by Calculated Risk on 5/31/2010 10:09:00 PM

Monday, May 31, 2010

In Foreclosure and ... happy?

From David Streitfeld at the NY Times: Owners Stop Paying Mortgages, and Stop Fretting. A few excerpts:

Foreclosure procedures have been initiated against 1.7 million of the nation’s households.Streitfeld provides a few examples. One lady said "The longer I’m in foreclosure, the better."

...

The average borrower in foreclosure has been delinquent for 438 days before actually being evicted, up from 251 days in January 2008, according to LPS Applied Analytics.

...

More than 650,000 households had not paid in 18 months, LPS calculated earlier this year. With 19 percent of those homes, the lender had not even begun to take action to repossess the property ...

This isn't for everyone. Streitfeld quotes Kyle Lundstedt, managing director of Lender Processing Service’s analytics group:

“These people are playing a dangerous game. There are processes in many states to go after folks who have substantial assets postforeclosure.”

Few Jobs for Students this Summer

by Calculated Risk on 5/31/2010 08:54:00 PM

Note: Here is the Weekly Summary and a Look Ahead (it will be a busy week).

From Mickey Meese at the NY Times: Fading Summer Jobs

State and local governments, traditionally among the biggest seasonal employers, are knee-deep in budget woes, and the stimulus money that helped cushion some government job programs last summer is running out. Private employers are also reluctant to hire until the economy shows more solid signs of recovery.

So expect fewer lifeguards on duty at public beaches this summer in California, fewer workers at some Massachusetts state parks and camping grounds and taller grass outside state buildings in Kentucky.

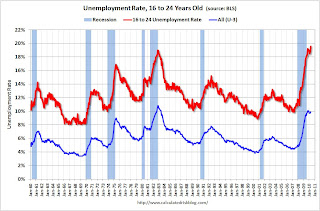

Click on graph for large image.

Click on graph for large image.For summer jobs, this will probably be the worst year since the Great Depression.

This graph shows the unemployment rate for workers 16 to 24 years old (from the BLS), and the headline unemployment rate (blue). The unemployment rate hit a record 19.6% in April for this group.

This probably ties into the recent NY Times article on overwhelming student debt. When I was in college, I was able to find summer jobs that helped me pay my way through college (of course I walked 10 miles through the snow and all that too). Times have really changed ...

ECB reports on financial stability, warns of "contagion"

by Calculated Risk on 5/31/2010 04:02:00 PM

The ECB released the twice yearly Finanical Stability Review report today. Here are couple of articles about the report:

From the Financial Times: ECB warns of ‘hazardous contagion’

The eurozone’s financial sector and economy are facing “hazardous contagion” effects from the region’s debt crisis, according to the European Central Bank ... Taking into account writedowns already reported and loan loss provisions, some €90bn of writedowns have yet to feed through, it said. For 2011, it expected banks would have to make additional loan-loss provisions of about €105.There is also a video discussion with Martin Wolf and Richard Haass, president of the Council on Foreign Relations.

except with permission

From the NY Times: Europe’s Banks at Risk From Slower Growth, Report Says

... the E.C.B. expressed particular concern about banks’ need to refinance some €800 billion, or $980 billion, in long-term debt by the end of 2012. Borrowing costs could rise as the banks compete with governments in the bond market “making it challenging to roll over a sizeable amount of maturing bonds by the end of 2012,” the report said.

Chicago: Shadow Condo Inventory

by Calculated Risk on 5/31/2010 12:39:00 PM

Just continuing a theme ...

From Eddie Baeb at Crain's Chicago Business: Nearly vacant condo tower goes back to lender

The 35-story Lexington Park, near Michigan Avenue and Cermak Road, was surrendered last week by its Irish developer through a deed-in-lieu of foreclosure. The private-equity venture that now owns the property acquired Corus Bank’s the distressed condo loans after the Chicago-based lender failed last fall.Hey, they closed on 1% percent of the units!

Just three buyers have closed on Lexington Park’s 333 units, according to property records. The tower, 2138 S. Indiana Ave., was supposed to be ready for occupancy in 2008.

Note that the developer just "walked away" (deed-in-lieu) and the original lender was Corus, the "Condo King". Unless listed for sale, these units are not included in the new or existing home inventory reports - real shadow inventory!

Real PCE Growth in Q2

by Calculated Risk on 5/31/2010 09:13:00 AM

Note: Here is the Weekly Summary and a Look Ahead (it will be a busy week).

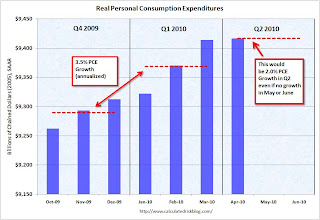

On Friday, the BEA released the Personal Income and Outlays report for April. The report showed that Real PCE increased less than 0.1 percent in April (compared to March).

