by Calculated Risk on 3/09/2010 06:49:00 PM

Tuesday, March 09, 2010

Vacant High Rise Condo Units

A couple of articles about vacant or near vacant high rise condo towers in Florida ...

From the News-Press: Sole occupant of 32-story Fort Myers condo wants out (ht several)

Victor Vangelakos is the only buyer to take possession of his unit in the 32-story Tower 1 of the Oasis high-rise project in downtown Fort Myers.Apparently the original plan was to build 5 towers with a total of 1,079 units. That is about 216 units per tower, and all but one unit are vacant in Tower 1. Tower 2 appears to have few lights on too.

And from the WSJ on the 850-unit Everglades project in Miami: BofA Lawyers Rebuked in Cabi Case

Only 109 or about 13% of the Everglades' 850 units have sold, according to CondoVultures.com. However, as of last month, the developer has rented about 260, or about 30%, of the units, in what it calls a "deferred purchase program."That sounds like another 480 vacant units.

Many of these high rise condo towers are part of the "shadow inventory" because the units do not show up on either the new home sales or existing home sales reports (unless they are listed in the MLS). For some areas - like South Florida and Las Vegas - this is a significant part of the inventory.

NY Fed's Sack on Communication

by Calculated Risk on 3/09/2010 03:28:00 PM

One of the important points NY Fed VP Brian Sack made in his speech yesterday was the need for clear communication:

[T]his tightening cycle, when it arrives, will be more complicated than past cycles, as there will be more decision points facing policymakers. With more decision points come more opportunities for the markets to be confused by our actions. The recent changes to the discount rate and the Treasury's Supplementary Financing Program balances highlight this concern, as the amount of attention that those actions received was outsized relative to their significance for the economy or for the path of short-term interest rates.Sack singled out two recent releases that he believes were misunderstood.

The burden is on the Fed to mitigate this risk by communicating clearly about its policy intentions and the purpose of any operational moves it might take. In this regard, the forward-looking policy language that the FOMC is currently using in its statement is important. I would argue that this language contains much more direct and valuable information about the likely path of the short-term interest rate target than does any decision about draining reserves.

The first was the change to the Discount Rate on February 18th. I think that release was very clear and it was released after the market closed. The increase in the discount rate had been expected, but the timing was a little surprising since the FOMC has trained participants that inter-meeting announcements are special.

Brian Sack suggests the FOMC should communicate "clearly about its policy intentions and the purpose of any operational moves it might take". Clearly the Fed could have done better, if, as Sack suggests, they had included a few sentences in the FOMC statement released a few weeks earlier and mentioned the possibility of this move.

Still any "outsized" attention was probably from people who didn't read the release (I'm not sure how to fix that problem).

The other announcement that Sack highlighted was from Treasury on the Supplementary Financing Program:

The U.S. Department of Treasury today issued the following statement on the Supplementary Financing Program (SFP):That was it.

"Treasury anticipates that the balance in the Treasury's Supplementary Financing Account will increase from its current level of $5 billion to $200 billion. This will restore the SFP back to the level maintained between February and September 2009.

This action will be completed over the next two months in the form of eight $25 billion, 56-day SFP bills. Starting tomorrow, SFP auctions will be held each Wednesday at 11:30 a.m. EST, unless otherwise noted."

Although I got that one right, is it any wonder that some people were confused by this statement? Why not expand and explain why this action was being taken?

It was a considered a positive step when the Treasury started to unwind the SFP, and here they are expanding it again without explanation.

Brian Sack argued the burden is on the Fed to communicate clearly and explain the reasons behind each action. I agree. And I'd suggest the burden is also on Treasury.

WaPo on Unemployment Benefits

by Calculated Risk on 3/09/2010 12:50:00 PM

A few factoids from Michael Fletcher and Dana Hedgpeth at the WaPo: Are unemployment benefits no longer temporary?

Note: The suggestion mentioned in the article that the unemployment rate is high because of unemployment benefits is off point: See Krugman's Supply, Demand, and Unemployment

Another important benefit of unemployment insurance is that the benefits have helped keep many households in place. If there were no extended benefits, many of the 5+ million people now receiving extended benefits would be moving out of their homes or apartments, and doubling up with friends and relatives, or living in their cars or worse. Fewer households would increase the number of excess vacant housing units in the U.S. and exacerbate the housing crisis.

BLS: Low Labor Turnover, More Job Openings in January

by Calculated Risk on 3/09/2010 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 2.7 million job openings on the last business day of January 2010, the U.S. Bureau of Labor Statistics reported today. The job openings rate rose over the month to 2.1 percent, the highest the rate has been since February 2009. The hires rate (3.1 percent) and the separations rate (3.2 percent) were unchanged in January.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. The CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people.

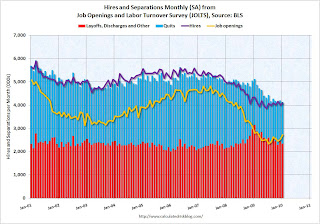

The following graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and light blue added together equals total separations.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (purple line) and separations (red and light blue stacked together) are pretty close each month. This is the level of turnover each month. When the purple line is above total separations, the economy is adding net jobs, when the purple line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 4.08 million hires in January (SA), and 4.122 million total separations, or 42 thousand net jobs lost. The comparable CES report showed a loss of 26 thousand jobs in January (after revision).

Separations have declined sharply from early 2009, but hiring has barely picked up. Quits (light blue on graph) are at near the low too. Usually "quits" are employees who have already found a new job (as opposed to layoffs and other discharges).

The low turnover rate is another indicator of a weak labor market.

NFIB: Small Business Optimism Declines in February

by Calculated Risk on 3/09/2010 08:57:00 AM

From Rex Nutting at MarketWatch: Small business optimism falls in Feb., NFIB says

An index measuring small-business optimism fell 1.3 points to 88.0 in February, erasing January's gain, according to a monthly survey released Tuesday by the National Association of Independent businesses.And a few excerpts from the report:

The National Federation of Independent Business Index of Small Business Optimism lost 1.3 points in February, falling back to the December reading of 88.0 (1986=100), only seven points higher than the survey’s second lowest reading reached in March 2009 (the lowest reading was 80.1 in 1980:2). The persistence of Index readings below 90 is unprecedented in survey history.And the number one problem continues to be poor sales.

...

Regular borrowers (accessing capital markets at least once a quarter) continued to report difficulties in arranging credit. A net 12 percent reported loans harder to get than in their last attempt, a two point improvement from January. Thirty-four (34) percent reported regular borrowing, up two points from January but still historically very low. Weak plans to make capital expenditures, to add to inventory and expand operations also make it clear that many potentially good borrowers are simply on the sidelines.