by Calculated Risk on 8/29/2009 01:02:00 PM

Saturday, August 29, 2009

Quarterly Housing Starts and New Home Sales

The Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q2 2009 a few days ago.

Monthly housing starts (even single family starts) cannot be compared directly to new home sales, because the monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows that there were 82,000 single family starts, built for sale, in Q2 2009 and that is less than the 102,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because homebuilders were stuck with “unintentional spec homes” during the housing bust because of the high cancellation rates, but cancellation rates are now much closer to normal. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last seven quarters, starts have been below sales – and new home inventories have been falling. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts in Q2 tied the all time record low for Condos built for sale set in Q1 (5,000); the previous record was 8,000 set in Q1 1991 (data started in 1975).

Owner built units are above the record low set last quarter (38,000 units compared to 24,000 units in Q1 2009), however the pickup in starts was probably mostly seasonal (this is NSA data).

And single family units built for sale were also above the record low set last quarter (82,000 compared to 53,000 in Q1 2009).

Failed Banks and the Deposit Insurance Fund

by Calculated Risk on 8/29/2009 10:11:00 AM

As a companion to the August 28 Problem Bank List (unofficial), below is a list of failed banks since Jan 2007.

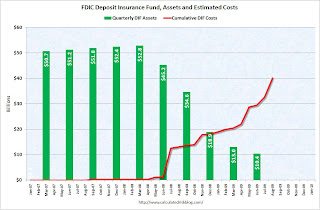

The FDIC released the Q2 Quarterly Banking Profile this week. The report showed that the Deposit Insurance Fund (DIF) balance had fallen to $10.4 billion or 0.22% of insured deposits. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows the cumulative estimated losses to the FDIC Deposit Insurance Fund (DIF) and the quarterly assets of the DIF (as reported by the FDIC). Note that the FDIC takes reserves against future losses in the DIF, and collects fees and special assessments - so you can't just subtract estimated losses from assets to determine the assets remaining in the DIF.

The cumulative estimated losses for the DIF are now over $40 billion.

In this Dick Bove interview with CNNMoney, the interviewer Poppy Harlow said:

"When we look at that list though - we don't get the names from the FDIC obviously - only about 13% of the bank on that list actually end up failing".The 13% number is historically accurate, but that is over the entire cycle - and this down cycle will probably be worse than most. So during this down period, the percentage will probably be much higher. As far as the names of the banks on the "list", most of them are on the Unofficial Problem Bank list.

The FDIC closed three more banks on Friday, and that brings the total FDIC bank failures to 84 in 2009.

Failed Bank List

Deposits, assets and estimated losses are all in thousands of dollars.

Losses for failed banks in 2009 are the initial FDIC estimates. The percent losses are as a percent of assets.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

Click here for a full screen version.

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can click on the number and see "the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Friday, August 28, 2009

Judge Stays FOIA Fed Ruling Pending Appeal

by Calculated Risk on 8/28/2009 11:55:00 PM

From Rolfe Winkler at Reuters: Judge puts Fed's bailout revelations on hold

Chief Judge Loretta Preska of the U.S. District Court in Manhattan stayed her August 24 order in favor of Bloomberg News, which had sought [the names of the banks that have participated in the Federal Reserve's emergency lending programs] under the federal Freedom of Information Act, so that the central bank could appeal.This case might go on and on. Perhaps Barney Frank and Ron Paul will pass new legislation requiring auditing the Fed before this FOIA case makes it through the courts.

UPDATE: Mish says

"[W]e will subject [the Federal Reserve] to a complete audit. I have been working with Ron Paul, who is the main sponsor of that bill. He agrees that we don't want to have the audit appear as if it is influencing monetary policy, because that would be inflationary. And Ron and I agree on that.

One of the things the audit will show you is what the Federal Reserve buys and sells. And that will be made public, but not instantly, because if that was made instantly you would have a lot people trading off of that and you would have too much impact the market - and again Ron agrees with that. So we will publicly have that data released after a time period of several months, enough time so it wouldn't be market sensitive. That will be part of the overall Federal regulation that we are redacting.

