by Calculated Risk on 3/28/2011 12:50:00 PM

Monday, March 28, 2011

Here come the downgrades for Q1 GDP Growth

Before the February Personal Income and Outlays report, most analysts were expecting real GDP growth of over 3% in Q1. As an example, Paul Kasriel at Northern Trust was forecasting 3.1% real GDP growth with 2.2% real Personal Consumption Expenditure (PCE) growth, and Goldman Sachs was forecasting 3.5% real GDP growth with 3.0% real PCE growth.

Both of those forecast now look too high.

Note: The quarterly change is not calculated as the change from the last month of one quarter to the last month of the next. Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q1, you would average PCE for January, February, and March, then divide by the average for October, November and December. Of course you need to take this to the fourth power (for the annual rate) and subtract one. Also the March data isn't released until after the advance Q1 GDP report.

There are a few commonly used methods to forecast quarterly PCE growth after the release of the second month of the quarter report (February for Q1). Some analysts use the "two month" method (averaging the growth from October-to-January with the growth from November-to-February). Others use the mid-month method and just use the growth from November-to-February.

Either way, the first two months of Q1 2011 suggest PCE growth of around 1.4% for the quarter as shown in the following table.

| PCE, Billions (2005 dollars), SAAR | 3 Month Change (annualized) | Quarter (Annualized) | |

|---|---|---|---|

| Jan-10 | $9,189.30 | ||

| Feb-10 | $9,228.20 | ||

| Mar-10 | $9,258.60 | ||

| Apr-10 | $9,257.20 | 2.99% | |

| May-10 | $9,280.50 | 2.29% | |

| Jun-10 | $9,289.30 | 1.33% | 2.2% |

| Jul-10 | $9,302.60 | 1.98% | |

| Aug-10 | $9,333.90 | 2.32% | |

| Sep-10 | $9,355.40 | 2.88% | 2.4% |

| Oct-10 | $9,402.80 | 4.38% | |

| Nov-10 | $9,426.60 | 4.03% | |

| Dec-10 | $9,439.30 | 3.64% | 4.0% |

| Jan-11 | $9,435.10 | 1.38% | |

| Feb-11 | $9,459.00 | 1.38% | |

| Mar-11 |

Although there are other components of GDP (investment, trade, government spending and inventory changes), it appears Q1 GDP growth will be lower than expected.

I still expect stronger GDP growth in 2011 than in 2010, but it appears 2011 is off to a sluggish start - and I'm concerned about world events and high oil prices.

Texas Manufacturing Activity Strengthens Further, Pending Home sales increase in February

by Calculated Risk on 3/28/2011 10:30:00 AM

• From the Dallas Fed: Texas Manufacturing Activity Strengthens Further

Texas factory activity increased in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose sharply to 24, its highest level in nearly a year.Another strong report. The last of the regional reports will be released on Thursday, and the ISM manufacturing index will be released on Friday (should be very strong again).

...

Labor market indicators continued to reflect expansion. The employment index came in at a reading of 12, similar to February. Twenty percent of manufacturers reported hiring new workers compared with eight percent reporting layoffs. The hours worked index jumped to 13, with the share of firms reporting decreases in employee workweeks falling to its lowest level since 2006. The wages and benefits index rose from 9 to 12, although the great majority of respondents noted no change in labor costs.

• From the NAR: February Pending Home Sales Rise

The Pending Home Sales Index,* a forward-looking indicator, rose 2.1 percent to 90.8, based on contracts signed in February, from 88.9 in January. The index is 8.2 percent below 98.9 recorded in February 2010. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.This suggests a slight increase in existing home sales in March and April.

Personal Income and Outlays Report for February

by Calculated Risk on 3/28/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income increased $38.1 billion, or 0.3 percent ... Personal consumption expenditures (PCE) increased $69.1 billion, or 0.7 percent.The following graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in February, in contrast to a decrease of less than 0.1 percent in January.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.PCE increased 0.7% in February, but real PCE only increased 0.3% as the price index for PCE increased 0.4 percent in February.

Personal income growth was slightly below expectations. Note: Core PCE - PCE excluding food and energy - increased 0.2 percent in February.

Even though PCE growth was at expectations, real PCE was low - and this suggests analysts will downgrade their forecasts for Q1 GDP. Using the two month estimate for PCE growth (averaging the growth of January and February over the first two months of the previous quarter) suggests PCE growth of around 1.4% in Q1 (down sharply from 4.0% in Q4).

Weekend on U.S. economy:

• Here is the Summary for Week ending March 25th.

