by Calculated Risk on 12/06/2010 01:10:00 PM

Monday, December 06, 2010

Residential Investment and Unemployment

One of the key reasons for the sluggish recovery has been the ongoing problems in housing. Usually residential investment (RI) is a major contributor to GDP growth in the early stages of a recovery, but not this time because of the huge overhang of existing vacant homes.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Click on graph for larger image in graphics gallery.

Click on graph for larger image in graphics gallery.

This graph shows RI and investment in single family structures as a percent of GDP. Usually RI rebounds strongly at the beginning of a recovery, but this time RI has continued to decline.

RI as a percent of GDP is at a post WWII low of 2.22%, and investment in single family structures is near the all time low.

Some people have asked how a sector that only accounts for 2.2% of GDP be so important? The answer is that usually RI accounts for a large percentage of the employment and GDP growth in the first year or so of a recovery. We can see this by looking at housing starts and the unemployment rate.

This graph shows single family housing starts (through October) and the unemployment rate (inverted) through November. Note: Of course there are many other factors too, but housing is a key sector.

This graph shows single family housing starts (through October) and the unemployment rate (inverted) through November. Note: Of course there are many other factors too, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) rebounded a little last year,and then moved sideways for some time, before declining again in May.

This is what I expected when I first posted the above graph in August 2009. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.I'm now looking at a 2011 forecast for housing, and the good news is RI should increase modestly next year. It will not be a vigorous recovery, but I do expect RI to make a positive contribution to GDP - and that is an improvement, and is one of the reasons I think real GDP growth in 2011 will be 3%+. Not great, but an improvement over 2010.

Germany rejects calls for larger rescue fund and "E-Bonds"

by Calculated Risk on 12/06/2010 09:17:00 AM

The European finance ministers are meeting today in Brussels. As we discussed over the weekend, some ministers are pushing to increase the bailout fund and others are arguing for "E-bonds" - joint European government bonds. As expected, Germany reject both suggestions ...

From the Irish Times: Germany rejects calls over debt fund

German Chancellor Angela Merkel said she saw no need to increase the size of the bailout mechanism.The German view is the higher spreads are the penalty for bad behaviour.

Mrs Merkel also said the European Union treaty did not allow for issuing common bonds, which would anyway reduce the element of competition and the interest rate incentive for fiscal good behaviour.

The key 10-year bond yields fell sharply last week (Ireland, Portugal, Spain), but are up slightly today.

Sunday, December 05, 2010

Bernanke: Without Fed's actions, unemployment rate might have hit 25%

by Calculated Risk on 12/05/2010 09:06:00 PM

From the CBS 60 Minutes interview: Fed Chairman Bernanke On The Economy

CBS: In the panic of 2008, the Fed put up $3.3 trillion. And just this past week, the Fed revealed who got emergency help. ... it was a historic transfusion of cash in a global system that was bleeding to death. We asked Bernanke what would have happened if the Fed hadn't acted.Although we don't how bad it would have been, I've repeatedly praised the Fed's creative and aggressive liquidity efforts - once they finally understood what was happening. This was the Federal Reserve at its best (and they are constantly criticized for this effort).

Scott Pelley: What would unemployment be today?

Fed Chairman Bernanke: Unemployment would be much, much higher. It might be something like it was in the Depression. Twenty-five percent. We saw what happened when one or two large financial firms came close to failure or to failure. Imagine if ten or 12 or 15 firms had failed, which is where we almost were in the fall of 2008. It would have brought down the entire global financial system and it would have had enormous implications, very long-lasting implications for the global economy, not just the U.S. economy.

And on the Fed at its worst:

Pelley: Is there anything that you wish you'd done differently over these last two and a half years or so?Bernanke was flat out blind. Missing the housing bubble and inevitable financial impact was inexcusable. I criticized Bernanke repeatedly in 2005, 2006 and 2007 for not recognizing the serious problems with the economy. I ridiculed Bernanke's 2005 piece in the WSJ: The Goldilocks Economy and wrote then that Bernanke was "channeling Coolidge's [Dec 1928] monument to economic shortsightedness".

Bernanke: Well, I wish I'd been omniscient and seen the crisis coming, the way you asked me about, I didn't.

There is much more in the interview including comments on income inequality ... "Well, it’s a very bad development. It’s creating two societies." ... and on unemployment ... "At the rate we're going, it could be four, five years before we are back to a more normal unemployment rate."

As always, I suggest ignoring Bernanke's comments on the deficit.

