by Calculated Risk on 4/30/2011 06:10:00 PM

Saturday, April 30, 2011

Goldman estimates 3.5 million Excess Vacant Housing Units

Some key numbers for the U.S. economy are: 1) the current number of excess housing units, 2) how many new households are being formed each year, and 3) how many housing units are being added to the housing stock each year (at a record low this year).

Unfortunately reliable data for the first two numbers is unavailable except with a significant lag.

I've used the quarterly Housing Vacancy Survey (HVS), but that is not really designed for this purpose.

Goldman Sachs put out an estimate yesterday of 3.5 million units based on the HVS: "Based on data from the Census Bureau, we estimate that about 3.5 million housing units currently sit vacant, above and beyond normal seasonal and frictional vacancies." They calculated a range of 2.5 to 4.5 million units based on different assumptions.

Recently economist Tom Lawler took a long look at the 2010 Census data, and estimated there were about 2 to 3 million excess vacant housing units as of April 1, 2010. With the record low number of housing units delivered last year, Lawler estimated that as of April 1, 2011 the excess “would be somewhere in the range of 1.45 to 2.45 million units – with the latter almost certainly too high”. With another record low number of units added to the housing stock this year, the excess will be in the 750 thousand to 1.7 million range next April (with the latter “certainly too high"). This suggests the excess supply will be gone sometime between early 2014 and 2016.

Goldman has a higher estimate of excess vacant units, but they also have a higher estimate for household formation (partially because of pent up formation from all those people who doubled up during the recession). The conclude "[W]e think the recovery in single family housing starts will remain very slow. A plausible central scenario would be an increase in starts from about 475,000 units in 2010 to 600,000 by 2012. We do not expect single-family housing starts to return to their historical average rate of about 1 million units until 2015 or later."

In Thoughts on Residential Investment Recovery, I noted: 'My guess is housing starts will return to "normal" in 2015 or 2016.' It is hard to pinpoint an exact date because the data is uncertain. Frustrating!

But here is a little good news on data via Tom Lawler:

The Census Bureau announced that beginning next week it will release “demographic” profiles of 13 states each Thursday in May, with the first round of “states” will be the District of Columbia, Florida, Kentucky, Maine, Massachusetts, Michigan, Mississippi, New Mexico, North Dakota, Rhode Island, South Carolina, Tennessee and West Virginia. For folks interested in the housing markets, the data will include (among other things) data on housing tenure (owners/renters), occupancy/vacancy (include vacancy status – for rent, for sale, seasonal, etc.), age and sex distributions, and household types. These releases will help analysts get a much better “feel” for the overall housing market as of April 1, 2010, and will highlight just how “messed up” the data from the Census Housing Vacancy Survey really is – and why analysts should not use it to try to estimate the “excess supply” of housing.I think the Goldman estimate is too high, but no one really knows. Hopefully by the end of May we will have a much better estimate for the excess supply as of April 1, 2010.

Earlier:

• Summary for Week ending April 29th

Summary for Week ending April 29th

by Calculated Risk on 4/30/2011 11:15:00 AM

Below is a summary of economic data last week mostly in graphs (I'll add some thoughts on the economy later):

• New Home Sales in March at 300 Thousand SAAR, Record low for March

The Census Bureau reported New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 300 thousand. This was up from a revised 270 thousand in February.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Although the 300 thousand sales (SAAR) was slightly above the consensus forecast, this was a new record low for March.

The second graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The second graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In March 2011 (red column), 29 thousand new homes were sold (NSA). This is a new record low for the month of March.

The previous record low for March was 31 thousand in 2009. The high was 127 thousand in 2005.

The third graph shows existing home sales (left axis) and new home sales (right axis) through March. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

The third graph shows existing home sales (left axis) and new home sales (right axis) through March. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

The gap is due mostly to the flood of distressed sales. This has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

• Case Shiller: Home Prices near post-bubble lows in February

S&P/Case-Shiller released the monthly Home Price Indices for February (actually a 3 month average of December, January and February).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.7% from the peak, and down 0.2% in February (SA). The Composite 10 is still 1.8% above the May 2009 post-bubble bottom.

The Composite 20 index is also off 31.4% from the peak, and down 0.2% in February (SA). The Composite 20 is only 0.4% above the May 2009 post-bubble bottom and will probably be at a new post-bubble low soon.

This shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

This shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 6 of the 20 Case-Shiller cities in February seasonally adjusted. Prices in Las Vegas are off 58% from the peak, and prices in Dallas only off 6.8% from the peak.

Real Prices: This graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 and CoreLogic House Price Indexes (both through February release) in real terms (adjusted for inflation using CPI less Shelter).

Real Prices: This graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 and CoreLogic House Price Indexes (both through February release) in real terms (adjusted for inflation using CPI less Shelter).

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to November 2000, and the CoreLogic index back to January 2000.

• Q1 2011: Homeownership Rate at 1998 Levels

The Census Bureau reported the homeownership rate declined to 66.4%, down from 66.5% in Q4 2010. This is the same as in 1998.

The Census Bureau reported the homeownership rate declined to 66.4%, down from 66.5% in Q4 2010. This is the same as in 1998.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. Some of the increase due to demographics (older population) will probably stick, so I've been expecting the rate to decline to around 66%, and probably not all the way back to 64%.

• Advance Report: Real Annualized GDP Grew at 1.8% in Q1

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q1 at 1.8% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q1 at 1.8% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Residential Investment (RI) made a negative contribution to GDP in Q1 2011, and the four quarter rolling average is negative again following the slight boost from the tax credit early in 2010.

Residential Investment (RI) made a negative contribution to GDP in Q1 2011, and the four quarter rolling average is negative again following the slight boost from the tax credit early in 2010.

Equipment and software investment has made a significant positive contribution to GDP for seven straight quarters (it is coincident).

The contribution from nonresidential investment in structures was negative in Q1. Nonresidential investment in structures typically lags the recovery. The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory.

Here is a look at office, mall and lodging investment:

This graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and has declined sharply to a new series low as a percent of GDP (data series starts in 1959).

This graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and has declined sharply to a new series low as a percent of GDP (data series starts in 1959).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by 70% (note that investment includes remodels, so this will not fall to zero). Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by 80% already.

This graph shows the various components of Residential Investment (RI) as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

This graph shows the various components of Residential Investment (RI) as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures was just above the record low set in Q2 2009.

Investment in home improvement was at a $151.0 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.0% of GDP), significantly above the level of investment in single family structures of $106.3 billion (SAAR) (or 0.7% of GDP).

Brokers' commissions declined slightly in Q1, and are near the lowest level (as a percent of GDP) since the early '80s. In nominal dollar terms, brokers' commissions are back to the 1999 level.

And investment in multifamily structures has been bouncing along at a series low for the last few quarters, although this is expected to increase this year as starts increase.

• Regional Fed Manufacturing Surveys show slower expansion in April

Three regional Fed manufacturing surveys released this week showed slower expansion in April:

From the Richmond Fed: Manufacturing Growth Moderates in April

From the Dallas Fed: Texas Manufacturing Activity Increases but at a Slower Pace

From the Kansas City Fed: Growth in Tenth District manufacturing activity moderated somewhat in April

Even with slower expansion, these reports were fairly solid. Here is a graph comparing the regional Fed surveys to the ISM manufacturing survey.

Even with slower expansion, these reports were fairly solid. Here is a graph comparing the regional Fed surveys to the ISM manufacturing survey.

The New York and Philly Fed surveys are averaged together (dashed green, through April), and averaged five Fed surveys (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

The regional surveys suggest the ISM manufacturing index will in the mid-to-high 50s range (fairly strong expansion). The ISM index for April will be released on Monday, May 2nd.

• Other Economic Stories ...

• A few takeaways from Bernanke Press Briefing

• LPS: Mortgage Delinquency Rates declined in March, Foreclosure pipeline "Bloated"

• HVS: Homeowner and Rental Vacancy Rates

• Restaurant Performance Index increases in March

• Consumer Sentiment increases slightly in April compared to March

• Personal Income and Outlays Report for March

• Unofficial Problem Bank list at 978 Institutions

Best wishes to all!

Unofficial Problem Bank list increases to 984 Institutions

by Calculated Risk on 4/30/2011 08:03:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 29, 2011.