Even though the month-to-month increase was small, this was fairly large increase from January (comparing the first month of Q2 to the first month of Q1).

In calculating PCE for the GDP report, the quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The following graph illustrates how this is calculated. Note that the y-axis doesn't start at zero to better show the change. Click on graph for large image.

Click on graph for large image.

The blue columns show real PCE by month, and the dashed red lines are the quarterly average.

PCE didn't increase much in January compared to December either, but there was strong growth in February and March. This resulted in PCE growing at an annualized rate of 3.5% for Q1.

Even if PCE was flat in May and June compared to April (preliminary reports suggest growth in May), real PCE would grow at 2.0% in Q2. More likely - with some growth in May and June - PCE will grow closer to 3% in Q2.

This is just a reminder that PCE growth (and GDP growth) is pretty much already baked into Q2.

Best to all.

Sunday, May 30, 2010

Condo Shadow Inventory

by Calculated Risk on 5/30/2010 10:13:00 PM

From Buck Wargo at the Las Vegas Sun: CityCenter condo closings slow in down economy

Through the end of April, MGM Mirage and Dubai World, the owners of the project, have closed on 78 of 1,543 units at the Vdara condo-hotel, according to SalesTraq.This is a reminder that unless these condos are listed, they do not show up as either existing or new home inventory (the new home report doesn't include high rise condos).

... Houston-based Metrostudy reported that Las Vegas has more than 8,200 condominium units that are sitting empty, including those still vacant in CityCenter.

There are some areas - like Las Vegas and Miami - that have a huge number of vacant high rise condos. But there are also many smaller buildings that are mostly vacant in a number of cities (like in New York, Raliegh, N.C. and Irvine, Ca). This is part of the shadow inventory ...

Percent Job Losses During Recessions, aligned at Bottom

by Calculated Risk on 5/30/2010 05:17:00 PM

By request ... here is an update through April with the impact of Census hiring added. Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - but this time aligned at the bottom of the recession. This assumes that the 2007 recession has reached bottom.

The current recession has been bouncing along the bottom for a few months - so the choice of bottom is a little arbitrary (plus or minus a month or two).

Notice that the 1990 and 2001 recessions were followed by jobless recoveries - and the eventual job recovery was gradual. In earlier recessions the recovery was somewhat similar and a little faster than the decline (somewhat symmetrical).

The dotted line shows the impact of Census hiring.

In April, there were 154,000 temporary 2010 Census workers on the payroll. This barely shows up on the graph.

The number of temporary workers will jump to around 573,000 in May - and the dotted line will be well below the red line. Starting in June, the number of Census workers will decline - and the two lines will meet later this year.

Weekly Summary and a Look Ahead

by Calculated Risk on 5/30/2010 12:01:00 PM

The key economic report this week will be the May Employment Report to be released on Friday. Note: U.S. and U.K. stock markets will be closed on Monday.

On Tuesday, at 10 AM, the ISM Manufacturing index for May will be released (expectations are for a decrease to 59.5 from 60.4 in April) and Construction Spending for April (consensus is for private spending to be flat).

On Wednesday, the automakers will report vehicle sales for May. Expectations are for about a 11.2 million SAAR for light vehicles in May – or about the same rate as in April. The NAR will release April Pending Home Sales at 10 AM (expect a tax credit related increase). And the American Bankruptcy Institute will probably report personal bankruptcy filings for May on Wednesday too. This will probably show another "surge" in filings.

On Thursday, the closely watched initial weekly unemployment claims will be released. Consensus is for a decline to 450K from 460K last week. Also on Thursday, the ADP employment report will be released (consensus is for an increase of 60K private sector jobs, up from 32K in April). Also on Thursday, the May ISM non-manufacturing report will be released. Consensus is for a slight increase to 55.9 from 55.4 in the service sector. Factory Orders for April will also be released.

And on Friday, the BLS will release the May Employment report at 8:30 AM. The consensus is for a gain of 540K payroll jobs in May, and for the unemployment rate to decline slightly to 9.8% (from 9.9%). Of course the 540K includes a substantial number of temporary hires for Census 2010 (May is the peak month). It will be important to remove the Census hiring to try to determine the underlying trend.

We can estimate the Census hiring using this data from the Census bureau (ht Bob_in_MA). If we subtract the number of Temporary 2010 Census Workers in the 2nd week of May from the number in the second week of April, this suggests the Census boost will be around 417K in May. The Census Bureau will release the actual number with the employment report.

