by Calculated Risk on 7/27/2010 09:00:00 AM

Tuesday, July 27, 2010

Case-Shiller: House Price indexes increase in May

IMPORTANT: These graphs are Seasonally Adjusted (SA). S&P has cautioned that the seasonal adjustment is probably being distorted by irregular factors. These distortions could include distressed sales and the various government programs.

S&P/Case-Shiller released the monthly Home Price Indices for May (actually a 3 month average).

This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities).

From S&P: For the Past Year Home Prices Have Generally Moved Sideways

Data through May 2010, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show that the annual growth rates in 15 of the 20 MSAs and the 10- and 20-City Composites improved in May compared to those reported for April 2010. The 10-City Composite is up 5.4% and the 20-City Composite is up 4.6%from where they were in May 2009. While 19 MSAs and both Composites reported positive monthly changes in May over April, only 12 of the MSAs and the two Composites saw better month-over-month growth rates in May than those reported in April.

Click on graph for larger image in new window.

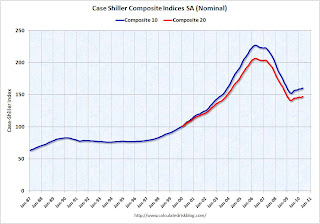

Click on graph for larger image in new window. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 29.3% from the peak, and up 1.0% in May (SA).

The Composite 20 index is off 28.7% from the peak, and up 1.1% in May (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 is up 5.4% compared to May 2009.

The Composite 20 is up 4.6% compared to May 2009.

This is the fourth month with YoY price increases in a row.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 15 of the 20 Case-Shiller cities in May seasonally adjusted.

Prices increased (SA) in 15 of the 20 Case-Shiller cities in May seasonally adjusted.Prices in Las Vegas are off 56.1% from the peak, and prices in Dallas only off 4.8% from the peak.

Case Shiller is reporting on the NSA data (19 cities with increasing prices), and I'm using the SA data. I'm not sure why S&P calls a 5% increase "moving sideways". Prices are probably starting to fall right now, but this will not show up in the Case-Shiller index for a few months.

Monday, July 26, 2010

Home builders to start building more homes?

by Calculated Risk on 7/26/2010 09:13:00 PM

The following article discusses both new and existing home supply. Here is a short excerpt on new homes ...

From Robbie Whelan at the WSJ: Supply of Homes Set to Grow

Home builders ... are stuck with thousands of acres that are prone to lose value as the market struggles. Many will build homes on the land, rather than write off its value and wait for the market to improve.In some communities with excess supply, home builders are competing with the distressed sales by building smaller homes. As an example, a couple months ago David Streitfeld at the NY Times wrote about a building boom in Las Vegas: In City of Homes That Sit Empty, Building Booms

... "They're discounting the homes, they're making very small profit margins, but they're building homes." [said Brad Hunter, chief economist at Metrostudy]

...

Other indicators also point to builders preparing to increase home construction, despite lagging sales. The number of finished vacant lots, or parcels of land that have been developed and readied for building, stands at about 1.2 million nationwide, according to Metrostudy, or just 5% below the peak in late 2008.

Home prices in Las Vegas are down by 60 percent from 2006 in one of the steepest descents in modern times. There are 9,517 spanking new houses sitting empty. An additional 5,600 homes were repossessed by lenders in the first three months of this year and could soon be for sale.But just because they have the lots, I hope they don't start overbuilding again.

Yet builders here are putting up 1,100 homes, and they are frantically buying lots for even more. ... Land and labor costs have fallen significantly, so the newest homes are competitively priced.

Jim the Realtor: Beach Cheapie?

by Calculated Risk on 7/26/2010 05:57:00 PM

Earlier (with graphs): New Home Sales: Worst June on Record

I haven't checked in with Jim for some time. This 800 sq ft REO is "cheap"?

Survey shows house prices falling in June, but long wait for house price indexes

by Calculated Risk on 7/26/2010 02:20:00 PM

Campbell Surveys put out a press release this morning: Home Prices Tumble in Most Categories During June (no link)

A drop in homebuyer activity helped trigger a noticeable decline in home prices between May and June, according to the latest Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions.We already know existing home sales collapsed in July, however, as Popik notes, it will take some time for the impact on house prices to show up in the house price indexes.

...

Average prices tumbled by 6.8% for move-in ready foreclosed properties, 6.3% for short sales, and 4.6% for non-distressed properties.

...

“Prices are dropping…same house that had 2 showings a day in April with hopes of a closing by June at $139,000 now gets a showing of just one a week if we are lucky and at $129,000,” reported a real estate agent responding to the survey and located in Florida.

