1.6 million to 7 million homes.The first number appears to come from RealtyTrac. This number is too high. The total REO is probably lower and a number of those are listed for sale. As the McClatchy article notes:

...

The McClatchy analysis found the following shadow inventory:

* 644,000 houses already owned by lenders but not yet for sale.

* 2.2 million homes whose owners have received initial foreclosure notices or notices of default but haven't yet been foreclosed on.

* 1.9 million properties whose owners are 90 days or more behind on their payments but haven't yet been served with foreclosure notices.

... Fannie Mae, Freddie Mac and the Federal Housing Administration hold about 250,000 homes. ... at least 100,000 of those aren't yet on the marketThat suggests close to 150,000 are listed for sale for just Fannie, Freddie and the FHA. The 250,000 is based on the same sources I use, and we can see how CoreLogic came up with the 390,000 REO not listed for sale.

The in-foreclosure and seriously delinquent numbers come from LPS Applied Analytics most recent report for August. LPS reported in August that there were:

• 1.87 million loans 90+ days delinquent.

• 2.15 million loans in foreclosure process.

That is just over 4 million loans, but many of these are listed for sale and are not "shadow inventory". The McClatchy article incorrectly stated they were all "shadown inventory".

CoreLogic estimated that 430,000 of the in-foreclosure properties are not listed for sale, and 770,000 of the 90+ day delinquent properties are not listed for sale. Note: CoreLogic compares addresses of delinquent properties with listed properties.

CoreLogic's estimate might be low (their estimate seems reasonable based on their definition), but the range given in the article of "1.6 million to 7 million homes" of shadow inventory is absurd. The only way to get to 7 million is to add the 'less than' 90 day delinquencies (2.38 million loans), 90+ day delinquencies (1.87 million loans), in-foreclosure (2.15 million loans) and total REO (and their estimate for REO is too high). And that ignores the visible inventory and that a certain percentage of loans will cure - especially for the shorter delinquency loans.

Although this article is a decent overview of several housing issues, it is unfortunately misleading and contains obvious errors. The "644,000 houses already owned by lenders but not yet for sale" appears too high. And the article incorrectly includes all of the properties in-foreclosure and with seriously delinquent loans as "shadow inventory" even though many are listed for sale.

Housing: A comment on Builder Confidence

by Calculated Risk on 10/18/2011 03:55:00 PM

A few comments ... We have to remember that the increase in October builder confidence, released this morning by the NAHB, is just one month of survey responses and could be noise.

Also, a reading of 18 is still very low. Before the current housing bust, the record low for the builder confidence survey was 20 in 1991 - and that was considered very depressed.

But we also to have remember that housing will not be depressed forever. As the excess supply of vacant housing units is absorbed, the home builders will start building more homes. The excess vacant supply isn't spread evenly geographically. Some areas have a large supply; other areas are probably getting close to exhausting the local excess supply.

Earlier this year, economist Tom Lawler estimated the national excess vacant supply was "in the 1.6 to 1.7 million range" as of April 1, 2010 (using the Census 2010 data). I came up with a similar estimate on a state by state basis: The Excess Vacant Housing Supply (see post for table).

These estimates were for April 1, 2010; about 18 months ago. The population is still growing and the economy is adding jobs (slowly), and the U.S. is adding households. At the same time, the builders delivered a record low number of housing units last year - and will probably break that record again this year. With more households, and few units being added, the excess supply is probably declining fairly rapidly.

Unfortunately there is no timely estimate of household formation. Note: the Freddie Mac chief economist put out an esimtate yesterday for household formation, but that was based on the HVS - and that is not an accurate survey for household formation.

So at some point we'd expect pockets of improvement. As I noted, the increase in October might just be noise, but it also might indicate some areas are improving slightly. If the latter, the survey should show further increases - and housing starts should begin to pick up too (the builder survey was for October, so we will have to wait until the October housing starts are released to see if there is any related increase in starts, seasonally adjusted).

Finally, it is important to distinguish between the large number of houses with seriously delinquent mortgages and the excess vacant housing supply. Some people might assume that new home sales will not pick up until the number of delinquent mortgages declines to normal. That is not correct. Most of the houses with seriously delinquent mortgages are occupied, and the units that are vacant are included in the above estimates of the excess supply. The large number of delinquent loans - and loans in the foreclosure process - will keep pressure on house prices for some time, but that is a different issue. Building will pick up as the excess supply is exhausted in each area.

So maybe the increase in confidence indicates the excess supply has been absorbed in a few areas - or maybe it was just noise. We will have to watch and see.

DataQuick: California Foreclosure Activity Back Up

by Calculated Risk on 10/18/2011 02:50:00 PM

From DataQuick: California Foreclosure Activity Back Up

A total of 71,275 Notices of Default (NoDs) were recorded at county recorders offices during the third quarter. That was up 25.9 percent from 56,633 for the prior three months, and down 14.4 percent from 83,261 in third-quarter 2010, according to San Diego-based DataQuick.Some of this increase was due to the surge in filings by BofA in August.