Earlier:

• Summary for Week ending December 4th

• Schedule for Week of December 5th

Europe Update: The launch of "E-Bonds"?

by Calculated Risk on 12/05/2010 07:02:00 PM

The European finance ministers meet this week in Brussels. Some ministers are pushing to increase the bailout fund and others are arguing for "E-bonds" - joint European government bonds. Although the key 10-year bond yields fell sharply last week (Ireland, Portugal, Spain), the crisis is far from over. A couple of articles:

From Stephen Castle at the NY Times: Pressure Rises to Bolster European Bailout Fund

European finance ministers are under mounting pressure to significantly increase the €750 billion rescue fund for the currency union when they meet Monday. ... Didier Reynders, the Belgian finance minister, suggested over the weekend that the fund ... will have to be increased when it is made permanent after 2013, and that it may make little sense to wait until then to do it.From the Financial Times: Europe’s leaders at odds over bond plan

Jean-Claude Juncker, Luxembourg’s prime minister who also chairs meetings of eurozone finance ministers, and Giulio Tremonti, Italy’s finance minister, argue in Monday’s Financial Times that the launch of “E-bonds” would send a clear message to financial markets and European citizens about the “the irreversibility of the euro”.Good luck getting Germany on board.

excerpt with permission

Bank Failures per Week in 2010

by Calculated Risk on 12/05/2010 02:29:00 PM

I haven't updated this graph for some time ...

There have been 314 bank failures in this cycle (starting in 2007):

| FDIC Bank Failures by Year | |

|---|---|

| 2007 | 3 |

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 149 |

| Total | 314 |

The FDIC has slowed down recently, and there are probably only two weeks left for bank closures this year. The 149 bank failures this year is the highest total since 1992 (181 bank failures).

Unfortunately banks are still being added to the unofficial problem bank list much faster than they are being removed ... so there are probably many more banks failures to come.

Earlier:

• Summary for Week ending December 4th

• Schedule for Week of December 5th

Summary for Week ending December 4th

by Calculated Risk on 12/05/2010 09:28:00 AM

Below is a summary of the previous week, mostly in graphs. Note: here is the economic schedule for the coming week.

• November Employment Report: 39,000 Jobs, 9.8% Unemployment Rate

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The unemployment rate increased to 9.8% (red line) from 9.6% in October.

The Employment-Population ratio declined to 58.2% in November matching the cycle low set in 2009 (black line).

The Labor Force Participation Rate was steady at 64.5% in November (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

For the current employment recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

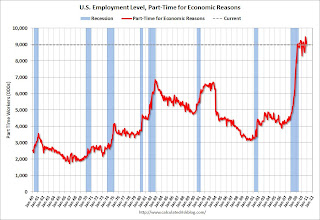

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined slightly to 8.972 million in November. This has been around 9 million since August 2009 - a very high level.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined slightly to 8.972 million in November. This has been around 9 million since August 2009 - a very high level.

These workers are included in the alternate measure of labor underutilization (U-6) that was steady at 17.0% in November. The high for U-6 was 17.4% in October 2009. Still very grim.

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more.

According to the BLS, there are 6.313 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 6.206 million in October. It appears the number of long term unemployed has peaked, however the level is extremely high - and the increases over the last two months is very concerning.

Most of the underlying details of the employment report were weak. The positives included small upward revisions to the September and October payroll reports, a slight increase in average hourly earnings, and a slight decline in part time workers.

The negatives include the unemployment rate increasing to 9.8%, few payroll jobs added (only 39,000 jobs), the decline in the employment-population ratio, the steady participation rate at a very low level, and the increase in workers unemployed for over 26 weeks.

• Case-Shiller: Broad-based Declines in Home Prices in Q3

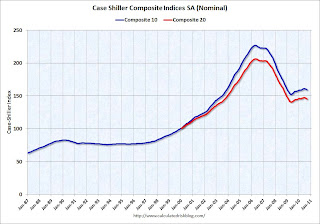

S&P/Case-Shiller released the monthly Home Price Indices for September (actually a 3 month average of July, August and September). This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities), and the quarterly national index.

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 29.8% from the peak, and down 0.7% in September(SA).

The Composite 20 index is off 29.6% from the peak, and down 0.8% in September (SA).

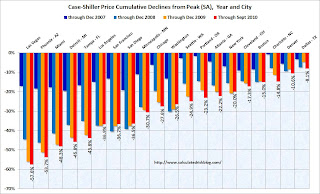

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in only 1 of the 20 Case-Shiller cities in September seasonally adjusted. Only Wash, D.C. saw a price increase (SA) in September, and that was very small.

Prices increased (SA) in only 1 of the 20 Case-Shiller cities in September seasonally adjusted. Only Wash, D.C. saw a price increase (SA) in September, and that was very small.

Prices in Las Vegas are off 57.6% from the peak, and prices in Dallas only off 8.1% from the peak.

Prices are now falling - and falling just about everywhere. And it appears there are more price declines coming (based on inventory levels and anecdotal reports).

• U.S. Light Vehicle Sales 12.26 million SAAR in November

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.26 million SAAR in November. That is up 13.2% from November 2009, and up slightly from the October 2010 sales rate.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for November (red, light vehicle sales of 12.26 million SAAR from Autodata Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for November (red, light vehicle sales of 12.26 million SAAR from Autodata Corp).

This is the highest sales rate since September 2008, excluding Cash-for-clunkers in August 2009.

This was above most forecasts of around 12.0 million SAAR.

