by Calculated Risk on 8/05/2011 07:41:00 PM

Friday, August 05, 2011

Misc: S&P Plans U.S. Downgrade, makes math error, ECB to Buy Italian Bonds

A few stories ...

• From CNN: S&P rethinking planned downgrade of U.S. after White House objects

• From CNBC: ECB Agrees to Start Buying Italian Bonds on Monday: Italian Minister

• From Reuters: Italy brings forward budget plans as crisis mounts

Q2 2011 Details: Investment in Office, Mall, and Lodging, Residential Components

by Calculated Risk on 8/05/2011 04:05:00 PM

Here are the earlier employment posts (with graphs):

• July Employment Report: 117,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• More Employment (Duration, Education, Diffusion Index)

• Employment graph gallery

The BEA released the underlying detail data today for the Q2 Advance GDP report. Here is a look at office, mall and lodging investment:

Click on graph for larger image in new graph gallery.

Click on graph for larger image in new graph gallery.

This graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and has declined sharply to a new series low as a percent of GDP (data series starts in 1959).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by 66% (note that investment includes remodels, so this will not fall to zero). Mall investment increased slightly in Q2 (probably remodels).

The bubble boom in lodging investment was stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by 80%.

Notice that investment for all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). Something similar will probably happen again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

The second graph is for Residential investment (RI) components. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

This graph shows the various components of RI as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

This graph shows the various components of RI as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures was just above the record low set in Q2 2009.

Investment in home improvement was at a $153.1 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.0% of GDP), significantly above the level of investment in single family structures of $105.8 billion (SAAR) (or 0.7% of GDP).

Brokers' commissions increased slightly in Q2, and are near the lowest level (as a percent of GDP) since the early '80s.

And investment in multifamily structures has been bouncing along at a series low for the last few quarters, although this is expected to increase this year as starts increase.

These graphs show there is currently very little investment in offices, malls and lodging - and also very little investment in most components of residential investment. For Residential Investment, I expect RI to make a positive contribution to GDP this year for the first time since 2005 - mostly because of increases in multifamily investment and home improvement.

More Employment

by Calculated Risk on 8/05/2011 01:15:00 PM

Here are the earlier employment posts (with graphs):

• July Employment Report: 117,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment graph gallery

And a few more graphs based on the employment report ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.Two key categories moved down in a little in July. The 27 weeks and more (the long term unemployed) declined slightly to 6.2 million workers, or 4.0% of the labor force.

Also the less than 5 weeks category declined in July after increasing in June.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of job - many college graduates are underemployed.

This is a little more technical. The BLS diffusion index for total private employment was at 58.6 in July, up from 56.6 in June, and for manufacturing, the diffusion index increased slightly to 53.1.

This is a little more technical. The BLS diffusion index for total private employment was at 58.6 in July, up from 56.6 in June, and for manufacturing, the diffusion index increased slightly to 53.1. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

by Calculated Risk on 8/05/2011 10:22:00 AM

This was an improvement over May and June, but still a weak report. As I noted yesterday, the BLS survey reference week includes the 12th of the month (the 2nd full week of July), and that was before the economy froze up due to the D.C. debate, and also before the European crisis really flared up again. That might be why this report was a little better than expected.

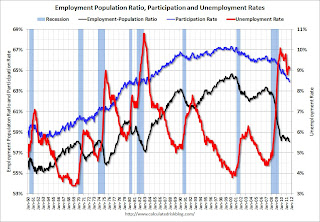

There were more jobs added in July (117,000 total and 154,000 private sector). The unemployment rate decreased from 9.2% to 9.1%, and the participation rate declined to 63.9%. This is the lowest participation rate since the early ‘80s. Note: This is the percentage of the working age population in the labor force.

The employment population ratio fell to 58.1%, also a new cycle low.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, decreased to 16.1%; barely off the high for the year.

The BLS revised up the May and June payrolls, showing a gain of 56,000 more jobs were created than previously reported.

