by Calculated Risk on 6/08/2011 06:30:00 PM

Wednesday, June 08, 2011

Hamilton on the OPEC Announcement

From Jim Hamilton: The significance of OPEC announcements. Professor Hamilton reviews the OPEC announcement today, and points out that quotas for OPEC have been routinely ignored. He concludes:

I think today's announcement that this "quota" will remain in effect is largely irrelevant. At best the statements issued from these meetings provide a noisy signal of the intentions of some OPEC members.The announcement might be "largely irrelevant" as far as actual production, but there was a market impact with WTI crude futures up over $100 per barrel (and Brent crude close to $118).

But if you're interested in what OPEC members really plan to produce, my view is that actions speak louder than words.

The good news is gasoline prices are down about 24 cents per gallon from the recent peak (down over 30 cents where I live). And it looks like gasoline prices will probably fall some more ... but oil prices at $100 per barrel is still a significant drag on the economy.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Earlier:

• CoreLogic House Price Graph, Real Prices, and Prices and Month-of-Supply

Fed's Beige Book: Economic activity continued to expand, "some deceleration"

by Calculated Risk on 6/08/2011 02:00:00 PM

Reports from the twelve Federal Reserve Districts indicated that economic activity generally continued to expand since the last report, though a few Districts indicated some deceleration. Some slowing in the pace of growth was noted in the New York, Philadelphia, Atlanta, and Chicago Districts. In contrast, Dallas characterized that region's economy as accelerating. Other Districts indicated that growth continued at a steady pace.And on real estate:

...

Consumer spending was mixed, with most Districts indicating steady to modestly increasing activity. Elevated food and energy prices, as well as unfavorable weather in some parts of the country, were said to be weighing on consumers' propensity to spend. ... Widespread supply disruptions--primarily related to the disaster in Japan--were reported to have substantially reduced the flow of new automobiles into dealers' inventories, which in turn held down sales in some Districts.

...

Manufacturing activity was reported as continuing to increase since the last report in all but two districts, although many noted that the pace of growth had slowed.

...

Labor market conditions continued to improve gradually across most of the nation, with a number of Districts noting a short supply of workers with specialized technical skills. Wage growth generally remained modest, though there were scattered reports of steeper increases for highly skilled workers in certain occupations.

Residential real estate sales markets showed continued weakness in most Districts, while rental markets strengthened. Most Districts indicate that home prices have declined since the last report: Boston, Philadelphia, Richmond, Atlanta, Kansas City, and San Francisco all report some downward drift in selling prices, while reports from the New York and Cleveland Districts indicate that prices have been steady, on balanceThis was based on data gathered before May 27th.

...

Commercial and industrial real estate markets have generally been steady since the last report, though there have been scattered signs of a pickup. Commercial leasing markets showed modest signs of improvement in the Richmond and San Francisco Districts. Boston and Dallas noted some firming in property sales markets, but Kansas City reported declines in prices for office buildings.

CoreLogic House Price Graph, Real Prices, and Prices and Month-of-Supply

by Calculated Risk on 6/08/2011 11:32:00 AM

Updating some graphs ...

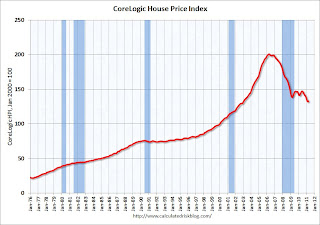

Last week CoreLogic their house price index for April: CoreLogic® Home Price Index Shows First Month-over-Month Increase since mid-2010. The CoreLogic HPI is a three month weighted average of February, March, and April (April weighted the most) and is not seasonally adjusted (NSA).

There was a change in how the data is released, so I didn't include a graph last week - here is the graph.

Note: Case-Shiller is the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.7% in April, and is down 7.5% over the last year, and off 33.8% from the peak.

This is the ninth straight month of year-over-year declines, and the index is now 4.0% below the March 2009 low.

Real House Prices

The second graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through March) and CoreLogic House Price Indexes (through April) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through March) and CoreLogic House Price Indexes (through April) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to October 2000, and the CoreLogic index is back to January 2000.

House Prices and months-of-supply

Here is a look at house prices and existing home months-of-supply.

This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

House prices are through March using the composite 20 index. Months-of-supply is through April. Based on this general relationship, I expect Case Shiller house prices to fall further - although there are some questions about the NAR inventory data.

It now appears that inventory is declining year-over-year (something to watch carefully), but of course sales have been declining too.

