by Calculated Risk on 1/29/2011 01:47:00 AM

Saturday, January 29, 2011

Late Night: Egypt

From Al Jazeera English (All times are local in Egypt.). Latest entries ...

6:38 am Internet and mobile phone networks are still down in Egypt.

6:30 am The headquarters of the ruling National Democratic Party in Cairo are still on fire.

A couple of stories ...

From the WaPo: Cairo in near-anarchy as protesters push to oust president

From the NY Times: Mubarak Orders Crackdown, With Revolt Sweeping Egypt

Friday, January 28, 2011

Bank Failure #11 for 2011: First Community Bank, Taos, New Mexico

by Calculated Risk on 1/28/2011 08:38:00 PM

The high price of low living

Malfeasance results

by Soylent Green is People

From the FDIC: U.S. Bank, National Association, Minneapolis, Minnesota, Assumes All of the Deposits of First Community Bank, Taos, New Mexico

As of September 30, 2010, First Community Bank had approximately $2.31 billion in total assets and $1.94 billion in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $260.0 million. ... First Community Bank is the eleventh FDIC-insured institution to fail in the nation this year, and the first in New Mexico.A billion here, a billion there ...

Bank Failure #10 for 2011: FirsTier Bank, Louisville, Colorado

by Calculated Risk on 1/28/2011 07:42:00 PM

Without it, which banks might fail?

Today: First Tier Bank.

by Soylent Green is People

From the FDIC: FDIC Creates the Deposit Insurance National Bank of Louisville to Protect Insured Depositors of FirsTier Bank, Louisville, Colorado

As of September 30, 2010, FirsTier Bank had $781.5 million in total assets and $722.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $242.6 million. FirsTier Bank is the tenth FDIC-insured institution to fail in the nation this year, and the second in Colorado.That makes three today - and another one with no buyer.

Report: Mubarak announces he is dismissing the government

by Calculated Risk on 1/28/2011 05:45:00 PM

From Al Jazeera English Mubarak announces he is dismissing the government

Update: From the NY Times: Mubarak Orders Ministers to Resign but Backs Armed Response to Egypt Protests

Bank Failure #8 in 2011: First State Bank, Camargo, Oklahoma

As of September 30, 2010, The First State Bank had approximately $43.5 million in total assets and $40.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20.1 million. ... The First State Bank is the eighth FDIC-insured institution to fail in the nation this year, and the first in Oklahoma.

Innumerable losses

When will perp walks start?

by Soylent Green is People

Update: Bank Failure #9 in 2011: Evergreen State Bank, Stoughton, Wisconsin

As of September 30, 2010, Evergreen State Bank had approximately $246.5 million in total assets and $195.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $22.8 million. ... Evergreen State Bank is the ninth FDIC-insured institution to fail in the nation this year, and the first in Wisconsin.

Evergreen's gone never green

Roots dead from red ink

by Soylent Green is People

Lawler: Downward Revisions Coming to Existing Home Sales?

by Calculated Risk on 1/28/2011 03:45:00 PM

This is from housing economist Tom Lawler (CR Note: I probably jumped the gun on the timing of the major revisions, but I believe they are coming):

As many readers may recall, over the last year and a half I have noted numerous times that the NAR’s estimates for existing home sales appear to have understated the decline in existing home sales since 2006, with the “gap” increasing from 2007 through 2009. The basis for that assertion was that existing home sales based on property records in some key states declined materially more than did the NAR’s estimate of existing home sales in those states. In addition, CoreLogic’s estimates of existing home sales based on property records in its database (which covers “over 80%”of the US housing market) show materially larger declines since 2006 than do the NAR’s estimates.

The NAR is aware of these “discrepancies” and has been since at least 2009, but changing its methodology is not a trivial task. However, reportedly the NAR (working with others) has been looking into this issue, and is exploring whether it needs to change its methodology to get better estimates of “actual” existing home sales.

Late last evening CalculatedRisk wrote that

‘The NAR is planning on releasing revisions for the past three years (2008 through 2010) on February 23rd along with the January existing home sales report. Many housing analysts expect these revisions to be significant - and to be down. Assuming the revisions are down, this will also reduce the "distressing gap" between existing and new home sales.’

Now it is true that the NAR plans to release revisions to it monthly existing home sales data for the past three years on February 23rd. However, it ALWAYS revises its monthly data at that time of year each year to reflect annual changes in seasonal factors. I’m not at all sure that the NAR will also be ready next month to revise its existing homes sales data based on a new methodology – though ultimately I expect it will do so.

