by Calculated Risk on 4/20/2010 10:18:00 PM

Tuesday, April 20, 2010

Shiller: "Mini-bubble" in Stock and Housing Markets

Jennifer Schonberger at Motley Fool interviews Professor Robert Shiller: Shiller: The Housing Recovery Could Be on Shaky Ground.

A couple of comments from Shiller, first on house prices:

Robert Shiller: Home prices have been going up for nearly a year now, according to our data, the S&P/Case-Shiller indices ... Normally we could extrapolate that kind of upward trend because historically home prices have shown a lot of momentum. But I think we're in a very unusual circumstance because of the massive bailouts, the homebuyer tax credits, the Fed's purchase of mortgage-backed securities -- and these things are coming to an end. So it's an unusual period. So I don't trust the trend that we have. I'm worried that it might get reversed.And on asset prices:

Shiller: We have had kind of a mini-bubble in the stock market and the housing market. It wasn't just because of rate cuts. It was also because of government stimulus and bailouts. So the question is: Are we at risk for even more price increases, and another bubble? I think we are at risk, but I'm not predicting it. I think it's more likely we don't do so well from here.

NY Times: Up to 300,000 public school jobs could be cut

by Calculated Risk on 4/20/2010 06:48:00 PM

From Tamar Lewin and Sam Dillon at the NY Times: School Districts Warn of Even Deeper Teacher Cuts (ht Ann)

School districts around the country ... are warning hundreds of thousands of teachers that their jobs may be eliminated in June.These cuts will make the employment situation worse. This is also a reminder that the Federal stimulus spending peaks in Q2, and then starts to decline in Q3.

... their usual sources of revenue — state money and local property taxes — have been hit hard by the recession. In addition, federal stimulus money earmarked for education has been mostly used up this year.

...

Districts in California have pink-slipped 22,000 teachers. Illinois authorities are predicting 17,000 public school job cuts. And New York has warned nearly 15,000 teachers that their jobs could disappear in June.

Secretary of Education Arne Duncan estimated that state budget cuts imperiled 100,000 to 300,000 public school jobs. In an interview on Monday, he said the nation was flirting with “education catastrophe.”

DataQuick: Foreclosures moving to mid-to-high end

by Calculated Risk on 4/20/2010 04:00:00 PM

As a followup to the previous post, here is some more data from DataQuick:

"We are seeing signs that the worst may be over in the hard-hit entry-level markets, while problems are slowly spreading to more expensive neighborhoods. We're also seeing some lenders become more accommodating to work-outs or short sales, while others appear to be getting stricter about delinquencies. It's very noisy out there," [John Walsh, DataQuick president] said.The foreclosure rates in the mid-to-high end areas will never be as high as in the low end areas, but the percentage of total foreclosures will probably continue to increase. I also expect the average time in the foreclosure process to start to decrease this year as the lenders start clearing out the backlog.

The state's most affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for 47.5 percent of all default activity a year ago. In first-quarter 2010 that fell to 40.9 percent.

California's mid- to high-end housing markets were more likely to have seen a rise in mortgage defaults last quarter, though the concentration of default activity - measured by defaults per 1,000 homes - remained relatively low in those areas.

For example, zip codes statewide with median home sale prices of $500,000-plus saw mortgage defaults buck the overall trend and rise 1.5 percent last quarter compared with the prior quarter, while year-over-year the decline was 19 percent (versus a 40.2 percent marketwide annual decrease). Collectively, these zips saw 4.5 default notices filed for every 1,000 homes in the community, compared with the overall market's rate of 9.3 NODs for every 1,000 homes statewide.

In zip codes with medians below $500,000, mortgage default filings fell 5.8 percent from the prior quarter and declined nearly 43 percent from a year earlier. However, collectively these zips saw 10.5 NODs filed for every 1,000 homes - more than double the default rate for the zips with $500,000-plus medians.

On average, homes foreclosed on last quarter spent 7.5 months winding their way through the formal foreclosure process, beginning with an NOD. A year ago it was 6.8 months. The increase could reflect, among other things, lender backlogs and extra time needed to pursue possible loan modifications and short sales.

Foreclosure resales accounted for 42.6 percent of all California resale activity last quarter. It was up from a revised 40.6 percent the prior quarter, and down from 57.8 percent a year ago, the peak.

