by Calculated Risk on 3/02/2011 10:06:00 AM

Wednesday, March 02, 2011

Fed Testimony: Surpluses Forever!

Fed Chairman Ben Bernanke is testifying before the House Committee on Financial Services today. The prepared testimony will be the same as yesterday (before the Senate).

Here is the CSpan feed.

Here is the CNBC feed.

It is probably a good time to revisit then Fed Chairman Alan Greenspan's testimony to the same committee 10 years ago today. Here is his testimony on March 2, 2001:

Both the Bush Administration and the Congressional Budget Office project growing on-budget surpluses under current policy over the next decade.How did that work out?

...

The most recent projections from OMB and CBO indicate that, if current policies remain in place, the total unified surplus will reach about $800 billion in fiscal year 2010, including an on-budget surplus of almost $500 billion. Moreover, the admittedly quite uncertain long-term budget exercises released by the CBO last October maintain an implicit on-budget surplus under baseline assumptions well past 2030 despite the budgetary pressures from the aging of the baby-boom generation, especially on the major health programs.

These most recent projections, granted their tentativeness, nonetheless make clear that the highly desirable goal of paying off the federal debt is in reach and, indeed, would occur well before the end of the decade under baseline assumptions.

As an aside, the policy of returning the surpluses to the people was supported by both Rep. Ron Paul (current Chairman House Committee on Financial Services) and Rep. Paul Ryan (current Chairman House Subcommittee for Domestic Monetary Policy and Technology).

In Greenspan's defense, he did suggest any tax cut to reduce the surpluses should have a trigger to reduce the tax cut if deficits reappeared:

Conceivably, [a surplus reduction tax plan] could include provisions that, in some way, would limit surplus-reducing actions if specified targets for the budget surplus or federal debt levels were not satisfied. Only if the probability were very low that prospective tax cuts or new outlay initiatives would send the on-budget accounts into deficit, would unconditional initiatives appear prudent.Of course that never happened.

...

With today's euphoria surrounding the surpluses, it is not difficult to imagine the hard-earned fiscal restraint developed in recent years rapidly dissipating. We need to resist those policies that could readily resurrect the deficits of the past and the fiscal imbalances that followed in their wake.

ADP: Private Employment increased by 217,000 in February

by Calculated Risk on 3/02/2011 08:15:00 AM

ADP reports:

Private-sector employment increased by 217,000 from January to February on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from December 2010 to January 2011 was revised up to 189,000 from the previously reported increase of 187,000.Note: ADP is private nonfarm employment only (no government jobs).

This month’s ADP National Employment Report suggests continued solid growth of nonfarm private employment early in 2011. The recent pattern of rising employment gains since the middle of last year was reinforced by today’s report, as the average gain from December through February (217,000) is well above the average gain over the prior six months (63,000).

This was above the consensus forecast of an increase of about 180,000 private sector jobs in February.

The BLS reports on Friday, and the consensus is for an increase of 180,000 payroll jobs in February, on a seasonally adjusted (SA) basis, and for the unemployment rate to increase slightly to 9.1%.

MBA: Mortgage Purchase Application activity decreases

by Calculated Risk on 3/02/2011 07:38:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6.5 percent from the previous week. The seasonally adjusted Purchase Index decreased 6.1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.84 percent from 5.00 percent, with points increasing to 1.30 from 0.96 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

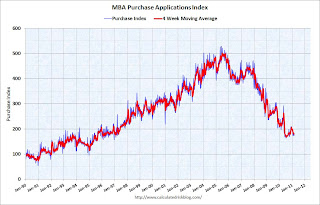

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is at 1997 levels - however there are have been a large percentage of cash buyers recently and cash buyers do not apply for a mortgage - still this suggests weak home sales through the first few months of 2011.

Tuesday, March 01, 2011

ISM Manufacturing Index and Employment

by Calculated Risk on 3/01/2011 10:33:00 PM

It is time for a scatter graph ...

Earlier today, I noted that the ISM manufacturing employment index was the highest level since January 1973 at 64.5, but the impact on overall employment would be less than in '73. This is because manufacturing employment is a much smaller percentage of overall U.S. employment now. In 1973, almost 30% of private payroll employment was manufacturing (18.3 million), today it is less than 11% (at 11.6 million). So the same ISM manufacturing employment reading today suggests a much smaller impact on overall U.S. employment than in 1973.

It is still good news, and the ISM survey suggests manufacturing employment grew at around 60,000 in February.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the relationship between the ISM manufacturing employment index and the change in BLS manufacturing employment (as a percent of the previous month employment).

The two yellow dots are for January 2011 (61.7 ISM and 49,000 jobs), and a forecast for February based on the ISM employment reading of 64.5.

There was a time when a 64.5 might mean a couple hundred thousand payroll jobs, but now it suggests around 60,000 jobs (with plenty of noise). Still helpful, but not the same overall impact as in the '50s, '60s or even '70s.

Earlier:

• ISM Manufacturing Index increases in February

• Private Construction Spending decreases in January

• U.S. Light Vehicle Sales 13.44 million SAAR in February

• Graphs: ISM manufacturing, Construction Spending, Vehicle Sales

Fannie Mae and Freddie Mac Delinquency Rates decline slightly

by Calculated Risk on 3/01/2011 07:27:00 PM

Earlier:

• ISM Manufacturing Index increases in February

• Private Construction Spending decreases in January

• U.S. Light Vehicle Sales 13.44 million SAAR in February

• Graphs: ISM manufacturing, Construction Spending, Vehicle Sales

Fannie Mae reported that the serious delinquency rate decreased to 4.48% in December from 4.50% in November. This is down from 5.38% a year ago.

Freddie Mac reported that the serious delinquency rate decreased to 3.82% in January from 3.84% in December. (Note: Fannie reports a month behind Freddie). This is down from 4.15% in January 2010.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

The slowdown in the decline was probably related to the new foreclosure moratoriums last year. Going forward, a key question is if falling house prices will lead to an increase in serious delinquent loans.