Last quarter's 71,275 NoDs, which mark the first step in the formal foreclosure process, jumped back to levels seen earlier this year and late last year. Lenders filed 68,239 NoDs during first-quarter 2011 and 69,799 in fourth-quarter 2010. NoDs peaked in first-quarter 2009 at 135,431.

...

"The way it looks right now, it's reasonable to expect default filings to run at a somewhat higher level than we saw earlier this year," [John Walsh, DataQuick president] said. "Obviously, some lenders and loan servicers have begun to plow through their backlogs of delinquent loans more aggressively."

Most of the loans going into default are still from the 2005-2007 period: the median origination quarter for defaulted loans is still third-quarter 2006. That has been the case for almost three years, indicating that weak underwriting standards peaked then.

And on completed foreclosures:

Trustees Deeds recorded (TDs), or the actual loss of a home to foreclosure, totaled 38,895 during the third quarter. That was down 8.4 percent from 42,465 for the prior quarter, and down 14.3 percent from 45,377 for third-quarter 2010. The all-time peak was 79,511 in third-quarter 2008. The state's all-time low was 637 in the second quarter of 2005, DataQuick reported.California is a non-judicial state, and it still takes an average of 10 months to foreclose after the Notice of Default is filed (the shortest possible period is 3 months and 21 days).

...

On average, homes foreclosed on last quarter took 9.9 months to wind their way through the formal foreclosure process, beginning with an NoD. That's about even with 10 months in the prior quarter but up from 8.7 months a year earlier.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the annual Notices of Default (NODs) filed in California. The current year was estimated at the total for Q1 through Q3, plus Q4 the same as Q3.

California had a significant housing bust in the early '90s, with defaults peaking - and prices bottoming - in 1996. That bust was mild compared to the recent housing bust - and defaults are still way above the 1996 peak.

Bernanke: Effects of the Great Recession on Central Bank Doctrine and Practice

by Calculated Risk on 10/18/2011 01:15:00 PM

From Fed Chairman Ben Bernanke: Effects of the Great Recession on Central Bank Doctrine and PracticeA few excerpts:

My guess is that the current framework for monetary policy--with innovations, no doubt, to further improve the ability of central banks to communicate with the public--will remain the standard approach, as its benefits in terms of macroeconomic stabilization have been demonstrated. However, central banks are also heeding the broader lesson, that the maintenance of financial stability is an equally critical responsibility. Central banks certainly did not ignore issues of financial stability in the decades before the recent crisis, but financial stability policy was often viewed as the junior partner to monetary policy. One of the most important legacies of the crisis will be the restoration of financial stability policy to co-equal status with monetary policy.In other words, the Fed did not pay enough attention to regulation, and allowed the banks to engage in risky practices with far too much leverage.

The financial crisis of 2008 and 2009 will leave a lasting imprint on the theory and practice of central banking. With respect to monetary policy, the basic principles of flexible inflation targeting--the commitment to a medium-term inflation objective, the flexibility to address deviations from full employment, and an emphasis on communication and transparency--seem destined to survive. However, following a much older tradition of central banking, the crisis has forcefully reminded us that the responsibility of central banks to protect financial stability is at least as important as the responsibility to use monetary policy effectively in the pursuit of macroeconomic objectives.

NAHB Builder Confidence index increases in October

by Calculated Risk on 10/18/2011 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased in October to 18 from 14 in September. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Home Builder Confidence Rises Four Points in October

Builder confidence in the market for newly built, single-family homes rose four points to 18 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for October, which was released today. This is the largest one-month gain the index has seen since the home buyer tax credit program helped spur the market in April of 2010.

"Builder confidence regained some ground in October due to modest improvements in buyer interest in select markets where economic recovery is starting to take hold and where foreclosure activity has remained comparatively subdued," said NAHB Chairman Bob Nielsen, a home builder from Reno, Nev.

...

"This latest boost in builder confidence is a good sign that some pockets of recovery are starting to emerge across the country as extremely favorable interest rates and prices catch consumers' attention," said NAHB Chief Economist David Crowe. "However, it's worth noting that while some builders have shifted their assessment of market conditions from 'poor' to 'fair,' relatively few have shifted their assessments from 'fair' to 'good.' One reason is that builders are facing downward pricing pressures from foreclosed homes at the same time that building materials costs are rising, and this is further squeezing already tight margins."

...

Each of the HMI's three component indexes recorded substantial gains in October. The component gauging current sales conditions rose four points to 18, the component gauging sales expectations in the next six months rose seven points to 24, and the component gauging traffic of prospective buyers rose three points to 14.

Regionally, the West led all other areas of the country with its nine-point gain to 21 – the highest HMI score for that region since August of 2007. The Midwest and South each recorded four-point gains, to 15 and 19, respectively, while the Northeast held unchanged at 15.

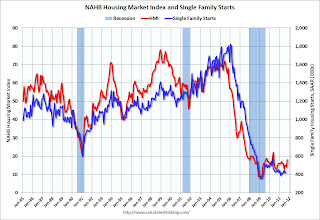

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts (September housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years. This is still very low, but this is the highest level since early 2010 - and that boost was due to the housing tax credit.