Note: there have been periods with high months-of-supply and rising house prices (see: Lawler: Again on Existing Home Months’ Supply: What’s “Normal?” ) so this is just a guide.

Ceridian-UCLA: Diesel Fuel index declines in May

by Calculated Risk on 6/08/2011 09:00:00 AM

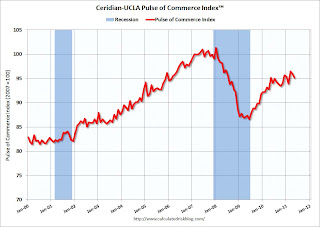

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Press Release: Pulse of Commerce Index Falls 0.9 percent in May

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), issued today by the UCLA Anderson School of Management and Ceridian Corporation fell 0.9 percent on a seasonally and workday adjusted basis in May, after falling 0.5 percent in April.

“The index has now declined in four of the first five months of 2011, and in eight of the past twelve months,” said Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast. ... “On a year over year basis, the PCI was flat in May. This was disappointing in that it ended a string of seventeen straight months of year over year improvement in the index,” Leamer continued. “One small glimmer of good news is that May of last year was the strongest month of 2010, and this month’s result nearly cleared that hurdle. Nevertheless, the PCI showed no growth, and this is another indication that the economy is stuck in neutral.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the index since January 2000.

“Over time, the PCI has proven to be a leading and amplified indicator of both Industrial Production and GDP,” explained Craig Manson, senior vice president and Index expert for Ceridian. “The May result further reinforces our long-held cautious outlook for below consensus growth in GDP, and suggests that second quarter GDP growth will be less than 2 percent. Similarly, the PCI is anticipating Industrial Production to show modest growth of 0.05 percent for May when the number is released by the Government on June 15, 2011.”This index was useful in tracking the slowdown last summer.

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

Note: This index does appear to track Industrial Production over time (with plenty of noise).

MBA: Mortgage Purchase Application activity decreases

by Calculated Risk on 6/08/2011 07:22:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The seasonally adjusted Purchase Index decreased 4.4 percent from one week earlier. ... The adjusted Refinance Index increased 1.3 percent from the previous week.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.54 percent from 4.58 percent, with points decreasing to 0.95 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year contract rate since November 19, 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week average of purchase activity is moving sideways at about 1997 levels. Of course there is a very high percentage of cash buyers right now, but this suggests weak existing home sales through mid-year (not counting cash buyers). Note that mortgage rates have fallen to the lowest level since last November.

Tuesday, June 07, 2011

CoreLogic: Negative Equity by State and more

by Calculated Risk on 6/07/2011 08:12:00 PM

As I mentioned this morning, CoreLogic released the Q1 2011 negative equity report today.

CoreLogic ... today released negative equity data showing that 10.9 million, or 22.7 percent, of all residential properties with a mortgage were in negative equity at the end of the first quarter of 2011, down slightly from 11.1 million, or 23.1 percent, in the fourth quarter. An additional 2.4 million borrowers had less than five percent equity, referred to as near-negative equity, in the first quarter.Here are a couple of graphs from the report:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

Close to 10% of homeowners with mortgages have more than 25% negative equity. This is trending down slowly - the decline is apparently mostly due to homes lost in foreclosure.

The second graph from CoreLogic shows the default rate by percent negative equity.

The second graph from CoreLogic shows the default rate by percent negative equity.The default rate increases the more 'underwater' the property, and the default rate really increases with Loan-to-values (LTV) of 125% or more.

Note that most homes with LTVs of 125% are still current. Many of these people will be stuck in their homes for years - or eventually default.

The third graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

The third graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming."Nevada had the highest negative equity percentage with 63 percent of all mortgaged properties underwater, followed by Arizona (50 percent), Florida (46 percent), Michigan (36 percent) and California (31 percent). ... Las Vegas led the nation with a 66 percent negative equity share, followed by Stockton (56 percent), Phoenix (55 percent), Modesto (55 percent) and Reno (54 percent)."

Bernanke: Growth "likely to pick up" in second half

by Calculated Risk on 6/07/2011 03:45:00 PM

From Fed Chairman Ben Bernanke: The U.S. Economic Outlook

U.S. economic growth so far this year looks to have been somewhat slower than expected. Aggregate output increased at only 1.8 percent at an annual rate in the first quarter, and supply chain disruptions associated with the earthquake and tsunami in Japan are hampering economic activity this quarter. A number of indicators also suggest some loss of momentum in the labor market in recent weeks. We are, of course, monitoring these developments. That said, with the effects of the Japanese disaster on manufacturing output likely to dissipate in coming months, and with some moderation in gasoline prices in prospect, growth seems likely to pick up somewhat in the second half of the year. Overall, the economic recovery appears to be continuing at a moderate pace, albeit at a rate that is both uneven across sectors and frustratingly slow from the perspective of millions of unemployed and underemployed workers.