To give one an idea of what such a revision might ultimately look like, below is a table showing the NAR’s estimate for existing home sales from 2006 to 2009 versus CoreLogic’s count of existing home sales from its property records database. Full year 2010 data from CL are not yet available; in addition, CL’s data for the past several months (through October) will be revised upward as new data from county recorders become available. (The CL data include “normal” existing home sales, REO sales, and short sales). Also shown are “grossed-up” CL estimates assuming that the NAR’s existing home sales estimate were “correct,” [in 2006] which would imply that CL’s database covers about 84.25% of total existing home transactions. That assumption, of course, may not be correct, but I’m showing the data that way anyway.

| Existing Home Sales (thousands) | |||

|---|---|---|---|

| Year | NAR | CoreLogic | Grossed-up CoreLogic |

| 2006 | 6,478 | 5,458 | 6,478 |

| 2007 | 5,652 | 4,465 | 5,299 |

| 2008 | 4,913 | 3,720 | 4,415 |

| 2009 | 5,156 | 3,641 | 4,321 |

One reason for the NAR/property records sales estimates gaps appears to be that since 2006 there was a cyclical increase in the share of home sales through local MLS. This reflects both the greater difficulty sellers had in selling homes, as well as the increased use of the internet by buyers in their home search.

CR Note: This was from housing economist Tom Lawler.

Egypt Update

by Calculated Risk on 1/28/2011 02:07:00 PM

Update: Al Jazeera English (ht km4)

The Telegraph is providing updates on events in Egypt.

Oil prices have surged.

From the Financial Times: Oil price spikes towards $100 and from Dow Jones: Egypt Unrest Sends Oil Prices Surging

Light, sweet crude for March delivery rose $3.61, or 4.2%, at $89.25 a barrel on the New York Mercantile Exchange. Brent crude on the ICE futures exchange gained $1.63, or $1.7%, at $99.02 a barrel. It earlier touched a 16-month high of $99.63 a barrel.I usually track the West Texas Intermediate price (just under $90). The divergence between the two, according to the Financial Times, is due to rising inventories at a key hub in Oklahoma.

Comments from Secretary of State Clinton: Egypt must respect citizen rights, reform

"We are deeply concerned about the use of violence by Egyptian police and security forces against protesters, and we call on the Egyptian government to do everything in its power to restrain the security forces," Clinton told reporters at the State Department. "At the same time, protesters should also refrain from violence and express themselves peacefully."

"We urge the Egyptian authorities to allow peaceful protests and to reverse the unprecedented steps it has taken to cut off communication," she said. "These protests underscore that there are deep grievances within Egyptian society, and the Egyptian government needs to understand that violence will not make these grievances go away."

Residential Investment near record low as Percent of GDP

by Calculated Risk on 1/28/2011 11:52:00 AM

A couple more graphs from the GDP report, and the final consumer sentiment for January ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Residential Investment (RI) increased slightly in Q4, but as a percent of GDP, RI is near a post-war low at 2.24% - essentially unchanged from Q3.

Some people have asked how a sector that only accounts for 2.2% of GDP could be so important? The answer is that usually RI accounts for a large percentage of the employment and GDP growth in the first year or so of a recovery (and increases in RI have a positive impact on other areas like furniture, etc). Not this time because of the huge overhang of existing vacant units.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

I expect RI to increase in 2011 and add to both GDP and employment growth - for the first time since 2005!

The second graph shows non-residential investment in structures and equipment and software.

The second graph shows non-residential investment in structures and equipment and software.

Equipment and software investment has been increasing sharply, although investment growth slowed in Q4 to a 5.8% annualized rate.

Non-residential investment in structures is near a record low and will probably stayed depressed for some time. I expect non-residential investment in structures to bottom later this year, but the recovery will be very sluggish for some time with the high vacancy rates for offices and malls.

The final Reuters / University of Michigan consumer sentiment index for January was at 74.2. This was up from the preliminary report of 72.7, and down from 75.2 in December.

The final Reuters / University of Michigan consumer sentiment index for January was at 74.2. This was up from the preliminary report of 72.7, and down from 75.2 in December.

This was slightly above the consensus forecast of 71.3, but the level is very low and well below the pre-recession levels.