• Lawler: Census 2010 and Excess Vacant Housing Units

• Schedule for Week of March 27th

Sunday, March 27, 2011

Ireland Update: Stress Tests, New ECB Liquidity Facility, and ... bondholder haircuts?

by Calculated Risk on 3/27/2011 07:29:00 PM

The next round of Irish bank stress test results are due on March 31st. Meanwhile the ECB is seeking a new liquidity facility and Ireland is talking haircuts for senior bondholders ...

• From Bloomberg: Ireland Seeks to Share Bank-Loss Burdens With Bond Holders, Noonan Says

Ireland wants to share bank losses with senior bondholders as part of a “final solution” for the country’s debt-laden financial system, Agriculture Minister Simon Coveney said.• From the Financial Times: Ireland seeks ECB deal to secure banks

Finance Minister Michael Noonan will seek agreement from European authorities to share losses with bond holders after stress-test results on March 31 determine how much extra capital the banks need, Coveney said.

• From the WSJ: ECB Seeks New Liquidity Plan for Irish Banks

the Sunday Business Post newspaper reported over the weekend that the tests will expose a capital shortfall of €18 billion to €23 billion. That is more than the €10 billion earmarked by the European Union, International Monetary Fund and European Central Bank in Ireland's November bailout deal, but less than the €35 billion many analysts had estimated the banks would require.Yesterday and Today:

• Here is the Summary for Week ending March 25th.

• Lawler: Census 2010 and Excess Vacant Housing Units

• Schedule for Week of March 27th

Japan Nuclear Update

by Calculated Risk on 3/27/2011 02:46:00 PM

• From Kyodo News: Woes deepen over radioactive water at nuke plant, sea contamination

Japan on Sunday faced an increasing challenge of removing highly radioactive water found inside buildings near some troubled nuclear reactors at the Fukushima Daiichi plant, with the radiation level of the surface of the pool in the basement of the No. 2 reactor's turbine building found to be more than 1,000 millisieverts per hour.• From the LA Times: Officials retract reports of extremely high radiation at Fukushima plant

... efforts to restore power and enhance cooling efficiency at the crisis-hit nuclear power plant is showing slow progress partly due to the radioactive pools of water found at the Nos. 1, 2, 3 and 4 units.

Workers there are planning to turn on the lights in the control room of the No. 4 reactor, while also trying to inject freshwater into tanks storing spent nuclear fuel at the plant's Nos. 1, 2, 3 and 4 reactors to prevent crystallized salt from seawater already injected from hampering the smooth circulation of water and thus diminishing the cooling effect.

• From the NY Times: Higher Levels of Radiation Found at Japan Reactor Plant

Yesterday and Today:

• Here is the Summary for Week ending March 25th.

• Lawler: Census 2010 and Excess Vacant Housing Units

• Schedule for Week of March 27th

Schedule for Week of March 27th

by Calculated Risk on 3/27/2011 09:27:00 AM

Yesterday:

• Here is the Summary for Week ending March 25th.

• Lawler: Census 2010 and Excess Vacant Housing Units

The key report for this week will be the March employment report to be released on Friday, April 1st.

Other key reports include the February Personal Income and Outlays report on Monday, the Case-Shiller house price index on Tuesday, the ISM manufacturing index on Friday, and vehicle sales also on Friday.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income and a 0.6% increase in personal spending.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Real Personal Consumption Expenditures (PCE) - PCE adjusted for inflation - decreased 0.1 percent in January.

Using the February data we can obtain an early estimate for Q1 real PCE growth (annualized) using the two-month method (usually pretty close).

10:00 AM: Pending Home Sales for February. The consensus is for pending sales home sales to be flat (a leading indicator for existing home sales).

10:30 AM: Dallas Fed Manufacturing Survey for March. The Texas production index increased last month to 9.7 (from 0.2 in January).

9:00 AM: S&P/Case-Shiller Home Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January.

This graph shows the seasonally adjusted Composite 10 and Composite 20 indices through December (the Composite 20 was started in January 2000).

This graph shows the seasonally adjusted Composite 10 and Composite 20 indices through December (the Composite 20 was started in January 2000).Prices are falling again, and the Composite 20 index will probably be close to a new post-bubble low in January. The consensus is for prices to decline about 0.4% in January; the seventh straight month of house price declines.

10:00 AM: Conference Board's consumer confidence index for March. The consensus is for a decrease to 65.0 from 70.4 last month due to world events and higher gasoline prices.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through the first few months of 2011.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for +205,000 payroll jobs in March, down slightly from the 217,000 reported in February.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 380,000 from 382,000 last week.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a slight decrease to a still very strong 70.0 (down from 71.2 in March).

