by Calculated Risk on 9/04/2009 07:13:00 PM

Friday, September 04, 2009

Bank Failures #86 & #87: InBank, Oak Forest, IL, Vantus Bank, Sioux City, IA

Small fries, not big potatos

Is a whopper next?

by Soylent Green is People

From the FDIC: MB Financial Bank, National Association, Chicago, Illinois, Assumes All of the Deposits of InBank, Oak Forest, Illinois

InBank, Oak Forest, Illinois, was closed today by the Illinois Department of Financial and Professional Regulation, Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...FDIC: Great Southern Bank, Springfield, Missouri, Assumes All of the Deposits of Vantus Bank, Sioux City, Iowa

As of August 3, 2009, InBank had total assets of $212 million and total deposits of approximately $199 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $66 million. ... InBank is the 86th FDIC-insured institution to fail in the nation this year, and the 14th in Illinois. The last FDIC-insured institution closed in the state was Mutual Bank, Harvey, on July 31, 2009.

Vantus Bank, Sioux City, Iowa, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of August 28, 2009, Vantus Bank had total assets of $458 million and total deposits of approximately $368 million. ...

The FDIC and Great Southern Bank entered into a loss-share transaction on approximately $338 million of Vantus Bank's assets. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $168 million. .... Vantus Bank is the 87th FDIC-insured institution to fail in the nation this year, and the first in Iowa. The last FDIC-insured institution closed in the state was Hartford-Carlisle Savings Bank, Carlisle, on January 14, 2000.

Bank Failure #85: First Bank of Kansas City, Kansas City, MO

by Calculated Risk on 9/04/2009 06:08:00 PM

A long weekend for resting

Also for failure

by Soylent Green is People

From the FDIC: Great American Bank, De Soto, Kansas, Assumes All of the Deposits of First Bank of Kansas City, Kansas City, Missouri

First Bank of Kansas City, Kansas City, Missouri, was closed today by the Missouri Division of Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Great American Bank, De Soto, Kansas, to assume all of the deposits of First Bank of Kansas City.A small one to start the day.

...

As of June 30, 2009, First Bank of Kansas City had total assets of $16 million and total deposits of approximately $15 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6 million. ... First Bank of Kansas City is the 85th FDIC-insured institution to fail in the nation this year, and the second in Missouri. The last FDIC-insured institution closed in the state was American Sterling Bank, Sugar Creek, on April 17, 2009.

Tax Credit: Mercury News Advocates Taxpayers pay $60 Thousand per Additional Home Sold

by Calculated Risk on 9/04/2009 04:29:00 PM

From the Mercury News: Editorial: Congress should expand $8,000 home-buyer tax credit (ht ShortCourage)

[I]t's crucial that when Congress returns from recess next week, lawmakers extend the soon-to-expire credit through 2010. And if they want to bolster the fledgling recovery, they'll expand eligibility.Do the math. $30 billion for an additional 500,000 sales equals $60,000 per house. Ouch.

Though the credit has helped stabilize the housing market nationally, in the pricey Bay Area, it hasn't been as helpful. ... Lifting the income caps and expanding the credit to all buyers of primary residences would nudge existing homeowners to move up. That would open up more houses in the red-hot lower end of the market, where many first-time buyers have been outbid by investors paying cash.

...

The National Association of Home Builders estimates that expanding and extending the credit through 2010 would generate 500,000 additional sales ... estimated to cost $30 billion ...

And forget the 500 thousand additional sales. The evidence suggests that interest is already waning (although there will be a flurry of activity at the end just like Cash-for-clunkers). My estimate is the program will cost taxpayers $100,000 per additional home sold. Not very efficient or effective.

Naught for Naughts Update

by Calculated Risk on 9/04/2009 03:12:00 PM

From Rex Nutting at MarketWatch: Lost decade for job growth

[T]he private sector didn't just lose jobs over the last month or the last year -- it's lost jobs over the last decade.Here is a different way to look at it: net jobs in the Naughts (2000 through 2009).

[The private sector] ended up with a net loss of 223,000 jobs since August 1999, according to the latest figures from the Bureau of Labor Statistics. Meanwhile, the nation's population has grown by 33.5 million people.

That's the worst job-creating performance by the private sector since, you guessed it, the Great Depression.

Click on graph for larger image.

Click on graph for larger image.Note: scale doesn't start at zero to show the change. This is a followup to Naught for the Naughts?.

The dashed lines show the level of private and total jobs at the end of the '90s (December 1999).

As Nutting notes, the private sector has lost jobs over the last decade, and is down 1.256 million jobs in the Naughts (so the decade will finish with net negative private sector jobs).