The average workweek was unchanged at 34.3 hours, and average hourly earnings increased. "In July, average hourly earnings for all employees on private nonfarm payrolls increased by 10 cents, or 0.4 percent, to $23.13. Over the past 12 months, average hourly earnings have increased by 2.3 percent."

Through the first seven months of 2011, the economy has added 930,000 total non-farm jobs or just 133 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.8 million fewer payroll jobs than at the beginning of the 2007 recession.

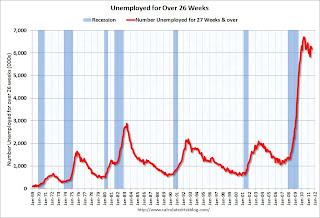

There are a total of 13.9 million Americans unemployed and 6.2 million have been unemployed for more than 6 months. Very grim numbers.

Even though this was an improvement over May and June, overall this was a weak report and reminds us that unemployment and underemployment are critical problems in the U.S.

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The unemployment rate decreased to 9.1% (red line).

The Labor Force Participation Rate declined to 63.9% in July (blue line). This is the percentage of the working age population in the labor force. This is a new cycle low - and the lowest participation rate since the early '80s.

The Employment-Population ratio declined to 58.1% in July (black line). This is also at a new cycle low and the lowest since the early '80s.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

In terms of lost payroll jobs, the 2007 recession was by far the worst since WWII.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged in July at 8.4 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) decreased to 8.396 million in July from 8.552 million in June.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 16.1% in July from 16.2% in June.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.185 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 6.3 million in June. This is very high, and long term unemployment is one of the defining features of this employment recession.

• Earlier Employment post: July Employment Report: 117,000 Jobs, 9.1% Unemployment Rate

July Employment Report: 117,000 Jobs, 9.1% Unemployment Rate

by Calculated Risk on 8/05/2011 08:30:00 AM

From MarketWatch: U.S. economy gained 117,000 jobs in July

The U.S. economy added 117,000 jobs in July and an even larger 154,000 in the private sector while the unemployment rate fell to 9.1% from 9.2%, partly because 193,000 people dropped out of the labor force, according to the latest government data. Job gains in May and June were also revised up by a combined 56,000, the Labor Department reported Friday. Average hourly wages rose 10 cents, or 0.4%, to $23.13. The workweek was unchanged at 34.3 hours.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the unemployment rate.

The unemployment rate decreased to 9.1%.

Note: The BLS website crashed - I'll add the Participation rate and Employment to population ratio soon.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at the start of the recession. The dotted line is ex-Census hiring.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at the start of the recession. The dotted line is ex-Census hiring. The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was still weak, but better than expectations for payroll jobs, and the unemployment rate. The 154,000 private sector jobs - and 56,000 in upward revisions to May and June are improvements. I'll have much more soon ...

Thursday, August 04, 2011

Employment Situation Preview: Another Weak Report

by Calculated Risk on 8/04/2011 08:58:00 PM

Tomorrow the BLS will release the July Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 75,000 payroll jobs in July, and for the unemployment rate to hold steady at 9.2%.

I've seen estimates all over the place, including hearing a few whispers of a negative headline number. This isn't surprising since the economic data for July was weak - especially over the last couple of weeks as companies and individuals prepared for a possible U.S. government default.

However the BLS survey reference week includes the 12th of the month (the 2nd full week of July), and that was before the economy froze up due to the D.C. debate, and also before the European crisis really flared up again. So even with the downbeat economic reports, it is possible that the headline number could be at or above consensus.

No wonder people are uncertain! Here is a summary of recent data:

• The ADP employment report (private sector only) showed an increase of 114,000 payroll jobs in July. Of course, in June, ADP initially reported an increase of 157,000 jobs and the BLS only reported a gain of 57,000 private sector jobs (and only 18,000 total jobs including government layoffs). The ADP uses the same reference week as the BLS. Also note that government payrolls have been shrinking by about 30,000 each month.

