by Calculated Risk on 3/02/2011 11:28:00 PM

Wednesday, March 02, 2011

Update on Possible Mortgage Servicer Settlement

Actually an update on the lack of progress ...

From Nelson Schwartz and David Streitfeld at the NY Times: Officials Disagree on Penalties for Mortgage Mess

The newly created Consumer Financial Protection Bureau is pushing for $20 billion or more in penalties, backed up by the attorneys general and the Federal Deposit Insurance Corporation.A key issue is what "$20 billion" means. Some regulators want the lenders to use the money to reduce principal for underwater borrowers or other modification efforts. Others argue that would be "a back-door bailout for delinquent homeowners" who weren't even harmed by the processing errors.

But other regulators, including the Office of the Comptroller of the Currency, which oversees national banks, and the Federal Reserve, do not favor such a large fine, contending a small number of people were the victims of flawed foreclosure procedures.

There is a long way to go - but it sounds like criminal charges are off the table.

Bernanke: Challenges for State and Local Governments

by Calculated Risk on 3/02/2011 08:11:00 PM

From Fed Chairman Ben Bernanke: Challenges for State and Local Governments

As the recession took hold, revenues dropped precipitously, especially at the state level. Driven partly by balanced-budget requirements under their constitutions, many governments have responded by cutting numerous programs and reducing workforces. As necessary as these cuts may have been, they have left some jurisdictions struggling to maintain essential services. The fiscal problems of state and local governments have also had national implications, as their spending cuts and tax increases have been a headwind on the economic recovery. Moreover, concerns about both the current fiscal condition of these governments and their longer-term commitments to provide pensions and health benefits have recently led to strains in municipal bond markets.This is one of the key downside risks this year along with oil prices, the European financial crisis and housing.

And on the muni bond market:

Around the turn of the year ... investor concerns about the fiscal situations of many governments, including those of some populous states, resulted in increased yields on municipal bonds relative to Treasury bonds as well as a widening of credit default swap spreads for a number of states. Fortunately, although these measures of risk in the municipal bond market remain elevated, they have been looking somewhat better recently, presumably reflecting expectations of continuing improvement in the finances of states and localities. The Federal Reserve will continue to monitor the municipal bond market closely.And on the long run challenges:

[S]tate and local governments are also confronting some difficult fiscal challenges in the longer term. Indeed, with the retirement of public employees who are part of the baby-boom generation and the continued rise in health-care costs, meeting obligations for pension and retiree health-care expenses will become increasingly difficult for many states and localities. Estimates of state and local governments' unfunded pension liabilities for the nation as a whole span a wide range, with some researchers putting the figure in the neighborhood of $2 trillion to $3 trillion.

Oil Prices and PCE

by Calculated Risk on 3/02/2011 06:29:00 PM

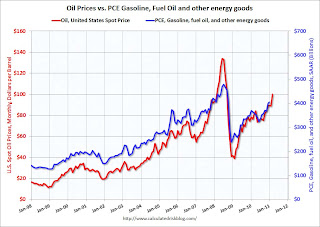

The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

As oil prices fell sharply in late 2008, consumption of gasoline and other energy goods fell sharply too. On a quarterly basis, PCE, "Gasoline and other energy goods" peaked at $467 billion (SAAR) in Q3 2008, and fell sharply to $265 billion (SAAR) in Q1.

The sharp decline in oil prices provided a cushion for the U.S. economy in early 2009.

Now, with U.S. spot prices over $100 per barrel, gasoline and other energy goods PCE will probably come in around $425 billion (SAAR) in Q1 2011 (up from $379 billion (SAAR) in Q4 2010. This was already over $400 billion SAAR in January.

This is a drag on consumers of about $5 to $6 billion per month, at the current oil price, compared to the average for 2010.

Data sources: PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product

Oil prices from EIA: U.S. Spot Prices

Fed's Beige Book: Economic activity continued to expand at a modest to moderate pace

by Calculated Risk on 3/02/2011 02:00:00 PM

Reports from the twelve Federal Reserve Districts indicated that overall economic activity continued to expand at a modest to moderate pace in January and early February.And on real estate:

...

Retail sales increased in all Districts, except Richmond and Atlanta, although Boston, New York, Philadelphia, Atlanta, and Kansas City noted that severe snowstorms had a negative impact on merchant activity.

...

All Districts, except St. Louis, experienced solid growth in manufacturing production, and new orders improved for Philadelphia, Atlanta, Chicago, Kansas City, and San Francisco.

...

Manufacturing and retail contacts across Districts reported rising input costs. Manufacturers in many Districts conveyed that they were passing through higher input costs to customers or planned to do so in the near future. ... There is little evidence of wage pressures across Districts.

...

Labor market conditions continued to strengthen modestly, with all Districts reporting some degree of improvement. The Boston, Cleveland, Minneapolis, and Dallas Districts cited noticeable improvements in the manufacturing sector, and the Boston and Cleveland Districts also observed increased labor demand in the healthcare and medical sectors.

Recent activity in residential real estate varied, but overall sales and construction remained at low levels across all Districts.Still "modest to moderate expansion". The good news is "labor market conditions continued to strengthen", but unfortunately "modestly". The bad news is rising input costs. This was based on data gathered before February 18th (late January, early February).

...

Reports on home prices were mixed. Atlanta and Kansas City observed persistent downward price pressure. Home prices continued to fall according to Philadelphia reports, but mainly at the high-end of the market. Cleveland and Chicago contacts described prices as little changed.

...

Commercial real estate activity showed signs of gaining traction according to a number of District reports. Boston, Chicago and Dallas reported that commercial real estate activity improved overall, while Richmond, Kansas City, and San Francisco noted increases in leasing activity. Kansas City described the market as stabilizing, while Philadelphia and Minneapolis reported that markets were flat overall, and New York described conditions as "slack" and St. Louis as "soft."

DOT: Vehicle Miles Driven increased in December

by Calculated Risk on 3/02/2011 11:55:00 AM

The Department of Transportation (DOT) reported that vehicle miles driven in December were up 0.6% compared to December 2009:

Travel on all roads and streets changed by +0.6% (1.4 billion vehicle miles) for December 2010 as compared with December 2009. Travel for the month is estimated to be 243.4 billion vehicle miles.

Cumulative Travel for 2010 changed by +0.7% (20.5 billion vehicle miles).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

• Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 37 months - another record that will be broken soon.

• For the year (2010), this was the most vehicle miles traveled since 2007 and the third-highest ever behind both 2006 and 2007.

• In December U.S. oil prices averaged just under $90 per barrel, and we might see $100 oil lead to a decrease in driving in March or April.