“Buyers just plan on deducting the $8,000 off what they are going to offer now. So, now prices are dropping to compensate for the credit not being available,” stated an agent located in Ohio.

...

“Contracts signed in June will be closing in July and August,” explained [Thomas Popik, research director for Campbell Surveys]. “That’s why we know prices for closed transactions will continue their decline. But this won’t be reflected in the publicly-released price indexes until October or November.”

The Case-Shiller index is a three month average and is released with a two month lag. The Case-Shiller house price index to be released tomorrow will be for a three month average ending in May.

The first Case-Shiller release with July prices will be released at the end of September - and that will include the months of May, June and July! And prices were probably up in May and June.

And prices don't fall overnight. Based on the timing of the above survey, prices fell from May to June - and those transactions will probably mostly closed in August. That is why Popik is saying the price declines will not show up in house price indexes until October of November.

The Corelogic data for July will also be released in September. There are other repeat sales measures (like from Radar Logic and Clear Capital), but in general it will be a long wait before reported house prices are falling.

Dallas Fed: Manufacturing Activity Remains Sluggish in July

by Calculated Risk on 7/26/2010 11:51:00 AM

Usually I don't post all the regional manufacturing surveys, however with the inventory adjustment over, export growth appearing to slow, and domestic consumer demand sluggish, these surveys might provide a hint of weakness in the manufacturing sector.

From the Dallas Fed: Texas Manufacturing Activity Remains Sluggish

Texas factory activity rebounded slightly in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key indicator of state manufacturing conditions, rose from –2 to 5, suggesting output expanded slightly in July after contracting in June.Although production was up slightly, new orders were down sharply. This was a weak report - I'll post a summary of the regional reports later this week.

Several indexes for factory activity continued to fall in July. The new orders and growth rate of orders indexes pushed deeper into negative territory, indicating a further contraction of demand. The index for capacity utilization dipped to –1, its first negative reading in nine months. The shipments index stabilized in July, rising from –9 to –1, with nearly equal shares of respondents noting an increase or decrease.

The general business activity index fell sharply to –21, its lowest level since July 2009. Thirty-one percent of firms reported a worsening of activity, up from 22 percent in June. The company outlook index also fell to a 12-month low, as only 13 percent of manufacturers said their outlook had improved over the previous month, compared with 24 percent who said it had worsened.

The employment index edged up and was positive for the fifth consecutive month, with 20 percent of firms reporting new hires.

New Home Sales: Worst June on Record

by Calculated Risk on 7/26/2010 10:00:00 AM

Ignore all the month to previous month comparisons. May was revised down sharply and that makes the increase look significant. Here is the bottom line: this was the worst June for new home sales on record.

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 330 thousand. This is an increase from the record low of 267 thousand in May (revised from 300 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

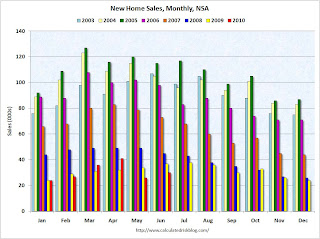

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2010. In June 2010, 30 thousand new homes were sold (NSA). This is a new record low for June.

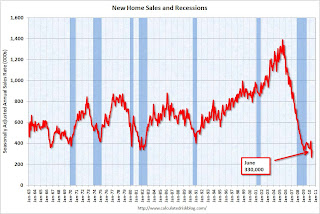

The previous record low for the month of June was 34 thousand in 1982; the record high was 115 thousand in June 2005. The second graph shows New Home Sales vs. recessions for the last 47 years.

The second graph shows New Home Sales vs. recessions for the last 47 years.

Sales of new single-family houses in June 2010 were at a seasonally adjusted annual rate of 330,000 ... This is 23.6 percent (±15.3%) above the revised May rate of 267,000, but is 16.7 percent (±10.9%) below the June 2009 estimate of 396,000.And another long term graph - this one for New Home Months of Supply.

Months of supply decreased to 7.6 in June from a revised 9.6 in May (revised from 8.5). The all time record was 12.4 months of supply in January 2009. This is still very high (less than 6 months supply is normal).

Months of supply decreased to 7.6 in June from a revised 9.6 in May (revised from 8.5). The all time record was 12.4 months of supply in January 2009. This is still very high (less than 6 months supply is normal). The seasonally adjusted estimate of new houses for sale at the end of June was 210,000. This represents a supply of 7.6 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. The 267 thousand annual sales rate for May is the all time record. This is a very sharp downward revision.

The 330 thousand in June is the worst June on record. With all the gyrations, it is difficult to see what is happening month to month, but overall this was a very weak report.