Here are two ex-Census forecasts from MarketWatch: Job growth seen a little less robust in May

David Greenlaw, economist at Morgan Stanley, expects a downshift to 105,000 jobs in May excluding the census workers.This is down from 224,000 ex-Census in April.

Economists at Credit Suisse expect private sector job creation around 130,000 in May.

Also on Friday the FDIC will probably have another busy Friday afternoon ... plus there will be several Fed speeches this week.

And a summary of last week:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April 2010 (5.77 million SAAR) were 7% higher than last month, and were 22.8% higher than April 2009 (4.61 million SAAR).

Sales surged last November when many first-time homebuyers rushed to beat the initial expiration of the tax credit. There will probably be a further increase in May and June this year. Note: existing home sales are counted at closing, so even though contracts must be signed in April to qualify for the tax credit, buyers have until June 30th to close.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 4.04 million in April from 3.63 million in March. The all time record high was 4.57 million homes for sale in July 2008.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Inventory increased 2.7% YoY in April, the first YoY increase since 2008.

Inventory increased 2.7% YoY in April, the first YoY increase since 2008. This increase in the inventory is especially concerning because the reported inventory is already historically very high, and the 8.4 months of supply in April is well above normal. The months of supply will probably decline over the next two months because of the increase in sales due to the tax credit (reported at closing), but this will be something to watch this summer and later this year.

This graph shows the nominal not seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal not seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 29.8% from the peak, and up slightly in March (SA).

The Composite 20 index is off 29.3% from the peak, and down slightly in March (SA).

This graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

This graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.Prices decreased (SA) in 11 of the 20 Case-Shiller cities in March (SA).

Prices in Las Vegas are off 56% from the peak, and prices in Dallas only off 5.8% from the peak.

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 504 thousand. This is an increase from the revised rate of 439 thousand in March (revised from 411 thousand).

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).Note the Red columns for 2010. In April 2010, 48 thousand new homes were sold (NSA).

The record low for the month of April was 32 thousand in 1982 and 2009; the record high was 116 thousand in 2005.

The second graph shows New Home Sales vs. recessions for the last 45 years.

The second graph shows New Home Sales vs. recessions for the last 45 years. Sales of new one-family houses in April 2010 were at a seasonally adjusted annual rate of 504,000 ... This is 14.8 percent (±19.5%)* above the revised March rate of 439,000 and is 47.8 percent (±26.0%) above the April 2009 estimate of 341,000.New home sales are counted when the contract is signed, so this pickup in activity is related to the tax credit.

For new home sales, the tax credit selling ended in April and sales will probably decline sharply in May.

Best wishes to all.

Europe Update

by Calculated Risk on 5/30/2010 09:07:00 AM

NY Times editorial: The Transatlantic Crisis: Europe’s Endangered Banks

... Several [European countries] have weak governments that may not be able to carry through the prescribed fixes. Even if they do, the budget cuts are likely to make them even weaker.From The Times: Spain races to avert banking crisis as euro faces slide

...

This is a recipe for economic stagnation. It also may not avert a debt rescheduling by some of the weaker European countries, which would force European banks to take a cut on their holdings. Sitting on slim cushions of capital reserves, European banks are in no shape for a sharp drop in the value of their assets.

It would be best to recognize that debt restructuring is inevitable.

...

American banks ended 2009 with $1.2 trillion worth of total European debt. ... It would be foolhardy to assume this problem is far away.

One of Spain’s biggest banks was this weekend negotiating a merger with five smaller rivals as part of a desperate government effort to restore confidence in the faltering economy, which threatens to drag down the rest of the eurozone.And also from The Times: Greece urged to give up euro

Caja Madrid, the country’s second-largest savings bank, opened talks in the hope of beating the June 30 deadline to tap a €99 billion (£84 billion) government bank rescue fund.

THE Greek government has been advised by [private] British economists to leave the euro and default on its €300 billion (£255 billion) debt to save its economy.

Saturday, May 29, 2010

Bank Failures per Week

by Calculated Risk on 5/29/2010 09:41:00 PM

I haven't updated this graph for some time ...

There have been 246 bank failures in this cycle (starting in 2007):

| FDIC Bank Failures by Year | 2007 | 3 |

|---|---|

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 78 |

| Total | 246 |

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows bank failures by week in 2008, 2009 and 2010.

The 140 bank failures last year was the highest total since 1992 (181 bank failures).

As the previous post noted, banks are being added to the unofficial problem bank list much faster than they are being removed ... and it looks like there will be something close to 200 failures this year. That is more than in 1992, but probably less than the 271 in 1991. Bank failures peaked at 534 in 1989 during the S&L crisis.