DataQuick: California Notice of Default Filings Decline in Q1

by Calculated Risk on 4/20/2010 02:06:00 PM

Click on graph for larger image in new window.

This graph shows the Notices of Default (NOD) by year through 2009, and for Q1 2010, in California from DataQuick.

Although the pace of filings has slowed, it is still very high by historical standards.

From Alejandro Lazo at the LA Times: California foreclosures drop 4.2% as lenders work with troubled borrowers

Across California, a total of 81,054 homes received a notice of default in the first quarter compared with 84,568 in the fourth quarter of 2009 and a record 135,431 in the first quarter of 2009.In terms of new NOD filings, the peak was probably in 2009. A few key points:

Philly Fed State Coincident Indicators

by Calculated Risk on 4/20/2010 11:05:00 AM

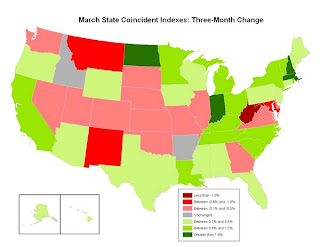

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Seventeen states are showing declining three month activity. The index increased in 31 states, and was unchanged in 2.

Here is the Philadelphia Fed state coincident index release for March.

In the past month, the indexes increased in 35 states, decreased in 10, and remained unchanged in five (Georgia, Illinois, South Dakota, Utah, and Vermont) for a one-month diffusion index of 50. Over the past three months, the indexes increased in 31 states, decreased in 17, and remained unchanged in two (Arkansas and Idaho) for a three-month diffusion index of 28.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Based on this indicator, most of the U.S. was in recession in early 2008.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Based on this indicator, most of the U.S. was in recession in early 2008.The last time the index was higher was in December 2007.

Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

DOT: Vehicle Miles Driven Decline in February

by Calculated Risk on 4/20/2010 08:52:00 AM

The Department of Transportation (DOT) reported today that vehicle miles driven in February were down from February 2009:

Travel on all roads and streets changed by -2.9%(-6.3 billion vehicle miles) for February 2010 as compared with February 2009. Travel for the month is estimated to be 212.9 billion vehicle miles.

Cumulative Travel for 2010 changed by -2.3% (-10.1 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent change from the same month of the previous year as reported by the DOT.

As the DOT noted, miles driven in February 2010 were down -2.9% compared to February 2009.

The second graph shows the moving 12 month total of miles driven (to remove seasonality).

The second graph shows the moving 12 month total of miles driven (to remove seasonality).The moving 12 month total peaked in November 2007. The impact on vehicle miles of the gasoline shortages in the '70s are clear - in the late '70s and early '80s, it took 40 months before vehicle miles returned to the peak of April 1979.

Blame it on the snow - except this is the 2nd month in a row with a year-over-year decline in miles driven. If vehicle miles continues to decline on a year-over-year basis, it might suggest high gasoline prices are starting to impact the economy.

Monday, April 19, 2010

Greece: Bond spreads widen as Bundesbank President says Greece may need more aid

by Calculated Risk on 4/19/2010 07:21:00 PM

An update on Greece: The IMF team was delayed arriving in Greece because of the ash from the Iceland volcano, meanwhile the Bundesbank president was quoted as saying Greece may need more aid.

Also the German Finance Minister was quoted in Der Spiegel: "We cannot allow the bankruptcy of a euro member state like Greece to turn into a second Lehman Brothers."

From the NY Times: Greek Debt Unsettles Bond Market

Yields on Greek bonds pushed to fresh highs on Monday ... as investors continued to worry about the country’s near-term ability to finance its debt. ... The yield on benchmark 10-year Greek government bonds closed in Europe at 7.63 percent — the highest since Greece joined the euro. That widened the spread, or difference, with equivalent German bonds to 4.55 percentage points.From Bloomberg: Weber Said to Tell German Lawmakers Greece May Need More Aid

Bundesbank President Axel Weber told German lawmakers that Greece may need more aid than the 30 billion euros ($40 billion) promised by the European Union as the government in Athens struggles to push through planned spending cuts, two people present at the briefing said.An interview with German Finance Minister Wolfgang Schäuble in Der Speigel: 'We Cannot Allow Greece to Turn into a Second Lehman Brothers'

Schäuble: [W]e have experienced a financial crisis from which we in Europe must draw a clear lesson: We cannot allow the bankruptcy of a euro member state like Greece to turn into a second Lehman Brothers.

