by Calculated Risk on 3/12/2011 08:36:00 AM

Saturday, March 12, 2011

Unofficial Problem Bank list increases to 964 Institutions

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Mar 11, 2011.

Changes and comments from surferdude808:

The week included failures and new additions to the Unofficial Problem Bank List. In all, there were two removals and four additions.

The List has 964 institutions with assets of $420.7 billion, which represents the second highest asset level since the List has been published. So far, the peak in assets occurred on September 24, 2010 at $422.4 billion.

The removals only include one of the failures this week -- Legacy Bank, Milwaukee, WI ($190 million); and an action termination -- Eastern Federal Bank, Norwich, CT ($166 million).

The additions were First American Bank, Fort Dodge, IA ($1.5 billion); Florida Bank, Tampa, FL ($840 million); Greer State Bank, Greer, SC ($456 million Ticker: GRBS); and Frontier Bank, FSB, Palm Desert, CA ($313 million). Next week, we anticipate the OCC will release its actions through mid-February 2011, so the List will likely continue its climb to 1,000 institutions.

Friday, March 11, 2011

Report: "Eurozone debt deal struck"

by Calculated Risk on 3/11/2011 09:18:00 PM

The Financial Times is reporting: Eurozone debt deal struck

The heads of the eurozone’s 17 governments came to an unexpected deal on short-term measures to lower borrowing costs of struggling peripheral economies, agreeing to give more financial backing to the bloc’s €440bn rescue fund and lowering the interest rates on Greece’s bail-out loans.According to the Financial Times, the EFSF will be allowed to intervene in the primary bond market - and the term for the Greek loans will be extended to 7.5 years. However there will be no interest rate cut for Ireland.

excerpt with permission

Earlier today:

• Retail Sales increased 1.0% in February.

• Consumer Sentiment declined sharply in March.

• BLS: Job Openings decline in January, Low Labor Turnover.

Bank Failure #24 in 2011: The First National Bank of Davis, Davis, Oklahoma

by Calculated Risk on 3/11/2011 06:59:00 PM

From the FDIC: The Pauls Valley National Bank, Pauls Valley, Oklahoma, Assumes All of the Deposits of The First National Bank of Davis, Davis, Oklahoma

As of December 31, 2010, The First National Bank of Davis had approximately $90.2 million in total assets and $68.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $26.5 million. ... The First National Bank of Davis is the 24th FDIC-insured institution to fail in the nation this year, and the second in Oklahoma.The FDIC is back at work.

Update: And #25 ...

From the FDIC: Seaway Bank and Trust Company, Chicago, Illinois Assumes All of the Deposits of Legacy Bank, Milwaukee, Wisconsin

As of December 31, 2010, Legacy Bank had approximately $190.4 million in total assets and $183.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $43.5 million. ... Legacy Bank is the 25th FDIC-insured institution to fail in the nation this year, and the third in Wisconsin.

Distressed House Sales using Sacramento data

by Calculated Risk on 3/11/2011 05:15:00 PM

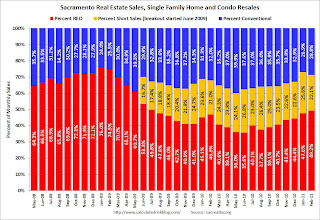

I've been following the Sacramento market to see the change in mix (conventional, REOs, short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009. Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales increases every winter. The tax credits might have also boosted conventional sales in 2009 and early 2010.

Note: Prior to June 2009, it is unclear if short sales were included as REO or as "conventional" - or some of both.

In February 2011, 71.2% of all resales (single family homes and condos) were distressed sales. This is the 2nd highest level of distressed sales since Sacramento started breaking out short sales - last month was the highest. And this is the highest level of REO since July 2009.

Also one-third of all homes were sold for cash, up from 31.3% last month.

A high level of distressed sales suggests falling prices, and this data from Sacramento suggests further price declines in February. The CoreLogic House Price index hit a new post-bubble low in January, and my guess is the Case-Shiller index will fall to a post-bubble low when the January data is released on March 29th.

Portugal Bailout Speculation

by Calculated Risk on 3/11/2011 02:39:00 PM

From Bloomberg: Portugal 5-Year Yield at Euro-Era Record on Bailout Speculation

When asked whether his country was preparing to request a bailout, Finance Minister Fernando Teixeira Dos Santos said European leaders must understand the “seriousness” of the region’s debt crisis.Here are the 2 year, 5 year and 10 year Portuguese bond yields from Bloomberg. The 5 year yield is up to almost 8%, the 2 year yield is at 6.5%, up from 4.5% earlier this week.

...

The minister’s comments “might indicate that financial support for Portugal will be discussed at the weekend,” said Michael Leister, a fixed-income analyst at WestLB AG in Dusseldorf, Germany. “Yields show that the market is concerned, and is waiting for something,” he said.

Meanwhile, Greek Prime Minister George Papandreou and Irish Prime Minister Enda Kenny are apparently asking for better terms.

Note: The Greek ten year yield is at 12.8%. The Irish ten year yield is 9.6%. Here are the Ten Year yields for Spain, and Belgium.