by Calculated Risk on 9/25/2009 04:36:00 PM

Friday, September 25, 2009

Bank Failure #95: Georgian Bank, Atlanta, GA

Just five simple syllables

Foreclosure central

by Rob Dawg (SGIP out today)

From the FDIC: First Citizens Bank and Trust Company, Incorporated, Columbia, South Carolina, Assumes All of the Deposits of Georgian Bank, Atlanta, Georgia

Georgian Bank, Atlanta, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Friday starts early ...

As of July 24, 2009, Georgian Bank had total assets of $2 billion and total deposits of approximately $2 billion. In addition to assuming all of the deposits of the failed bank, First Citizens Bank agreed to purchase essentially all of the assets.

The FDIC and First Citizens Bank entered into a loss-share transaction on approximately $2 billion of Georgian Bank's assets. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $892 million. ... Georgian Bank is the 95th FDIC-insured institution to fail in the nation this year, and the nineteenth in Georgia. The last FDIC-insured institution closed in the state was First Coweta, Newnan, on August 21, 2009.

Freddie Exec Compensation, Bandos, Market and more

by Calculated Risk on 9/25/2009 04:00:00 PM

Michelle at Footnoted.org digs up the employment contract for Freddie Mac's new CFO: Taxpayer funded signing bonus at Freddie Mac?

• annual compensation of $3.5 million (this includes $675K in salary, $1.6 million in something called “additional annual salary” and $1.1 million in a target incentiveWhy is Freddie paying more than the private sector? And I bet Geithner is jealous about the house deal!

• a $1.95 million signing bonus

• immediate buyout of Kari’s house

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And the Bandos are moving on up in Miami! From nbcphiladelphia.com: After Miami's Ritzy Bubble Bursts, Squatters Move on Up

Miami's squatter problem has garnered national media attention over the past year and a half, as the foreclosure crisis threatened to transform the Magic City into something resembling a lawless, "Mad Max"-esque landscape.Maybe the lenders should sell the foreclosed homes?

The squatters mostly kept a low profile, moving in ... to neighborhoods where they could take over unnoticed.

But now come reports that squatters are seeking out more ritzy neighborhoods, including the pricey, tree-lined streets of Coral Gables.

...

A check of county records found that the home went into foreclosure over a year ago, just about the time residents said the alleged squatters showed up.

The bank which owns the property hired a realtor to sell it last month ...

And from the LA Times: Calls to renew home buyer tax credit get louder in Washington. Yeah, an expensive, poorly targeted tax credit for those not suffering during the recession. This isn't as dumb as allowing the FHA DAP to continue (Downpayment Assistance Program - the poster child for bad housing policy), but close. Why not a "first-time renters" tax credit for anyone who hasn't rented for 3 years? That makes as much economic sense.

Truck Tonnage Index Increased in August

by Calculated Risk on 9/25/2009 02:23:00 PM

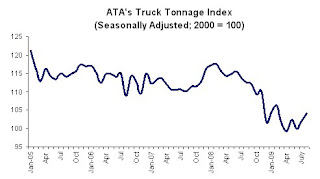

From the American Trucking Association: ATA Truck Tonnage Index Rose 2.1 Percent in August Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.1 percent in August, matching July’s increase of the same magnitude. The latest gain raised the SA index to 104.1 (2000=100), which was the best reading since February 2009. ... Compared with August 2008, SA tonnage fell 7.5 percent, which was the best year-over-year showing since November 2008. ...The Rail Freight Traffic shows some recent pickup too, but the level is still way below 2008 and 2007. (ht Bob_in_MA) Note: Trucking accounts for about 70% of tonnage carried by all modes of domestic freight transportation, and about 83% of total revenue.

“The gains in tonnage during July and August reflect a growing economy and less of an overhang in inventories,” [ATA Chief Economist Bob Costello] noted. “While I am optimistic that the worst is behind us, most economic indicators, including industrial output and household spending, suggest freight tonnage will exhibit moderate, and probably inconsistent, growth in the months ahead."

It appears the economy has reset to a new lower level, and growth will probably be sluggish. Trucking is probably benefiting from inventory restocking, and exports - the key positive areas for the economy.

Existing Home Turnover Ratio, and Distressing Gap

by Calculated Risk on 9/25/2009 12:16:00 PM

For graphs based on the new home sales report this morning, please see: New Home Sales Flat in August

The following graph is a turnover ratio for existing home sales. This is annual sales and year end inventory divided by the total number of owner occupied units. For 2009, sales were estimated at 4.8 million units, and inventory at the August level. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Although the turnover ratio has fallen from the bubble years, the level is still above the median for the last 40 years. This suggests 2009 is about a normal year for existing home turnover.

That might seem shocking based on all the reports of weak existing home sales. But the problem isn't the number of sales (except as compared to the bubble years), but the type and price of sales.