• ISM Manufacturing Index decreases slightly to 56.6 in November

From the Institute for Supply Management: November 2010 Manufacturing ISM Report On Business® PMI was at 56.6% in November, down slightly from 56.9% in October. The consensus was for a decrease to 56.5%.

Here is a long term graph of the ISM manufacturing index.

Here is a long term graph of the ISM manufacturing index.

In addition to the PMI, the ISM's new orders index was down to 56.6 from 58.9 in October.

The employment index decreased to 57.5 from 57.7 in October.

This was inline with the regional Fed manufacturing surveys.

• Other Economic Stories ...

• Restaurant Performance Index Rose to Three-Year High In October

• Hamilton: Europe and China: is this deja vu all over again?

• Michael Pettis: The rough politics of European adjustment.

• From Catherine Rampell at the NY Times: Persistence of Long-Term Unemployment Tests U.S.

• DOT: Vehicle miles driven increased in September

• From the Institute for Supply Management: October 2010 Non-Manufacturing ISM index showed expansion in November

• From the NAR:

Strong Rebound in Pending Home Sales

• ADP: Private Employment increased by 93,000 in November

• Unofficial Problem Bank list increases to 920 Institutions

Best wishes to all!

Saturday, December 04, 2010

Schedule for Week of December 5th

by Calculated Risk on 12/04/2010 08:45:00 PM

A light week for economic releases. The trade report on Friday is probably the key release ...

Note: Employment posts yesterday:

• November Employment Report: 39,000 Jobs, 9.8% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Seasonal Retail Hiring: Retailers remain cautious

• Graphics Gallery for Employment

7:00 PM: Fed Chairman Bernanke discusses the economy on CBS 60 Minutes. This interview took place on November 30th.

1:15 PM Richmond Fed President Jeffrey Lacker speaks at Charlotte Chamber of Commerce's "Annual Economic Outlook Conference."

9:00 AM ET: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for November (a measure of transportation).

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS. This report has been showing a general increase in job openings, but very little turnover in the labor market.

3:00 PM: Consumer Credit for October. The consensus is for a $1 billion decline in consumer credit.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly recently.

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims has been trending down over the last several weeks. The consensus is for a decrease to 425,000 from 436,000 last week (still high, but lower than earlier this year).

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for October. The consensus is 0.9% increase in inventories.

12:00 PM: Q3 Flow of Funds Accounts from the Federal Reserve.

8:30 AM: Trade Balance report for October from the Census Bureau. The consensus is for the U.S. trade deficit to be around $44 billion, the same level as in September.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for December. The consensus is for a slight increase to 72.5 from 71.6 in November.

After 4:00 PM: The FDIC might have a busy Friday afternoon ...

Participation Rate of 25 to 54 Age Men at Record Low

by Calculated Risk on 12/04/2010 04:34:00 PM

The collapse in the labor force participation rate has been one of the key stories of the great recession. The participation rate is the percentage of the working age population in the labor force.

The labor force participation rate has fallen from 66.2% in May 2008 to just 64.5% in November 2010.

A few weeks ago I looked at Labor Force Participation Rate: What will happen?. I looked at the aging of the population and concluded that the participation rate will probably increase to around 66% over the next 5 years before declining again - and that will keep upward pressure on the unemployment rate.

However one of the key trends has been the decline in the participation rate of men - and that is continuing.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

The participation rate for men in this key demographic fell to a record low 88.8% in November.

An important question is: how much of the recent decline in this key participation rate is cyclical because of the recession, and how much is part of the long term trend. We won't know for sure until the labor market starts to recover.

Employment Graph Repeat

by Calculated Risk on 12/04/2010 11:50:00 AM

A repeat of a key graph ...

Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The dotted line shows payroll employment excluding temporary Census workers.

This is by far the worst post WWII employment recession.

This second graph shows the same information aligned at maximum job losses.

This second graph shows the same information aligned at maximum job losses.

Not only is this the deepest post WWII recession in terms of payroll job losses, but the recovery is very sluggish. I'll have more on employment later today ...

Employment posts yesterday:

• November Employment Report: 39,000 Jobs, 9.8% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Seasonal Retail Hiring: Retailers remain cautious

• Graphics Gallery for Employment

Unofficial Problem Bank list increases to 920 Institutions

by Calculated Risk on 12/04/2010 08:33:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 3, 2010.

Changes and comments from surferdude808:

It was a very quiet week for the Unofficial Problem Bank List. There were two additions and one removal because of duplication.

The two additions were First Community Bank, Glasgow, MT ($219 million) and Monadnock Community Bank, Peterborough, NH ($110 million), which is the first institution from New Hampshire to appear on the Unofficial Problem Bank List. The duplicated entry was SouthBank, a Federal Savings Bank, Cornith, MS, which has relocated to Huntsville, AL.

The other change is the termination of a Prompt Corrective Action order by the OTS issued against Aurora Bank FSB, Wilmington, DE ($4.4 billion). After these changes, the Unofficial Problem Bank List includes 920 institutions with assets of $410.3 billion.