10:00 AM: Manufacturers' Shipments, Inventories and Orders for February. The consensus is for a 0.3% increase in orders.

11:00 AM: Kansas City Fed regional Manufacturing Survey for March. The index was at an all time high 19 in February.

8:30 AM: Employment Report for March.

The consensus is for an increase of 195,000 non-farm payroll jobs in March, after an increase of 192,000 in February (that was partially "payback" for the weak January report).

The consensus is for an increase of 195,000 non-farm payroll jobs in March, after an increase of 192,000 in February (that was partially "payback" for the weak January report). This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The estimate for March is in blue.

The consensus is for the unemployment rate to remain at 8.9% in March.

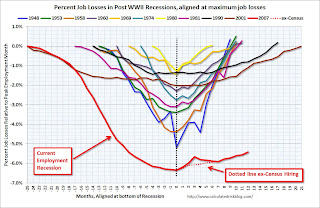

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions - aligned at maximum job losses.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions - aligned at maximum job losses.This shows the severe job losses during the recent recession - there are currently 7.5 million fewer jobs in the U.S. than when the recession started.

10:00 AM: ISM Manufacturing Index for March. The consensus is for a slight decrease to 61.2 from the strong 61.4 in February. All of the regional manufacturing surveys showed continued expansion in March.

10:00 AM: Construction Spending for February. The consensus is for no change in construction spending.

All day: Light vehicle sales for March. Light vehicle sales are expected to decrease to 13.2 million (Seasonally Adjusted Annual Rate), from 13.4 million in February.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate. Edmunds is forecasting: "Edmunds.com analysts predict that March’s Seasonally Adjusted Annualized Rate (SAAR) will be 13.07 million, down from 13.38 in February 2011."

Best wishes to All!

Saturday, March 26, 2011

LPS: Overall mortgage delinquencies declined slightly in February

by Calculated Risk on 3/26/2011 10:24:00 PM

Earlier:

• Here is the Summary for Week ending March 25th.

• Lawler: Census 2010 and Excess Vacant Housing Units

LPS Applied Analytics recently released their February Mortgage Performance data. From LPS:

•Delinquency rates resumed their decline after an increase in January and foreclosure inventories remain stable, slightly below historic highs.

• Delinquencies continue to improve as new problem loan rates decline and cure rates increase.

• Foreclosure start declines and foreclosure suspensions are reducing the upward pressure on inventories caused by foreclosure sale moratoria.

• An enormous backlog of foreclosures still exists with overhang at every level:

–There are three times the number of loans deteriorating greater than 90+ days delinquent as compared to foreclosure starts.

–There are also three times the number foreclosure starts vs. foreclosure sales.

–Foreclosure inventory levels are over 30 times monthly foreclosure sale volume.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

The percent in the foreclosure process has been trending up because of the foreclosure moratoriums.

According to LPS, 8.80% of mortgages are delinquent (down from 8.90% in January), and another 4.15% are in the foreclosure process (about the same as 4.16% in January) for a total of 12.96%. It breaks down as:

• 2.49 million loans less than 90 days delinquent.

• 2.16 million loans 90+ days delinquent.

• 2.2 million loans in foreclosure process.

For a total of 6.86 million loans delinquent or in foreclosure.

The second graph shows the break down of serious deliquencies.

The second graph shows the break down of serious deliquencies.The number of seriously delinquent loans has stopped decreasing - mostly because the number of seriously delinquent loans that have not made a payment in over a year continues to increase.

Note: I've seen some people include these almost 7 million delinquent loans as "shadow inventory". This is not correct because 1) some of these loans will cure, and 2) some of these homes are already listed for sale (so they are included in the visible inventory).

Lawler: Census 2010 and Excess Vacant Housing Units

by Calculated Risk on 3/26/2011 05:54:00 PM

CR Note: This long and detailed note on the 2010 Census data is from economist Tom Lawler. Here is a spreadsheet for the 50 states (and D.C.) including the 2000 and 1990 Census data.

This starts with a brief excerpt (click read more for the full post). For those not interested in why some data drives demographers to drink, here is the Summary for Week ending March 25th.

