by Calculated Risk on 10/06/2011 12:21:00 PM

Thursday, October 06, 2011

Freddie Mac: Mortgage Rates below 4%

Another record ... from Freddie Mac: 30-Year Fixed Mortgage Rate Falls Below 4 Percent

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the average rate for the conventional 30-year fixed mortgage dropping below 4 percent for the first time in history amid increasing global economic concerns. The 15-year fixed, a popular refinancing option, also fell to the lowest level on record for the sixth consecutive week.

...

"Average 30-year conventional fixed mortgage rates fell below 4 percent for the first time in history this week following a sharp drop in 10-year Treasuries early in the week as concerns over a global recession grew. Average 15-year fixed rates fell to a record low in the PMMS as well. Interest rates for 1-year ARMs, however, rose, as the Fed began replacing $400 billion of its short-term Treasury securities, which serve as benchmarks for many ARMs." [said Frank Nothaft, vice president and chief economist, Freddie Mac]

...

30-year fixed-rate mortgage (FRM) averaged 3.94 percent with an average 0.8 point for the week ending October 6, 2011, down from last week when it averaged 4.01 percent. Last year at this time, the 30-year FRM averaged 4.27 percent.

15-year FRM this week averaged 3.26 percent with an average 0.8 point, down from last week when it averaged 3.28 percent. A year ago at this time, the 15-year FRM averaged 3.72 percent.

CoreLogic: Home Price Index declined 0.4% in August

by Calculated Risk on 10/06/2011 10:19:00 AM

Notes: This CoreLogic Home Price Index report is for August. The Case-Shiller index released last week was for July. Case-Shiller is currently the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of June, July and August (August weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® August Home Price Index Shows Month-Over-Month and Year-Over-Year Decline

CoreLogic ... today released its August Home Price Index (HPI) which shows that home prices in the U.S. decreased 0.4 percent on a month-over-month basis, the first monthly decline in four months. According to the CoreLogic HPI, national home prices, including distressed sales, also declined on a year-over-year basis by 4.4 percent in August 2011 compared to August 2010. This follows a decline of 4.8 percent in July 2011 compared to July 2010. Excluding distressed sales, year-over-year prices declined by 0.7 percent in August 2011 compared to August 2010 and by 1.7 percent in July 2011 compared to July 2010. ...

“Although the calendar says August, the end of the summer traditionally marks the beginning of ‘fall’ for the housing market as it begins to prepare for ‘winter.’ So the slight month-over-month decline was predictable, particularly given the renewed concerns over a double-dip recession, high negative equity, and the persistent levels of shadow inventory. The continued bright spot is the non-distressed segment of the market, which is only marginally lower than a year ago and continues to exhibit relative strength,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.4% in August, and is down 4.4% over the last year, and off 30.4% from the peak - and up 4.8% from the March 2011 low.

As Mark Fleming noted, some of this decrease is seasonal (the CoreLogic index is NSA). Month-to-month prices changes will probably remain negative through February or March 2012 - the normal seasonal pattern. It is likely that there will be new post-bubble lows for this index late this year or early in 2012.

Weekly Initial Unemployment Claims increase to 401,000

by Calculated Risk on 10/06/2011 08:30:00 AM

The DOL reports:

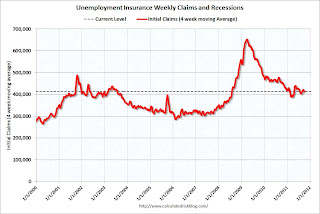

In the week ending October 1, the advance figure for seasonally adjusted initial claims was 401,000, an increase of 6,000 from the previous week's revised figure of 395,000. The 4-week moving average was 414,000, a decrease of 4,000 from the previous week's revised average of 418,000.The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 414,000.

This is the lowest level for the 4-week average of weekly claims since August, and this was below the consensus forecast of 410,000. Still elevated, but some improvement.

Reis: Apartment Vacancy Rate falls to 5.6% in Q3

by Calculated Risk on 10/06/2011 12:04:00 AM

Reis reported that the apartment vacancy rate (82 markets) fell to 5.6% in Q3 from 6.0% in Q2. The vacancy rate was at 7.1% in Q2 2010 and peaked at 8.0% at the end of 2009.

From the WSJ: Landlords Push Up Apartment Rents

The vacancy rate for the third quarter, which wraps up the prime leasing season, fell to 5.6% from 7.1% a year earlier. That is the lowest since 2006.

The increased demand follows several years that saw little new apartment development. About 8,200 units came online during the third quarter, one of the lowest quarterly figures since Reis began tracking the data in 1999.

...

Average effective apartment rents, the amount paid after discounting, rose to $1,004 nationwide in the third quarter, up 2.4% from a year earlier ... In the third quarter, 36,000 net units were filled, down from 42,000 in the second quarter.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

A few key points we've been discussing:

• Apartment vacancy rates are falling fast.

