by Calculated Risk on 8/27/2010 12:49:00 PM

Friday, August 27, 2010

Estimate of Decennial Census impact on August payroll employment: minus 116,000

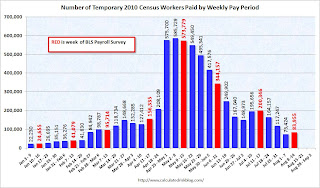

The Census Bureau released the weekly payroll data for the week ending August 14th this week (ht Bob_in_MA). If we subtract the number of temporary 2010 Census workers in the week containing the 12th of the month, from the same week for the previous month - this provides a close estimate for the impact of the Census hiring on payroll employment.

The Census Bureau releases the actual number with the employment report.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of Census workers paid each week. The red labels are the weeks of the BLS payroll survey.

The Census payroll decreased from 200,346 for the week ending July 17th to 83,955 for the week ending August 14th.

So my estimate for the impact of the Census on August payroll employment is minus 116 thousand (this will probably be close). The employment report will be released on September 3rd, and the headline number for August - including Census numbers - will probably be negative again. But a key number will be the hiring ex-Census (so we will add back the Census workers again this month).

The following table compares the weekly payroll report estimate to the monthly BLS report on Census hiring (the weekly report is revised slightly, so the correlation looks better than in real time):

| Payroll, Weekly Pay Period | Payroll, Monthly BLS | Change based on weekly report | Actual Change (monthly) | |

|---|---|---|---|---|

| Jan | 25 | 24 | ||

| Feb | 41 | 39 | 16 | 15 |

| Mar | 96 | 87 | 55 | 48 |

| Apr | 156 | 154 | 61 | 67 |

| May | 574 | 564 | 418 | 410 |

| Jun | 344 | 339 | -230 | -225 |

| Jul | 200 | 196 | -144 | -143 |

| Aug | 84 | -116 | ||

| All thousands | ||||

Analysis: Bernanke paves the way for QE2

by Calculated Risk on 8/27/2010 11:22:00 AM

Just some quick thoughts on Fed Chairman Ben Bernanke's speech today.

For a sustained expansion to take hold, growth in private final demand--notably, consumer spending and business fixed investment--must ultimately take the lead. On the whole, in the United States, that critical handoff appears to be under way. ... the pace of that growth recently appears somewhat less vigorous than we expected. ... Incoming data on the labor market have remained disappointing. ... Overall, the incoming data suggest that the recovery of output and employment in the United States has slowed in recent months, to a pace somewhat weaker than most FOMC participants projected earlier this year. ... I expect the economy to continue to expand in the second half of this year, albeit at a relatively modest pace.

Despite the weaker data seen recently, the preconditions for a pickup in growth in 2011 appear to remain in place.

Under what conditions would the FOMC make further use of these or related policy tools? At this juncture, the Committee has not agreed on specific criteria or triggers for further action, but I can make two general observations.

First, the FOMC will strongly resist deviations from price stability in the downward direction. ... It is worthwhile to note that, if deflation risks were to increase, the benefit-cost tradeoffs of some of our policy tools could become significantly more favorable.

Second, regardless of the risks of deflation, the FOMC will do all that it can to ensure continuation of the economic recovery. Consistent with our mandate, the Federal Reserve is committed to promoting growth in employment and reducing resource slack more generally. Because a further significant weakening in the economic outlook would likely be associated with further disinflation, in the current environment there is little or no potential conflict between the goals of supporting growth and employment and of maintaining price stability.

A first option for providing additional monetary accommodation, if necessary, is to expand the Federal Reserve's holdings of longer-term securities. As I noted earlier, the evidence suggests that the Fed's earlier program of purchases was effective in bringing down term premiums and lowering the costs of borrowing in a number of private credit markets. I regard the program (which was significantly expanded in March 2009) as having made an important contribution to the economic stabilization and recovery that began in the spring of 2009. Likewise, the FOMC's recent decision to stabilize the Federal Reserve's securities holdings should promote financial conditions supportive of recovery.Bernanke was not as positive on changes to the "extended period" language or reducing the interest rate on excess reserves.