..

Although the recent increase in inflation is a concern, the appropriate diagnosis and policy response depend on whether the rise in inflation is likely to persist. So far at least, there is not much evidence that inflation is becoming broad-based or ingrained in our economy; indeed, increases in the price of a single product--gasoline--account for the bulk of the recent increase in consumer price inflation.

...

Although it is moving in the right direction, the economy is still producing at levels well below its potential; consequently, accommodative monetary policies are still needed. Until we see a sustained period of stronger job creation, we cannot consider the recovery to be truly established.

AAR: Rail Traffic mixed in May

by Calculated Risk on 6/07/2011 11:52:00 AM

The Association of American Railroads (AAR) reports carload traffic in May 2011 increased 0.5 percent compared with the same month last year (essentially flat), and intermodal traffic (using intermodal or shipping containers) increased 7.5 percent compared with May 2010.

On the carload side, May 2011 was not especially impressive, following a not especially impressive April. U.S. freight railroads originated 1,159,328 carloads in May, an average of 289,832 per week. That’s up 0.5% (5,960 carloads for the month) on a seasonally unadjusted basis over May 2010, though it was up 16.4% (163,308 carloads) over May 2009.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows U.S. average weekly rail carloads (NSA).

As the first graph shows, rail carload traffic collapsed in November 2008, and now, 2 years into the recovery, carload traffic has only recovered about half way. From AAR:

For the year to date through May, total U.S. rail carloadings in 2011 were 6,110,554, up 3.2% (186,751 carloads) over the first five months of 2010. Neither 2011 nor 2010 include the Memorial Day holiday.For the last two months, traffic has been tracking 2010 (no growth from last year). Of course auto traffic was down in May.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):In contrast to carload traffic, U.S. rail intermodal traffic continues to be impressive. U.S. railroads originated 932,956 intermodal trailers and containers in May 2011, an average of 233,239 per week and up 7.5% (65,440 units) over May 2010 on a non-seasonally adjusted basis.So intermodal traffic is essentially at record highs, but carload traffic (commodities and autos) is only about half way back to pre-recession levels.

Seasonally adjusted U.S. rail intermodal traffic was up 0.8% in May 2011 over April 2011, the sixth straight monthly increase.

Intermodal’s weekly average in May 2011 of 233,239 units was the second highest May ever. The highest May ever was in 2006 at 233,516 units per week.

excerpts with permission

BLS: Job Openings decline in April

by Calculated Risk on 6/07/2011 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in April was 3.0 million, little changed from 3.1 million in March. After increasing in February, job openings have been flat. Job openings have been around 3.0 million for three consecutive months; the last three-month period with levels this high was September—November 2008. The number of job openings was 549,000 higher than at the end of the recession in June 2009 (as designated by the National Bureau of Economic Research) but remains well below the 4.4 million openings when the recession began in December 2007.The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent (and dismal) employment report was for May.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - however job openings declined slightly in April - and are actually down year-over-year compared to April 2010. However April 2010 included decennial Census hiring, so that isn't a good comparison.

Overall turnover remains low.

Note: I've had some questions about "quits", and quits have been trending up (although they were down slightly in April). For this graph I add quits to other discharges to compare to total hires, but I'll look at just tracking quits too.

Report: 10.9 Million U.S. Properties with Negative Equity in Q1

by Calculated Risk on 6/07/2011 08:38:00 AM

From Robbie Whelan at the WSJ: Second-Mortgage Misery

[A] report to be released Tuesday by real-estate data firm CoreLogic Inc. ... says 38% of borrowers who took cash out of their residences using home-equity loans are underwater ... By contrast, 18% of borrowers who don't have these loans were underwater.This is a slight decrease from the 11.1 million, or 23.1 percent of homeowners with a mortgage who were underwater at the end of Q4 2010. The WSJ article notes the decline was probably due to completed foreclosures.

...

Overall ... 10.9 million Americans who borrowed to buy their homes, or 22.7% of all homeowners with a mortgage nationwide, were underwater in the first quarter ...

I'll have more when the CoreLogic report is available online.