Changes and comments from surferdude808:

The FDIC got back to closing banks this and released its enforcement actions for March 2011, which contributed to many changes to the Unofficial Problem Bank List. In total, there were six removals and 14 additions this week. After these changes, the list includes 984 institutions with assets of $422.1 billion, compared to 976 institutions with assets of $422.2 billion last week.

Among the removals are two action terminations AmericanWest Bank, Spokane, WA ($1.6 billion Ticker: AWBCQ); and Bank of Franklin, Meadville, MS ($95 million). Of the five failures this week, only four were on the list -- The Park Avenue Bank, Valdosta, GA ($953 million Ticker: PABK); Community Central Bank, Mount Clemens, MI ($476 million Ticker: CCBD); First National Bank of Central Florida, Winter Park, FL ($352 million); and Cortez Community Bank, Brooksville, FL ($72 million Ticker: COTZ).

Most notable among the 14 additions are Artisans' Bank, Wilmington, DE ($643 million); Arthur State Bank, Union, SC ($636 million); The Business Bank, Appleton, WI ($357 million); The Pueblo Bank and Trust Company, Pueblo, CO ($333 million); and Ojai Community Bank, Ojai, CA ($124 million Ticker: OJCB).

A number of Prompt Corrective Action orders were released this week to Bank of Choice, Greeley, CO ($1.2 billion); Oxford Bank, Oxford, MI ($285 million); Summit Bank, Burlington, WA ($147 million); Coastal Bank, Cocoa Beach, FL ($133 million); Bank of Shorewood, Shorewood, IL ($125 million); and Signature Bank, Windsor, CO ($73 million). The FDIC terminated the PCA order against Prosper Bank, Prosper, TX ($69 million).

Comparing names and locations of institutions on the Unofficial Problem Bank List with the FDIC's structure database resulted in 15 name changes and 16 city changes. In these instances, the FDIC certificate number is unchanged. However, should anyone not be able to locate an institution from a previous week's list drop us a note and we will get back to you on where that institutions has gone.

There may be some good news when looking at the monthly numbers. The list declined by one institution at the end of April 2011 to 984 from 985 at the end of March 2011. This is the smallest monthly change since the list was first published in August 2009 with the next smallest being an increase of two institutions in December 2009. For the month, there were 27 additions and 28 removals including 11 failures, 10 unassisted mergers, and 7 action terminations. For the past 21 months, on average, there have been about 46 additions, 12 failures, 3 unassisted mergers, and 4 action terminations. During April 2010, the slowdown in additions and the increase in unassisted mergers (namely multi-bank holding company subsidiary combinations) contributed to the net decline.

Friday, April 29, 2011

Jim the Realtor: A Stinker REO

by Calculated Risk on 4/29/2011 10:57:00 PM

Jim was just assigned this REO - in a pretty nice neighborhood - but it is a real "stinker". I looked at an REO in the early '80s with a similar issue, but this one has been sitting closed up and vacant for 30 months. Oh my ...

Earlier:

• Consumer Sentiment increases slightly in April compared to March

• Personal Income and Outlays Report for March

• Restaurant Performance Index increases in March

• Q1 2011 Details: Investment in Office, Mall, and Lodging, Residential Components

• LPS: Mortgage Delinquency Rates declined in March, Foreclosure pipeline "Bloated"

Bank Failures #35 through #39 in 2011

by Calculated Risk on 4/29/2011 07:20:00 PM

Five finance fatalities

Bereaving bankers.

by Soylent Green is People

From the FDIC: Premier American Bank, National Association, Miami, Florida, Acquires All the Deposits of Two Florida Banks, First National Bank of Central Florida, Winter Park and Cortez Community Bank, Brooksville

As of December 31, 2010, First National Bank of Central Florida had total assets of $352.0 million and total deposits of $312.1 million; and Cortez Community Bank had total assets of $70.9 million and total deposits of $61.4 million. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for First National Bank of Central Florida will be $42.9 million; and for Cortez Community Bank, $18.6 million. ... The closings are the 35th and 36th FDIC-insured institutions to fail in the nation so far this yearFrom the FDIC: Bank of the Ozarks, Little Rock, Arkansas, Acquires All the Deposits of Two Georgia Banks, First Choice Community Bank, Dallas and The Park Avenue Bank, Valdosta

