by Calculated Risk on 11/19/2010 05:14:00 PM

Friday, November 19, 2010

Bank Failure #147: Gulf State Community Bank, Carrabelle, Florida

Note: I started posting bank failures a few years when I was predicting 100s of banks would fail. Since then it has become sort of a Friday afternoon ritual.

Rare Florida solvent bank

So few may exist

by Soylent Green is People

From the FDIC: Centennial Bank, Conway, Arkansas, Assumes All of the Deposits of Gulf State Community Bank, Carrabelle, Florida

As of September 30, 2010, Gulf State Community Bank had approximately $112.1 million in total assets and $112.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $42.7 million. ... Gulf State Community Bank is the 147th FDIC-insured institution to fail in the nation this year, and the 28th in Florida.Another 40% or so loss on assets. Ouch.

Disposition of Canceled HAMP Trial Modifications

by Calculated Risk on 11/19/2010 03:47:00 PM

Treasury released the October HAMP statistics last night.

There is some interesting data on the disposition of canceled HAMP trial modifications. The general view was that a majority of these borrowers would lose their homes in foreclosure or through a short sale. That hasn't happened yet.

The statistics, from the 8 largest servicers (about 80% of HAMP), show that most of these borrowers are in alternative modification programs or have cured the default (current of loan paid off).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the disposition of canceled HAMP trial modifications (in percentages). This represents 552 thousand canceled trial modifications as of September.

Only 3.9% of borrowers have lost their homes in foreclosure, and another 8.5% have lost their homes through a short sale or deed-in-lieu of foreclosure.

About 13% of borrowers are in the foreclosure process, and another 1.9% in bankruptcy.

So what has happened to the borrowers in all of those canceled trials? The largest percentage of borrowers are in alternative modification programs (lender programs). The next largest group is in "action pending". Some have paid off their loans (probably sold their homes), and another 7.7% have managed to become current.

So the number of foreclosures was lower than many expected, although many of the borrowers in the alternative modification programs will probably redefault (and the action pending group might also results in a number of foreclosures). Hopefully HAMP will keep updating this table.

Fed Manufacturing Surveys and ISM Manufacturing Index

by Calculated Risk on 11/19/2010 12:04:00 PM

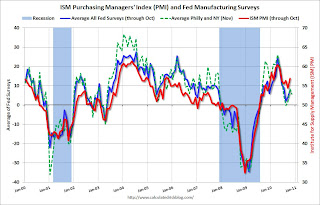

Earlier this week, the NY Fed and the Philly Fed manufacturing surveys were released. The readings couldn't have been more different, with the NY Fed survey showing "conditions deteriorated", and the Philly Fed showing activity improved sharply:

The Empire State Manufacturing Survey indicates that conditions deteriorated in November for New York State manufacturers. For the first time since mid-2009, the general business conditions index fell below zero, declining 27 points to -11.1. The new orders index plummeted 37 points to -24.4, and the shipments index also fell below zero.And the Philly Fed:

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of 1.0 in October to 22.5 in November. This is the highest reading in the index since last December. Indexes for new orders and shipments also improved this month, and each index increased 15 points.Usually these two surveys are fairly consistent, and this is reminder not to make too much of any one data point! Is manufacturing slowing or is activity picking up again? These two surveys provide opposite answers.

The other regional Fed surveys and the ISM manufacturing index will be released over the next two weeks, and hopefully they will provide some clarity.

The following graph compares the regional Fed surveys with the ISM manufacturing index, including the NY Fed and Philly Fed surveys for November. Averaging the NY Fed and Philly Fed survey suggests manufacturing is still expanding, but at a sluggish pace:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The New York and Philly Fed surveys are averaged together (dashed green, through November), and averaged five Fed surveys (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City.

The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM manufacturing index will released on Dec 1st. The Richmond Fed survey will be released on Tuesday Nov 23rd, the Kansas City Fed survey on Wednesday Nov 24th, and the Dallas Fed survey on Monday Nov 29th.

A slowdown in manufacturing has been one of the reasons I thought GDP growth would slow in the 2nd half of 2010 and into 2011 (this is part of the general sluggish and choppy recovery). My view was based on the end of the inventory adjustment, a slowdown in export growth, and sluggish growth for consumer spending. So the Philly Fed reading was surprising to me.

"Some thoughts on the muni market"

by Calculated Risk on 11/19/2010 09:30:00 AM

From Bond Girl: Some thoughts on the muni market

I have been somewhat hesitant to write about the recent sharp correction in the muni market, mainly because I do not like wasting my time.I think it is important to understand that these supply issues are what is driving the muni market - not an imminent default.

...

My opinion, for whatever it is worth to you, is that there are a handful of factors – mostly unrelated to the relative creditworthiness of muni issuers – that have provoked this correction. These factors are related, and they will likely contribute to volatility going into next year. The first, obviously, is a supply glut. The pending expiration of the Build America Bond (BAB) program has pulled supply forward, and this is going to seesaw over the next several weeks. Since the BAB program was initiated, most issuers have structured their new issues with the sense that they will go to either the tax-exempt or taxable market, whichever is more advantageous at the time. It has been almost completely a supply management game since the market for these bonds was established and munis became truly bifurcated.