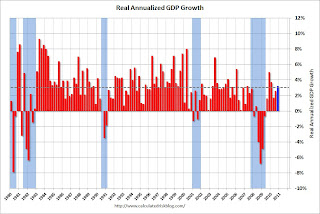

Advance Report: Real Annualized GDP Grew at 3.2% in Q4

by Calculated Risk on 1/28/2011 08:30:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 3.2 percent in the fourth quarter of 2010, (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the median growth rate of 3.05%. Growth in Q4 at 3.2% annualized was slightly above trend growth - weak for a recovery, especially with all the slack in the system.

A few key numbers:

• The change in real private inventories subtracted 3.70 percentage points from the fourth-quarter change in real GDP after adding 1.61 percentage points to the third-quarter change.

GDP would have been very strong without this change in private inventories. This was offset by a postive contribution from Net exports of goods and services of 3.44 percentage points.

• Real personal consumption expenditures increased 4.4 percent in the fourth quarter, compared with an increase of 2.4 percent in the third.

• Investment: Nonresidential structures increased 0.8 percent, equipment and software increased 5.8 percent and real residential fixed investment increased 3.4 percent.

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Residential Investment (RI) made a small positive contribution to GDP in Q4 2010, and the four quarter rolling average is negative again following the slight boost from the tax credit early in 2010.

Residential Investment (RI) made a small positive contribution to GDP in Q4 2010, and the four quarter rolling average is negative again following the slight boost from the tax credit early in 2010.Equipment and software investment has made a significant positive contribution to GDP for six straight quarters (it is coincident).

The contribution from nonresidential investment in structures was slightly positive in Q4, although this will probably be revised down.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

Thursday, January 27, 2011

Update: Coming Existing Home Sales Revisions

by Calculated Risk on 1/27/2011 11:32:00 PM

UPDATE:

• On February 23rd, the National Association of Realtors (NAR) will release revisions for the past three years (2008 through 2010) along with the January existing home sales report. This is the ordinary annual revision, and the revisions will probably be minor.

• The NAR is working on benchmarking existing home sales for previous years with other industry data. There is no planned release date for these possible revisions - if any are announced. The process is expected to be completed sometime after mid-year, and I expect this effort will lead to significant downward revisions to previously reported sales.

Original post:

This morning I noted:

I've been discussing the National Association of Realtors (NAR) existing home sales data with several analysts. ... I think the NAR started over estimating sales in 2006 or 2007 ... and the errors have increased since then ... I expect the NAR will revise down sales for these years in the not too distant future ...The NAR is planning on releasing revisions for the past three years (2008 through 2010) on February 23rd along with the January existing home sales report. Many housing analysts expect these revisions to be significant - and to be down. Assuming the revisions are down, this will also reduce the "distressing gap" between existing and new home sales.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a repeat of the graph showing existing home sales (left axis) and new home sales (right axis) through December. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

After the housing bubble and bust, the "distressing gap" appeared due mostly to distressed sales. Even with a significant downward revision to existing home sales (say 10% or even 15%) that will only reduce the "distressing gap" a little.

Update on Egypt, Yemen

by Calculated Risk on 1/27/2011 08:26:00 PM

From the Telegraph: Egypt protests: Mubarak rival flies to Egypt as the revolt gathers pace

For the past three days, the revolt against Mr Mubarak has been one of unadulterated people-power, galvanised by the internet and word of mouth and driven by the young.From the Financial Times: ElBaradei return raises stakes in Egypt

Disgruntled Egyptians from different classes and different parts of the country have joined the cause, shedding a fear of authority that has become part of the country's collective psyche. It is this growing confidence of the masses, inspired by Tunisia's Jasmine Revolution, which has so unnerved the authorities.

The 68-year-old Mr ElBaradei, a former Egyptian diplomat and ex-chief of the International Atomic Energy Agency, told reporters in Cairo that he would take part in protests that opposition parties and a youth protest movement have called for following Friday prayers.From the NY Times: Thousands in Yemen Protest Against the Government

“The barrier of fear is broken and it will not come back,” he said.

excerpt with permission

Yemen, one of the Middle East’s most impoverished countries and a haven for Al Qaeda militants, became the latest Arab state to witness mass protests on Thursday, as thousands of Yemenis took to the streets in the capital and other regions to demand a change in government.This has a 1989 feel to it, but I fear the outcome will not be as successful - or as peaceful.