Census 2010: Households, Housing Stock, and Vacant Housing Units: Understanding Why Demographers Drink by Tom Lawler

Census has now released the final Census 2010 counts for state and local population and housing units – occupied and vacant. Here are some national totals, as well as a comparison to the “official” Census 2000 counts – which are “known” to be off, but by uncertain amounts.

| Census 2010 | Census 2000 | Change | % Change | |

|---|---|---|---|---|

| Population | 308,745,538 | 281,421,906 | 27,323,632 | 9.7% |

| Total Housing Units | 131,704,730 | 115,904,641 | 15,800,089 | 13.6% |

| Occupied | 116,716,292 | 105,480,101 | 11,236,191 | 10.7% |

| Vacant | 14,988,438 | 10,424,540 | 4,563,898 | 43.8% |

| Gross Vacancy Rate | 11.38% | 8.99% | 2.39% |

For those who follow housing production, one of the “striking” things about the Census 2010 vs. the Census 2000 data is the apparent growth in the housing stock – 15.8 million units.

Summary for Week ending March 25th

by Calculated Risk on 3/26/2011 11:31:00 AM

World events once again dominated the headlines last week, with the Japanese nuclear issues, Libya, the Middle-East (especially Syria) and also the European financial crisis (Portugal, Ireland, Greece - even Spain and more) all on the front page.

In the U.S., the economic data was weaker, mostly because the major economic releases were housing related. New home sales were at a record low, and existing home sales fell sharply. But also durable goods orders were weaker than expected and consumer sentiment declined sharply from February (probably due to high gasoline prices and world events).

On the positive side, initial weekly unemployment claims continued to decline and the Richmond Fed manufacturing survey indicated continued expansion in March.

Below is a summary of economic data last week mostly in graphs:

• New Home Sales Fall to Record Low in February

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Census Bureau reported New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 250 thousand. This was down from a revised 301 thousand in January.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate. This was a new record low sales rate and well below the consensus forecast of 290 thousand homes sold (SAAR).

The 2nd graph shows "months of supply". Months of supply increased to 8.9 in February from 7.4 months in January. The all time record was 12.1 months of supply in January 2009. This is very high (less than 6 months supply is normal).

The 2nd graph shows "months of supply". Months of supply increased to 8.9 in February from 7.4 months in January. The all time record was 12.1 months of supply in January 2009. This is very high (less than 6 months supply is normal).

The third graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In February 2010 (red column), 19 thousand new homes were sold (NSA). This is a new record low for the month of February.

In February 2010 (red column), 19 thousand new homes were sold (NSA). This is a new record low for the month of February.

The previous record low for February was 27 thousand in 2010. The high was 109 thousand in 2005.

This was a very weak report ...

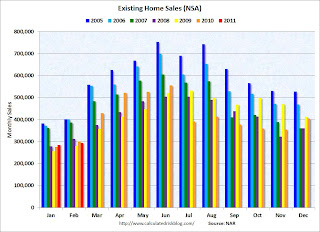

• February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

The NAR reported: February Existing-Home Sales Decline

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February 2011 (4.88 million SAAR) were 9.6% lower than last month, and were 2.8% lower than February 2010.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Although inventory increased from January to February (as usual), inventory decreased 1.2% YoY in February. This is a small YoY decrease and follows six consecutive month of year-over-year increases in inventory.

Although inventory increased from January to February (as usual), inventory decreased 1.2% YoY in February. This is a small YoY decrease and follows six consecutive month of year-over-year increases in inventory.

Inventory should increase over the next few months (the normal seasonal pattern), and the YoY change is something to watch closely this year. Inventory and "months of supply" are already very high, and further YoY increases in inventory would put more downward pressure on house prices.

This graph shows existing home sales Not Seasonally Adjusted (NSA).

This graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns in January and February are for 2011.

Sales NSA were about the same level as the last three years. February is usually the second weakest month of the year for existing home sales (close to January). The real key is what happens in the spring and summer - and March sales and inventory will give a clearer picture of existing home sales activity.

• AIA: Architecture Billings Index increased slightly in February

From the American Institute of Architects: Architecture Firm Billings Increase Slightly in February. Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index showed billings were slightly higher in February (at 50.6).

This graph shows the Architecture Billings Index since 1996. The index showed billings were slightly higher in February (at 50.6).

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end mid-year 2011 or so - but there won't be a strong increase in investment.

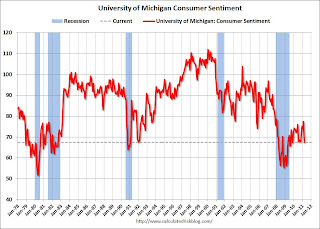

• Consumer Sentiment declines in March

The final March Reuters / University of Michigan consumer sentiment index declined to 67.5 from the preliminary March reading of 68.2 - and down from 77.5 in February. This is the lowest level since November 2009 and was below the consensus forecast of 68.0.

