by Calculated Risk on 4/30/2010 11:46:00 PM

Friday, April 30, 2010

Unofficial Problem Bank List hits 722

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 30, 2010.

Changes and comments from surferdude808:

Failure Friday and the FDIC issuing its enforcement actions for March contributed to many changes in the Unofficial Problem Bank List.The list keeps growing ...

Of the seven failures this week, six were on the list including Westernbank Puerto Rico ($11.9 billion), R-G Premier Bank of Puerto Rico ($6.1 billion), Frontier Bank ($3.6 billion), Eurobank ($2.6 billion), CF Bancorp ($1.7 billion), and BC National Banks ($67 million). There was one other removal as the action against University Bank ($134 million) was terminated.

Thirty-five institutions with aggregate assets of $9.8 billion made their first appearance on the list this week. Among the additions are FSGBank, National Association, Chattanooga, TN ($1.4 billion Ticker: FSGI); Centennial Bank, Fountain Valley, CA ($848 million); Beach Community Bank, Fort Walton Beach, FL ($706 million Ticker: BCBF); and CIBM Bank, Champaign, IL ($698 million Ticker: CIBH). The additions include four institutions based in Illinois, Minnesota, and Nevada, and three in Florida, Georgia, Texas, and Washington.

The FDIC also issued Prompt Corrective Action orders against a few banks already on the Unofficial Problem Bank List including Nevada Security Bank, Reno, NV ($502 million) and Sun West Bank, Las Vegas, NV ($381 million). After the failures and additions, the Unofficial Problem Bank List stands at 722 institutions with aggregate assets of $349.8 billion.

This week, Cascade Bank, Everett, WA ($1.7 billion Ticker: CASB) disclosed that it now expects to sign a Consent Order in Q2."[I]n light of the current challenging operating environment, along with our elevated level of nonperforming assets and adversely classified assets and our recent operating results, we expect Cascade Bank to enter into a Consent Order with the FDIC and Washington State DFI during the second quarter. We expect that under the Order, Cascade Bank will be required, among other things, to improve asset quality and reduce classified assets; to improve profitability; and to increase Tier 1 capital.

We also expect the Company will enter into a similar Order with the Federal Reserve Bank of San Francisco."

Bank Failure #64: Frontier Bank, Everett, Washington

by Calculated Risk on 4/30/2010 09:14:00 PM

A limitless horizon

Much like our debt load.

by Soylent Green is People

From the FDIC: Union Bank, National Association, San Francisco, California, Assumes All of the Deposits of Frontier Bank, Everett, Washington

Frontier Bank, Everett, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Is that about $7 billion today?

As of December 31, 2009, Frontier Bank had approximately $3.50 billion in total assets and $3.13 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $1.37 billion. ... Frontier Bank is the 64th FDIC-insured institution to fail in the nation this year, and the sixth in Washington. The last FDIC-insured institution closed in the state was City Bank, Lynnwood, on April 16, 2010.

Bank Failure #63: BC National Banks, Butler, Missouri

by Calculated Risk on 4/30/2010 07:33:00 PM

Deposits gone with the wind

I don't give a damn

by Soylent Green is People

From the FDIC:Community First Bank, Butler, Missouri, Assumes All of the Deposits of BC National Banks, Butler, Missouri

BC National Banks, Butler, Missouri, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ..

As of December 31, 2009, BC National Banks had approximately $67.2 million in total assets and $54.9 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.4 million. ... BC National Banks is the 63rd FDIC-insured institution to fail in the nation this year, and the third in Missouri. The last FDIC-insured institution closed in the state was Champion Bank, Creve Coeur, earlier today.

Bank Failure #62: Champion Bank, Creve Coeur, Missouri

by Calculated Risk on 4/30/2010 06:34:00 PM

The breakfast of Champion

They drank our milk shake

by Soylent Green is People

From the FDIC: Bankliberty, Liberty, Missouri, Assumes All of the Deposits of Champion Bank, Creve Coeur, Missouri

Champion Bank, Creve Coeur, Missouri, was closed today by the Missouri Division of Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Busy day ...

As of December 31, 2009, Champion Bank had approximately $187.3 million in total assets and $153.8 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $52.7 million. ... Champion Bank is the 62nd FDIC-insured institution to fail in the nation this year, and the second in Missouri. The last FDIC-insured institution closed in the state was Bank of Leeton, Leeton, on January 22, 2010.

Bank Failure #61: CF Bancorp, Port Huron, Michigan

by Calculated Risk on 4/30/2010 06:23:00 PM

Autos and banks only hope

Federal bailouts.

by Soylent Green is People

From the FDIC: First Michigan Bank, Troy, Michgan, Assumes All of the Deposits of CF Bancorp, Port Huron, Michigan

CF Bancorp, Port Huron, Michigan, was closed today by the Michigan Office of Financial and Insurance Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes four today ... "only" $615 million cost ...

As of December 31, 2009, CF Bancorp had approximately $1.65 billion in total assets and $1.43 billion in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $615.3 million. ... CF Bancorp is the 61st FDIC-insured institution to fail in the nation this year, and the second in Michigan. The last FDIC-insured institution closed in the state was Lakeside Community Bank, Sterling Heights, on April 16, 2010.

Bank Failures #58 to 60: Puerto Rico

by Calculated Risk on 4/30/2010 04:44:00 PM

Los prestamos dudosos

Peo gestion

by Soylent Green is People

From the FDIC: Oriental Bank and Trust, San Juan, Puerto Rico, Assumes All of the Deposits of Eurobank, San Juan, Puerto Rico

Eurobank, San Juan, Puerto Rico, was closed today by the Office of the Commissioner of Financial Institutions of the Commonwealth of Puerto Rico, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Scotiabank de Puerto Rico, San Juan, Puerto Rico, Assumes All of the Deposits of R-G Premier Bank of Puerto Rico, Hato Rey, Puerto Rico

As of December 31, 2009, Eurobank had approximately $2.56 billion in total assets and $1.97 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $743.9 million. ... Eurobank is the 58th FDIC-insured institution to fail in the nation this year. Eurobank is one of three institutions closed in Puerto Rico today.

R-G Premier Bank of Puerto Rico, Hato Rey, Puerto Rico, was closed today by the Office of the Commissioner of Financial Institutions of the Commonwealth of Puerto Rico, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Banco Popular de Puerto Rico, San Juan, Puerto Rico, Assumes All of the Deposits of Westernbank Puerto Rico, Mayaguez, Puerto Rico

As of December 31, 2009, R-G Premier Bank of Puerto Rico had approximately $5.92 billion in total assets and $4.25 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $1.23 billion.... R-G Premier Bank of Puerto Rico is the 59th FDIC-insured institution to fail in the nation this year. R-G Premier Bank of Puerto Rico is one of three institutions closed in Puerto Rico today.

Westernbank Puerto Rico, Mayaguez, Puerto Rico, was closed today by the Office of the Commissioner of Financial Institutions of the Commonwealth of Puerto Rico, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...There goes a quick $5+ billion from the DIF ...

As of December 31, 2009, Westernbank Puerto Rico had approximately $11.94 billion in total assets and $8.62 billion in total deposits...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.31 billion. ... Westernbank Puerto Rico is the 60th FDIC-insured institution to fail in the nation this year. Western Bank was one of three institutions closed in Puerto Rico today.

Market Update, Goldman, and Housing Tax Credit expires

by Calculated Risk on 4/30/2010 04:00:00 PM

First, housing economist Tom Lawler will be on CNBC around 4:15 PM ET with Maria Bartoromo to discuss the expiration of the housing tax credit.

Second, Goldman is having a bad day, from Dow Jones: Goldman Sachs Shares, Bonds Slide On Criminal Probe

The stock has slumped more than 20% since the Securities and Exchange Commission filed civil securities-fraud charges against the company two weeks ago. Analystssaid they see little near-term upside for the shares. The Wall Street Journal's report late Thursday that the Justice Department is conducting a criminal investigation into whether Goldman or its employees committed securities fraud in connection with mortgage trading pushed the stock down ...Goldman is off almost 10% today.

And from Doug Short:

This graph from Doug is titled: "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Restaurant Index shows Expansion in March

by Calculated Risk on 4/30/2010 02:41:00 PM

This is one of several industry specific indexes I track each month.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the first time in 29 months that the index is showing expansion.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading above 100 shows expansion for this index.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Continues to Improve as Restaurant Performance Index Tops 100 for the First Time in More Than Two Years

[T]the National Restaurant Association’s Restaurant Performance Index (RPI) ... stood at 100.5 in March, up 1.4 percent from February and its strongest level since September 2007. In addition, the RPI rose above 100 for the first time in 29 months, which signifies expansion in the index of key industry indicators.Restaurants are a discretionary expense, and they tend to be 'first in, last out' of a recession for consumer spending (as opposed to housing that is usually first in and first out).