• Initial weekly unemployment claims averaged about 412,000 per week in July, down slightly from the 427,000 average in June. Not great, but an improvement.

• The ISM manufacturing employment index decreased to 53.5%, down from 59.9% in June, and the ISM non-manufacturing index decreased to 52.5% in July from 54.1%. Based on a historical correlation between the ISM indexes and the BLS employment report, these readings would suggest close to 100,000 private payroll jobs added for services and manufacturing in July (similar to the ADP report).

• The final July Reuters / University of Michigan consumer sentiment index decreased to 63.7 from 71.5 in June. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This might have been impacted by the debt ceiling debate, but in general this would suggest a weak labor market.

• And on the unemployment rate from Gallup: Gallup Finds Unemployment Unchanged in July

U.S. unemployment, as measured by Gallup without seasonal adjustment, is at 8.8% at the end of July, showing essentially no change from June 2011 (8.7%) or July a year ago (8.9%).NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. Usually the NSA unemployment rate increases in July, so this would suggest little change in the unemployment rate.

My guess is that payroll growth was positive in July, but I'll take the "under" on the consensus based on the weak economic news.

LPS: Foreclosure Starts Increased in June

by Calculated Risk on 8/04/2011 05:57:00 PM

LPS Applied Analytics released their June Mortgage Performance data. From LPS:

The June Mortgage Monitor report released by Lender Processing Services, Inc. (NYSE: LPS) shows that, while still down 16.4 percent from the start of the year, foreclosure starts increased by more than 10 percent in June 2011. Delinquencies were also up, but incrementally, showing a 2.4 percent increase over May. As of the end of June, 4.1 million loans were either 90+ days delinquent or in foreclosure, representing a 12.8 percent increase since June 2010.According to LPS, 8.15% of mortgages were delinquent in June, up from 7.96% in May, and down from 9.55% in June 2010.

Foreclosure timelines continue their upward trajectory, with the average loan in foreclosure having been delinquent for a record 587 days. More than 40 percent of 90+-day delinquencies have not made a payment in more than a year. For loans in foreclosure, 35 percent have been delinquent for more than two years.

Looking at the differences between judicial and non-judicial foreclosure states, the LPS data shows that the foreclosure pipeline ratio – that is, the number of loans either 90+ days delinquent or in foreclosure divided by the six-month average of foreclosure sales – is more than three times as high for judicial foreclosure states. Additionally, the slowdown associated with foreclosure moratoria has been almost exclusively felt in judicial states.

LPS reports that 4.12% of mortgages were in the foreclosure process, up slightly from 4.11% in May, and up from 3.66% in June 2010. This gives a total of 12.27% delinquent or in foreclosure. It breaks down as:

• 2.38 million loans less than 90 days delinquent.

• 1.91 million loans 90+ days delinquent.

• 2.17 million loans in foreclosure process.

For a total of 6.45 million loans delinquent or in foreclosure in June.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 8.15% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.12% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.17 million) - and the average loan in foreclosure has been delinquent for a record 587 days!

This graph provided by LPS Applied Analytics shows the days delinquent for the loans in foreclosure.

This graph provided by LPS Applied Analytics shows the days delinquent for the loans in foreclosure.About 35% of those 2.17 million loans in the foreclosure process have not made a payment in over 2 years. Another 34% have not made a payment in over a year (but less than 2 years). That is around 1.5 million properties.

Many of these long term in-foreclosure properties are in judicial states.

The third graph shows foreclosure sales by the previous month's delinquency bucket.

The third graph shows foreclosure sales by the previous month's delinquency bucket.Foreclosure sales are down compared to last year, regardless of time in delinquency - although sales are slowly picking up. Also the servicers are foreclosing a lower percentage of long term in-foreclosure properties - these long term in-foreclosure properties are just hanging over the housing market (mostly in judicial states like Florida).