The House will pass [the bill] probably in October."

Bank Failure #84: Affinity Bank, Ventura, California

by Calculated Risk on 8/28/2009 09:19:00 PM

Affinity burned brightly

Extinguished today

by Soylent Green is People

From the FDIC: Pacific Western Bank, San Diego, California, Assumes All of the Deposits of Affinity Bank, Ventura, California

Affinity Bank, Ventura, California, was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...A quarter of billion here, a quarter of a billion there ...

As of July 10, 2009, Affinity Bank had total assets of $1 billion and total deposits of approximately $922 million. ...

The FDIC and Pacific Western Bank entered into a loss-share transaction on approximately $934 million of Affinity Bank's assets. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $254 million. ... Affinity Bank is the 84th FDIC-insured institution to fail in the nation this year, and the ninth in California. The last FDIC-insured institution closed in the state was Vineyard Bank, National Association, Rancho Cucamonga, on July 17, 2009.

Bank Failure #83: Mainstreet Bank, Forest Lake, Minnesota

by Calculated Risk on 8/28/2009 07:10:00 PM

Chance favors the prepaired mind

not so for Mainstreet.

by Soylent Green is People

From the FDIC: Central Bank, Stillwater, Minnesota, Assumes All of the Deposits of Mainstreet Bank, Forest Lake, Minnesota

Mainstreet Bank, Forest Lake, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Two down today.

As of June 30, 2009, Mainstreet Bank had total assets of $459 million and total deposits of approximately $434 million. ...

The FDIC and Central Bank entered into a loss-share transaction on approximately $268 million of Mainstreet Bank's assets. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $95 million. ... Mainstreet Bank is the 83rd FDIC-insured institution to fail in the nation this year, and the second in Minnesota. The last FDIC-insured institution to be closed in the state was Horizon Bank, Pine City, on June 26, 2009.

Bank Failure #82: Bradford Bank, Baltimore, Maryland

by Calculated Risk on 8/28/2009 06:10:00 PM

Three...four hundred...one thousand???

Bradford bank now toast.

by Soylent Green is People

From the FDIC: Manufacturers and Traders Trust Company, Buffalo, New York, Assumes All of the Deposits of Bradford Bank, Baltimore, Maryland

Bradford Bank, Baltimore, Maryland, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday.

As of June 30, 2009, Bradford Bank had total assets of $452 million and total deposits of approximately $383 million. ...

The FDIC and M&T entered into a loss-share transaction on approximately $338 million of Bradford Bank's assets. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $97 million. ... Bradford Bank is the 82nd FDIC-insured institution to fail in the nation this year, and the second in Maryland. The last FDIC-insured institution closed in the state was Suburban Federal Savings Bank, Crofton, on January 30, 2009.

Misc: Cerberus, Flippers and Market

by Calculated Risk on 8/28/2009 04:00:00 PM

While we wait for the first bank failure of the day, here is the Problem Bank List (Unofficial) Aug 28, 2009 .

And a few interesting notes ...

From the WSJ: Cerberus Holders Elect to Leave Core Funds

Cerberus Capital Management's investors overwhelmingly want out of the firm's core hedge funds, asking for the return of more than $5.5 billion, or almost 71% of the fund assets, according to people familiar with the matter.And see Tanta's first post on CR in 2006: Tanta: Let Slip the Dogs of Hell (T wrote under her own byline soon after).

"We have been surprised by this response," Cerberus chief Stephen Feinberg and co-founder William Richter wrote in a letter delivered to clients late Thursday.