• A record low number of multi-family units will be completed this year (2011). Only 8,200 apartments came on the market in Q3 (in the Reis survey area).

• Multi-family starts are increasing, and that is helping both GDP and employment growth this year. These new starts will not be completed until 2012 or 2013, so vacancy rates will probably continue to decline.

Earlier:

• Reis: Office Vacancy Rate declines slightly in Q3 to 17.4%

• ADP: Private Employment increased 91,000 in September

• ISM Non-Manufacturing Index indicates expansion in September

• Europe Update: New Stress Tests and Bank Recapitalisation

• Employment Situation Preview: Another Weak Report

Wednesday, October 05, 2011

Open Thread

by Calculated Risk on 10/05/2011 08:58:00 PM

A rare open thread for discussion - and a few articles on the passing of Steve Jobs ...

• From the LA Times: Steve Jobs: More than a turnaround artist

• From the NY Times: Steve Jobs, Apple’s Visionary, Dies at 56

• From the WSJ: Apple's Steve Jobs Is Dead

• From CNBC: Apple Says Former CEO Steve Jobs Has Passed Away

Earlier:

• Reis: Office Vacancy Rate declines slightly in Q3 to 17.4%

• ADP: Private Employment increased 91,000 in September

• ISM Non-Manufacturing Index indicates expansion in September

• Europe Update: New Stress Tests and Bank Recapitalisation

• Employment Situation Preview: Another Weak Report

Europe Update: New Stress Tests and Bank Recapitalisation

by Calculated Risk on 10/05/2011 03:50:00 PM

This sounds like EU policymakers are getting ready for either larger haircuts for private Greek debt holders or a default. And is sounds like they are preparing to force the banks to recapitalize. These tests are going to have be conducted pretty quickly ...

• From the Financial Times: EU banks face new ‘Greek’ stress test

European Union finance ministers have asked the bloc’s leading bank regulator to test the strength of Europe’s banks on the assumption of a big writedown on Greek sovereign debt.The article says Merkel would like to discuss an EU-wide bank support plan at the next EU summit in two weeks.

The move, a tacit admission that the European Banking Authority’s two previous rounds of bank stress tests were not sufficiently robust, came as Angela Merkel ... said she was prepared to recapitalise her country’s banks if necessary.

excerpt with permission

• From the WSJ: IMF Floats Bond-Buying Proposal in Europe

The International Monetary Fund could create a special financing tool to buy bonds in private markets as a way to help stem the euro zone's debt crisis, a senior IMF official said Wednesday.• From the WSJ: ECB Chief's Legacy Under Fire

...

Such a plan could aid countries such as Spain and Italy, which face rising costs for financing in capital markets.

Many economists expect the ECB to keep interest rates on hold at Thursday's meeting, despite signs that the euro-zone economy is stagnating and may even slide into recession later this year. ... Mr. Trichet is expected Thursday to unveil new stimulus measures aimed at protecting European banks from short-term funding pressures.The Greek 2 year yield is up to 66%. The Greek 1 year yield is at 140%. (Obviously expecting a large haircut)

The Portuguese 2 year yield is down to 17.5% and the Irish 2 year yield is at 7.1%.

The Spanish 10 year yield is at 5.1% and the Italian 10 year yield is at 5.5%.

Employment Situation Preview: Another Weak Report

by Calculated Risk on 10/05/2011 01:29:00 PM

On Friday the BLS will release the September Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 65,000 payroll jobs in September, and for the unemployment rate to increase to 9.2% from 9.1% in August.

Overall the economic data for September was fairly weak, though mostly better than in August. The BLS reported zero jobs added in August, so "better" doesn't mean much. Of course, the Verizon labor dispute subtracted 45,000 payroll jobs in August, and these jobs will be added back in the September report. So better means more than 45,000.

Here is a summary of recent data:

• The ADP employment report showed an increase of 91,000 private sector payroll jobs in September. Unfortunately ADP hasn't been very useful in predicting the BLS report. Also note that government payrolls have been shrinking by about 35,000 on average per month this year. Also the ADP doesn't include the Verizon labor dispute, so this suggests around 91,000 private nonfarm payroll jobs added, plus 45,000 from Verizon, minus 35,000 government workers - or around 101,000 total jobs added in September.

• The ISM manufacturing employment index increased to 53.8% from 51.8% in August. Based on a historical correlation between the ISM index and the BLS employment report for manufacturing, this reading suggests an increase of 2,000 private payroll jobs for manufacturing in September. This is consistent with the regional Fed manufacturing surveys showing some hiring in September.

However, the ISM non-manufacturing employment index decreased 2.9 percentage points to 48.7 percent. According to ISM this means contraction, but a historical correlation suggests this indicates some hiring.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This scatter graph compares the ISM non-manufacturing employment index (x-axis) and the BLS report for private service employment (as a percent change per month). This suggests private service employment growth of around 27,000 in September (not including Verizon).