The RPI’s solid performance in March was driven by improvements among both the current-situation and forward-looking indicators,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Restaurant operators reported net gains in both same-store sales and customer traffic in March, the first time in 31 months that both indicators stood in positive territory.”

“In addition, restaurant operators are increasingly optimistic about growth in sales and staffing levels in the months ahead, while their outlook for the economy soared to its strongest level in five years,” Riehle added.

...

For the first time in 22 months, restaurant operators reported net positive same-store sales.

...

Restaurant operators also reported a net increase in customer traffic in March, the first positive reading in 31 months.

emphasis added

A few comments on Q1 GDP Report

by Calculated Risk on 4/30/2010 11:59:00 AM

The change in private inventories was smaller this quarter - adding 1.7% to GDP in Q1 2010 compared to 4.4% in Q4 2009. It is important to note that the inventory contribution to Q4 GDP was from a slowdown in the liquidation of inventories, but in Q1 businesses were building inventories - and this inventory build will probably slow in Q2.

As I noted earlier, the two leading sectors, residential investment (RI) and personal consumption expenditures (PCE), were mixed. RI declined to a new record low as percent of GDP, however PCE increased at a 3.6% real annualized rate.

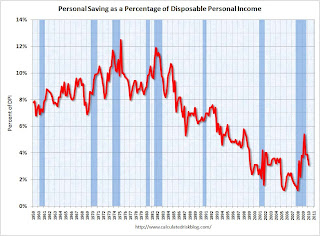

The increase in PCE does not seem sustainable unless employment and incomes increase soon. A large portion of the increase in PCE came from a decrease in personal saving. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows personal saving as a percent of disposable personal income.

It is not unusual for the saving rate to decline at the beginning of a recovery as people become more confident. This helps drive consumer spending, but with the high levels of household debt, I expect the saving rate to increase over the rest of the year.

Here are some Q1 numbers (all annualized):

So the boost in PCE came from the decline in saving and the increase in benefits. That is not sustainable.

The second graph shows real personal income less transfer payments as a percent of the previous peak.

The second graph shows real personal income less transfer payments as a percent of the previous peak.Unlike the recovery in GDP, real personal income less transfer payments has barely increased and is still 6.6% below the pre-recession level.

The peak of the stimulus spending is in Q2 2010 (right now), and then the stimulus spending starts to taper off in the 2nd half of 2010. So underlying demand better increase soon - and that means jobs and incomes going forward.

Unfortunately residential investment is usually one of the key engines for employment and growth at the beginning of a recovery - and I expect RI to be sluggish all year because of the huge overhang of existing housing units. So my guess is the recovery will probably remain sluggish, and I still expect a slowdown in the 2nd half of 2010.

Thursday, April 29, 2010

Misc: "99ers", Puerto Rico and Goldman

by Calculated Risk on 4/29/2010 09:05:00 PM

Three followup stories ...

From Alana Semuels at the LA Times: '99ers' dread future without jobless benefits

In California, state officials estimate there are nearly 100,000 people who are still looking for work but can no longer draw an unemployment check. Federal labor officials could not provide a number nationally, but private-sector experts say it could easily top 1 million.From Eric Dash at the NY Times: Puerto Rican Lenders Face Their Own Crisis

What is certain is that, as the jobless rate remains stubbornly high, more Americans will have to face the challenge of making ends meet without a monthly check.

"People are going off a cliff and we're not really doing anything about it," said Andrew Stettner, deputy director of the National Employment Law Project.

At least three of Puerto Rico’s banks — Eurobank, R-G Premier Bank and Westernbank — are operating under cease-and-desist orders from regulators ...And from Susan Pulliam and Evan Perez at the WSJ: Criminal Probe Looks Into Goldman Trading . No real details, but earlier the NY Post reported that Goldman "may soon settle its [civil] fraud case".

Now that the deadline has come and gone, regulators have been working on a confidential plan to auction off the lenders ... It is known as Project Themis ... the efforts could cost the F.D.I.C. insurance fund as much as $5 billion, some analysts estimate.

And Q1 2010 GDP will be released in the morning. Consensus is for 3.4% annualized real GDP growth, but the details will be important.