Dow Down 500+, S&P off 4.8%

by Calculated Risk on 8/04/2011 04:15:00 PM

From the WSJ: Dow Tumbles 500 Points, Putting It in Red for Year

The Dow slid 512.61 points, or 4.3%, to 11383.83, erasing all its gains for 2011.Here is a table of the largest one day declines (in percentage terms) for the S&P 500 since January 1950. There were quite a few large down days in 2008 and early 2009 ...

...

The Standard & Poor's 500-stock index fell 60.26 points, or 4.8%, to 1200.08, putting it in correction territory, having fallen more than 10% since May. The Nasdaq Composite slumped 136.68 points, or 5.1%, to 2556.39, also in the red for the year.

The Chicago Board Options Exchange's Volatility Index, known as the fear gauge, broke the 30 level for the first time since March 16, up 30% at 30.48.

| Largest S&P 500 One Day Percentage Declines since 1950 | ||||||

|---|---|---|---|---|---|---|

| Date | Percent Decline | Close | Previous Close | Six Months Later | ||

| 1 | 10/19/1987 | -20.5% | 224.84 | 282.70 | 15.3% | |

| 2 | 10/15/2008 | -9.0% | 907.84 | 998.01 | -4.7% | |

| 3 | 12/1/2008 | -8.9% | 816.21 | 896.24 | 15.7% | |

| 4 | 9/29/2008 | -8.8% | 1,106.42 | 1,213.27 | -28.8% | |

| 5 | 10/26/1987 | -8.3% | 227.67 | 248.22 | 15.3% | |

| 6 | 10/9/2008 | -7.6% | 909.92 | 984.94 | -5.9% | |

| 7 | 10/27/1997 | -6.9% | 876.99 | 941.64 | 23.7% | |

| 8 | 8/31/1998 | -6.8% | 957.28 | 1,027.14 | 28.0% | |

| 9 | 1/8/1988 | -6.8% | 243.40 | 261.07 | 11.7% | |

| 10 | 11/20/2008 | -6.7% | 752.44 | 806.58 | 17.9% | |

| 11 | 5/28/1962 | -6.7% | 55.50 | 59.47 | 10.6% | |

| 12 | 9/26/1955 | -6.6% | 42.61 | 45.63 | 14.1% | |

| 13 | 10/13/1989 | -6.1% | 333.65 | 355.39 | 3.2% | |

| 14 | 11/19/2008 | -6.1% | 806.58 | 859.12 | 10.1% | |

| 15 | 10/22/2008 | -6.1% | 896.78 | 955.05 | -5.0% | |

| 16 | 4/14/2000 | -5.8% | 1,356.56 | 1,440.51 | -2.0% | |

| 17 | 10/7/2008 | -5.7% | 996.23 | 1,056.89 | -18.1% | |

| 18 | 6/26/1950 | -5.4% | 18.11 | 19.14 | 10.0% | |

| 19 | 1/20/2009 | -5.3% | 805.22 | 850.12 | 18.1% | |

| 20 | 11/5/2008 | -5.3% | 952.77 | 1,005.75 | -4.8% | |

| 21 | 11/12/2008 | -5.2% | 852.30 | 898.95 | 4.8% | |

| 22 | 10/16/1987 | -5.2% | 282.70 | 298.08 | -8.1% | |

| 23 | 11/6/2008 | -5.0% | 904.88 | 952.77 | 2.7% | |

| 24 | 9/17/2001 | -4.9% | 1,038.77 | 1,092.54 | 12.2% | |

| 25 | 2/10/2009 | -4.9% | 827.16 | 869.89 | 21.8% | |

| 26 | 9/11/1986 | -4.8% | 235.18 | 247.06 | 23.4% | |

| 27 | 8/4/2011 | -4.8% | 1,200.08 | 1,260.34 | --- | |

| 28 | 9/17/2008 | -4.7% | 1,156.39 | 1,213.60 | -31.3% | |

| 29 | 9/15/2008 | -4.7% | 1,192.70 | 1,251.70 | -36.8% | |

| 30 | 3/2/2009 | -4.7% | 700.82 | 735.09 | 47.1% | |

| 31 | 2/17/2009 | -4.6% | 789.17 | 826.84 | 27.2% | |

| 32 | 4/14/1988 | -4.4% | 259.75 | 271.58 | 7.0% | |

| 33 | 3/12/2001 | -4.3% | 1,180.16 | 1,233.42 | -8.0% | |

| 34 | 4/20/2009 | -4.3% | 832.39 | 869.60 | 31.7% | |

| 35 | 3/5/2009 | -4.3% | 682.55 | 712.87 | 46.2% | |

| 36 | 11/30/1987 | -4.2% | 230.30 | 240.34 | 10.0% | |

| 37 | 11/14/2008 | -4.2% | 873.29 | 911.29 | 4.2% | |

| 38 | 9/3/2002 | -4.2% | 878.02 | 916.07 | -6.4% | |

| 39 | 10/2/2008 | -4.0% | 1,114.28 | 1,161.06 | -25.1% | |