I believe that additional purchases of longer-term securities, should the FOMC choose to undertake them, would be effective in further easing financial conditions.

"Revenue is being affected by weaker than expected demand for consumer PCs in mature markets," the company said in a statement.Or perhaps the unemployment rate ticking up in the August employment report next Friday might be enough. There will be plenty of data released before the September 21 FOMC meeting (and if the data is weaker, the meeting might be expanded to two days). Or perhaps the FOMC will wait until November, but it does appears Bernanke is preparing everyone for QE2.

Bernanke: The Economic Outlook and Monetary Policy

by Calculated Risk on 8/27/2010 10:02:00 AM

From Fed Chairman Ben Bernanke: The Economic Outlook and Monetary Policy. Excerpt on monetary policy:

Policy Options for Further EasingPaving the way for QE2.

...

I will focus here on three that have been part of recent staff analyses and discussion at FOMC meetings: (1) conducting additional purchases of longer-term securities, (2) modifying the Committee's communication, and (3) reducing the interest paid on excess reserves. I will also comment on a fourth strategy, proposed by several economists--namely, that the FOMC increase its inflation goals.

A first option for providing additional monetary accommodation, if necessary, is to expand the Federal Reserve's holdings of longer-term securities. ...

A second policy option for the FOMC would be to ease financial conditions through its communication, for example, by modifying its post-meeting statement. ...

A third option for further monetary policy easing is to lower the rate of interest that the Fed pays banks on the reserves they hold with the Federal Reserve System. Inside the Fed this rate is known as the IOER rate, the "interest on excess reserves" rate. The IOER rate, currently set at 25 basis points, could be reduced to, say, 10 basis points or even to zero. ...

A rather different type of policy option, which has been proposed by a number of economists, would have the Committee increase its medium-term inflation goals above levels consistent with price stability. I see no support for this option on the FOMC.

Update: Bernanke also addressed WHEN the FOMC will act:

Each of the tools that the FOMC has available to provide further policy accommodation--including longer-term securities asset purchases, changes in communication, and reducing the IOER rate--has benefits and drawbacks, which must be appropriately balanced. Under what conditions would the FOMC make further use of these or related policy tools? At this juncture, the Committee has not agreed on specific criteria or triggers for further action, but I can make two general observations.

First, the FOMC will strongly resist deviations from price stability in the downward direction. Falling into deflation is not a significant risk for the United States at this time, but that is true in part because the public understands that the Federal Reserve will be vigilant and proactive in addressing significant further disinflation. It is worthwhile to note that, if deflation risks were to increase, the benefit-cost tradeoffs of some of our policy tools could become significantly more favorable.

Second, regardless of the risks of deflation, the FOMC will do all that it can to ensure continuation of the economic recovery. Consistent with our mandate, the Federal Reserve is committed to promoting growth in employment and reducing resource slack more generally. Because a further significant weakening in the economic outlook would likely be associated with further disinflation, in the current environment there is little or no potential conflict between the goals of supporting growth and employment and of maintaining price stability.

Q2 real GDP revised down to 1.6% annualized growth rate

by Calculated Risk on 8/27/2010 08:48:00 AM

From the BEA: Gross Domestic Product, 2nd quarter 2010 (second estimate)

The following table shows the changes from the advance release (this is the Contributions to Percent Change in Real Gross Domestic Product).

The largest downward revisions were to the change in private inventories, imports, and non-residential structure investment. Personal consumption expenditures and investment in Equipment and software were revised up.