...

By allowing muni issuers to sell taxable bonds, the BAB program opened the market up to investors like pensions and foreign investors, who otherwise would not benefit from a tax exemption on the interest income on the bonds and would find tax-exempt yields unappetizing. This program has relieved the supply pressure on the market for essentially two years now, keeping interest rates low.

What is going on now is that muni issuers are scrambling to get deals done to take advantage of the program before it expires, and this is pulling the number of new issues that would ordinarily be coming to market forward. So the looming expiration of the BAB program is creating the very conditions it was created to alleviate. Issuers are very conscious of this fact, and that is why a large number of deals are getting pulled. As more issues get pulled and supply is reduced, there will be some relief on rates, which I think is what happened today. But you can expect that muni issuers will be dancing around this until the program expires at the end of the year, so there will likely be significant volatility. There is also considerable uncertainty as to how supply issues will play out in the first quarter of 2011.

Thursday, November 18, 2010

Bernanke criticizes China, Supports additional fiscal stimulus

by Calculated Risk on 11/18/2010 10:25:00 PM

Here are two speeches from Fed Chairman Ben Bernanke:

Rebalancing the Global Recovery

[O]n its current economic trajectory the United States runs the risk of seeing millions of workers unemployed or underemployed for many years. As a society, we should find that outcome unacceptable. Monetary policy is working in support of both economic recovery and price stability, but there are limits to what can be achieved by the central bank alone. The Federal Reserve is nonpartisan and does not make recommendations regarding specific tax and spending programs. However, in general terms, a fiscal program that combines near-term measures to enhance growth with strong, confidence-inducing steps to reduce longer-term structural deficits would be an important complement to the policies of the Federal Reserve.And on China:

The exchange rate adjustment is incomplete, in part, because the authorities in some emerging market economies have intervened in foreign exchange markets to prevent or slow the appreciation of their currencies. ... why have officials in many emerging markets leaned against appreciation of their currencies toward levels more consistent with market fundamentals? The principal answer is that currency undervaluation on the part of some countries has been part of a long-term export-led strategy for growth and development. This strategy, which allows a country's producers to operate at a greater scale and to produce a more diverse set of products than domestic demand alone might sustain, has been viewed as promoting economic growth and, more broadly, as making an important contribution to the development of a number of countries. However, increasingly over time, the strategy of currency undervaluation has demonstrated important drawbacks, both for the world system and for the countries using that strategy.And from Bernanke: Emerging from the Crisis: Where Do We Stand?

In the United States, we have seen a slowing of the pace of expansion since earlier this year. The unemployment rate has remained close to 10 percent since mid-2009, with a substantial fraction of the unemployed out of work for six months or longer. Moreover, inflation has been declining and is currently quite low, with measures of underlying inflation running close to 1 percent. Although we project that economic growth will pick up and unemployment decline somewhat in the coming year, progress thus far has been disappointingly slow.Reports on the speeches:

From the NY Times: Bernanke Speech Offers Support for Obama Policy

From Bloomberg: Bernanke Steps Up Stimulus Defense, Turns Tables on China

From the WSJ: Bernanke Takes Aim at China

Q3: Quarterly Housing Starts and Unemployment

by Calculated Risk on 11/18/2010 06:33:00 PM

This week the Census Bureau released the "Quarterly Starts and Completions by Purpose and Design" report for Q3 2010. Although this data is Not Seasonally Adjusted (NSA), it shows the trends for several key housing categories.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The number of units built for rent increased sharply in Q3. Although still fairly low, there were 40 thousand rental units started in Q3 2010, almost double the 22 thousand started in Q3 2009. With the rental vacancy rate starting to fall - and no more ill-conceived homebuyer tax credits on the horizon - rental unit construction has probably bottomed. This increase in construction will help a little with employment.

The number of condo units started doubled from last year too - but from close to zero (from 5 thousand in Q3 2009 to 6 thousand last quarter).

The largest category - starts of single family units, built for sale - decreased to 75,000 in Q3 from 92,000 in Q2. Some of this was seasonal, and some was related to end of the tax credit. Starts of owner built units declined in Q3 too.

And an update by request ...

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) rebounded a little last year,and then moved sideways for some time, before declining again in May.

This is what I expected when I first posted the above graph in August 2009. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.Until the excess housing inventory is reduced, housing starts will stay depressed, and the unemployment rate will probably stay elevated. It does appear progress is being made reducing the excess inventory, but it will take some time. To reduce the excess inventory requires new household formation to be higher than housing starts - and even though housing starts are near record lows, new household formation has also been sluggish - partially because there are few construction jobs!

Hotels: RevPAR up 14.1% compared to same week in 2009

by Calculated Risk on 11/18/2010 02:51:00 PM

From HotelNewsNow.com: STR: Chain scales report strong weekly results

Overall, the industry’s occupancy increased 11.1% to 58.4%, ADR was up 2.7% to US$98.77, and RevPAR ended the week up 14.1% to US$57.65.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 9.2% compared to last year and 6.1% below the median for 2000 through 2007.