I still haven’t gotten over the fact that there’s a “capital management” group out there having named itself “Cerberus”. Those of you who were not asleep in Miss Buttkicker’s Intro to Western Civ will recognize Cerberus; the rest of you may have picked up the mythological fix from its reprise as “Fluffy” in the first Harry Potter novel. Wherever you get your culture, Cerberus is the three-headed dog who guards the gates of Hell. It takes three heads to do that, of course, because it’s never clear, in theology or finance, whether the idea is to keep the righteous from falling into the pit or the demons from escaping out of it (the third head is busy meeting with the regulators). Cerberus is relevant not just because it supplies me with today’s metaphor, but because it was the Biggest Dog of three (including Citigroup and Aozora, a Japanese bank) who in April bought a 51% stake in GMAC’s mega-mortgage operation, GM having, of course, once been renowned as one of the Big Three Automakers until it became one of the Big Three Financing Outfits With A Sideline In Cars. I tried to find a link for you to Aozora Bank’s announcement of the purchase, but the only press release I could find for that day involved the loss of customer data. They must have been so busy letting GMAC into the underworld that the dog head keeping the deposit tickets from getting out got distracted.Read the entire post ... Tanta wouldn't have been "surprised" by the "response" of Cerberus' investors. BTW, Tanta and I first started talking about bagholders in early 2005 - and we both agreed it would largely be the U.S. taxpayer.

...

I bring all this up not just to stick it to Citicorp, but because we’ve all been asking the question lately of who will be the bagholder when the exotic/subprime mortgage problem finds a home. We have noted in our discussions that credit risk can move in two directions: the wholesaler takes it off the originator and the bond investor takes it off the wholesaler/issuer with the helpful assistance of protection sellers in the hedge fund credit-swap market, but when the “DETOUR” signs pop up, the bond investor can work really hard on forcing it back to the wholesaler/issuer, who can try to put it back to the originator, who gets to try to recover something in a foreclosure sale. If the originator has any financial strength left to buy loans back with, that is; see the sad stories of Ownit, Option One, Fremont, New Century, etc.

[CR: remember T wrote this in 2006]

...

If you thought the only thing that would stop the circle jerk of risk was putting some credit and pricing discipline into the game, I guess you’re just a weenie like me. Anyone who can make sense of this is free to set me straight. And if the answer has “sorting socks” in it, don’t bother. I’ve tried that.

And a market graph from Doug Short.

This matches up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And a flipper in 2006 (ht Yal). I believe this is her house today on Zillow, around $650K:

Problem Bank List (Unofficial) Aug 28, 2009

by Calculated Risk on 8/28/2009 01:50:00 PM

This is an unofficial list of Problem Banks.

The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay (the FDIC July Enforcement Actions were released today). The Fed and OTC data is more timely, and the OCC a little lagged. Credit: surferdude808.

Changes and comments from surferdude808:

The “unofficial Problem Bank list” underwent substantial changes since last week because of failures; new additions, especially from the OCC and FDIC as they released a number of actions for July; and an identification of unassisted mergers during Q2.See description below table for Class and Cert (and a link to FDIC ID system).

This week there are 412 institutions on the “unofficial Problem Bank list” with assets of $252.2 billion compared with 391 institutions with assets of $256.5 billion last week. The failure of Guaranty Bank with assets of $14.4 billion was responsible for the great majority of the asset decline. Another 10 institutions with assets of $2.5 billion were removed because of failure or unassisted merger and there was one action that was terminated.

Additions during the week are 32 institutions with assets of $15.7 billion. Most notable of these additions are the ShoreBank, Chicago, IL with assets of $2.7 billion and three subsidiaries of First National of Nebraska, Inc. (ticker symbol FINN) with assets of $4.5 billion.

Since the FDIC released the latest quarterly data, we were able to update assets for all institutions as of Q2. For the 381 institutions that were on the “unofficial Problem Bank list” at Q1 and Q2, assets declined by $3.3 billion.

With the FDIC Q2 release, we can see how well the “unofficial Problem Bank list” compares with the FDIC’s official Problem Bank list. The FDIC list includes 416 institutions with assets of $299.8 billion at Q2 while for a comparable period the “unofficial Problem Bank list” had 392 institutions with assets of $280 billion; thus, the unofficial list is a reasonable approximation with an acceptable tracking error.

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Unemployment and Net Jobs

by Calculated Risk on 8/28/2009 10:23:00 AM

Next Friday the BLS employment report for August will be released.

Last month, when the unemployment rate dipped slightly to 9.4% from 9.5% in June, there were several articles like this one from the LA Times: Unemployment rate decline may indicate the recession has hit bottom.