| Advance | 2nd Estimate (Revision) | Change | |

|---|---|---|---|

| Percent change at annual rate: | |||

| Gross domestic product | 2.4 | 1.6 | -0.8 |

| Percentage points at annual rates: | |||

| Personal consumption expenditures | 1.15 | 1.38 | 0.23 |

| Goods | 0.79 | 0.82 | 0.03 |

| Durable goods | 0.53 | 0.49 | -0.04 |

| Nondurable goods | 0.25 | 0.33 | 0.08 |

| Services | 0.36 | 0.56 | 0.20 |

| Gross private domestic investment | 3.14 | 2.75 | -0.39 |

| Fixed investment | 2.09 | 2.12 | 0.03 |

| Nonresidential | 1.50 | 1.54 | 0.04 |

| Structures | 0.14 | 0.01 | -0.13 |

| Equipment and software | 1.36 | 1.53 | 0.17 |

| Residential | 0.59 | 0.58 | -0.01 |

| Change in private inventories | 1.05 | 0.63 | -0.42 |

| Net exports of goods and services | -2.78 | -3.37 | -0.59 |

| Exports | 1.22 | 1.08 | -0.14 |

| Imports | -4.00 | -4.45 | -0.45 |

| Government consumption expenditures and gross investment | 0.88 | 0.86 | -0.02 |

| Federal | 0.72 | 0.72 | 0.00 |

| National defense | 0.4 | 0.39 | -0.01 |

| Nondefense | 0.33 | 0.32 | -0.01 |

| State and local | 0.16 | 0.14 | -0.02 |

Thursday, August 26, 2010

Summary, Fannie-Freddie "Autopsy", and European Bond Spreads

by Calculated Risk on 8/26/2010 10:10:00 PM

Here’s a last-minute option for summer reading material: An autopsy on Fannie Mae and Freddie Mac by their overseer, the Federal Housing Finance Agency.

The report aims to inform the continuing debate in Washington about the future of the government’s role in housing finance. It’s not hard sledding, just 15 pages of bullet points and charts. And it does a good job of making a few key points:

1. Fannie and Freddie did not cause the housing bubble. ...

2. This was not for a lack of trying. ...

3. Importantly, the companies’ losses are mostly in their core business of guaranteeing loans, not in their investment portfolios.

Click on graph for larger image in new window.

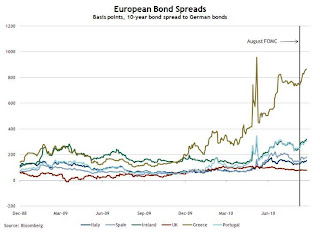

Click on graph for larger image in new window.From the Atlanta Fed:

Peripheral European bond spreads (over German bonds) have risen since the August FOMC meeting.In fact the Greece-to-Germany, and the Ireland-to-Germany, bond spreads are near the levels reached during the May financial crisis.

The total percent of loans delinquent or in the foreclosure process declined only slightly in Q2 from Q1 - and the rate is the second highest on record.

The total percent of loans delinquent or in the foreclosure process declined only slightly in Q2 from Q1 - and the rate is the second highest on record.Loans 30 days delinquent increased to 3.51%, and this is about the same levels as in Q4 2008 (slightly below the peak of 3.77% in Q1 2009).

Delinquent loans decreased in all other buckets - especially in the 90+ day bucket. MBA Chief Economist Jay Brinkmann suggested the decline in the 90+ day bucket was because of some successful modifications - since the lenders reported the loans as delinquent until the modification was made permanent.

This graph shows the negative equity and near negative equity by state.

This graph shows the negative equity and near negative equity by state. Although the five states mentioned above have the largest percentage of homeowners underwater, 10 percent or more of homeowners with mortgages in 33 states and the D.C. have negative equity.

Are lenders "procrastinating" on foreclosures?

by Calculated Risk on 8/26/2010 07:13:00 PM

From Jeff Horwitz and Kate Berry at American Banker: Procrastination on Foreclosures, Now 'Blatant,' May Backfire

[S]ervicers are not initiating or processing foreclosures at the pace they could be.There is much more in the article.

By postponing the date at which they lock in losses, banks and other investors positioned themselves to benefit from the slow mending of the real estate market. But now industry executives are questioning whether delaying foreclosures — a strategy contrary to the industry adage that "the first loss is the best loss" — is about to backfire. With home prices expected to fall as much as 10% further, the refusal to foreclose quickly on and sell distressed homes at inventory-clearing prices may be contributing to the stall of the overall market seen in July sales data.

...