The reason turnover hasn't fallen further is because of all the distressed sales (foreclosures and short sales) primarily in the low priced areas. Distressed sales declined in August, and this is a major reason existing home sales declined.

There is another wave of foreclosures coming, so existing home sales might stay elevated for some time. Plus, the "first-time" homebuyers tax credit might be extended (a poorly targeted an inefficient credit).

Note: there is a substantial shadow inventory too.

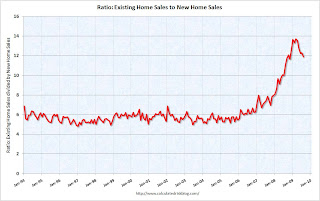

All this distressed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap. This graph shows existing home sales (left axis) and new home sales (right axis) through August.

This graph shows existing home sales (left axis) and new home sales (right axis) through August.

As I've noted before, I believe this gap was caused primarily by distressed sales. Even with the recent rebound in new and existing home sales, the gap is still very wide.

The third graph shows the same information, but as a ratio for existing home sales divided by new home sales. Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio.

The ratio could decline because of a further increase in new home sales, or a decrease in existing home sales - or a combination of both. I expect the ratio will decline mostly from a decline in existing home sales as the first-time home buyer frenzy subsides, and as the foreclosure crisis moves into mid-to-high priced areas (with fewer cash flow investors).

New Home Sales Flat in August

by Calculated Risk on 9/25/2009 10:00:00 AM

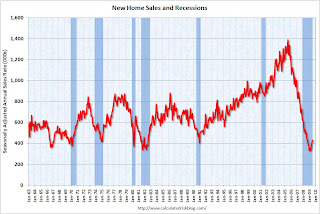

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 429 thousand. This is a slight increase from the revised rate of 426 thousand in July (revised from 433 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. Sales in August 2009 were the same as August 2008. This is the 4th lowest sales for August since the Census Bureau started tracking sales in 1963.

In August 2009, 38 thousand new homes were sold (NSA); the record low was 34 thousand in August 1981; the record high for August was 110 thousand in 2005. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but are now 30% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but are now 30% above the low in January.

Sales of new one-family houses in August 2009 were at a seasonally adjusted annual rate of 429,000 ...And another long term graph - this one for New Home Months of Supply.

This is 0.7 percent (±16.2%)* above the revised July rate of 426,000, but is 3.4 percent (±13.3%) below the August 2008 estimate of 444,000.

There were 7.3 months of supply in August - significantly below the all time record of 12.4 months of supply set in January.

There were 7.3 months of supply in August - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of August was 262,000. This represents a supply of 7.3 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, and new homes sales has probably also bottomed for this cycle. However any further recovery in sales will likely be modest because of the huge overhang of existing homes for sale.

I'll have more later ...

Durable Goods Orders off 2.4% in August

by Calculated Risk on 9/25/2009 08:33:00 AM

From the Census Bureau:

New orders for manufactured durable goods in August decreased $4.0 billion or 2.4 percent to $164.4 billion, the U.S. Census Bureau announced today. This was the second decrease in the last three months. This followed a 4.8 percent July increase. Excluding transportation, new orders were down slightly.So excluding civilian aircraft, durable goods orders were only down slightly.

Transportation equipment, also down two of the last three months, had the largest decrease, $4.0 billion or 9.3 percent to $39.5 billion. This was led by nondefense aircraft and parts, which decreased $3.7 billion.

The manufacturers continue to work down their unfilled orders and inventory:

Unfilled Orders

Unfilled orders for manufactured durable goods in August, down eleven consecutive months, decreased $2.8 billion or 0.4 percent to $737.1 billion. This was the longest streak of consecutive monthly decreases since the series was first published on a NAICS basis in 1992 ...

Inventories

Inventories of manufactured durable goods in August, down eight consecutive months, decreased $4.2 billion or 1.3 percent to $308.9 billion. This followed a 1.1 percent July decrease.

emphasis added

Thursday, September 24, 2009

CNBC: Lawler on Housing

by Calculated Risk on 9/24/2009 09:59:00 PM

Housing economist Thomas Lawler on CNBC this morning.

"It is virtual certainty that [foreclosure] sales will pick up. Various moratoria has actually diminished the pace of sales, but as people try to see who can qualify for the modification program. But the backlog of loans in foreclosure are rising, and foreclosure sales will 100% pickup, we just don't know when."

On tax credit: "It has been very very expensive, if you look at the number of people who have claimed the credit versus estimates of the incremental number of sales that wouldn't have occurred otherwise, looks it is costing the government about $40 thousand for every home sale generated."