So the ISM surveys suggests 27,000 service jobs added, 2,000 manufacturing jobs added, plus the 45,000 Verizon workers, minus 35,000 government jobs - or about 39,000 jobs added in September.

• Initial weekly unemployment claims averaged about 417,000 per week in September, up from the 411,000 average in August.

• Initial weekly unemployment claims averaged about 417,000 per week in September, up from the 411,000 average in August.

However, claims were elevated during the BLS reference week (includes the 12th of the month). For the middle two weeks of September, claims averaged 430,000 per week - suggesting some increase in layoffs mid-month.

• The final September Reuters / University of Michigan consumer sentiment index increased to 59.4 from 55.7 in August. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This was probably impacted by the debt ceiling debate (it usually take 2 to 4 months from sentiment to recover from an "event"). In in general this low level would suggest a weak labor market.

• And on the unemployment rate from Gallup: Gallup Finds U.S. Underemployment Stuck at 18.5% in Mid-Sept.

Unemployment, as measured by Gallup without seasonal adjustment, is 8.8% in mid-September -- down from 9.1% at the end of August and the same as it was at the end of July. However, the apparent improvement in unemployment from August to mid-September may merely reflect normal seasonal hiring patterns and not be an indication that the employment situation is improving. On the other hand, current unemployment is considerably better than the 9.4% of a year ago.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. Usually the NSA unemployment rate declines in September, so this would suggest little change in the unemployment rate from August.

There always seems to be some randomness to the employment report, but my guess is it will be in the 40,000 to 100,000 range. There were some clear negatives this month - weekly claims were elevated during the reference period, consumer sentiment was very low, and the ISM non-manufacturing employment index declined below 50. Still I'll take the over on the consensus (above 65,000), mostly because of the 45,000 jobs added from Verizon. Caveat: my track record when I take the under has been very good - but recently I've been mostly wrong when I've taken the over!

ISM Non-Manufacturing Index indicates expansion in September

by Calculated Risk on 10/05/2011 10:00:00 AM

The September ISM Non-manufacturing index was at 53.0%, down from 53.3% in August. The employment index decreased in September to 48.7%, down from 51.6% in August. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: September 2011 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in September for the 22nd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 53 percent in September, 0.3 percentage point lower than the 53.3 percent registered in August, and indicating continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased 1.5 percentage points to 57.1 percent, reflecting growth for the 26th consecutive month. The New Orders Index increased by 3.7 percentage points to 56.5 percent. The Employment Index decreased 2.9 percentage points to 48.7 percent, indicating contraction in employment after 12 consecutive months of growth. The Prices Index decreased 2.3 percentage points to 61.9 percent, indicating prices increased at a slower rate in September when compared to August. According to the NMI, nine non-manufacturing industries reported growth in September. Respondents' comments reflect an uncertainty about future business conditions and the direction of the economy."

emphasis added

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly above the consensus forecast of 52.9% and indicates slightly slower expansion in September than in August. However the employment index indicated contraction in September.

ADP: Private Employment increased 91,000 in September

by Calculated Risk on 10/05/2011 08:15:00 AM

ADP reports:

According to today’s ADP National Employment Report, employment in the nonfarm private business sector rose 91,000 from August to September on a seasonally adjusted basis. Employment in the private, service-providing sector rose 90,000 in September, up slightly from an increase of 83,000 in August. Employment in the private, goods-producing sector rose a scant 1,000 in September, while manufacturing employment declined by 5,000.Note: ADP is private nonfarm employment only (no government jobs).

“Like August, this month’s jobs report continues to show modest job creation,” said Gary C. Butler, Chief Executive Officer of ADP. “The number of jobs added to the private sector in August and September were virtually identical."

This was slightly above the consensus forecast of an increase of 90,000 private sector jobs in September. The BLS reports on Friday, and the consensus is for an increase of 65,000 payroll jobs in September, on a seasonally adjusted (SA) basis.

Of course the ADP report has not been very useful in predicting the BLS report.

MBA: Mortgage Purchase Application Index Decreased in Latest Survey

by Calculated Risk on 10/05/2011 07:17:00 AM

The MBA reports: Mortgage Applications, except Government Refinances, Decrease in Latest MBA Weekly Survey

Refinance Index decreased 5.2 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.8 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Interest rates continued to fall last week, driven by the latest Federal Reserve actions to invest in longer-term Treasury and mortgage securities, but potential borrowers largely remained on the sidelines, seemingly unimpressed by the lowest (by any measure) mortgage rates since the 1940s," said Mike Fratantoni, MBA's Vice President of Research and Economics. "Refinance application volume declined and purchase volume was little changed. ... Many refinance borrowers are opting to deleverage by moving to a 15-year term, with this product accounting for 27.0 percent of refinance volume last week."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.18 percent from 4.24 percent ... The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) decreased to 4.49 percent from 4.53 percent

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The purchase index declined in August - although this doesn't include the large number of cash buyers - this suggests fairly weak home sales this fall.