| 40 | 10/25/1982 | -4.0% | 133.32 | 138.83 | 20.3% | |

European Commission President: Crisis no longer contained to periphery

by Calculated Risk on 8/04/2011 01:02:00 PM

Admitting the obvious ... from the WSJ: Letter from the President of the European Commission José Manuel Barroso

Developments in the sovereign bond markets of Italy, Spain and other euro area Member States are a cause of deep concern ... they reflect a growing scepticism among investors about the systemic capacity of the euro area to respond to the evolving crisis.Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany. The Italian spread is at a record 389.5, the Spanish spread is at are record 398.5. The race is on ...

...

The 21st of July bold decisions on the Greek package and the increased flexibility of the EFSF (precautionary use, recapitalisation of banks and intervention in secondary bond markets), are not having their intended effect on the markets.

...

[I]t is clear that we are no longer managing a crisis just in the euro-area periphery. ... We need also to consider how to further improve the effectiveness of both the EFSF and the ESM in order to address the current contagion.

...

I would like to call on you to accelerate the approval procedures for the

implementation of these decisions so as to make the EFSF enhancements operational very soon.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

NMHC Quarterly Apartment Survey: Market Conditions Tighten

by Calculated Risk on 8/04/2011 10:53:00 AM

From the National Multi Housing Council (NMHC): Apartment Sector Continues Across-the-Board Improvement, NMHC Market Conditions Survey Finds

The Market Tightness Index, which examines vacancies and rents, came in at 82, down from a record 90. This is the sixth straight quarter the index has topped 50. Though down slightly from last quarter’s record level, two-thirds of respondents noted tighter markets (lower vacancies and/or higher rents) compared with three months earlier.

...

“Demand for apartment residences continues to rise, even as the overall economy remains hampered by the aftermath of the housing bubble,” said NMHC Chief Economist Mark Obrinsky. “For the fifth time in the last six quarters, all four survey measures of market health showed improvement over the prior three months. Markets are tighter, debt and equity capital are more available and sales volume is rising.”

Click on graph for larger image in graph gallery.

This graph shows the quarterly Apartment Tightness Index.

The index has indicated tighter market conditions for the last six quarters and although down from the record 90 in April - a reading of 82 is still very strong. A reading above 50 suggests the vacancy rate is falling and / or rents are rising. This data is a survey of large apartment owners only.

This fits with the recent Reis data showing apartment vacancy rates fell in Q2 2011 to 6.0%, down from 6.2% in Q1 2011, and 7.8% in the Q2 2010.

New multi-family construction is one of the few bright spots for the U.S. economy and this survey indicates demand for apartments is still strong.

A final note: This index helped me call the bottom for effective rents (and the top for vacancy rate) over a year ago.