Banks have filed fewer notices of default so far this year in California ... than they did 2009 or 2008, according to data gathered by [RadarLogic]. Foreclosure default notices are now at their lowest level since the second quarter of 2007, when the percentage of seriously delinquent loans in the state was one-sixth what it is now.

New data from LPS Applied Analytics in Jacksonville, Fla., suggests that the backlog is no longer worsening nationally — but foreclosures are not at the levels needed to clear existing inventory.

...

"The industry as a whole got into a panic mode and was worried about all these loans going into foreclosure and driving prices down, so they got all these programs, started Hamp and internal mods and short sales," said John Marecki, vice president of East Coast foreclosure operations for Prommis Solutions ... "Now they're looking at this, how they held off and they're getting to the point where maybe they made a mistake in that realm."

...

"The math doesn't bode well for what is ultimately going to occur on the real estate market," said Herb Blecher, a vice president at LPS. "You start asking yourself the question when you look at these numbers whether we are fixing the problem or delaying the inevitable."

Note: The LPS delinquency data for July will be released tomorrow. Here are some of the findings (no link):

• July showed an astounding 24.5% month-over-month increase in foreclosure starts, which dovetails with Treasury's latest report on HAMP cancellations (approx. 50% according to Treasury's numbers)The report shows the GSEs are stepping up foreclosures.

• Abysmal foreclosure rates in NV, FL and CA have led to much higher level equity loss for homeowners in those states as compared to the rest of the country.

• Cure rates remain steady, but seriously delinquent (6 mos.+) cures have declined significantly, by approximately 25%

• Origination remains depressed due to much stricter underwriting guidelines and low purchase activity, but what is being originated is of good quality.

• Until the deterioration ratio improves from its steady two deteriorations for every one improvement, it's hard to see how we're going to get out of the hole.

CoreLogic: 11 Million U.S. Properties with Negative Equity in Q2

by Calculated Risk on 8/26/2010 03:32:00 PM

Note that the slight decline in homeowners with negative equity was mostly due to foreclosures.

First American CoreLogic released the Q2 2010 negative equity report today.

CoreLogic reports that 11 million, or 23 percent, of all residential properties with mortgages were in negative equity at the end of the second quarter of 2010, down from 11.2 million and 24 percent from the first quarter of 2010. Foreclosures, rather than meaningful price appreciation, were the primary driver in the change in negative equity. An additional 2.4 million borrowers had less than five percent equity. Together, negative equity and near negative equity mortgages accounted for nearly 28 percent of all residential properties with a mortgage nationwide.From the report:

...

"Negative equity continues to both drive foreclosures and impede the housing market recovery. With nearly 5 million borrowers currently in severe negative equity, defaults will remain at a high level for an extended period of time," said Mark Fleming, chief economist with CoreLogic.

Negative equity remains concentrated in five states: Nevada, which had the highest percentage negative equity with 68 percent of all of its mortgaged properties underwater, followed by Arizona (50 percent), Florida (46 percent), Michigan (38 percent) and California (33 percent). The declines were primarily due to foreclosures, not the stabilization or small increases in prices in some markets. The largest decrease in negative equity occurred among those with loan-to-value (LTV) ratios in excess of 125 percent, where the number of negative equity borrowers fell to 4.8 million, down from 5 million last quarter.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the negative equity and near negative equity by state.

Although the five states mentioned above have the largest percentage of homeowners underwater, 10 percent or more of homeowners with mortgages in 33 states and the D.C. have negative equity.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA on the graph above.

CoreLogic also released a negative equity report for 164 metro areas (excel file) (with a minimum of 50,000 mortgages). Las Vegas is at the top with 72.8% of homeowners with mortgages in negative equity (another 3.3% are close) - and the top of the list is dominated by Nevada, California, Arizona and Florida - but it is amazing how widespread the problem is!

Even with foreclosures reducing the number of negative equity mortgages, I expect the number of homeowners with negative equity will increase as prices fall later this year.