As of December 31, 2010, First Choice Community Bank had total assets of $308.5 million and total deposits of $310.0 million; and The Park Avenue Bank had total assets of $953.3 million and total deposits of $827.7 million. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for First Choice Community Bank will be $92.4 million; and for The Park Avenue Bank, $306.1 million. ... The closings are the 37th and 38th FDIC-insured institutions to fail in the nation so far this yearFrom the FDIC: Talmer Bank & Trust, Troy, Michigan, Assumes All of the Deposits of Community Central Bank, Mount Clemens, Michigan

As of December 31, 2010, Community Central Bank had approximately $476.3 million in total assets and $385.4 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $183.2 million. ... Community Central Bank is the 39th FDIC-insured institution to fail in the nation this year

LPS: Mortgage Delinquency Rates declined in March, Foreclosure pipeline "Bloated"

by Calculated Risk on 4/29/2011 04:55:00 PM

LPS Applied Analytics released their March Mortgage Performance data. From LPS:

• Delinquencies ended the quarter 12% lower than the end of last year, over 500,000 loans have left the delinquent pool over the last three months.

• New problem loan rates are at a three year low as fewer loans are going bad. At the same time, seasonal trends have helped support a large increase in monthly cure rates.

• March typically sees large seasonal declines in new delinquency rates, though this year was the second largest on record.

• Modification activity also contributes to the improved landscape with almost a quarter of 90+ delinquencies from last year now current on their payments.

• The foreclosure pipeline is still bloated with overhang at every level:

– There are almost twice as many loans deteriorating greater than 90+ days delinquent vs. starting foreclosure.• Origination activity has dropped off in early 2011 and due to much stricter underwriting, recent vintages have been performing exceptionally well.

– There are almost three times the number foreclosure starts vs. foreclosure sales.

– 90+ and foreclosure inventory levels are almost 45 times monthly foreclosure sales.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph provided by LPS Applied Analytics shows the percent delinquent and percent in foreclosure.

The percent in the foreclosure process has been trending up because of the foreclosure issues.

According to LPS, 7.78% of mortgages are delinquent (down from 8.80% in February), and a record 4.21% are in the foreclosure process (up from 4.15% in February) for a total of 11.93%. It breaks down as:

• 2.12 million loans less than 90 days delinquent.

• 1.99 million loans 90+ days delinquent.

• 2.22 million loans in foreclosure process.

For a total of 6.33 million loans delinquent or in foreclosure.

The second graph shows the break down of foreclosures by days delinquent.

The second graph shows the break down of foreclosures by days delinquent."31% of loans in foreclosure have not made a payment in over 2 years." So about one third of the 2.22 million loans in the foreclosure process haven't made a payment in over 2 years.

The decline in the delinquency rate is partially seasonal, but the sharp decline is a positive. A key problem is all those homes in the foreclosure process. As LPS notes: "Delinquencies have dropped to about 1.8 times the 1995-2005 average, foreclosure inventories are 8 times historical “norms”." There were only 94,780 foreclosure sales in March and 270,681 foreclosure starts - so the foreclosure inventory just keeps growing.

Q1 2011 Details: Investment in Office, Mall, and Lodging, Residential Components

by Calculated Risk on 4/29/2011 03:04:00 PM

The BEA released the underlying detail data today for the Q1 Advance GDP report. Here is a look at office, mall and lodging investment:

Click on graph for larger image in new graph gallery.

Click on graph for larger image in new graph gallery.

This graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and has declined sharply to a new series low as a percent of GDP (data series starts in 1959).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by 70% (note that investment includes remodels, so this will not fall to zero). Mall investment is also at a series low (as a percent of GDP).

The bubble boom in lodging investment was stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by 80% already.

Notice that investment for all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). Something similar will probably happen again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

The second graph is for Residential investment (RI) components. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

This graph shows the various components of RI as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

This graph shows the various components of RI as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures was just above the record low set in Q2 2009.

Investment in home improvement was at a $151.0 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.0% of GDP), significantly above the level of investment in single family structures of $106.3 billion (SAAR) (or 0.7% of GDP).

Brokers' commissions declined slightly in Q1, and are near the lowest level (as a percent of GDP) since the early '80s. In nominal dollar terms, brokers' commissions are back to the 1999 level.