Total jobs are up 691 thousand since Dec 1999, and with four months to go, the race is on! If the economy loses about 172 thousand jobs on average over the next four months, total jobs will finish negative too.

Naught for the Naughts. A lost decade for employment.

Problem Bank List (Unofficial) Sep 4, 2009

by Calculated Risk on 9/04/2009 01:45:00 PM

This is an unofficial list of Problem Banks.

The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Changes and comments from surferdude808:

During the week, 12 institutions with aggregate assets of $17.7 billion were added to the Unofficial Problem Bank List.See description below table for Class and Cert (and a link to FDIC ID system).

The list stands at 421 institutions with assets of $267.8 billion.

Largest among the additions is Capmark Bank, a Utah-based industrial loan company with assets of $11.1 billion. Should the parent, Capmark Financial Group, not find a buyer this could be another costly failure. Other notable additions include the $2.4 billion Bank of the Cascades, Bend, Oregon; the $1.9 billion Citizens First Savings Bank, Port Huron, Michigan; and two bankers’ banks – Midwest Independent Bank in Missouri and Nebraska Bankers’ Bank.

All three deletions from the list were because of failure including Affinity Bank, Mainstreet Bank, and Bradford Bank. Lastly, the OTS issued a Prompt Corrective Action order against Vantus Bank, Sioux City, Iowa, which was already operating under a Cease & Desist order.

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Employment-Population Ratio, Part Time Workers, Average Workweek

by Calculated Risk on 9/04/2009 10:40:00 AM

A few more graphs based on the (un)employment report ...

Employment-Population Ratio Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce. As an example, in 1964 women were about 32% of the workforce, today the percentage is closer to 50%.

This measure fell in August to 59.2%, the lowest level since the early '80s. This also shows the weak recovery following the 2001 recession - and the current cliff diving!

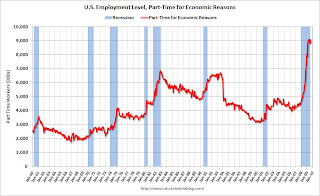

Part Time for Economic Reasons

From the BLS report:

In August, the number of persons working part time for economic reasons was little changed at 9.1 million. These individuals indicated that they were working part time because their hours had been cut back or because they were unable to find a full-time job. The number of such workers rose sharply in the fall and winter but has been little changed since March.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at 9.076 million. This is only slightly below the peak of 9.084 million in May.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at 9.076 million. This is only slightly below the peak of 9.084 million in May.Note: the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this is not quite a record.

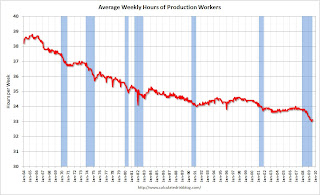

Average Weekly Hours

From the BLS report:

In August, the average workweek for production and nonsupervisory workers on private nonfarm payrolls was unchanged at 33.1 hours. The manufacturing workweek and factory overtime also showed no change over the month (at 39.8 hours and 2.9 hours, respectively).

The average weekly hours has been declining since the early '60s, but usually falls faster during a recession. Average weekly hours worked has essentially been flat since March.

The average weekly hours has been declining since the early '60s, but usually falls faster during a recession. Average weekly hours worked has essentially been flat since March.Some analyst look to an increase in this series as an indicator a recession is over. I guess they are still waiting.

Note: the graph doesn't start at zero to better show the change.

Earlier employment posts today:

Unemployment: Stress Tests, Unemployed over 26 Weeks, Diffusion Index

by Calculated Risk on 9/04/2009 09:40:00 AM

Note: earlier Employment post: Employment Report: 216K Jobs Lost, 9.7% Unemployment Rate . The earlier post includes a comparison to previous recessions.

Stress Test Scenarios Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link).

This is a quarterly forecast: the Unemployment Rate for Q3 is an average of July and August (rounded to 9.6%), and will probably move higher. Once again, the unemployment rate is already higher than the "more adverse" scenario.

Note also that the unemployment rate has already exceeded the peak of the "baseline scenario".

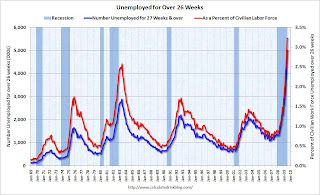

Unemployed over 26 Weeks

The DOL report yesterday showed seasonally adjusted insured unemployment at 6.2 million, down from a peak of about 6.9 million. This raises the question of how many unemployed workers have exhausted their regular unemployment benefits (Note: most are still receiving extended benefits, although this is about to change).

The monthly BLS report provides data on workers unemployed for 27 or more weeks, and here is a graph ... The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are almost 5.0 million workers who have been unemployed for more than 26 weeks (and still want a job). This is 3.2% of the civilian workforce.