FDIC: "Credit quality declined sharply" for Shared National Credits

by Calculated Risk on 9/24/2009 05:53:00 PM

From the FDIC: Credit Quality Declines in Annual Shared National Credits Review

Notes from the Fed:

A SNC is any loan and/or formal loan commitment, and any asset such as other real estate, stocks, notes, bonds and debentures taken as debts previously contracted, extended to borrowers by a supervised institution, its subsidiaries and affiliates. Further, a SNC must have an original amount that aggregates $20 million or more and either 1) is shared by three or more unaffiliated supervised institutions under a formal lending agreement or 2) a portion is sold to two or more unaffiliated supervised institutions with the purchasing institutions assuming their pro rata share of the credit risk.Some key findings:

• Criticized assets, which included SNCs classified as special mention, substandard, doubtful, or loss, reached $642 billion, up from $373 billion last year, and represented 22.3 percent of the SNC portfolio compared with 13.4 percent in 2008.

...

• Classified assets, which included SNCs classified as substandard, doubtful, or loss, rose to $447 billion from $163 billion and represented 15.5 percent of the SNC portfolio, compared with 5.8 percent in 2008. Classified dollar volume increased 174 percent from a year ago.

• Special mention assets, which exhibited potential weakness and could result in further deterioration if uncorrected, declined to $195 billion from $210 billion and represented 6.8 percent of the SNC portfolio, compared with 7.5 percent in 2008.

• The severity of criticism increased with the volume of SNCs classified as doubtful and loss rising to $110 billion, up from $8 billion in 2008. Loans in nonaccrual status also increased nearly eight times to $172 billion from $22 billion. Nonaccrual loans included $32 billion in credits classified as loss and $56 billion classified doubtful.

...

• Criticized volume was led by the Media and Telecom industry group with $112 billion, Finance and Insurance with $76 billion, and Real Estate and Construction with $72 billion. These three groups also represented the highest shares of criticized credits with 17.3 percent, 11.7 percent, and 11.2 percent of criticized credits in the SNC portfolio, respectively.

Click on graph for larger image in new window.

Click on graph for larger image in new window.A record $447 billion in assets were classified as substandard, doubtful, or a loss, almost triple the peak following the 2001 recession. As a percent of commitments, the current 15.5% of loans "classified" far exceeds the previous peak in 1991 of just under 10% of loans.

Also, according to the FDIC, nonbanks held 47 percent of classified assets despite owning only 21.2 percent of the SNC portfolio. American Banker has an excellent quote: Syndicated Loan Losses Skyrocket

"Anyone could get credit from banks because banks knew they would have ready and willing buyers of syndicated loans even if red lights were blinking when the loans were booked." ... said Karen Shaw Petrou, the managing director of Federal Financial Analytics Inc.

Fed: Homeowner Mortgage Obligations Still Historically High

by Calculated Risk on 9/24/2009 03:35:00 PM

The Federal Reserve released the Household Debt Service and Financial Obligations Ratios for Q2 today.

NOTE from Fed: "The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments."

Because of these limitations, the Financial Obligations Ratio (FOR) should be used to look at changes over time, not the absolute value of the ratio. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the homeowner financial obligations for consumer and mortgage debt as a percent of disposable personal income (DPI) since 1980.

"The homeowner mortgage FOR includes payments on mortgage debt, homeowners' insurance, and property taxes, while the homeowner consumer FOR includes payments on consumer debt and automobile leases."

Consumer financial obligations are still a little high historically, but mortgage obligations are very high (especially considering the level of interest rates). Just like after the housing bubble of the late '80s/ early '90s, it will probably take some time for the mortgage FOR to decline to more normal levels.

Hotel RevPAR off 18.3 Percent

by Calculated Risk on 9/24/2009 12:43:00 PM

We are now into the business travel season, and as expected, RevPAR is off sharply from 2008.

From HotelNewsNow.com: Oahu Island occupancy increases in STR weekly numbers

Overall the U.S. industry’s occupancy fell 8.6 percent to end the week at 59.6 percent. Average daily rate dropped 10.5 percent to finish the week at US$98.34. Revenue per available room for the week decreased 18.3 percent to finish at US$58.57.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 8.4% from the same period in 2008.

The average daily rate is down 1.5%, and RevPAR is off 18.3% from the same week last year.

After Labor Day business travel becomes far more important for the hotel industry than leisure travel, and so far there is no evidence that business travel is recovering significantly - especially at the high end - from Bloomberg: Luxury Hotels in U.S. Risk Default as $850 Rooms Remain Empty

Loans secured by more than 1,500 hotels with a total outstanding balance of $24.5 billion may be in danger of default, according to Realpoint LLC, ... “All segments are showing signs of distress but the luxury segment carries much higher loan balances and is more clearly affected,” [said] Frank Innaurato [of] Realpoint ...

Occupancy among chains with the costliest rooms fell to 60 percent in the first half from 70 percent a year earlier, according to Smith Travel Research. The decline was the industry’s largest for that period. ...

The U.S. hotel loan-delinquency rate may climb to 8.2 percent by year-end, Morgan Stanley analysts led by Andy Day said in a June 23 report. That would match the peak from the last recession in 2001.

Upscale hotels are suffering from “a heightened focus on prudent corporate travel expenditures,” as well as the pullback in vacation travel, Day said.

emphasis added