And investment in multifamily structures has been bouncing along at a series low for the last few quarters, although this is expected to increase this year as starts increase.

These graphs show there is currently very little investment in offices, malls and lodging - and also very little investment in most components of residential investment. I expect investment in commercial real estate to bottom mid-year, but the recovery will not start until the vacancy rates fall. For Residential Investment, I expect RI to make a positive contribution to GDP this year for the first time since 2005 - mostly because of increases in multifamily investment and home improvement.

Restaurant Performance Index increases in March

by Calculated Risk on 4/29/2011 11:56:00 AM

This is one of several industry specific indexes I track each month.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The index increased to 101.0 in March (above 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

From the National Restaurant Association: Restaurant Industry Outlook Gained Strength in March as Same-Store Sales, Customer Traffic Levels Continued to Improve

The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.0 in March, up 0.3 percent from February and the third gain in the last four months. In addition, March represented the sixth time in the last seven months that the RPI stood above 100, which signifies expansion in the index of key industry indicators.Increased traffic and sales, and a positive outlook for capital spending and hiring ... another solid report.

“The March increase in the Restaurant Performance Index was fueled by continued improvements in the same-store sales and customer traffic indicators,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Most notably, the overall Current Situation component of the RPI stood above 100 for the first time in 43 months, which signifies expansion in the indicators of current industry performance.”

...

Restaurant operators continued to report improvements in same-store sales in March. ... Restaurant operators also reported a net increase in customer traffic levels in March.

...

Along with an optimistic sales outlook, restaurant operators’ plans for capital spending rose to its highest level in 41 months.

...

For the sixth consecutive month, restaurant operators reported a positive outlook for staffing gains in the months ahead.

Earlier:

• Consumer Sentiment increases slightly in April compared to March

• Personal Income and Outlays Report for March

Consumer Sentiment increases slightly in April compared to March

by Calculated Risk on 4/29/2011 09:55:00 AM

• From the Chicago Business Barometer™ Tempered: "The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER slackened but remained strong, indicating expanding economic activity for the nineteenth consecutive month. In response to special questions about the Japanese disaster, panelists reported minimal impact."

The overall index decreased to 67.6 from 70.6 in March. This was below consensus expectations of 69.2. Note: any number above 50 shows expansion. The employment index decreased to a still strong 63.7 from 65.6. This was another fairly strong report.

• The final April Reuters / University of Michigan consumer sentiment index decreased to 68.9 in April from the preliminary 69.6. This was up slightly from the March reading of 67.5.

Click on graph for larger image in graphic gallery.

Click on graph for larger image in graphic gallery.

This was below the consensus forecast of 70.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

This low reading is probably due to $4 per gallon gasoline prices.

Personal Income and Outlays Report for March

by Calculated Risk on 4/29/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $67.0 billion, or 0.5 percent ... Personal consumption expenditures (PCE) increased $60.7 billion, or 0.6 percent.Real PCE was revised up significantly for both January and February.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in March, compared with an increase of 0.5 percent in February.

The following graph shows real Personal Consumption Expenditures (PCE) through March (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.PCE increased 0.5% in March, but real PCE only increased 0.2% as the price index for PCE increased 0.4 percent in March.

Note: Core PCE - PCE excluding food and energy - increased 0.1% in March.

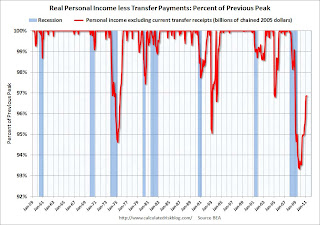

The second graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and real personal income less transfer payments declined slightly in March. This remains 3.1% below the previous peak.

The second graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and real personal income less transfer payments declined slightly in March. This remains 3.1% below the previous peak.The personal saving rate was unchanged at 5.5% in March.

Personal saving -- DPI less personal outlays -- was $651.2 billion in March, compared with $647.5 billion in February. Personal saving as a percentage of disposable personal income was 5.5 percent in March, the same as in February.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the March Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the March Personal Income report. One of the surprises in the Q1 GDP report was the 2.7% annualized growth rate for PCE. PCE growth in January and February was revised up significantly, and PCE in March increased at a 3.1% annualized rate (over the last 3 months).