The good news is there wasn't much of an increase from July. The bad news is many of these 5 million long term unemployed will start exhausting their extended unemployment benefits soon. According to the projections by the National Employment Law Project about 0.5 million will have exhausted their benefits by the end of this month (September) and about 1.5 million by the end of the year.

In California alone, from the O.C. Register: "an estimated 143,000 unemployed workers in California [exhausted] their jobless benefits by Sept. 1, according to new figures released by the state Employment Development Department".

Diffusion Index

Here is a look at how "widespread" the job losses are using the employment diffusion index from the BLS.

Although job losses continued in many of the major industry sectors in August, the declines have moderated in recent months.

BLS, August Employment Report

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Before last Summer, the all industries employment diffusion index was in the 40s, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. In March, the index hit 19.6, suggesting job losses were very widespread. The index has recovered since then to 35.2 in August, suggesting job losses are not as widespread across industries as early this year - but losses continue in many industries.

The manufacturing diffusion index fell even further, from 40 in May 2008 to just 6 in January 2009. The manufacturing index has rebounded to 29.5 in August, indicating improvement, but still fairly widespread job losses across manufacturing industries.

Employment Report: 216K Jobs Lost, 9.7% Unemployment Rate

by Calculated Risk on 9/04/2009 08:30:00 AM

From the BLS:

Nonfarm payroll employment continued to decline in August (-216,000), and the unemployment rate rose to 9.7 percent, the U.S. Bureau of Labor Statistics reported today. Although job losses continued in many of the major industry sectors in August, the declines have moderated in recent months.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 216,000 in August. The economy has lost almost 5.83 million jobs over the last year, and 6.93 million jobs during the 20 consecutive months of job losses.

The unemployment rate increased to 9.7 percent. This is the highest unemployment rate in 26 years.

Year over year employment is strongly negative.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up over the last year, and the current recession is now the 2nd worst recession since WWII in percentage terms (and the 1948 recession recovered very quickly) - and also in terms of the unemployment rate (only early '80s recession was worse).

The economy is still losing jobs at about a 2.6 million annual rate, and the unemployment rate will probably be above 10% soon. This is still a weak employment report - just not as bad as earlier this year. Much more to come ...

Thursday, September 03, 2009

FHA: The Next Bailout?

by Calculated Risk on 9/03/2009 09:25:00 PM

John Burns Consulting sent out a note today titled: FHA Likely To Be The Next Shoe To Drop

"The FHA's aggressive lending programs have continued throughout the housing downturn, causing its market share of the mortgage industry to grow from 2% in 2005 to 23% today. ... The FHA insurance fund, however, is likely running dry. ...And from the WSJ: Loan Losses Spark Concern Over FHA

While almost all of the experts believe that Congress would support the FHA if necessary (it's currently self-funded), we wonder if FHA officials will be under pressure to continue tightening their lending policies, which currently allow 96.5% mortgages to people with 600 FICO scores. ... Claims against the insurance fund have climbed, with roughly 7% of all FHA-insured loans now delinquent.

The Federal Housing Administration ... is in danger of seeing its reserves fall below the level demanded by Congress, according to government officials, in a development that could raise concerns about whether the agency needs a taxpayer bailout.Based on the issues at the FHA, the end of the tax credit, and more supply coming on the market, Burns concluded that "housing could see another leg down later this year or early next year":

...

Resulting FHA losses are offset by premiums paid by borrowers. Federal law says the FHA must maintain, after expected losses, reserves equal to at least 2% of the loans insured by the agency. The ratio last year was around 3%, down from 6.4% in 2007.

...

Officials said as recently as May that they didn't expect to fall below the 2% limit, but home price declines have exceeded those used to model their expected losses. Given the pace of those declines, "there is no way they will make the 2%" if the current study follows last year's methodology, says [Thomas Lawler, an independent housing economist].

[W]atch the growing controversy regarding the FHA very carefully. The decisions made to allow the FHA to continue lending will have a huge impact on the housing market, particularly when so few entry-level buyers have a substantial down payment.

Junk Bond Default Rate Passes 10 Percent

by Calculated Risk on 9/03/2009 08:09:00 PM

From Rolfe Winkler at Reuters: U.S. junk bond default rate rises to 10.2 pct -S&P

The U.S. junk bond default rate rose to 10.2 percent in August from 9.4 percent in July ... Standard & Poor's data showed on Thursday.Bad loans everywhere ...

The default rate is expected to rise to 13.9 percent by July 2010 and could reach as high as 18 percent if economic conditions are worse than expected, S&P said in a statement.

...

In another sign of corporate distress, the rating agency has downgraded $2.9 trillion of company debt year to date, up from $1.9 trillion in the same period last year.