by Calculated Risk on 8/19/2011 01:18:00 PM

Friday, August 19, 2011

On Track for Record Low Housing Completions in 2011

An update: The U.S. is on pace for a record low number of total housing completions this year, and the fewest net housing units added to the housing stock since the Census Bureau started tracking completions in the '60s.

Below is a table of net housing units added to the housing stock since 1990. Note: Tom Lawler thinks scrappage is closer to 250,000 units per year.

This means there will be a record low number of housing units added to the housing stock this year (good news with all the excess inventory), and that the overhang of excess inventory should decline significantly in 2011 depending on the rate of household formation (and that depends on jobs).

| Housing Units added to Stock (000s) | ||||||

|---|---|---|---|---|---|---|

| 1 to 4 Units | 5+ Units | Manufactured Homes | Sub-Total | Demolitions / Scrappage | Total added to Stock | |

| 1990 | 1010.8 | 297.3 | 188.3 | 1496.4 | 200 | 1296.4 |

| 1991 | 874.4 | 216.6 | 170.9 | 1261.9 | 200 | 1061.9 |

| 1992 | 999.7 | 158 | 210.5 | 1368.2 | 200 | 1168.2 |

| 1993 | 1065.7 | 127.1 | 254.3 | 1447.1 | 200 | 1247.1 |

| 1994 | 1192.1 | 154.9 | 303.9 | 1650.9 | 200 | 1450.9 |

| 1995 | 1100.2 | 212.4 | 339.9 | 1652.5 | 200 | 1452.5 |

| 1996 | 1161.6 | 251.3 | 363.3 | 1776.2 | 200 | 1576.2 |

| 1997 | 1153.4 | 247.1 | 353.7 | 1754.2 | 200 | 1554.2 |

| 1998 | 1200.3 | 273.9 | 373.1 | 1847.3 | 200 | 1647.3 |

| 1999 | 1305.6 | 299.3 | 348.1 | 1953 | 200 | 1753 |

| 2000 | 1269.1 | 304.7 | 250.4 | 1824.2 | 200 | 1624.2 |

| 2001 | 1289.8 | 281 | 193.1 | 1763.9 | 200 | 1563.9 |

| 2002 | 1360.1 | 288.2 | 168.5 | 1816.8 | 200 | 1616.8 |

| 2003 | 1417.8 | 260.8 | 130.8 | 1809.4 | 200 | 1609.4 |

| 2004 | 1555 | 286.9 | 130.7 | 1972.6 | 200 | 1772.6 |

| 2005 | 1673.4 | 258 | 146.8 | 2078.2 | 200 | 1878.2 |

| 2006 | 1695.3 | 284.2 | 117.3 | 2096.8 | 200 | 1896.8 |

| 2007 | 1249.8 | 253 | 95.7 | 1598.5 | 200 | 1398.5 |

| 2008 | 842.5 | 277.2 | 81.9 | 1201.6 | 200 | 1001.6 |

| 2009 | 534.6 | 259.8 | 49.8 | 844.2 | 150 | 694.2 |

| 2010 | 505.2 | 146.5 | 50 | 701.7 | 150 | 551.7 |

| 2011 (est) | 433 | 120 | 46 | 599 | 150 | 449 |

State Unemployment Rates "little changed" in July

by Calculated Risk on 8/19/2011 10:30:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

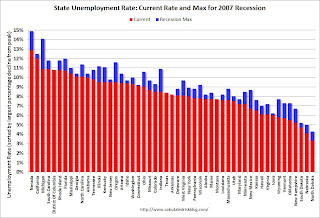

Regional and state unemployment rates were generally little changed in July. Twenty-eight states and the District of Columbia registered unemployment rate increases, nine states recorded rate decreases, and thirteen states had no rate change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue, the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 12.9 percent in July. California recorded the next highest rate, 12.0 percent. North Dakota reported the lowest jobless rate, 3.3 percent, followed by Nebraska, 4.1 percent. ...

Nevada recorded the largest jobless rate decrease from July 2010 (-2.0 percentage points). Ten additional states had smaller but also statistically significant decreases over the year: New Mexico (-1.8 percentage points), Indiana (-1.6 points), Michigan and Oklahoma (-1.5 points each), Oregon (-1.2 points), Wyoming (-1.1 points), Ohio (-1.0 point), Florida (-0.8 point), Virginia (-0.7 point), and North Dakota (-0.6 point). The remaining 39 states and the District of Columbia registered unemployment rates that were not appreciably different from those of a year earlier.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

Three states are at new 2007 recession highs: Arkansas (8.2%), Texas (8.4%) and Montana (7.7%).

The fact that 39 states and the District of Columbia have seen little or no improvement over the last year is a reminder that the unemployment crisis is ongoing.

Europe Update: More Bank Funding Concerns

by Calculated Risk on 8/19/2011 09:01:00 AM

From the Financial Times: Funding fears hit European bank stocks

Worries that the eurozone debt crisis could infect the financial system hit the short-term funding markets ... Switzerland’s two largest banks, Credit Suisse and UBS, both denied they had made use of the Federal Reserve’s swap facility ...There is no panic in the bond markets. Some of the spreads have widened, but that is mostly because of lower German yields.

excerpt with permission

Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany. The Italian spread is at 283, down from 389 on Aug 4th, and the Spanish spread is at 286, down from 398 on Aug 4th. The yield on the Spanish Ten and Italian 10 year bonds are under 5%.

Also the Irish 2 year yield is at 8.9%. And the French 10 year is at 2.8%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Thursday, August 18, 2011

Key Measures of Inflation in July

by Calculated Risk on 8/18/2011 09:55:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in July on a seasonally adjusted basis ... The gasoline index rebounded from previous declines and rose sharply in July, accounting for about half of the seasonally adjusted increase in the all items index. ... The index for all items less food and energy increased as well, though the 0.2 percent increase was slightly smaller than the two previous months.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in July. The 16% trimmed-mean Consumer Price Index increased 0.3% (3.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for July here.

Over the last 12 months, the median CPI rose 1.8%, the trimmed-mean CPI rose 2.1%, the CPI rose 3.6%, and the CPI less food and energy rose 1.8%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.On a year-over-year basis, these measures of inflation are increasing, and near the Fed's target.

On a monthly basis, the median Consumer Price Index increased 2.9% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 3.3% annualized in July, and core CPI increased 2.7% annualized.

With the slack in the system - and falling gasoline prices, the year-over-year measures will probably stay near or be below 2% by the end of this year.

Earlier:

• Philly Fed Survey: "Regional manufacturing activity has dipped significantly"

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Bank Failure #65: On a Thursday?

by Calculated Risk on 8/18/2011 07:01:00 PM

From the FDIC: Capital Bank, National Association, Rockville, Maryland, Assumes All of the Deposits of Public Savings Bank, Huntingdon Valley, Pennsylvania

As of June 30, 2011, Public Savings Bank had approximately $46.8 million in total assets and $45.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.0 million. ... Public Savings Bank is the 65th FDIC-insured institution to fail in the nation this year, and the first in Pennsylvania.Thursday failures are pretty unusual.

Earlier:

• Philly Fed Survey: "Regional manufacturing activity has dipped significantly"

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs