by Calculated Risk on 12/01/2010 12:31:00 PM

Wednesday, December 01, 2010

Auto Sales: GM, Ford sales up in November

Note: The real key is the seasonally adjusted annual sales rate (SAAR) compared to the last few months, not the year-over-year comparison provided by the automakers.

From MarketWatch: GM posts 11% jump in Nov. U.S. car sales

From MarketWatch: Ford Nov. U.S. sales jump 24%

From MarketWatch: Chrysler U.S. November sales rise 17%

Once all the reports are released, I'll post a graph of the estimated total November light vehicle sales (SAAR) - usually around 4 PM ET. Most estimates are for a decrease to 12.0 million SAAR in November from the 12.21 million SAAR in October.

Private Construction Spending increases in October

by Calculated Risk on 12/01/2010 11:00:00 AM

The Census Bureau reported overall construction spending increased in October compared to September.

[C]onstruction spending during October 2010 was estimated at a seasonally adjusted annual rate of $802.3 billion, 0.7 percent (±1.4%)* above the revised September estimate of $797.1 billion.Private construction spending also increased in October:

Spending on private construction was at a seasonally adjusted annual rate of $481.8 billion, 0.8 percent (±1.1%)* above the revised September estimate of $477.8 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending increased in October; private non-residential construction spending is still declining. Residential spending is 66% below the peak early 2006, and non-residential spending is 39% below the peak in January 2008.

Residential investment (RI) will probably be a minimal drag on Q4 GDP growth (or even make a slight positive contribution), and even though the recovery in RI will be sluggish, I expect RI will make a positive contribution to GDP growth in 2011. Non-residential investment will probably bottom sometime next year, but stay depressed for some time.

ISM Manufacturing Index decreases slightly to 56.6 in November

by Calculated Risk on 12/01/2010 10:00:00 AM

PMI at 56.6% in November, down slightly from 56.9% in October. The consensus was for a decrease to 56.5%.

From the Institute for Supply Management: November 2010 Manufacturing ISM Report On Business®

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector grew during November, with both new orders and production continuing to expand. With the PMI at 56.6 percent, November's rate of growth is the second fastest in the last six months. Exports and imports continue to support expansion in the sector. Prices moderated slightly during the month, but comments from the respondents express concerns with regard to pricing pressures. The list of commodities in short supply increased, though short supply items are not yet posing significant problems. Manufacturing continues to benefit from the recovery in autos, but those industries reliant upon housing continue to struggle."

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a long term graph of the ISM manufacturing index.

In addition to the PMI, the ISM's new orders index was down to 56.6 from 58.9 in October.

The employment index decreased to 57.5 from 57.7 in October.

This was in line with the regional Fed manufacturing surveys.

ADP: Private Employment increased by 93,000 in November

by Calculated Risk on 12/01/2010 08:15:00 AM

ADP reports:

Private-sector employment increased by 93,000 from October to November on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from September to October was revised up from the previously reported increase of 43,000 to an increase of 82,000.Note: ADP is private nonfarm employment only (no government jobs).

This month’s ADP National Employment Report shows an acceleration of employment and suggests the nation’s employment situation is brightening somewhat. November’s gain in private-sector employment is the largest in three years. This is the tenth consecutive month of gains, which have averaged 47,000 during that period. Nevertheless, employment gains of this magnitude are not sufficient to lower the unemployment rate, which likely will remain above 9% for all of 2011.

The consensus was for ADP to show an increase of about 68,000 private sector jobs in November, so this was above consensus.

The BLS reports on Friday, and the consensus is for an increase of 145,000 payroll jobs in November, on a seasonally adjusted (SA) basis and for the unemployment rate to stay steady at 9.6%.

MBA: Mortgage Purchase Applications increase slightly last week

by Calculated Risk on 12/01/2010 07:27:00 AM

The MBA reports: Refinance Activity Continues to Decline as Rates Rise in Latest MBA Weekly Survey

The Refinance Index decreased 21.6 percent from the previous week. This is the third weekly decrease for the Refinance Index which reached its lowest level since June 2010. The seasonally adjusted Purchase Index increased 1.1 percent from one week earlier and is at its highest level since the beginning of May 2010.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.56 percent from 4.50 percent, with points increasing to 0.96 from 0.87 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

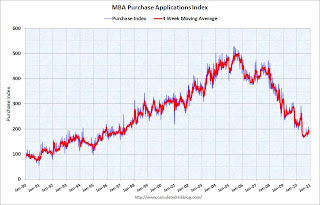

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Even with the increase in applications (seasonally adjusted), the four-week moving average of the purchase index is about 19% below the levels of April 2010 and suggests weak existing home sales through the end of the year.

Tuesday, November 30, 2010

Hamilton: Europe and China: is this deja vu all over again?

by Calculated Risk on 11/30/2010 08:06:00 PM

Earlier on house prices:

• Case-Shiller: Broad-based Declines in Home Prices in Q3

• Real House Prices, Q3 2010

Professor Hamilton presents several charts on rising bond yields in Europe, the decline in China's stock market, and the appreciation of the dollar. Hamilton asks: Europe and China: is this deja vu all over again?

If this is deja vu all over again, what might we expect next? What happened last spring was a flight to the dollar as a seemingly safe refuge. And there's been some appreciation of the dollar with the latest events as well, with more to come if history repeats itself.Hamilton didn't mention the U.S. stock market, but as the dollar strengthened against the euro in the spring, and the Shanghai composite sold off about 25% from the peak in mid-April, the S&P 500 also sold off about 15% from the peak in April. Currently the Shanghai is off about 10% from the peak in early November. I don't know if this will be deja vu all over again ...

But this is a slower-moving and broader wave than the first one. And tsunamis pack much more power than a simple crashing breaker.