SPIEGEL: You are exaggerating. In past years, it's happened again and again that a country couldn't pay its debts, and yet that hasn't led to a collapse of the global financial system. Why should this be different in Greece's case?

Schäuble: Because Greece is a member of the European monetary union. Greece's debts are all denominated in euros, but it isn't clear who holds how much of those debts. For that reason, the consequences of a national bankruptcy would be incalculable. Greece is just as systemically important as a major bank.

Fannie Mae updates "Waiting Period" following Pre-Foreclosure Events

by Calculated Risk on 4/19/2010 03:27:00 PM

From Austin Kilgore at HousingWire: Fannie Shortens Wait for Some Distressed Borrowers to Get New Loans

Fannie Mae announced it is reducing the wait time for some borrowers between when they complete a short sale or deed-in-lieu of foreclosure transaction and when they can obtain a new mortgage.Here is the update from Fannie Mae. For other loans (mostly higher risk loans), the period has been increased to seven years (per the eligibility matrix).

Previously, a borrower was required to wait four years before getting a new mortgage, or two years if their home sold in a short sale. Under the new guidelines, a borrower that previously completed a deed-in-lieu of foreclosure transaction can get a new mortgage in two years, provided the borrower has a 20% down payment.

If the borrower has a 10% down payment, the wait period is still four years.

A couple notes: Several reports are mentioning the shorter waiting period (2 years instead of 4 years), but that is just for borrowers who put 20% down. This update also makes the policy consistent for short sales and deed-in-lieu of foreclosure transactions - and for the first time explicitly mentions short sales (since these are becoming much more common).

Moody's: CRE Prices Decline 2.6% in February

by Calculated Risk on 4/19/2010 11:43:00 AM

Moody's reported this morning that the Moody’s/REAL All Property Type Aggregate Index declined 2.6% in February. This is a repeat sales measure of commercial real estate prices.

Moody's noted that the share of distressed sales has increased sharply. In 2008 distressed sales were only 4% of all sales, in 2009 nearly 20% of all the repeat sales transaction were classified as distressed. In February 2010, the percent of distressed sales jumped to a record 32%.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

Commercial real estate values are now down 25.8% over the last year, and down 41.8% from the peak in August 2007.

More Housing Bust and Construction Employment

by Calculated Risk on 4/19/2010 10:58:00 AM

Back in 2006, we discussed that the hardest hit areas, in the then coming housing bust, would be the communities most dependent on residential construction employment. Last week, I posted a follow up focused on California: The Housing Bust and Construction Employment

Zach Fox at SNL Interactive writes about the impact on Cape Coral, a construction dependent community in Florida: A generation of wealth lost

With so little commercial space in Cape Coral, the metro area became especially reliant on construction for employment. By June 2006, 16.8% of all jobs in the metro area came from the mining, logging and construction sector (the Bureau of Labor Statistics does not break out construction jobs for the Cape Coral-Fort Myers, MSA). By contrast, the national average reliance on the sector that month was 6.3%. Even the notoriously growth-dependant Phoenix-Mesa-Glendale, Ariz., MSA (the U.S. Office of Management and Budget changed the name of the MSA from Phoenix-Mesa-Scottsdale, Ariz., in December 2009), was far less reliant on development, with 10.1% of its jobs coming from mining, logging and construction in June 2006.

"I can remember driving up the west [Florida] coast and saying, 'Where are all these people going to work?'" [Andrea Heuson, a professor of finance at the University of Miami] said.

Unsurprisingly, with construction jobs falling off a cliff, Cape Coral-Fort Myers has posted a towering unemployment rate, hitting 13.9% in February, according to a preliminary report; the national average was 10.4% in February, non-seasonally adjusted. Whatever housing market metric one picks, Cape Coral-Fort Myers is near the top — in a bad way. The metro area has seen prices fall 49.5% from the 2006 first quarter through the 2009 fourth quarter, larger than the 42.0% drop posted by California's infamous Inland Empire and the 49.3% decline seen in Nevada's eviscerated Las Vegas-Paradise MSA, according to the FHFA's all-transactions index. With unemployment shooting up and prices tumbling, it comes as little surprise that Cape Coral-Fort Myers is also one of the nation's most foreclosure-prone neighborhoods. The metro posted the second-highest foreclosure rate of any metro area in the nation during 2009, according to RealtyTrac.This was so easy to predict ...