Note: Even though the occupancy rate is above the level of the same week in 2008, and RevPAR (revenue per available room) is up 14.1% compared to the same week in 2009 - RevPAR is still down 3.7% compared to the same week in 2008 - and the 2nd half of 2008 was a very difficult period for the hotel industry.

This suggests some increase in business travel - and probably a little more business confidence (the spring and fall are mostly business travel).

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

MBA National Delinquency Survey: Delinquency rate declines in Q3

by Calculated Risk on 11/18/2010 11:29:00 AM

The MBA reports that 13.52 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2010 (seasonally adjusted). This is down from 14.42 percent in Q2 2010.

Note: the MBA's National Delinquency Survey (NDS) covered "about 44 million first-lien mortgages on one- to four-unit residential properties" and the "NDS is estimated to cover approximately 88 percent of the outstanding first lien mortgages in the market." This gives about 50 million total first lien mortgages or about 6.75 million delinquent or in foreclosure.

From the MBA: Delinquencies and Loans in Foreclosure Decrease, but Foreclosure Starts Rise in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 9.13 percent of all loans outstanding as of the end of the third quarter of 2010, a decrease of 72 basis points from the second quarter of 2010, and a decrease of 51 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.Note: 9.13% (SA) and 4.39% equals 13.52%.

...

The percentage of loans in the foreclosure process at the end of the third quarter was 4.39 percent, down 18 basis points from the second quarter of 2010 and down eight basis points from one year ago.

Most of the decline in the overall delinquency rate was in the seriously delinquent categories (90+ days or in foreclosure process). Part of the reason is lenders were being more aggressive in foreclosing in Q3 (before the foreclosure pause), and there was a surge in REO inventory (real estate owned). Some of the decline was probably related to modifications too.

The following graph shows the percent of loans delinquent by days past due.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Loans 30 days delinquent decreased to 3.36%. This is slightly below the average levels of the last 2 years, but still high.

Delinquent loans in the 60 day bucket decreased to 1.44% - the lowest since Q2 2008.

With the foreclosure pause, the 90+ day and in foreclosure rates will probably increase in Q4. The 30 day and 60 day buckets are dependent on jobs and house prices.

More from the press release:

“Mortgage delinquency rates declined over the quarter and over the past year, due primarily to a large decline in the 90+ day delinquency rate. The number of loans in foreclosure also dropped, bringing the serious delinquency rate to its lowest level since the second quarter of 2009. However, the foreclosure starts rate increased for all loan types and the foreclosure starts rate for prime fixed loans set a new record high in the survey, as more loans entered the foreclosure process,” said Michael Fratantoni, MBA’s Vice President of Research and Economics.The MBA also noted that a majority of delinquent loans (and loans in foreclosure) are prime loans. We are all subprime now!

“Most often, homeowners fall behind on their mortgages because their income has dropped due to unemployment or other causes. Although the employment report for October was relatively positive, the job market had improved only marginally through the third quarter, so while there was a small improvement in the delinquency rate, the level of that rate remains quite high. As we anticipate that the unemployment rate will be little changed over the next year, we also expect only modest improvements in the delinquency rate.”

...

“The foreclosure paperwork issues announced by several large servicers in late September and early October are unlikely to have had a large impact on the third quarter numbers, but may well increase the foreclosure inventory numbers in the fourth quarter of 2010 and in early 2011. ... The servicers that halted foreclosure sales temporarily may show higher foreclosure inventory numbers in the fourth quarter of 2010 and in early next year than would otherwise have been the case. ... However, these foreclosed homes are likely to come on the market in the medium term, so it is only a delay rather than a change in the underlying economics.”

Philly Fed Index shows pickup in manufacturing activity

by Calculated Risk on 11/18/2010 10:00:00 AM

Here is the Philadelphia Fed Index: Business Outlook Survey

Results from the Business Outlook Survey suggest that regional manufacturing activity showed improvement in November. All of the survey's broad indicators of economic performance showed improvement from their reading in October, and firms reported an increase in employment and work hours.This is well above the consensus expectations of a reading of 5.6 - and shows the opposite of the NY Fed manufacturing survey.

...

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of 1.0 in October to 22.5 in November. This is the highest reading in the index since last December. Indexes for new orders and shipments also improved this month, and each index increased 15 points.

...

Labor market conditions also showed some improvement this month, paralleling the improvement in other broad indicators. This month, firms also reported some growth in employment and a longer workweek.

emphasis added

Weekly Initial Unemployment Claims increase slightly

by Calculated Risk on 11/18/2010 08:39:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 13, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 2,000 from the previous week's revised figure of 437,000. The 4-week moving average was 443,000, a decrease of 4,000 from the previous week's revised average of 447,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 4,000 to 443,000.

This is the lowest level for the 4-week moving average since September 2008 - a clear improvement over recent months, but still elevated - and still a sign of weakness in the job market.