MBA Q2 2010: 14.42% of Mortgage Loans Delinquent or in Foreclosure

by Calculated Risk on 8/26/2010 01:30:00 PM

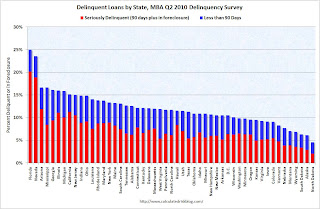

The MBA reports that 14.42 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2010 (seasonally adjusted). This is down slightly from the record 14.69 percent in Q1 2010.

From the MBA: Delinquencies and Foreclosure Starts Decrease in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties dropped to a seasonally adjusted rate of 9.85 percent of all loans outstanding as of the end of the second quarter of 2010, a decrease of 21 basis points from the first quarter of 2010, and an increase of 61 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.Note: 9.85% (SA) and 4.57% equals 14.42%.

...

The percentage of loans in the foreclosure process at the end of the second quarter was 4.57 percent, a decrease of six basis points from the first quarter of 2010, but an increase of 27 basis points from one year ago.

Much was made at the end of 2009 about the decline in the 30 day delinquency "bucket" (percent of loans between 30 and 60 days delinquent). Unfortunately the seasonally adjusted 30 day delinquency rate increased again in Q2 2010.

And much was made on the conference call this morning about the declines in the other "buckets", however the total percent of loans delinquent or in the foreclosure process declined only slightly in Q2 from Q1 - and is the second highest on record.

Note: there are some questions about the seasonal adjustment, especially for the 90 day bucket since we've never seen numbers this high before, but the adjustment for the 30 and 60 day periods are probably reasonable.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Loans 30 days delinquent increased to 3.51%, and this is about the same levels as in Q4 2008 (slightly below the peak of 3.77% in Q1 2009).

Delinquent loans decreased in all other buckets - especially in the 90+ day bucket. MBA Chief Economist Jay Brinkmann suggested the decline in the 90+ day bucket was because of some successful modifications - since the lenders reported the loans as delinquent until the modification was made permanent.

The second graph shows the delinquency rate by state (red is seriously delinquent: 90+ days or in foreclosure, blue is delinquent less than 90 days).

The second graph shows the delinquency rate by state (red is seriously delinquent: 90+ days or in foreclosure, blue is delinquent less than 90 days). Clearly Florida and Nevada have a large percentage of loans delinquent or in foreclosure. But the delinquency problem is widespread with 36 states and D.C. all having total delinquency rates above 10%.

When asked if he expected the slight improvements to continue, Brinkmann said "Improvements are more of a hope". He said the problem is jobs, and he is revising down his economic forecasts. He also the improvement in the 90+ day bucket might be because of modifications - and that might not continue.

With house prices falling - and growth slowing - the delinquency rate will probably increase later this year.

Kansas City Fed: Manufacturing activity slowed in August

by Calculated Risk on 8/26/2010 11:25:00 AM

Usually I don't post all the regional manufacturing surveys, but it appears manfuacturing is slowing right now - and the regional surveys provide early clues ...

From the Kansas City Fed:

Tenth District manufacturing activity slowed in August, and producers were somewhat less optimistic than in previous months.This is the lowest level for the Kansas City survey since August 2009.

...

The net percentage of firms reporting month-over-month increases in production in August was 0, down from 14 in July ... The shipments, new orders, and employment indexes dropped into negative territory, and the order backlog index slipped from -2 to -16.

Yesterday I compared the ISM PMI (to be released next week) with the regional Fed surveys, and based on these surveys, I expect the PMI to fall further in August.

Note on MBA: I'll post analysis of the MBA Q2 delinquency data after I receive the material (some sort of glitch this morning).

MBA Q2 National Delinquency Survey Conference Call

by Calculated Risk on 8/26/2010 11:06:00 AM

On the MBA conference call concerning the "Q2 2010 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

From MarketWatch: Foreclosure inventory down, new delinquencies up

The percentage of mortgage loans somewhere in the foreclosure process was 4.57% in the second quarter, down from 4.63% in the first quarter; the percentage is still up from 4.3% a year ago. However, the percent of loans one payment behind is now a seasonally adjusted 3.51%, said Jay Brinkmann, the MBA's chief economistNote: I have not received the press release or materials. Hopefully I'll have more later today.