Earlier I pointed out that the dip in unemployment was just monthly noise: Jobs and the Unemployment Rate

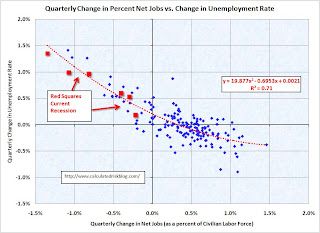

FAQ: How can the unemployment rate fall if the economy is losing net jobs, especially since the population is growing?Here are a couple of scatter graphs to illustrate this point ...

This data comes from two separate surveys. The unemployment Rate comes from the Current Population Survey (CPS: commonly called the household survey), a monthly survey of about 60,000 households.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 400,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

...

[T]he jobs and unemployment rate come from two different surveys and are different measurements (one for positions, the other for people). Some months the numbers may not seem to make sense (lost jobs and falling unemployment rate), but over time the numbers will work out.

The first graph shows the monthly change in net jobs (on the x-axis) as a percentage of the civilian workforce, and the change in the unemployment rate on the y-axis.

The data is for the last 40 years: 1969 through July 2009.

Click on graph for large image.

Click on graph for large image.Obviously there is a correlation - the more jobs added (further right on the x-axis), the more the unemployment rate declines (y-axis). And generally the more jobs lost, the more the unemployment rate increases.

But the graph sure is noisy on a monthly basis.

If the economy added 0.2% net jobs in one month (as a percent of the civilian workforce, or about 300 thousand net jobs currently), the unemployment rate could increase 0.2% or decrease 0.4% - and still be within the normal scatter.

The second graph covers the same period but on a quarterly basis:

Now we see a much sharper correlation.

Now we see a much sharper correlation.The Red squares are the for 2008, and the first two quarters of 2009. This recession fits the normal pattern.

If the economy loses about 200 thousand jobs per month in August and September, this relationship suggests the unemployment rate will probably be close to 10% by the end of September.

This also suggests the economy needs to be adding about 0.33 percent of the civilian workforce per quarter to keep the unemployment rate from rising. That is about 170 thousand net jobs per month.

Note that the trend line is a 2nd order polynomial (equation on graph). When the economy starts to add jobs, more people start looking for work - and the relationship between net jobs and unemployment rate is not linear.

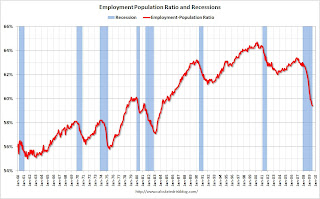

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

This measure fell slightly in July to 59.4%, the lowest level since the early '80s. However once the economy starts adding jobs, more people will be looking for work, and the employment-population ratio will start to increase. This means the stronger the economy, the more net jobs required each quarter to lower the unemployment rate by the same amount (as shown on the 2nd graph above).

The bottom line is the unemployment rate will still increase, and we will probably see 10% later this year.

July PCE and Saving Rate

by Calculated Risk on 8/28/2009 08:30:00 AM

From the BEA: Personal Income and Outlays, July 2009

Personal income increased $3.8 billion, or less than 0.1 percent, and disposable personal income (DPI) decreased $4.6 billion, or less than 0.1 percent, in July, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $25.0 billion, or 0.2 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in July, compared with an increase of 0.1 percent in June.

...

Personal saving -- DPI less personal outlays – was $458.5 billion in July, compared with $486.8 billion in June. Personal saving as a percentage of disposable personal income was 4.2 percent in July, compared with 4.5 percent in June.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the July Personal Income report. The saving rate was 4.2% in July.

Households are saving substantially more than during the last few years (when the saving rate was around 1.0%). The saving rate will probably continue to rise.

The following graph shows real Personal Consumption Expenditures (PCE) through July (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The July numbers suggest PCE will grow at a 1.3% (annualized rate) in Q3.

Note that PCE declined sharply in Q3 and Q4 2008 - the cliff diving - and was been relatively flat in Q1 and Q2 2009. Auto sales should gave a boost to PCE in Q3, but in general PCE will probably remain weak over the 2nd half of 2009 and into 2010 as households continue to repair their balance sheets.