by Calculated Risk on 10/22/2009 07:02:00 PM

Thursday, October 22, 2009

CNBC's Olick: Could Home Valuation Code of Conduct Be History??

From Diana Olick at CNBC: Could HVCC Be History??

The House Financial Services Committee has just passed an amendment to the Consumer Financial Protection Agency Act to sunset the HVCC [Home Valuation Code of Conduct].I can understand fixing problems with the HVCC, but I can't understand going back to agents ordering appraisals. That was part of the systemic problem - some agents and appraisers abused the system.

...

Now before all you realtors and mortgage brokers get all excited, remember this is just a committee vote. ... The bill will be voted out of committee later today and then have to go to the House floor in some form and then of course there's the Senate, etc.

From David Streitfeld at the NY Times in August: In Appraisal Shift, Lenders Gain Power and Critics

Mike Kennedy, a real estate appraiser in Monroe, N.Y., was examining a suburban house a few years ago when he discovered five feet of water in the basement. The mortgage broker arranging the owner’s refinancing asked him to pretend it was not there.

Brokers, real estate agents and banks asked appraisers to do a lot of pretending during the housing boom, pumping up values while ignoring defects. While Mr. Kennedy says he never complied, many appraisers did, some of them thinking they had no choice if they wanted work. A profession that should have been a brake on the spiral in home prices instead became a big contributor.

Fed Treasury Purchases: Just $2 Billion More

by Calculated Risk on 10/22/2009 04:00:00 PM

Just an update on the status of the Fed's Treasury and MBS purchase programs.

From the Atlanta Fed weekly Financial Highlights:  From the Atlanta Fed:

From the Atlanta Fed:

The NY Fed purchased $1.05 billion more yesterday, so there is just $2 billion more to come over the next week.The Fed has purchased a total of $297 billion of Treasury securities through October 21, bringing it about 99% toward its goal. Of these purchases, $4.5 billion have been TIPS. Last week, the Fed made a purchase on October 13 for $2.95 billion in the seven-to-10-year sector.

And from the Atlanta Fed:

And from the Atlanta Fed: The Fed purchased an additional $18.1 billion net in MBS over the last week, bringing the total to $963 billion.The Fed purchased a net total of $16.1 billion of agency-backed MBS between October 8 and 14, bringing its total purchases up to about $945 billion, and by year-end [CR Note: by the end of Q1] the Fed will purchase up to $1.25 trillion.

The Treasury purchases will end next week - and will probably make the news. The MBS purchases are ongoing.

The third graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Christina Romer on Impact of Stimulus on GDP

by Calculated Risk on 10/22/2009 02:52:00 PM

A key point on the impact of the stimulus on GDP ...

From Christina Romer, Chair, Council of Economic Advisers in Testimony before the Joint Economic Committee: From Recession to Recovery

In a report issued on September 10, the Council of Economic Advisers (CEA) provided estimates of the impact of the ARRA on GDP and employment. ...The impact on GDP will be smaller going forward, and according to Dr. Romer, the impact will be around zero by mid next year, and will be a drag later in 2010 (as stimulus is reduced).

These estimates suggest that the ARRA added two to three percentage points to real GDP growth in the second quarter and three to four percentage points to growth in the third quarter. This implies that much of the moderation of the decline in GDP growth in the second quarter and the anticipated rise in the third quarter is directly attributable to the ARRA.

Fiscal stimulus has its greatest impact on growth around the quarters when it is increasing most strongly. When spending and tax cuts reach their maximum and level off, the contribution to growth returns to roughly zero. This does not mean that stimulus is no longer having an effect. Rather, it means that the effect is to keep GDP above the level it would be at in the absence of stimulus, not to raise growth further. Most analysts predict that the fiscal stimulus will have its greatest impact on growth in the second and third quarters of 2009. By mid-2010, fiscal stimulus will likely be contributing little to growth.

emphasis added

Hotel RevPAR off 16 Percent

by Calculated Risk on 10/22/2009 12:14:00 PM

From HotelNewsNow.com: Houston leads losses in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 8.1 percent to end the week at 58.9 percent. ADR dropped 8.5 percent to finish the week at US$99.14. RevPAR for the week decreased 16.0 percent to finish at US$58.42.

Click on graph for larger image in new window.

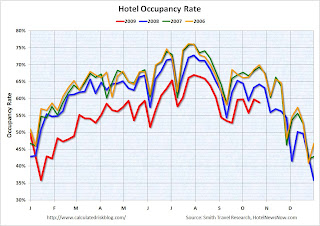

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was late in 2008, so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

The above graph shows the distinct seasonal pattern for occupancy.

The occupancy rate is higher in the summer (because of leisure travel), and lower on certain holidays. This also shows that hotels are in two year occupancy slump. The year-over-year comparisons are easier now since business travel fell off a cliff last October. Comparing to the same week two years ago, occupancy rates are off 15%.

The HotelNewsNow press release has three graphs on daily occupancy, room rates, and RevPAR variance with 2008.

The HotelNewsNow press release has three graphs on daily occupancy, room rates, and RevPAR variance with 2008.This graph shows the RevPAR variance by day, and indicates that business travel (weekdays) is off more than leisure travel (weekends). This has been an ongoing story ...

So far there is little evidence of an increase in business travel this Fall.

CNN: 7,000 People per Day exhaust Extended Unemployment Benefits

by Calculated Risk on 10/22/2009 10:59:00 AM

From Tami Luhby at CNNMoney: 7,000 unemployed Americans lose their lifeline every day (ht Dirk)

Another day, another 7,000 people run out of unemployment benefits.This will probably hit 10,000 people per day soon. An extension of this safety net has widespread support ... and is still being held up in the Senate.

One month after the House passed a bill extending unemployment benefits, the issue is still being debated in the Senate.

...1.3 million people [are] set to lose their benefits before year's end if Congress doesn't act, according to the National Employment Law Project, an advocacy group. In October alone, more than 200,000 people will fall off the rolls.