The final March Reuters / University of Michigan consumer sentiment index declined to 67.5 from the preliminary March reading of 68.2 - and down from 77.5 in February. This is the lowest level since November 2009 and was below the consensus forecast of 68.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

With higher gasoline prices and the scary world news, a low reading isn't that surprising.

• Other Economic Stories ...

• From the Chicago Fed: Economic Growth Near Average in February

• From the Richmond Fed: Manufacturing Activity Continues to Advance in March; Expectations Remain Upbeat

• ATA Truck Tonnage Index declined in February

• Moody's: Commercial Real Estate Prices declined 1.2% in January

• DOT: Vehicle Miles Driven increased slightly in January

• Q4 Real GDP Growth revised up to 3.1%

• Unofficial Problem Bank list increases to 985 Institutions

Best wishes to all!

Unofficial Problem Bank list increases to 985 Institutions

by Calculated Risk on 3/26/2011 08:15:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Mar 25, 2011.

Changes and comments from surferdude808:

The Unofficial Problem Bank List continued to climb as the FDIC released its actions for February 2011. This week, there were eight additions and five removals, which leaves the list with 985 institutions with assets of $431.1 billion.

The removals include the failed The Bank of Commerce, Wood Dale, IL ($163 million); one action termination against First Bank, Williamstown, NJ ($212 million); and three sales to private investors by West Michigan Community Bank, Hudsonville, MI ($123 million); Treaty Oak Bank, Austin, TX ($110 million Ticker: TOAK); and Community State Bank, Austin, TX ($21 million).

Among the eight additions are Plumas Bank, Quincy, CA ($483 million Ticker: PLBC); Country Bank, Aledo, IL ($213 million); and First Financial Bank, Bessemer, AL ($205 million).

Other changes include the issuance of seven and termination of one Prompt Corrective Order. The FDIC terminated the PCA order against Seattle Bank, Seattle, WA and issued orders against The Village Bank, Saint George, UT ($209 million); First Heritage Bank, Snohomish, WA ($179 million); Summit Bank, Prescott, AZ ($81 million); and four subsidiaries of Capitol Bancorp (Ticker: CBCR): Michigan Commerce Bank, Ann Arbor, MI ($934 million); Bank of Las Vegas, Las Vegas, NV ($375 million); Sunrise Bank of Arizona, Phoenix, AZ ($353 million); and Central Arizona Bank, Casa Grande, AZ ($76 million). (Edited by CR: see here for correction on Capitol Bancorp)

With the passage of another quarter, it is time to update the transition matrix. The Unofficial Problem Bank List debuted on August 7, 2009 with 389 institutions with assets of $276.3 billion (see table). Over the past 19 months, 176 institutions have been removed from the original list with 120 due to failure, 40 due to action termination, and 16 due to unassisted merger. Almost 31 percent of the 389 institutions on the original list have failed, which is substantially higher than the 12 percent figure usually cited by the media as the failure rate for institutions on the FDIC Problem Bank List. Failed bank assets have totaled $166.6 billion or 60 percent of the $276.3 billion on the original list.

Since the publication of the original list, another 940 institutions have been added. However, only 772 of those 940 additions remain on the current list as 168 institutions have been removed in the interim. Of the 168 interim removals, 119 were due to failure, 32 were due to unassisted merger, 15 from action termination, and two from voluntary liquidation. In total, 1,329 institutions have made an appearance on the Unofficial Problem Bank List and 239 or 18.0 percent have failed. Of the 344 total removals, failure is the primary form of exit (239 or 69.5 percent) while only 55 or 16.0 percent have been rehabilitated. The average asset size of removals because of failure is $1.04 billion. Currently, the average asset size of institutions on the current list is $438 million versus $710 million on the original list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 40 | (5,853,210) | |

| Unassisted Merger | 16 | (2,478,895) | |

| Voluntary Liquidation | 0 | - | |

| Failures | 120 | (166,633,042) | |

| Asset Change | (16,154,143) | ||

| Still on List at 3/25/2011 | 213 | 85,194,139 | |

| Additions | 772 | 345,874,340 | |

| End (3/25/2011) | 985 | 431,068,479 | |

| Interperiod Deletions1 | |||

| Action Terminated | 15 | 15,245,458 | |

| Unassisted Merger | 32 | 26,763,786 | |

| Voluntary Liquidation | 2 | 833,567 | |

| Failures | 119 | 81,716,210 | |

| Total | 168 | 124,559,021 | |

| 1Institution not on 8/7/2009 or 3/25/2011 list but appeared on a list between these dates. | |||